Do I bother starting with the obligatory, “I’ll try to make this post shorter this time around?”

Nah.

We all know how that goes.

But it’s not for lack of effort on my part! It’s just really, really hard to describe an entire year’s blog posts or an entire year’s real estate stories in a standard blog-post length.

Kudos to those of you who read last week’s blog in full, whether you were reading while trodding along on the TTC or reading while eating in your Canoe…

As is always the custom at the end of the year, we first look at the “Top Five Blog Posts” of the last twelve months and then conclude with the “Top Five Real Estate Stories.”

Stories, topics, subjects, themes, issues, or however you wan to define it, but essentially what were the most important and most discussed real estate matters over the last year.

This is likely more subjective than the top five blog posts, but then again, we run into many of the same themes over and over.

For reference, here are the Top Five Real Estate Stories Of 2022:

5) The Rental Market & The Future Of Landlords’ Rights

4) Development: Yes or No?

3) The Market Shift

2) “Fixing” The Housing Market

1) Inflation & Interest Rates

I can’t imagine that we won’t overlap with at least one of those themes this year.

And just for fun, here are the Top Five Real Estate Stories Of 2021:

5) The Offer Process

4) Prices Outside The City Of Toronto

3) Market Frustration

2) The Election & Real Estate

1) The “Problem” In Our Housing Market

As I said: always some overlap!

For what it’s worth, I always pick the top five topics before I look back at previous years, just so I don’t subconsciously get influenced. I also go back through the year’s blog posts to see which themes were discussed the most, compiling a list of blog titles and categorizing them for reference.

So without further adieu, here are the “Top Five Real Estate Stories Of 2023” as I see them:

#5: Condos, Development, & Pre-Construction

This “theme” or story has far-reaching implications; at least more so than what you might conclude simply from the title.

Condos. Sure. The housing style and the market for them.

Development. Great. It’s always a topic of conversation.

Pre-Construction. Indeed. There are always ups and downs here.

But collectively, these three things will have a major impact on the future of housing in Toronto, and that’s not to exaggerate.

Condos are the future of housing in Toronto, like it or not. I don’t have any statistics on the ratio of condo-to-freehold being built in the GTA, but I would be willing to bet it’s a 10-to-1 ratio or more.

In the central core of Toronto, just about every housing completion is a condo. Sure, we have freehold homes being built outside the central core, as acres of fields are continuing to turn into rows of townhouses, all sold in the pre-construction phase and seemingly all of which come with one set of issues or another. But condominiums are dominating the landscape, especially when we consider the central core where everybody wants to live.

Development is always a topic of conversation in Toronto, whether people are complaining that there’s too much development and cranes litter the city skyline while lane closures on major streets cause traffic congestion, or whether people complain that there’s not enough development and that our deficit of homes is only worsening.

We talk incessantly about who is responsible for development, as many claim the government hasn’t done enough to build housing – especially affordable housing, and some, oddly, clamour for the private sector to build affordable housing even though that’s the public sector’s job.

And all the while, the topic of pre-construction remains a hot one, since all almost all new properties in the province are financed and built after 70-80% of units are pre-sold. Within this system comes a litany of issues, many foreseeable and many experienced so often that they’re almost expected.

This could easily have been our #1 point if we wanted to flush out just how many other issues, topics, and themes stem from condos, development, and pre-construction. But as it is, let’s explore how we got this to #5 on the list.

I started 2023 by writing about the serious issue of condo maintenance fees and how they have risen astronomically in recent years, way beyond the rate of inflation.

On January 30th, I wrote: “What’s Happening With Condo Maintenance Fees?”

And on February 1st, I penned a second part: “What’s Happening With Condo Maintenance Fees? (pt2)”

In the first post, I outlined how “acceptable” maintenance fees had changed over the years and referenced previous TRB posts from 2007 onward.

For example, in a 2012 blog post, I said that $0.60 – $0.70 per square foot was “average” for downtown Toronto.

In a blog post from 2016, I said that $0.65 – $0.75 per square foot was “average,” with no reference to the previous post.

I noted that when I bought my first condo in 2005, the fees were $0.49/sqft including all utilities.

Then I gave examples of units that had sold and resold and how much the fees in the buildings had increased.

In the second blog post, we looked at buildings that had the highest maintenance fees in the city and buildings that had the lowest maintenance fees in the city. When all was said and done, we concluded that buildings with fees of $0.90/sqft and up, which was in the “insane” category in my 2012 blog post, were now simply the new normal.

