What is a “double whammy?”

You’ve heard the term before many times. You’ve probably used it yourself before on occasion.

It was also a really bad movie from 2001 with Denis Leary, Elizabeth Hurley, and Steve Buscemi that managed to still get a 5.7 rating on IMDB. As embarrassed as I am to admit this, I watched Double Whammy one lonely night in university on CHCH television, channel 11, circa 2002-2003, with commercials, and I honestly have no idea why…

The term “double whammy” can essentially be used to describe any situation in which there are two of something.

However, I think the term, when used in its correct form, references two things that, when combined, have a greater impact than their collective sum.

For example, if you have pain caused by both physical and emotional trauma, it’s two pains, but combined they are far worse.

It’s a classic double-whammy.

Now, in another case, if you found a condo that was both tiny and expensive, and it was tiny because of how expensive it was, but also expensive because of how tiny it was (I’ll explain this in a moment), then that’s a classic double-whammy too.

An old friend of mine emailed me last week with the following:

Hey Dave – I was re-reading your multiple blog posts on the horrors and pitfalls of pre-con condo buying in Toronto. I re-read them quarterly because they help me keep the pre-con temptations in check…you must understand, these temptations are…overwhelming at times. Sometimes I can’t control myself! These blog posts are like bible verses that keep me from sinning. “Heavenly Fleming please forgive me!” lol.

In one of them you mentioned you have a client that does pre-con purchases as investments and I was wondering if you’d be willing to share the contact someone with first hand experience could walk me through it. I know it’s a lot to ask and if you aren’t comfortable with it when I totally understand.

So people are still curious about pre-construction condos in Toronto?

I thought that ship had sailed.

I wrote my friend back and said that I wouldn’t feel comfortable connecting him with my client, but more to the point, my client doesn’t “invest” in pre-construction anymore for a multitude of reasons.

Also last week, I asked the TRB readers to post suggestions for future blog topics and we received this:

More on that in a moment, but first, a client of mine is preparing to list his downtown condo for sale later this month and we’re currently renovating the place.

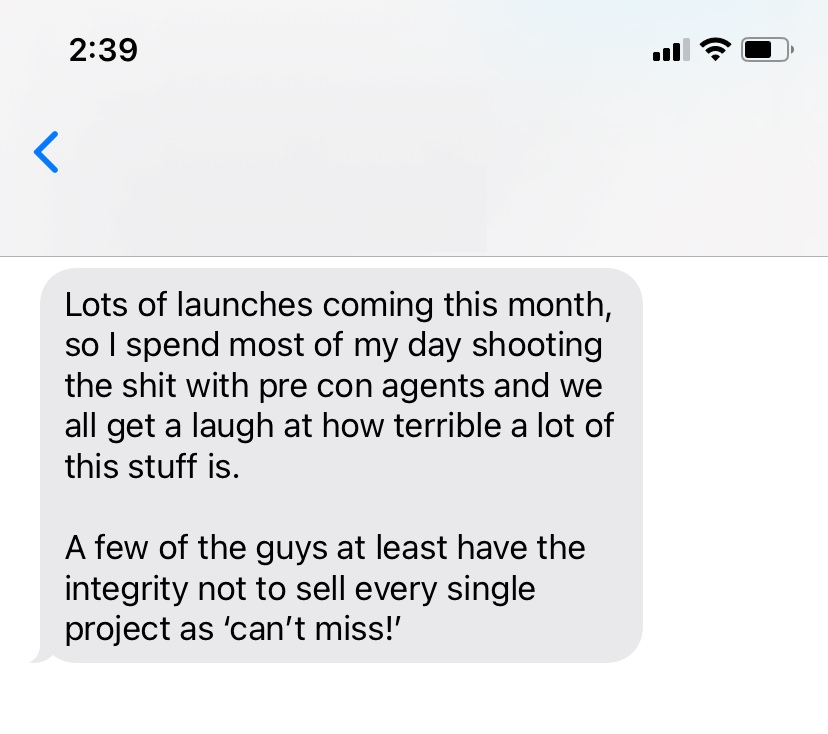

New floors, new light fixtures, changing out the hardware on the doors, painted kitchen cabinets, and a full paint-job throughout. While we got to chatting on Friday, he sent me this text message, among others:

He then proceeded to introduce me to a project called “The Goode Condos” which is a development being built at 37 Parliament Street.

The Goode.

