That’s good stuff.

I find myself saying that a lot lately with respect to market happenings, and that’s the case whether the “stuff” is good or bad.

In actual fact, more often than not, I say this sarcastically.

But how can I not?

You see a property listed for an insane price?

“That’s good stuff.”

A property receives thirteen offers and the seller and listing agent reject them all only to re-list the next day?

“That’s good stuff.”

A listing agent calls you to say that she’s expecting five or six offers tonight, but when pressed, she confirms she has zero registered offers?

“That’s good stuff.”

It’s a line that I share with a number of agents and the number of times we use it only seems to be increasing in this market.

Believe it or not, there are other agents out there that keep a proverbial “file” of properties they’re watching.

MLS has a tool for “favourite listings” and while many agents will click the star next to a property because they’re watching it for a buyer client, or they’re using it as a comparable for a potential seller, many agents will favourite listings that are complete train wrecks so they know how the story ends.

Let’s tell some of those stories today, shall we?

No harm to a long closing date…………….right?

Buyers and sellers alike often ask me, “What’s the average closing date out there?”

I would probably say it’s sixty days.

A 30-day closing is quick. A 90-day closing is long.

Ergo, a normal closing is around sixty days.

There are pros and cons to both short and long closing dates and it all depends on whether you’re the buyer or the seller and what your specific situation is.

If you’re a seller first, and you want to have ample time to search the market and buy, then you’d love to sell your home with a 120-day closing so you don’t end up homeless!

If you’re a buyer and you’re sitting on cash, living at home, and trying to negotiate with a seller, offering a 15-day closing on a vacant property is going to be highly attractive to the seller and thus you can probably work the price down.

As I said, there are all kinds of scenarios where short or long closing dates are either good or bad.

But today, I’m going to show you where a long closing was a diaster.

Look at this property:

This sold in February of 2022 for $2,400,000

Nothing special to report here, right?

But the property was tenanted until “late 2022,” per the listing. And that was my first red flag.

“Late 2022.”

Why not say, “October 31st, 2022?”

It didn’t make sense to me. It felt like the listing agent was being deliberately aloof.

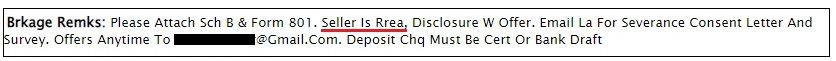

Not only that, the listing read, “No Viewing. Must Assume Tenants.”

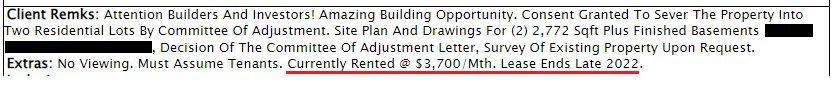

Take a look:

This looks suspect to me.

But it turns out – this is simply land value.

I mean, don’t tell that to the tenants who live inside the house! But it’s being sold as land value since the owners obtained a consent to sever the lot, and presumably this is being bought by a builder.

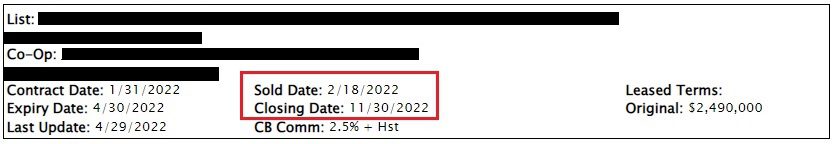

Now when did it sell? When was it scheduled to close?

Oh, boy.

A nine-month closing?

That could be problematic, right?

I mean, I assume that the buyer wanted a long closing date because they didn’t want to assume the tenants. Of course, we don’t know exactly when the lease ends; we merely know it ends “late 2022.”

But can you see a problem with a 9-month closing?

What if, say, oh, I dunno…….maybe, ummm………..the market changed?

What if the Bank of Canada implemented seven interest rate hikes and then in November, the buyer couldn’t afford to close?

Well, folks, that’s what happened!

Because the property is back on the market!

Even priced $112,000 below what they sold for in February of 2022, it’s still over priced.

They’ll be lucky to get $2,000,000.

But mistakes happen, right?

It’s not like this agent (ahem), I mean this seller should have known better…

Oh man, that’s good stuff!

–

The market doesn’t owe you anything

Have you watched the Netflix documentary called, “Eat The Rich: The GameStop Saga?”

It’s a must-watch!

At times, I felt myself pulling for the little guys. And at times, I felt myself pulling for the institutions.