Real estate prices might have the biggest effect on affordability in Toronto, but don’t underestimate how high condominium maintenance fees impact affordability for young people looking to buy their first property.

Later in February, I wrote: “What Causes Pre-Construction Condo Delays?”

This was a post that was probably fifteen years overdue, but I think I’ve covered the topic enough over the years.

I outlined the following reasons:

1) Deliberately misleading target completion dates

2) Approvals

3) Sales

4) Financing

5) Economic viability

A few days later, I followed up with a necessary second part: “What Causes Pre-Construction Condo Cancellations?”

These two posts rank near the top in 2023 for page views since so many people seem to be entering those exact questions into Google and other search engines. But it just goes to show you how many delays and cancellations there are, and how much buyers are afraid of it.

In this post, I provided the following reasons:

1) Zoning and approval

2) Economic viablity

3) Financing

4) Bankruptcy

5) The ability to cancel and re-sell without reprisal

While a couple of the points are repeated from the previous blog post, the explanations and reasoning are completely different.

As for the pricing of pre-construction condos and the market for them, we covered this topic many times in 2023!

January 25th, I wrote: “What’s The Price Of New Condos In This Changing Market?”

March 13th, I wrote: “Are People Really Lining Up Outside Pre-Con Sales Centres?”

July 4th, I wrote: “Buying Pre-Construction On Installment Plans!”

November 29th, I wrote: “How Are Pre-Construction Sales This Fall?”

The subject matter and the tone of these posts got more negative as the year went on, and if I were to tackle this subject right now, the news would be all about how developers and agents are resorting to gimmicks to sell units and offer commissions like I’ve never seen before. But that started months ago! The blog I wrote in July about buying on installment plans proves that pre-construction sales were weak throughout the entire year! Well, almost the entire year. I suppose the video of people lining up outside a Mattamy Homes sales centre in March tells us that there was demand at one point.

The delays, cancellations, and sluggish sales of pre-construction condominiums in Toronto have massive implications for the housing market in the short, medium, and long-term. We’re in the midst of a housing crisis, with calls to build 3.5 Million new homes in Canada over the next decade, and yet pre-construction condo projects were in peril all throughout 2023. We heard in the fall that buyers were walking away from deposits, and none of this is a good sign for condo completions over the next 1-3 years.

Say what you want about the market right now, and call out if you disagree, but I really believe that we could see a massive deficit in condos in the downtown core 3-4 years from now. We’re not building nearly fast enough and a lot of developers put projects on hold in 2023 because of high interest rates or because they didn’t get the approvals they wanted from the city. This means that 3-4 years down the line, we won’t have nearly as many new units coming online as the market demands.

Of course, much of the problem with development comes from the lack of the labour needed to actually build!

June 28th, I wrote: “Now Hiring: Anybody Who Can Swing A Hammer!”

In this blog post, I clearly demonstrated my age, not only as I reminisced about using power tools as a grade-schooler in the 80’s and 90’s, but also because of how I talked about students going into skilled trades ten and twenty years ago instead of obtaining a bachelor of gender studies with a minor in inclusivity.

With fewer young Canadians being encouraged to learn a skilled trade, and the immigration policies in Canada clearly not attracting the same, we’ve left ourselves with an untenable gap in the housing market. Skilled labourers are aging and will be retiring in droves over the coming years, and we have absolutely no plan on how to train and/or attract the labour to build necessary housing across the country.

We also spent a good amount of time discussing development in terms of how we can build and who should be responsible!

November 20th, I wrote: “Is It The Private Sector’s Job To Build Affordable Housing?”

I used to think this question was rhetorical in that everybody was taught the difference between “private sector” and “public sector” in high school, but if society’s sentiments are any indication, this question isn’t so simple anymore.

If the government can tell grocers what to charge, maybe they can tell developers too?

Last, but not least, we spent a fair amount of time talking about NIMBY’is in 2023.

Does that have anything to do with development?

Yes.

It has everything to do with development!

May 19th, I wrote: “NIMBY’s Are Alive And Well In The GTA!”

This one was amazing because the NIMBY’s actually posed for a photo! There they stood, arms crossed, looking angry, posing for a photo that would be in a newspaper whereby they get absolutely zero sympathy.

See what I meant about this being the #5 topic – that this could easily be the #1 topic because of how many implications it has? Just think about how this will affect a topic like “the future of housing in Toronto,” for example.

Housing in Toronto will almost entirely depend on how much gets built in the next five years, but we have so many things (and people) standing in the way of development.