It almost bothers me that the word “good” is spelled incorrectly, but society in 2021 loves to say, “heyyy gurl” because it’s cool, or “U R 2 sweet.” I’m just a 41-year-old cynic, so what do I know.

I mean, maybe “Goode” is the surname of the builder? Maybe I have no bone to pick?

Except that their catch-phrase says otherwise:

It’s all good.

Remember that stupid catch-phrase from 2001?

Bump into a guy at the bar waiting for a drink: “It’s all good, bro,” which means “I’m sorry.”

The waitress tells you they’re out of your favourite beer: “It’s all good,” which means, “No worries.”

Or your annoying buddy with the frosted-tips in his hair, the puka-shell necklace, and the thumb-ring says, “It’s all good” to anything and everything, but he says it like, “sallguud.”

I don’t love this catch-phrase.

But I have a larger problem, and it’s the following:

The best downtown Toronto condo opportunity in 2021

Really, eh?

How do you define “best” though?

If you’re reading this on Monday morning from the sales centre at Graywood Developments, just remember: you opened the door to this…

First and foremost, combining a silly catch-phrase like “it’s all good” with some nonsense about this being the “best opportunity” is actually a double-whammy, but not the one I wanted to talk about today.

Today, I wanted to talk about a different double-whammy and it starts with a conversation about $455,900 condos in Toronto.

If you could afford a condo in downtown Toronto for $455,900, would you be interested?

The average 416 condo price is over $720,000, and just from cruising MLS or House Sigma, I think you’ll find that buying condos under $500,000 is near impossible.

So a $455,900 condo? Piques your interest right?

Okay, but let me switch gears for a moment and go in a completely different direction.

Let’s say that, oh, I dunno, I asked you if you wanted to live in a very clean, very comfortable…………………dorm room.

Interested?

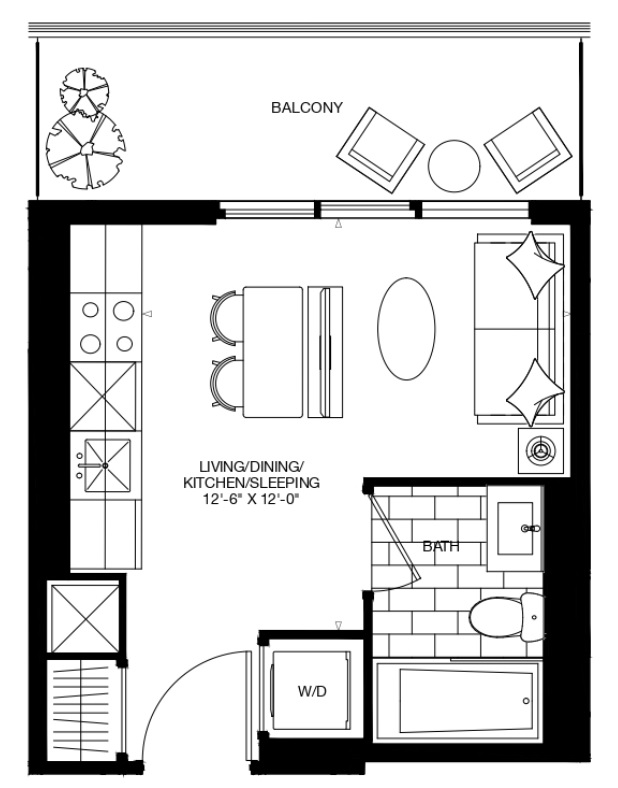

What does this remind you of:

I know what you’re thinking.

You’re thinking, “David………..most dorm rooms don’t have balconies!”

And you’re right, that’s fair.

But are we really at the point in Toronto where we’re combining LIVING/DINING/KITCHEN/SLEEPING?

The only thing that stops this from being a supersized jail cell is the wall the separates the bathroom from the rest of the space. Put the toilet in the living room, and voila! It’s Wentworth in there.

Folks, this is something I’ve never seen before in Toronto. It’s a 263 square foot condo.

And if you’re playing along thus far, you’ve put two-and-two together and have come to realize that the $455,900 condo I speak of, and this 263 square foot jail-like unit, are in fact one and the same.

I’ll save you the calculation: it’s $1,733 per square foot.

Ready to talk about pre-construction investments now?

Not only is this condo merely 263 square feet but it’s also priced at $1,733 per square foot!

A classic double-whammy!

I mean, if this 263 square foot condo were modestly priced at “only” $1,000 per square foot like so much of the downtown core, and was available at $263,000, then you might accept the silliness of the size and layout in order to achieve an unheard-of price point.