In the end, I think both parties were to blame.

I have no doubt that RobinHood turned “off” retail traders’ ability to buy GameStop shares so RobinHood could influence the market, so in that respect, I harbour resentment towards the institutions.

But I also have no sympathy for retail investors who were buying shares of a stock that was being manipulated in a way that no other stock, in the history of modern man, had been before. It was beyond the tulip bulb craze or the dot-com tech bubble.

Surely, they had to know they could get burned, right?

The same can be said of the buyers of Mattamy Homes’ pre-construction properties, as we read in The Star last week:

“They Paid Top Dollar For Pre-Construction Homes At The Market Peak. Now The Builder Is Selling The Same Models For Far Less.”

Toronto Star

February 5, 2023

Thanks to blog readers Ace Goodheart, Different David, and JL for pointing this article out.

But it’s nothing new, right?

In fact, we’ve heard this before.

Come to think of it, we’ve read this before!

This exact same story was written five years ago, with the same developer, the same buyers, and the same ignorance among “investors” who don’t believe a market can go up and down:

“Price Drop Crushes Pre-Construction Home Buyers’ Dreams”

Toronto Star

February 2, 2018

It’s almost ironic, right?

I don’t mean to make light of the shortcomings of others, but the buyers of this project in 2022 could have Googled the builder, and/or pre-construction, and/or any number of terms, phrases, and risks during their research phase (assuming they did research…) and found that the worst-case scenario had already happened.

Per the first story there – the one from 2023, commenter Ace Goodheart duly noted:

The story originally had a picture of the lawyer standing in front of three expensive looking cars. They seem to have changed that, and he is now sitting at his desk.

This guy’s biggest enemy is the person who stares back at him, whenever he looks in the mirror…..

Sounds like “mens rea” to me.

Innocent men don’t stage the crime scene to look like an accident.

And poor, unfortunate, taken-advantage-of, unknowing, unwitting, naive, inexperienced, unlucky individuals don’t pose in front of three luxury cars for a photo and then claim “devastation” from an “unfair” experience with an unscrupulous developer…

People can win or lose in any market, and while the Toronto real estate market has been almost “can’t miss” for the better part of two decades, you can’t make any investment without considering the potential for a loss.

In the Gamestop Saga documentary, some of the longest-tenured investment experts in the country said that a hedge fund manager never could have accounted for a million amateur retail investors conspiring on Reddit to artificially manipulate a deadbeat stock into appreciating from $5 to $500.

But is a real estate market declining the same “one-in-a-billion” event?

I don’t think so.

Check out this house:

Ugly as hell, right?

Well, what if you bought that house, renovated it, and sold it for more money

Novel idea!

Let’s say that you turned that house into this one:

Beautiful!

And let’s say that you turned this kitchen….

….into this one:

Would you expect to make money?

Let’s say that you purchased the house for $1,025,000.

How much money does it take to renovate that house?

We could all throw out guesses, and we’d be all over the place. Anything from $75,000 to $300,000, I’m sure.

So what if you put in all that work and then sold for less?

It could happen in a market that moves up and down…

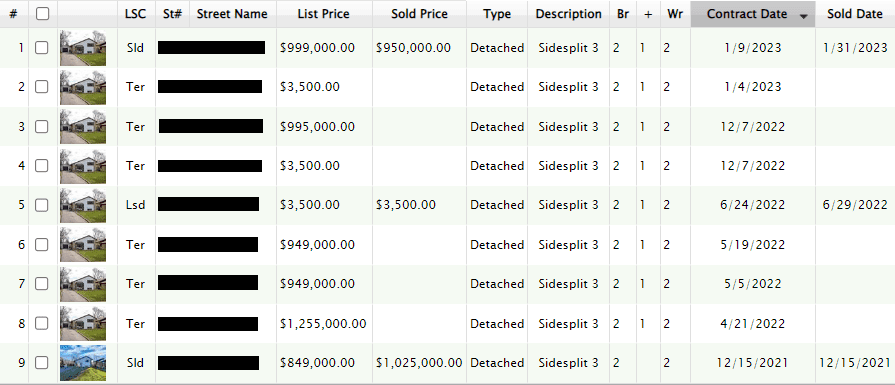

Check out the listing history:

They paid $1,025,000 on December 15th, 2021 and closed on December 29th, 2021.

Quick closing, right?

They did a quick (and dirty?) renovation and had the property back out on the market on April 21st, 2022.