Hmmm….is it too late to move this up the list?

#4: Changing Business Practices Amid A Changing Market

Oh, wow.

Here comes a doozie, folks! And while this might not be the most interesting of our “Top Five” today, I logged the most blog posts under this topic when I went through my year-end count.

Let’s start from the beginning: the market changed.

Yes, it certainly did! But it changed in 2022 and the ups-and-downs simply continued.

Consider that the average home price increased 20% in four months to start 2022 then came back down. We saw some lift in the fall of 2022 but it was exceptionally slow.

Enter: 2023.

And from the very onset, it seemed as though the sellers and many of the agents out there simply forgot to turn the page on their calendars.

If there was one constant in our market this year it was a willful ignorance of market prices on the part of sellers, or as time would ultimately prove, would-be sellers.

For many sellers, the ignorance was truly wilful or conscious. But for others, it was subconscious. Many sellers were truly ignorant without being deliberate.

The market spiked in the spring, as it always does. We saw some very good months for sellers but that was short-lived and the sluggishness that dominated the market in the fall of 2022 returned mid-2023, through the summer, and into the fall.

But all the while, so many market participants refused to accept the market conditions, and the sales figures showed this better than anything else.

I started to notice a change in the market and the associated business practices very early on in the year.

January 20th, I wrote: “Failing To Adapt To A Changing Market”

Not even fifty words into the post and I’d already used “wilful ignorance” as well as “greed and entitlement.”

This post was about owners of newly registered condos trying to sell the units they purchased in pre-construction, while competing against the last few builder-owned units. It wasn’t going well. It still isn’t going well, since that post was from nearly one year ago and nobody in the building achieved the valuations they were looking for when these units were listed for sale.

January 27th, I wrote: “Sold Conditional On The Sale Of Buyer’s Property”

I don’t believe that through seventeen years here on Toronto Realty Blog we had ever discussed this in a single, dedicated blog post, and yet here we were! While we weren’t seeing SOP, or “sale of property” conditions in the central core, we were seeing it in the outskirts of the GTA. I was doing showings in Georgetown at the time and I was shocked by the number of properties that were sold conditionally – with the condition being “sale of buyer’s property.”

The market eventually picked back up as we went into February, March, and April, and I didn’t see nearly as many SOP’s as I did in January, but the fact that we were seeing these at all told me that the market had changed and that the some savvy agents, buyers, and sellers were changing with it.

February 10th, I wrote: “What Do Sales To Listings Ratios Look Like Right Now?”

This was an early look at what would become a very common theme in 2023: a super-low SNLR or absorption rate.

Only one month into the year and we already knew that 2023 would be different.

February 15th, I wrote: “What Does A Listing ‘Strategy’ Look Like In This Market?”

This was going to be a big theme throughout the year and it will appear shortly in another of our “Top Five,” but at the time, we were six weeks into 2023 and simply trying to understand which sellers and agents actually had a strategy and which were merely out of touch with the market.

Now, if you stop for a moment and think about that, it sheds light on both a pro and a con of real estate as a commodity.

“Who has a strategy and who is out of touch with the market.”

Surely there’s an opportunity there, no?

Imagine if this was another commodity – one with no fixed value, like a share of stock that trades two million identical shares per day.

But sadly, 2023 became the year of “listings versus sales,” since so many properties were listed four, five, or six times before finally selling, if at all.

April 12th, I wrote: “The Listing Agent: Friend or Foe?”

Here was a story about how to (gasp!) actually work with the listing agent as opposed to working against them, as so many buyer agents out there do.

Perhaps the phrase, “It takes two to tango” rings true here, but so many agents out there think that a “negotiation” means a war.

In any good negotiation course, you’ll learn the difference between distributive negotiation and integrative negotiation. In a market like the one we found in 2023, it’s essential that agents work together and not against each other, and while money is likely going to be the biggest factor in any real estate negotiation (and thus distributive), there are a lot of elements of an integrative negotiation at play.

I worked on a lot of sales this year where money was secondary.

Some sellers needed to sell, either because they had purchased and had a closing date upcoming, or because they were moving abroad and had a sale deadline, or because they had bridge financing to satisfy.

Then some buyers needed to buy as well, most notably to lock in a favourable interest rate, although some needed to buy before the onset of a school year or because of a job transfer deadline.

In cases like this, the deals were consummated because two agents worked together, rather than barking at each other like so many Toronto agents feel is the “job.”