Or, if you found a condo priced at $455,900 that happened to provide 450 square feet – a small size indeed, and among the smaller condos in the city, but functional nonetheless, you might be interested in the unit.

But put together the price and the size and it’s a double-whammy!

It’s a wham that Adam West and Burt Ward would be proud of.

It’s a wham that George Michael and Andrew Ridgeley would be proud of too.

And I ask again: how in the world is this an “investment?”

There’s absolutely, positively, nothing to justify this valuation of $1,733 per square foot. Not only that, as a pre-construction “investor,” you’ve got to consider the additional costs that lay ahead. Wait until you get a call from the sales centre inviting you to “come and choose your finishes!” They’ll remind you to bring your cheque-book, since most people don’t settle for the standard finishes, and you’ll end up paying for upgrades, no doubt about it. And just wait until closing when fees, levies, and charges you had no idea existed are added to your tab. I’m not talking about “closing costs” like that of a resale transaction where you pay for legal fees, disbursements, et al. I’m talking about potentially tens of thousands of dollars of fees that most pre-construction buyers don’t know exist.

It’s not unreasonable to assume that a condo sold or $1,733/sqft could end up costing the buyer $1,850/sqft after all is said, done, and added in.

But let’s just assume we could actually secure this “deal” for only $1,733/sqft.

What are neighbouring properties selling for?

How about right next door at 39 Parliament Street?

This condo was completed in 2000, so there’s no comparison between the two buildings, of course. But if real estate is really “location, location, location,” then what the hell are we talking about?

The last sale in this building was for a 549 square foot unit in August.

What did it sell for?

$500,000.

That’s $911 per square foot.

Oh, it’s such an old building! Built in the year 2000 when some of you weren’t even born! What an awful place to live!

So………would living next door be worth $1,733/sqft then?

Immediately north of 39 Parliament Street is another condo: 33 Mill Street, called “Pure Spirit” and built in the year 2010.

The last sale in there?

A 1-bed-plus-den with parking for $740,000.

How large was it?

850 square feet.

That’s $871 per square foot.

Condos.ca shows the average price in the building at $1,003 per square foot, so if you want to chalk up the last sale to an outlier, no problem. But this is still $730/sqft less than the pre-construction building two doors over, which has yet to be completed, which could be delayed, come with deficiencies, have a prolonged occupancy period where you pay a fee on a unit you’re supposed to own, and which could have egregious closing costs.

Why?

Because the hallways have nicer carpet?

An “investment.”

Yeesh.

Classic magic beans scenario.

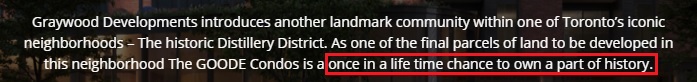

However, it’s apparently a “once in a lifetime opportunity.” I mean, I know I heard somebody say that. Somewhere. Who was it?

Oh, it was the developer, who has this on the website:

Wow!

A chance to own a part of history!

Unlike every other condo in the city, that is?

Wait, wait. This isn’t entirely fair, since this is, apparently, the last parcel of land to be developed in the neighbourhood, so it really is a “once in a lifetime chance,” if your lifetime ends soon.

Wait, wait. I read that wrong. This is “one of” the final parcels of land to be developed, so with an indeterminate amount of future parcels that could be developed, anywhere from one to, say, fifty, I’m not exactly sure their “chance to own a part of history” bullshit carries any weight.

Look, all cynicism aside, and yes, there has been much of it – I’ve been writing about the pitfalls of pre-construction condominium buying (notice I didn’t say “investing”) since I started this blog in 2007.

If you want to invest in a condo in The Distillery District then go buy something you can see in person, walkthrough, and inspect, next door at 33 Mill Street. You can also review the condominium’s financial documents via the status certificate and make sure you’re making a sound investment.

Or, you could buy magic beans.

These magic beans also come with an eyelash from a random salesperson, and everybody knows that if you wish on an eyelash, there’s a good chance that your wish will come true.

The coffee company Nabob has a slogan that reads, “Better beans, better coffee.”

Better beans, eh? This got me thinking: as good as the $1,733/sqft magic beans are, can we possibly do better?

A-ha! We can!

A project called “The Capitol” at Yonge & Castlefield which was “launched” on September 14th, 2021, as though it were a ship leaving the harbour on its way to save the planet from extinction!