They listed for $999,000, with an offer date, and didn’t sell.

They then raised the price to $1,255,000.

But they couldn’t sell!

So on May 5th, they re-listed for $949,000 with an offer date, but that didn’t work.

Soooo………they re-listed at $949,000, again?

Then, they did what so many people did last year: they said, “Well just lease it and sell it for more money next year!”

So they leased it for $3,500/month in June.

But by December, they were looking for another tenant!

They tried to cut their losses in December and listed the house for $995,000, which was $30,000 less than they paid, after spending money on a renovation, but they couldn’t sell.

Then when the calendar turned to 2023, they listed for $999,000 and finally sold for $950,000.

The land transfer tax they paid on the $1,025,000 purchase was $33,950.

If they paid a full commission (which I highly doubt they did…), they would have paid $53,675 in real estate fees on the $950,000 sale.

They’re in the hole for $162,625 before we even consider the renovation costs.

The before-and-after photos tells me this renovation has to be at least $150,000. Maybe more. Probably more, but I shudder to think.

This is a $300,000 loss.

And it’s an exceptional purchase for somebody out there who is going to call this place “home.”

I feel for these sellers. Er, these “investors.”

You’d have be a complete bastard to smile when you see somebody lose money like this.

I just hope others learn from the story and realize that there has to be a plan-b, an accounting for market fluctuations, and some acknowledgment of risk.

–

What does “normal” look like in this market?

Good question!

And yet, it remains so hard to define…

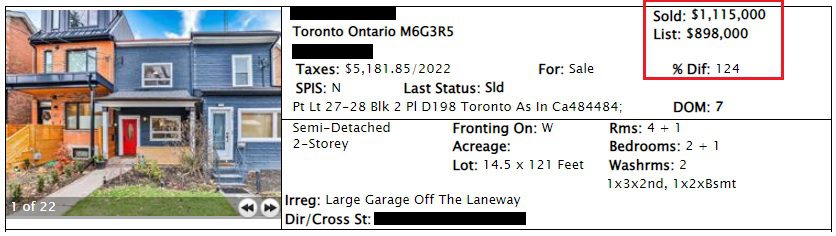

If I had to pick a listing that represents a definition of “normal,” it would be something like this:

Knowing nothing about this house other than the fact that it’s a 14.5 x 121 foot lot, 2-beds, 2-baths, plus a finished basement with a third bedroom, we might think this is too much or too little.

But I think the price was just right.

This was a great price for the buyer but also a great price for the seller.

How can that be?

Well, I’m simply looking at what it sold for last time:

The current owners paid $845,000 for the property in April of 2018.

They sold for $1,115,000 in January of 2023.

That’s a 32.0% increase through not quite five years.

Calculating that return through 57 months, unadjusted for compounding, that’s a 6.73% return per year.

There’s nothing wrong with that, right?

This is after a decline from February of 2022 through January of 2023.

So while a seller might say, “Aw, gee, shucks, we would/could/should have sold for $1,200,000 last year,” this is still a great return.

Hmmm….no sarcasm here; that’s actually good stuff!

–

Explain this to me. Please.

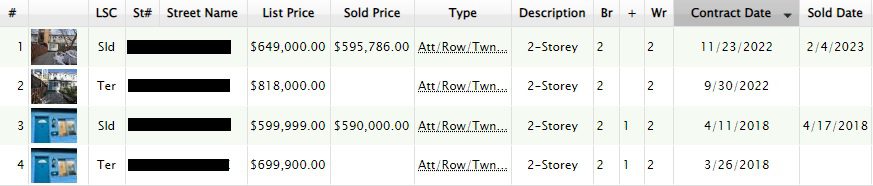

Last, but not least, I’m going to show you a sale that makes zero sense to me.

I’ve looked at this one over and over, but I can’t make sense of it.

It sold for $109,900 less than the original price in 2018.

It sold for $222,214 less than the original price in 2023.

But above all, it sold for less in 2023 than it sold for in 2018!

Do you know what I say?

That’s good stuff!

Appraiser

at 7:13 am

Lack of supply is the greatest contributor to the current stalemate in the market. Lack of supply means that investors are able to rent their properties out at record high levels, if they can’t sell them.

All the while, higher than required interest rates guarantee that many potential buyers can’t qualify for a mortgage. And the stalemate of unaffordability continues.

Build Baby Build!

Nick

at 7:58 am

I’d also argue that lack of patience. Many people could see the bubble especially in early 2022. But rather than wait they bought which contributed to the overheating. The fed had also warned about interest rates by then but until the increases started they kept on going.

