A younger agent in my office told me the other day, “You need to start your Instagram videos with a hook.”

I then put on my cozy slippers, unfolded my bifocals, put my newspaper aside, took a sip of my prune juice, and said, “Tell me more….”

Apparently, people have short attention spans in today’s world.

Go figure.

No more does “Hi everybody, it’s David Fleming here from the Toronto Realty Group…” offer a satisfactory introduction of a topic, story, or attempt to educate.

Shall I simply start every video with “Free beer!” and then begin talking about inventory levels in the downtown core?

Thankfully, here on the Toronto Realty Blog, we’re not bound by the same “rules of attraction” that govern social media.

No, here on Toronto Realty Blog, we can do things slowly.

We can take our time.

We can flush things out.

We can write almost every new sentence on its own line…

But just because it’s en vogue, here’s the “hook” for today’s blog post:

There are currently 39 properties listed on MLS that are being sold by lenders.

Hmmm. I think “Free Beer!” was a much better hook…

Back in October, I wrote the following:

October 10th, 2023: “So You Want To Purchase A Power Of Sale, Do You?”

This post was about the clauses that the seller/bank includes in their standard schedules and just how crazy a buyer would be to purchase a property with some or all of those clauses.

Today, I want to look at how bank-owned properties are priced, listed, and sold, and I want to use real examples.

Now, the disclaimer: As with everything else on TRB, I can’t show you the addresses of the properties, since RECO rules prohibit unauthorized advertising and disparaging remarks.

So first, let’s look at who’s selling the 39 properties:

14 – Canadian Imperial Bank of Commerce

6 – Bank of Montreal

5- Equitable Bank

4 – The Bank of Nova Scotia

3 – Haventree Bank

2 – Royal Bank Of Canada

1 – Toronto Dominion Bank

Then there are four “power of sales” for what looks like private lenders.

What I want to talk about today will branch off into a variety of different areas, and while many of you might ask, “How does one get to the point of foreclosure?” or essentially “What happens to get to the point where a property owner has their home taken away and listed on MLS?” I can’t really get into specifics here. We know that there is a process for foreclosure and that any of these properties represent a situation where a home owner wasn’t able to satisfy their financial obligations, but beyond that, we can’t speculate.

So what can we answer?

How long do these take to sell?

How many times are these properties listed?

What pricing strategies are used?

How do list prices compare to the prices that the borrowers originally paid?

Are these investment properties or are they owner occupied?

In what areas are most of these properties located?

Let me work through a few examples just to provide some context on all of the above.

First up, let’s look at a condo that’s cleary within the city (as you can tell from the photo), just to alleviate any thoughts of, “Foreclosures only happen in the suburbs!”

Check this out:

You would expect to see hundreds of 1-bed, 1-bath condos on MLS on any given day.

There’s nothing really special about this one.

Except that it’s being sold by a bank after the bank foreclosed on the owner.

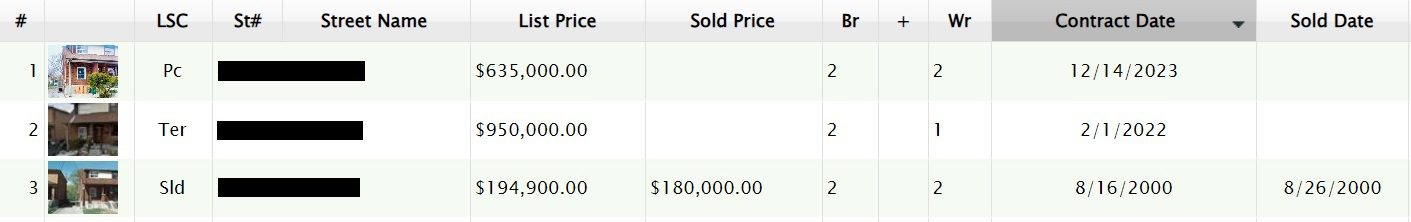

Let’s take a look at the listing history and see what we can glean from it:

So this isn’t somebody who bought in 2022 and then got trapped in a higher interest rate environment and subsequently defaulted.