Google “The Capitol Condos” and look at the first 4-5 links. They’re all ads with URL’s that sound like they might be the actual sale centre website, but they’re not. They’re bottom-feeding real estate agents who cyber-squat URL’s when new projects are launched, and then create websites to look like they belong to the developer. These agents look to capture contact information, which they either use to attempt to sell magic beans, or they sell this info back to the developer.

But that’s merely the sauce for the beans!

The beans themselves, in this case, come in the form of condos that are rumoured to cost around $1,900 per square foot.

Rumoured, since the whole industry is soaked in this cloak-and-dagger nonsense, which is probably how you get people to shoot themselves in with their own gun in the first place.

Check this out:

Note the following items grouped together:

“Residences Starting from the $1M”

“Upto 3,000 SQFT”

That’s not a typo above. I wrote “Upto” because that’s what the pamphlet says. It’s their typo.

Regardless, note they have sheepishly put the $1M figure next to the 3,000 square foot figure, as though these numbers aren’t mutually exclusive.

At $1,900 per square foot, you might expect to get a 526 square foot condo for $1,000,000.

And unless a developer can cram two bedrooms into 526 square feet, I’m going to assume that this building might be the first of it’s kind: million-dollar one-bedrooms!

Ah, that’s been done before, of course. But not at Yonge & Eglinton!

Magic beans. They never lose their charm.

And there’s no shortage of people lined up to buy these magic beans. Trust me, you can actually see the lineups outside of sales centres!

So, to the blog readers that asked about pre-construction “investments,” there you go. $1,900/sqft. It’s a lead-pipe lock, I tell ya!

Now, if you’ll excuse me, it’s time for my lunch. I just paid $9.00 for this sandwich, so after I eat half, and take a small bite out of the second half, I’ll see if I can sell that near-half for $7.50…

J

at 10:05 am

I’m guessing “Goode” as an homage to Gooderham & Worts.

I think these examples of high-priced microcondos are part of a phenomena we’ve seen for a while. Larger units tend to sell for less than smaller units on a per square foot basis. The total opposite of diamonds, where prices increase exponentially as a function of carats. Even Rosedale/Forest Hill mansions often sell for the same or less on a per square foot basis than cookie-cutter 1-br condos, especially if you include the basement square footage (apparently the generous fraction of an acre of centrally-located land gets thrown in as a free bonus).

This irrational behaviour seems to result from there being a larger buyer pool the further down the pricing ladder you go. Also, there’s a crowd desperate to get into real estate no matter what, value and common sense be damned.

Appraiser

at 10:09 am

The old line is that the cure for high prices is high prices. When prices rise, businesses tend to respond by producing more. If the price of something gets too high, then people buy less, which then leads to too much supply, which lowers prices.

Unfortunately at this rate, owing to a chronic lack of supply, the previous economic dictum no longer appears to apply.

Izzy Bedibida

at 10:52 pm

Unfortunately the RE/Development industry is looking for ways to keep high prices high.

Appraiser

at 8:39 am

Perhaps, but I believe that you will find an even greater number of NIMBY’s and their political enablers (city counsellors) holding development back, especially in the 416.

A kind of double-whammy of its own.

Edwin

at 11:13 am

These get priced so high because a large percentage of the buyers have no intention on closing. They buy with the intention to assign in 5 years. It’s just an investment vehicle, treated like a stock. Investors choose to park their cash here over the stock market due to the astronomical gains the market has seen.

If the units had to be priced solely based on people buying them to live in, the developers would have to lower the price drastically.

Jennifer

at 12:19 pm

a large percentage? do you have back-up for that?

Appraiser

at 8:31 am

Back-up? Nope. Myths need no evidence.

Steve

at 11:55 am

You woke up feeling generous I guess. Even the layouts for The Goode that have actual bedrooms are good for a laugh. I am pretty sure to get to your closet in one of the 2BR layouts you would have to vault the bed, at least as depicted.

Libertarian

at 12:22 pm

This, to me, is another example of financial illiteracy and how so many real estate fanatics have it in spades. These fanatics make up numbers about how you pay it off in increments and you’re using leverage, so your gains are magnified, and someone else will pay off your mortgage, etc., etc., blah, blah, blah. Going through all these hoops makes it difficult to figure out how much you’re really making.

So much easier to buy stocks or ETFs or whatever. Where is JG to remind everyone about FAANG?

But there is also the possibility of the stereotype of the foreign buyer – pulling money out of their country to hide in Canada. I think even David admits that this number is higher than what’s reported.