One of the toughest sales I worked on this year was one where I had to go crawling back to an agent who lowballed us four weeks earlier because my sellers needed to sell. In this case, I checked my ego at the door and did what I needed to get the deal. But he also checked his, and rather than trying to squeeze blood from a stone like some agents might be inclined to do, he worked with me and my sellers to get his clients into the home – as was their goal from the start.

2023 was truly a year of changing business practices, and what started at the onset of the year continued through the spring and into summer.

May 23rd, I wrote “How Many Offers Are You Expecting?”

This was a blog post about semantics, since so many sellers and listing agents were putting their fingers on the scale, trying to feign interest that wasn’t present.

This was also around the time that we started to see an abundance of “re-lists” after failed offer nights and the “list low, hold back offer” strategy began to wane.

May 25th, I wrote: “Can A Seller Accept A Pre-Emptive Offer Without Notice?”

When times get tough, people start to do stupid things.

And although this nonsense has been around since 2017, we started to see listing agents flaunt the rules again and decide to do whatever they please.

Outside of the real estate world, you can’t justify breaking a rule or a law because you said in advance that you were going to do so.

You can’t spraypaint “DRIVING 160 KM/H” on the sides of your car and expect not to get pulled over by the police when you’re driving on the 401.

So by the same token, when rules exist that specify you must notify any interested parties of the existence of a pre-emptive offer, why do listing agents feel they can write, “Seller Can Accept Pre-Emptive Offer Without Notice” on the MLS listing and get away with it?

I suppose a rule is only as good as its enforcement.

August 25th, 2023, I wrote: “Are Sellers Offering Special Mortgage Terms To Buyers?”

Once again, we see that when the market changes, so do the associated business practices.

And just as we didn’t expect to see properties sold conditional on the sale of buyer’s property, we also didn’t expect to see vendor take-back mortgages or assumable mortgages advertised along with the listings.

But any smart seller or listing agent will use that proverbial leg-up when they have one.

I had a listing this fall where the seller possessed a 1.69% mortgage rate for another three years, fully assumable! You don’t think we advertised that to buyers?

September 25th, I wrote: “Alternative Brokerage Models: Are We Trying To Solve A Problem That Doesn’t Exist?”

Okay, so I didn’t write this, but I penned the blog, and it was a guest blog by Chris Cansick.

This article appeared in our INSIGHTS magazine this fall and it was very well-received.

As I write this, I’m dealing with the closing of a property that was purchased by a buyer using a new discount brokerage model.

I absolutely hate it.

There have been eleven different licensed real estate agents with their hands on this one and it’s a total mess.

For example, when the buyer wants to head back to the house and use a “buyer visit,” the agent he or she used as the buyer agent doesn’t do the showing. So if Royal LePage sold the property, why am I getting a showing request from a Century 21 agent to show the home?

Then Homelife the next time. Then Ipro Realty after that.

Well, because these agents are probably paid $40 for the showing. But that’s not cool with me, because that agent isn’t actually representing the buyer, and thus if they’re simply present to open the lockbox and retrieve the house key, then they don’t give a shit about anything else. Is that who I want in my client’s property?

Who are these agents? Wouldn’t it be fair for me to specify that I only want the agent who represented the buyer (ie. submitted the offer) to be present for buyer visits?

Not according to the RECO rules that allow this brokerage model.

Every few days, I receive a text message question about the house from a different phone number that I don’t recognize.

I always ask, “Who is this, please?” as a reply, then I get the run-around. I tried calling, but the agents didn’t answer. Then finally, they specify that they’re working on behalf of the buyer for this property, but are they really?

I don’t want to freely give out information about this sale to anybody who asks, but this is the brokerage model where it’s a pay-for-service and a different agent – from one of hundreds of different brokerages, may have signed up to earn fifty bucks for that service.

We haven’t even touched on TRESA yet.

For those that don’t know, there’s new real estate legislation that was rolled out on December 1st and it’s supposed to protect consumers, but it’s simply going to muddy the waters, at least for the first couple of years.

As of December 1st, I cannot show you a property without you signing something first.

How many agents are going to adhere to this? Seriously?

So what’s going to happen when a buyer asks an agent to see properties, but doesn’t want to sign anything, and that agent refuses?

That buyer will go to one of the thousands of agents who either aren’t aware of the new rules, or don’t care. The trickle-down effect might be that the agents abiding by the new rules might think, “If you can’t beat ’em, join ’em.”

We’ll save TRESA for next year.