This is somebody who bought in pre-construction, clearly as an investment, and rented the property out for six or seven years.

Then the bank got involved and look at how they’ve “strategically” listed this.

They’ve been on the market for seven months.

I don’t profess to know how banks decide on the list price and the eventual trigger price, and I’m sure every bank is different. Maybe they refuse to sell for less than what’s owed to them. But this property is in its eighth month on the market, on its third listing, at its fourth price.

–

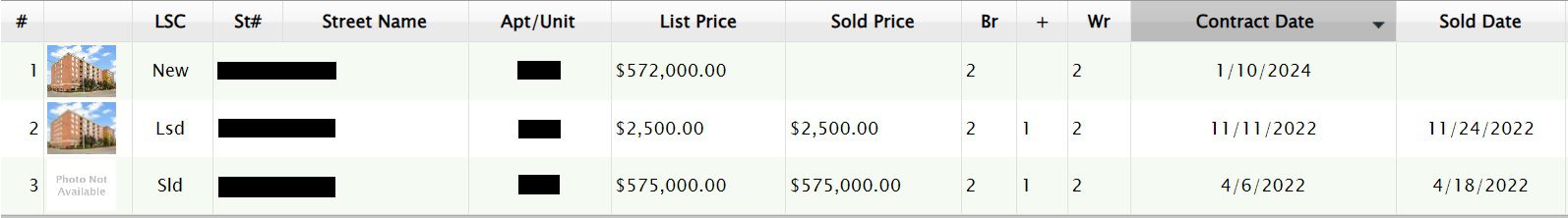

Here’s an interesting one:

Nothing special just from looking at the listing – with all those blacked-out areas, right?

Sigh.

If only I could have carte blanche to write whatever I want, but I digress…

Here’s the listing history:

So this was purchased in April of 2022 and closed in May.

It was posted for lease in November and closed in December.

Now it’s on the market – for sale, by the bank.

What happened?

It’s anybody’s guess, but it doesn’t look like this was your typical investment property. Closing in May – why would the owner wait to list for lease until November if this was an investment property?

This feels like one of those “life change” situations where the owner relocated for work and decided to keep the property.

But notice the pricing here: bought for $575,000 and the bank has the property listed for $572,000. Yes, the market value is lower today than it was in April of 2022, but by how much? More importantly, how much is the bank owed here?

Take a look at the comments on the listing:

No offers before January 17th, but, there’s an open house for January 20th and 21st.

So this isn’t an “offer date” situation but rather the bank has a pre-determined set of criteria for their listings which says the property must be exposed to the market for a certain number of days before offers are submitted.

While some of these comment sections don’t allude to the fact that the bank owns the property, this one makes a point of saying, “Banks Says SELL SELL SELL!!!” Even though that’s not grammatically correct…

–

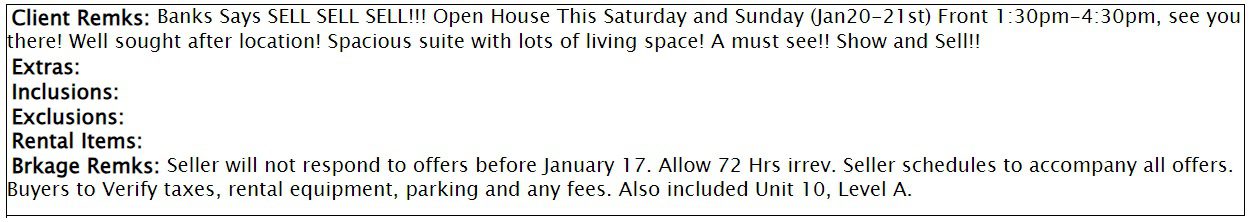

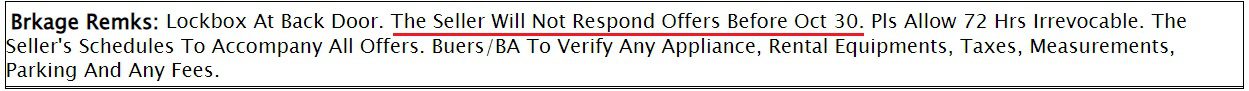

This one looks like it could be your neighbour’s house:

What a darling little home!