Kyle

at 1:43 pm

“Going through all these hoops makes it difficult to figure out how much you’re really making.”

Those who claim to be financially literate shouldn’t have any difficulty whatsoever figuring out how much they’re making.

“So much easier to buy stocks or ETFs or whatever. Where is JG to remind everyone about FAANG?”

Is the point for it to be easier or to actually grow one’s wealth? While i might agree financial assets are easier to invest in, they aren’t easier to build your wealth with. There are literally 100’s of thousands of homeowners in this City who have become millionaires by doing nothing more than paying the mortgage for the roof over their heads, meanwhile i have yet to meet a single non-homeowner accumulate anywhere close to a million through investing in financial assets. I’m sure some exist, but the only ones i’ve encountered are the pretend kind behind keyboards.

In fact, accumulating wealth without owning real estate is such a rarity (read difficult or near impossible) that the few who do manage it get articles written about them lauding them for their acumen, but invariably the secret to them getting there had less to with investing in financial assets and more to do with them subsisting on a tiny fraction of their income, or living with parents well into adulthood.

There is a reason it’s near impossible. When you buy a home, you lock in your shelter costs. Overtime, as one’s income rises they have more and more disposable income to build more and more equity. Those that don’t own, are on this never ending treadmill, where rent increases eat up income increases, so they’re always left with a meagre amount to invest in financial assets. I don’t care what kind of returns you get on your FAANG stocks, if all you can put a way is a couple hundred each month, your wealth isn’t going anywhere fast vs a home owner who on average made close to $120K last year.

Appraiser

at 2:05 pm

$120k X 4 here.

J

at 2:47 pm

The reason you don’t hear much about long term success with investing in financial assets is because it’s extremely crass to discuss this sort of thing openly. But for whatever reason it’s socially acceptable to brag about real estate performance at proverbial dinner parties and BBQs (see Appraiser’s comment above).

Yes you’ll hear anecdotes about high flying tech stocks or cryptocurrencies or what not, but those aren’t serious long-term investors. Successful long term investment in financial assets is an extremely boring story to tell, even if it weren’t so tacky to do so.

Owning your primary residence and investing for retirement shouldn’t be seen as mutually exclusive choices. The former is a (very expensive) lifestyle choice while the latter is necessary regardless of your choice in home (unless you’re fortunate enough to have a government pension). After all, if you don’t have retirement savings you’d have no way to fund your ever increasing housing expenses upon retirement – you’d be forced to pack up or get a reverse mortgage.

If we’re talking about investment properties as opposed to a primary residence, well then the contest isn’t even close with regards to ease. These days you can be brain dead and still successfully use a roboadvisor, while real estate investment involves a steep learning curve and a heavy amount of ongoing effort and headaches.

You can cherry pick data to make one look better than the other, and good luck predicting the future. But I’ll be sticking with the investment that doesn’t rely on a long-term decline in interest rates.

davey

at 10:45 am

Bang on, I rent my home and my dividends pay the rent , the party is soon to be more over with rising inflation. Once interest rates rise you will see real estate values go down. This has all been done before, Canadians have very little financial knowledge , for being some of the most educated in the world!

Libertarian

at 2:57 pm

Once again you hijack the comment and flip it to fit your narrative.

First, the topic of the post is investment condos, not houses as primary residences. I understand the difference. Do you? You talk as if everybody who ever bought real estate did so as a primary residence. It’s not a secret that a large chunk of pre-construction condos are purchased by people who want to be landlords and rent them out. I’m not talking about renting vs. owning.

I own my home. My investments in RSPs, TFSAs, etc., are worth more than the equity in my home, so I guess I’m one of those “pretend kind behind keyboards.”

Just because you don’t know successful investors, doesn’t mean they don’t exist. Perhaps you should try to meet new people.

And as others have previously mentioned to you, owning a home in Toronto doesn’t make the person wealthy. It makes them not poor. If you want to retire and live off the equity in your home of a million bucks, go ahead.

Kyle

at 5:15 pm

So much deflection….

The topic of David’s post is actually precon vs resale. So who’s the one flipping the narrative to fit?

My point, which you haven’t touched whatsoever is that without owning your home, there’s slim chance of ever accumulating much wealth, contrary to what JG strategy of all FAANG, all the time. Now if someone wants to invest in financial assets after they’ve bought a home i’m all for that, if they want to invest in real estate i’m all for that too, but let’s be clear all the same factors that help a home owner build wealth much faster than a financial assets investor still apply (leverage, locking in your price, principal paydown), except now it’s someone else paying down the principal.