But for now, just consider that there’s even more change afoot for next year, and that’s going to change the way we transact and the market in which we do so…

#3: Landlords & Tenants

Is this cheating?

Or being cheeky?

As noted above, our #5 real estate story in 2022 was dubbed “The Rental Market & The Future of Landlord’s Rights.”

So are we simply trying to drink two beers from the same bottle here, or is this a story that has actually gained traction over the last twelve months?

Seeing as the general concept of “landlords and tenants” was #5 on our list in 2022 and now checks in at #3, maybe we could argue that it’s more important today than ever before. Maybe including this on our 2023 list is an “absolute must.”

I think it is.

It’s not like 2023 saw fewer posts on Toronto Realty Blog about problem landlords, conniving and scheming tenants, or the complete breakdown of the rental system in the Province of Ontario. In fact, I think this too has been worse than it’s ever been and thus is more of a story than ever before as well.

In this space in 2022, I wrote:

So while “The Rental Market” was a big topic in 2022, the future of the rights of landlords is just as big a topic, if not bigger…

That’s still true, but I feel as though in 2023, the story was more about the “war” between landlords and tenants.

Some tenants really, truly seem to believe they are owed everything, and many pride themselves on taking advantage of the system – and the landlords, by going on rent strikes and waiting eighteen months for an LTB hearing.

But some landlords, despite the overwhelming risks, really, truly seem to believe they can act with reckless disregard for the Residential Tenancies Act and continue to push the envelope and see what they can get away with.

Real estate investing can be exceptionally lucrative.

Once upon a time, investors looked for yield. Much like the old-world of equities investing revolved around dividends, real estate investors wanted monthly cash flow.

But just as equities investors began to scoff at a 5.7% dividend from a bluechip bank stock and begin searching for stocks that would double in value, I feel as though real estate investors’ primary concern became market appreciation.

For a while, that’s really all it was. If the real estate market was going up 5-10% per year, then with a leveraged investment (ie. real estate investors who buy with a 20% down payment), there was no better return than the real estate market.

But two things changed in real estate investing in the last couple of years: 1) Prices declined, 2) Landlording got a whole lot harder.

September 18th, 2023, I wrote: “Landlords & Tenants: The Modern-Day Hatfields & McCoys”

I usually start in chronological order with the blog posts that relate to our “Top Five Stories,” but I think starting with the above blog post makes the most sense.

This was essentially the culmination of a year’s frustration with the topic of “landlords and tenants,” and the blog post received 34 comments from the TRB readers.

Blog reader, Appraiser, said:

Unfortunately the war on real estate investors has only just begun, I fear.

Blog reader, PAPA360, said:

Government is silent partner now with every privately owned individual Condo. The Government has no money down and zero risk but controls 100% of the investment.

Welcome to Ontario landlord reality

Blog reader, JG, said:

25k cash for key is not ridiculous, go check Reddit forums.

Some tenants are asking 50-60k cash for key because their rent is so far below market (since they moved in long ago, or during lows of Covid). They are basiscally asking for 36 months worth of rent difference.

As landlord, if you can’t handle 1-2 years of non-payment, you shouldn’t be buying

There were a lot of choice comments from the readers, and while a couple of commenters were more pro-tenant, I think the comments were overwhelmingly on the side of “it’s impossible to be a landlord in Ontario” and “tenants are getting away with murder.”

Having said that, I’m not entirely biased toward one side.

May 10th, 2023, I wrote: “Giving All Landlords A Bad Name!”

In this blog, I told the story of an exceptionally shady landlord who also happens to be a licensed real estate agent. Go figure.

I would never suggest that every landlord in the province is a saint, but I would, however, suggest that there are more problem tenants than landlords.

More importantly, I would suggest that the stystem we have now is so broken that a problem tenant can cause ten times the damage as a problem landlord.

May 12th, 2023, I wrote: “Giving All Tenants A Bad Name”

Fair is fair, right?

There are two sides to every coin?

Except if I’m going to be completely honest, I feel that the problem tenants and the problem landlords aren’t the issue, but rather the system that allows them to act a certain way.

Once upon a time, if you were a landlord and had a tenant refuse to leave, you could expect the sheriff to show up in three weeks or less to deal with the problem. Post-pandemic, it could take eight months to get a hearing in front of the Landlord & Tenant Board.

And what happens when you do get that hearing?

I go back to a ridiculous example from earlier this year where mom-and-pop landlords, ie. they owned exactly one investment condo, provided legal notice to their tenant to vacate so their son could move into the condo and attend the University of Toronto this fall.