Cute as a button and cheap, too!

But the listing history tells me all I need to know here:

This property was offered for sale for $950,000 in February of 2022.

Somewhere along the line, perhaps in mid-to-late 2023, the bank foreclosed.

Now the property is listed for $635,000.

That’s $315,000 less than the original list price, and while the market was higher in February of 2022 than it is today, the price gap here is stark.

This feels like somebody had financial difficulties and tried to escape them, but either got greedy or got bad advice: listing for $950,000.

Now, the house is up for $635,000.

Oh, what could have been!

And the worst part: they bought it for a mere $180,000 in 2000. This house didn’t owe them anything!

–

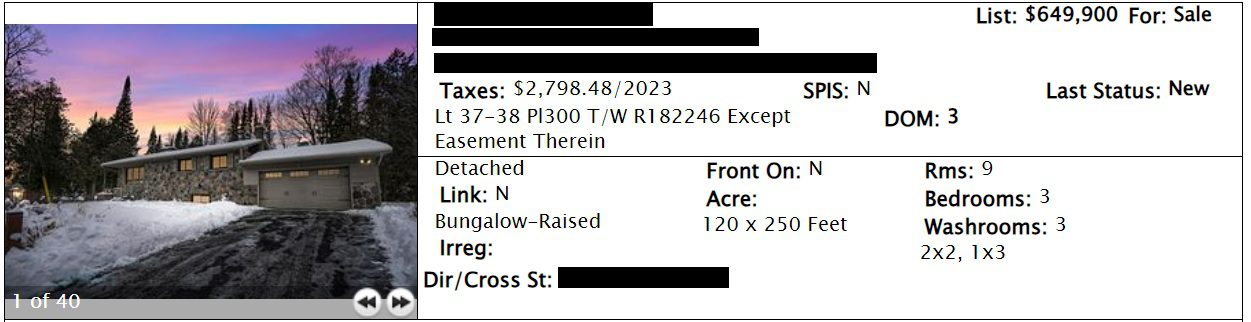

Really nice piece of land here:

But sadly, there’s a similar story in the listing history with this property as well:

This was bought for $625,000 in August of 2021.

The owner tried to “flip” the property for $849,000 in June of 2022.

Things got real when the owner dropped $120,000 to $729,900 in August of 2022.

The owner hung on for a while, listing next for $699,000 in October of 2023, but never sold.

The bank foreclosed.

Now the property is listed for sale by the bank for $649,900.

Hindsight is 20/20 in all these cases so I don’t want to sound accusatory when I suggest that these owners should have sold while they could have….

….however….

….these owners should have sold while they could have…

–

Perhaps a similar story with this house?

Beautiful lot, wow!

65 x 256 feet and a pretty heritage home!

Up for $1,599,900 for 58 days, so clearly not selling, and clearly not “worth” that price.

But the listing history tells us what we need to know:

The previous owner tried to sell from March through July, but was priced way, way too high!

$2,495,000

$2,395,000

$2,295,000

And then the bank forecloses and says, “We’re going to list for $1,599,900, thank you!”

Yes, the bank can do that. And they clearly did.

–

Here’s an example of the level of service many of these listing agents provide:

Um, yeah.

It’s January.

This listing hasn’t been updated in three months.

You would think that a bank, which is a publicly-traded company and has a duty to shareholders, would hire better agents, but they often just go with who is the cheapest, regardless of experience, skill, or ability.