As to that article I remember the original from Whitby with that builder years ago. For some reason they love writing about them but many were doing it in the area at the time.

Marina

at 10:32 am

With some of the houses selling for a lot less than expected, you have to wonder what else is going on. Did a Hell’s Angels club house move in next door?

We have friends who just sold their house for 1.6 mil, and a house next door is trying to sell for 1.3 and having a hard time. Why? Because they started a condo construction next door and it’s pretty obvious that a buyer will be living in a dust cloud for the next 2 years, and in the shade of a 30-story tower thereafter.

There is a house in my neighborhood that sat on the market for 3 months, beautiful house, no interest. And a semi just sold, ugliest house I’ve ever seen in this area, and sold for over asking. Makes no sense.

Ace Goodheart

at 1:19 pm

Current take on interest rates in the media is interesting. The star ran what amounts to a “self help” story this morning advising people not to go long on their mortgage renewal, as interest rates will probably be cut again and start going down in 2024 (“and potentially even as early as 2023”).

This, of course, assuming that inflation is back down to 2% by the summer of 2023, that our current Liberal government, which seems to have more control over the workings of the BoC then it really should have, doesn’t lose the next election, and that the “sunny ways” doctrine of spending borrowed money to fund expensive social programs, putting our kids, grandkids, and grand kids kids, into taxpayer funded long term Federal debt for their entire lives, keeps being seen as a responsible and fiscally sound way of running a government.

If any of the above turns out not to be true, then where are 5 year fixed rates going to be in the summer of 2024? 2025? 2026?

Those with the crystal ball tell us lower. Again, it bothers me that people keep doing this. The reason why a lot of people are in trouble with their mortgages right now is that the governor of the BoC promised to keep interest rates low “for a long time” (something he cannot do, he must react to inflationary pressures, no matter what that does to people’s finances).

Why tell people to go short on their mortgages, when interest rates might be HIGHER in 2024, 2025?

Ace Goodheart

at 8:11 pm

Am I the only person who thinks that John Tory didn’t really do anything wrong?

I actually like him more now than I used to. I mean, a 31 year old? That is pretty cool!

Isn’t there a new gender that is part of the LGBTQ2+, where you have more than partner, and it’s OK? At least one of his partners knew about the other one after all.

I feel like we’re living in 1950’s Toronto with some strict moral code.

I mean the guy had a girl friend. So what?

I want our mayor back!

Sirgruper

at 12:09 am

I think it has more to do with that he was in a position of power over the young employee.

Ace Goodheart

at 8:24 am

There was no suggestion that he took advantage of her. It seems to have been a mutual affection type thing. A relationship.

Different+David

at 8:15 am

I agree with you in spirit – he apologized, the woman no longer works with the city, it should have been the case where it was a stain, but one that could be cleaned up. However, Jerry Agar made a good point that the left-leaning councilors (and the left media) would be habitually bringing this up at every council meeting, every news conference etc. It would be a distraction from getting things done.

It wasn’t like he was caught rezoning prime land for a few developer friends…who happened to be donors to his re-election campaign.

JF007

at 8:47 am

How do we know the person reporting to him was not advantaged in assignments, hikes, bonus etc. since she was in a relationship with her boss.. it’s a tricky slope to be on in this kind of relationship where your boyfriend is your boss and both of you are on city dime, even if nothing was wrong it most definitely is a breach of their ethical oath of some sort which would be part of their contract with city and hence grounds for either getting fired without benefits or voluntary resignation..i suspect the resignation might have to do more with saving his benefits post it than a moral obligation as he is portraying it as..

Ace Goodheart

at 12:33 pm

Isn’t that one of the ways to get to the top? I know back when I was still a corporate lackey (before I went out on my own and discovered the hardships of running a small business) the word on the office floor was always that certain folks got their jobs by having relationships with certain managers. It was an open secret.

This was guys and girls too, not just a female thing. The men were doing it as well.

Looking Up

at 10:50 pm

Actually Ace the vast majority of people that have given a opinion of the Tory thing are in your camp. His personal life has nothing to do with his ability to run Toronto and what he does on his time off is his business.

Steph

at 10:55 am

Was this article about the mayor? I must have missed that part.

Jennifer

at 11:39 am

Can you explain the last example? By original price you mean list price? (I thought we established that means nothing.) It sold for 5,986 more is what I see, where are you seeing less?