The tenant refused to leave.

The landlord appealed to the LTB.

The judge at the LTB asked the son of the landlords, “Where do you live now?”

The son replied that he lived with his parents.

The judge asked, “And where is that?”

The son provided the address, which happened to be a very expensive home in an affluent area.

The judge said, “Well, we’re in a housing crisis, and you already have a place to live. The tenant in the condo that you want to evict will have nowhere to go. Simply put, she needs it more than you.”

And that was that.

Eviction notice rejected.

This is literally “taking the law into your own hands” and if it’s the future of this city, then the implications are massive. People won’t want to be landlords anymore, and that’s not a good thing, despite what the ignorant and uneducated believe. If nobody owned the hundreds of thousands of condo units that are currently rented, or if the people who did own them refused to rent them out, then where would all of those people live?

November 13th, I wrote: “How You Can Purchase A Tenanted Property And Ensure Vacant Possession”

This is how bad things are.

The fact that we’re talking about disaster planning for when people break rules or refuse to abide by the laws perfectly underscores the problem.

And this post was also a Google darling, probably because of the question being asked in the title.

I could write another thousand words on this topic, I swear!

But I’ll leave it at this: 2023 didn’t see any improvement in landlord/tenant relations, but rather things only got worse.

So what in the world does that mean for 2024?

#2: Pricing

Prices?

Or pricing?

They’re different but they tie into one another, and I suppose you could argue that prices depend on pricing.

Over the last few years, the topic of prices has been on this list a couple of times, but it’s the actual way in which we price real estate that I feel is worthy of the #2 real estate story in 2023.

We discussed this a little bit in story #4, which referred to the changing market and the changing business practices therein. But that was more about the real estate industry, its participants, and the order (or lack thereof…) within the market.

In terms of actual pricing, we made an entire year of discussing how buyers and sellers are determining value in the Toronto real estate market.

Now, you might ask why this is so important. Prices are more important than pricing, right?

Except that in this case, the way in which sellers were pricing their properties, and the way in which buyers were pricing – or “valuing” properties, had a massive impact on price.

Price and sales.

The year isn’t over yet so we don’t have a complete picture of the 2023 data, but I’d like to run an exercise regardless.

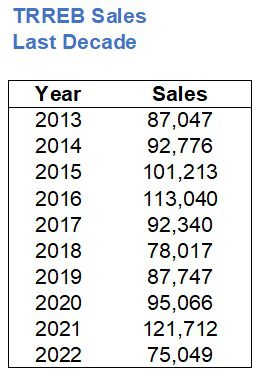

In 2021, we saw a whopping 121,712 sales in the GTA which is was a record.

Over the past ten year, we’ve only seen fewer than 80,000 sales twice. That was in 2018 and then in 2022, when we saw only 75,049 sales – a decade low:

As noted throughout 2023 and as recent as the November TRREB stats blog from two weeks ago, almost every single month in 2023 provided a near-low number of sales, when compared historically against the last two decades.

Let’s look at the sales from each month in 2023 and estimate December using the exact number of sales from 2023. Even though we are likely to see fewer sales, we’ll be conservative and use the 3,117 sales recorded in December of 2022:

That number is a pittance.

Not only would it be a new decade low, but it would be almost 10,000 sales lower than last year’s figure, which was the previous decade low.

It would also be a little more than half of the sales we saw in 2021.

And why were sales so low, you might ask?

“Interest rates” would probably be the number one answer, but if you’re following where I’m going with this, I’m going to suggest that it all had to do with how sellers were pricing.

We have already talked about pricing in the early year, but it was August, September, and October that gave us the lowest sales of all time in those respective months, so let’s look at some of the blog posts therein.

August 30th, I wrote: “Does The ‘Re-List At A Higher Price Strategy’ Actually Work?”

This post was necessitated by the scores of houses being “listed low with an offer date,” only to not sell, and be listed at a higher price thereafter.

But within the post, we learned that even if a property is under-listed, it often won’t result in any offers.

Why?

Because that’s a strategy for a seller’s market!

There are three reasons why a buyer might not make an offer on a property that’s under-listed, when the market is in “buyer’s market” territory:

1) Many buyers simply refuse to compete.

2) Many buyers fear the property will bring too much competition.

3) Many buyers want to see what the property is re-listed for.

As I said: when you’re in a buyer’s market, buyers are reluctant to work with sellers who act like it’s a seller’s market.