While your financial assets may be greater than your home equity. Let’s be honest, how much less equity would you have if you had chosen to rent and never buy? Despite your deflection that it’s the company i keep, i’m quite confident, you don’t know a lot of (more like any) millionaire perma-renters either.

Frankly for someone who is always going on about financial illiteracy, to be out here endorsing Mr. “Let ‘er all ride on FAANG”, seems really rich to me.

Libertarian

at 8:07 pm

I’m not sure what post you read, but David clearly quotes various people who reached out to him talking about pre-con condos as investments. So don’t try to bully me and say I don’t know what I’m talking about.

Instead of attacking people, why don’t you just summarize your theory as this: “Hi, my name is Kyle. I believe owning is better than renting because of the forced savings of a mortgage. Have a nice day.”

Investing is more than let it ride on FAANG stocks. Financial literate people understand this. And yes, most people are financially illiterate, including renters. So most of them aren’t millionaires. But a lot of people in this city who own homes aren’t millionaires either. Not every house and condo is worth more than a million.

Appraiser

at 8:45 am

” …expertise is often associated with documents, certifications, diplomas, and degrees and a person who has an abundance of these is often perceived as having more education than practical “working” experience. However, true expertise may require practical familiarity that may be inaccessible to someone who has little or no actual experience in the field…in many such cases, it is realistically possible to achieve only knowledge of theory…” https://www.newworldencyclopedia.org/entry/polymath

Chris

at 3:38 pm

Great points from both J and Libertarian.

Kyle is straying back to the old rent vs. buy debate, which I believe we’ve all already agreed there is far more to than the financial factors. Hence, we typically discuss real estate as an investment, rather than shelter, so that we can make a more apples-to-apples comparison.

As for the $120k HPI appreciation (+17.37%), with the S&P500 up 33.42% YoY, $360k invested at this point last year in a fund tracking it would have also seen an investor earn $120k. Higher returns or less capital required had one employed leverage through margin or options trading, for example. Not that I suspect the majority of people did this, but it is far from “near impossible” to grow your wealth through equity markets.

Jenn

at 2:51 pm

This feels more like a Friday Rant to me! ????

F Cook

at 3:37 pm

Pre-cons used to sell for cheaper than their built counterparts precisely because of the risks and costs involved in buying a “yet-to-exist” building. They were lucrative investments if you are willing to stomach the risk. Somewhere along the way, the notion of pre-cons being money makers became ingrained in people’s heads and they are willing to pay higher and higher prices for them thinking they will make a killing when the buildings are completed. So here we are today finding ourselves among monstrosities like Goode where you can stand in the middle of your “multipurpose room” and the kettle, fridge, bed and couch are all within an arm’s reach.

JL

at 5:14 pm

Exactly this. There was a time when there was a discount for pre-construction, then it become on-par, and now it actually costs way more than what’s available in the resale market. Only thing I can think of is demand from those who want to “get in the market” but can’t really buy now in full, but even that would have its limits (as to premium people would be willing to pay).

Condodweller

at 12:42 am

Back in the day people losing their shirts on RE was fresh on their minds which resulted in builders needing to provide incentives to sell their units. This mainly consisted of selling at well below market prices. This lasted for a good number of years.

It would be interesting to dig up old forum discussions on the subject pre social media to see attitudes with declining prices, and even when we turned a corner it took another 10-15 years before price started to move up in a meaningful way.

Appraiser

at 9:38 am

From the files of “Why the U.S. A. has gone Mad”

This is the fifth conservative radio host to die of covid in the past six weeks. All had spoken against vaccination, though several changed their minds in their final days https://twitter.com/gtconway3d?ref_src=twsrc%5Egoogle%7Ctwcamp%5Eserp%7Ctwgr%5Eauthor

Condodweller

at 1:22 am

I’m not surprised by the small size and while I would not invest at this price, it is a new lowest rung on the property ladder and it is priced below the current norm smallest units. I don’t know if the builder is positioning them for investors but I think they would make more sense for people who have been priced out of the market to get on the ladder by eliminating rent payments. Even if the price is high, it’s exciting to know that you are not paying rent anymore and it will be paid off eventually.

It would be great if David could follow up with how the sale goes and whether owner occupiers or investors but them. It will also be interesting to see how much rent they can bring.

Tak Loo

at 4:34 am

David – I enjoy your posts. Thanks

Would you be able to post how Toronto real estate compares with other global metros?