And that was a major theme in 2023, and also why I believe we had so few sales.

October 25th, I wrote: “Is Pricing Really Rocket Science?”

I’m still not sure whether this was a rhetorical question or not, but the blog post was yet another attempt to demonstrate the cognitive dissonance that exists in our market when it comes to pricing.

Imagine telling a seller, “Your house is worth $1,200,000.”

Then ask the seller, “How much is your house worth?” only to have that seller repeat back to you, “My house is worth $1,200,000.”

Then when you ask the seller, “What do you want to list your house for?” the seller responds, “I want to list for $1,400,000.”

That’s how 2023 felt for a lot of agents.

I had lunch with a prominent agent in the late spring and I said, “You must be doing well; you have a ton of stuff listed!”

The agent responded, “Half of my day consists of calling sellers and telling them we need to reduce the price, and the other half of my day consists of taking phone calls from sellers telling me not to ask them to reduce their price but to get their property sold.”

I spoke to another agent around that time who seemed to have an abundance of properties up for lease.

She told me, “Every lease listing I have used to be a sale listing. Each of these sellers thinks that the market owes them something, and they want to lease the property for a year or two until they can get their price.”

She told me about one seller who wanted $1,400,000 for his condo as he “needed the money for retirement.” He planned to move out of the city and buy something on the cheap, but the condo was only worth $1,300,000.

“The guy paid $320,000 for this condo in the fucking 90’s,” she told me. “What does it owe him?”

November 8th, I wrote: “Fall Pricing Strategies: Are We Grasping At Straws?”

I honestly don’t know if we can use the word “strategy” to explain a lot of the actions taken by the listing agents and sellers described in this post.

It seemed to me that people were just throwing caution to the wind.

Er, I guess, grasping at straws, as the saying goes.

“If at first you don’t succeed, try, try again,” goes the saying, but how many times can you list a property for sale in attempts to achieve a $1,000,000 sale price, only to fail every time, and continue?

Try $799,000 with an offer date, then $1,000,000 with offers any time, then $899,000 with an offer date, then back to $1,000,000 again.

If it was worth it, somebody would have paid it.

And thus the prices in our fall, 2023 real estate market were wholly a function of the pricing.

November 15th, I wrote: “What In The World Is A Marketing Price?”

This blog tried to describe the insane notion of pricing a property at a price well below what the seller wants, yet without a posted ‘offer date,’ and leaving the property listed at that price for weeks or months at a time.

Some would suggest that this is no different than what listing agents usually do – under-listing with an offer date, but I don’t agree, and I explained that in the post.

November 22nd, I wrote: “Does Extreme Under-Pricing Work In This Market?”

Yet again, we see how pricing fails the market and its participants, resulting in record-low sales.

The crazy thing is: that despite record-low sales, the average home price held in there fairly well. You might think that in a year where we see a little more than half the number of sales that we did two years ago, the average price would plummet.

No so.

And this is why I describe our market, in a word as “resilient.”

#1: The Future of Housing In Toronto

In 2022, the #2 topic was “Fixing The Housing Market.”

In 2021, the #1 topic was “The Problem In Our Housing Market.”

Is the #1 topic in 2023 just a re-wording of these?

I don’t entirely think so.

I believe that the idea of “fixing” the housing market referenced all the suggestions on what needs to be done in an attempt to bring the market to a place where most would be content with it.

I believe that the “problem” with our housing market was a theme of the criticism of affordability, pricing, market dynamics, and everything in between.

But in 2023, we talked about all of these things and more in the context of the future.

June 26th, I wrote: “Monday Morning Quarterback: I Guess We’re All Screwed?”

You wanna talk about the future of housing in Toronto? There’s your starting point!

The headline was cynical but the BMO Report that we discussed in the blog post was bleak!

How else could you describe conclusions like this:

With the construction industry already building at full speed to satisfy domestic demand, we clearly don’t have the infrastructure or ability to meet the additional demand created by historic immigration levels.”

That was merely one takeaway from the BMO Report which read more like a “how to” guide on failure in city planning.

But how about this:

“While most will argue for a supply-side fix, our longstanding view has been that it’s wishful thinking to believe that an industry, already running at full capacity, can simply double output in short order, flood the market with new units and bring prices and rents down.”

Uh-oh.

Wasn’t this the solution we so desperately sought?

Now what?

In August, I wrote a blog post that I feared reprisal for, but the response was actually quite tame:

“Immigration, Housing Prices, & Blame”

When we talk about the future of housing in Toronto, we have to look at current public policies, espeically those surrounding immigration. What used to be a hot-button topic isn’t anymore, which shows you just how much public sentiment has changed.

In this blog post, I looked firstly at Prime Minister Justin Trudeau’s now famous quote:

“I’ll be blunt as well — housing isn’t a primary federal responsibility. It’s not something that we have direct carriage of.”

Yikes. That’s not going to age well.

But I didn’t blame the prime minister, even though I had the opportunity to do so. Instead, I wrote:

Immigration is likely exacerbating the housing crisis or is most certainly going to in the next few years, but it’s not the cause of the housing crisis, and I hope people recognize this.

There are many, many causes, and this isn’t something that happened overnight. I’ve been talking about supply issues on TRB for a decade, and my issues with the absurdly negative effect that municipalities have on housing supply go back even further.

I also don’t think, and I don’t like defending the man, that Justin Trudeau isn’t personally responsible for the current housing crisis.

His policies have made it worse but he didn’t start this. He didn’t cause it.

To blame Justin Trudeau simply gives us an enemy for today, but it does nothing to solve the problem tomorrow.

Mr. Trudeau will be gone by the next election, either as his party is defeated, or he is replaced within his own party. But without focusing on the real causes of the housing crisis and real solutions, it’s simply going to be “next man up” and the country will fall further and further behind…

As much as we like to avoid talking about politics on Toronto Realty Blog, it’s so intertwined with the housing market that it’s impossible to ignore.

Blame was also a common topic on TRB in 2023.

December 4th, I wrote: “Is It Time To Blame Investors For High Housing Prices?”

Again, it was Prime Minister Justin Trudeau who gave us this idea, although the notion of blaming investors was disputed by many economists and media personalities alike.

Also on the topic of blame:

October 23rd, I wrote: “Is AirBnB Exacerbating The Housing Crisis?”

If we want to talk about “the future of housing in Toronto” then both AirBnb and investors will be a part of the conversation.

So too will be many of the ideas, solutions, or paths to housing affordability, or at least the attempts to achieve it.

October 30th, I wrote: “Monday Morning Quarterback: Olivia Chow’s $0 Housing Plan”

November 1st, I wrote: “Shared Accommodations: The Future Of The GTA?”

November 20th, I wrote: “Is It The Private Sector’s Job To Build Affordable Housing?”

Each one of these posts painted a bleak “future” for housing in Toronto, either by casting doubt on a plan, pointing out a trend headed in the wrong direction, or by questioning the accuracy of the role of the public/private sectors.

Mayor Olivia Chow really, truly did launch a “housing plan” that sought tens of billions of dollars from other levels of government.

Home owners in Toronto really, truly are offering closets and hallways in their houses to prospective tenants in a housing-starved market.

And people really do believe that for-profit, private-sector corporations should be building subsidized and affordable housing in Toronto.

Sometimes, I fear what comes next.

July 24th, I wrote: “Monday Morning Quarterback: Forcing Seniors From Their Homes Isn’t The Answer”

I received some push-back on this one which really surprised me, but if this is the direction that society is headed, all in the name of “restoring affordability” to the Toronto housing market, then I want no part of it.

Not only that, but in the queue for a blog post next year is this:

“Attention Older, Affluent Homeowners: Let’s Put Our Housing Wealth To Work”

Globe & Mail

December 9th, 2023

(sigh)

Just another person suggesting that the way to “help” the next generation with housing affordability is to tax seniors because they own their homes.

Is that the “future of housing in Toronto?”

What is?

I’m genuinely asking, because like so many of you, I have absolutely no idea what lays ahead.

I surely don’t want the #1 story of 2023 to come off as bleak, much like the BMO report referenced above, or come off dispirited in any way. But we spent so much time in 2023 talking about the future of development, planning, infrastructure, neighbourhoods, taxation, government initiatives, zoning, and more, all in the context of supplying much-needed housing to a growing population.

And what do we have to show for it?

Just a lot of questions and uncertainty.

But that likely means that this will remain a topic of discussion in 2024 and beyond, and perhaps make another appearance in next year’s “Top Five” list…

Phew!

Thank you to whoever I did not scare away with this ridiculously long post, and I’m writing it as I fight off the first cold of the winter so I’m not sure how clearly my points are coming through.

Did I miss anything?

Kidding! Just kidding!

At the length of three standard blog posts, I would hope not!

See you back here in a few days for our official goodbyes. 🙂