–

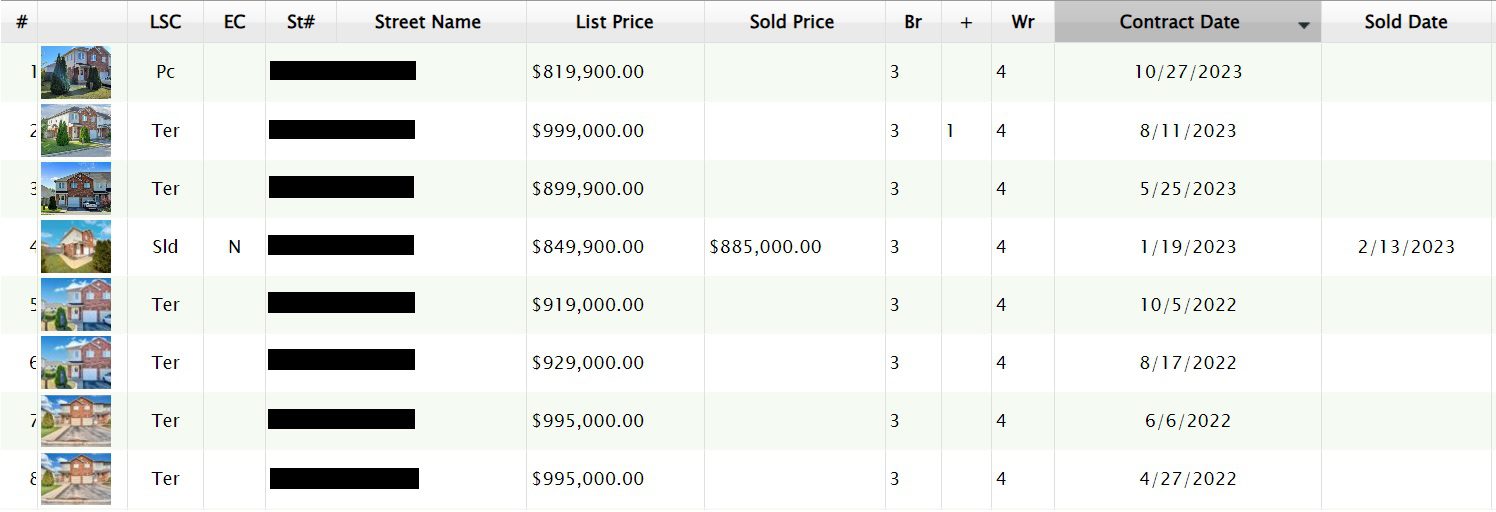

Last, but not least, this is a sad one.

Here’s the house, listed for $819,900:

And now here is the listing history.

But go over it carefully, because it’s not what you think…

These people listed for $995,000 twice in early 2022.

Then $929,000 and $919,000 in the summer and fall of 2022.

Finally, in February of 2023, they sold the property for $885,000.

But the buyer walked away!

That sale never closed, so when you see the property listed for $899,900 in May of 2023 – it’s the same sellers!

They had no luck at that price, nor did they have luck at………….$999,000 in August??

Then the bank foreclosed.

Now it’s for sale at $819,900 and not selling.

Oh, what could have been!

Blame bad luck for the $885,000 sale not closing. That isn’t the sellers’ fault.

But the sellers listed too high in 2022 and too high later in 2023 after their sale had fallen through.

There are similarities in many of these cases, are there not?

–

Bank sales make up an incredibly small number of overall sales in our city.

As noted above, there are currently 39 properties being sold by banks or other lenders.

But there are currently 14,830 listings in the TRREB districts.

Rare, but not non-existent.

And when they do hit the market, it’s usually with a long, winding ribbon of red tape that I would certainly never walk my buyer-clients into.

As for why and how these sellers got to the point of of foreclosure, well, I think the above examples paint a pretty good picture.

Yes, an increase in interest rates can make mortgage payments unaffordable and often result in financial impossibilities for some borrowers, but there are also a lot of cases where a lack of financial literacy plays a role too. Ask any private lender and they’ll tell you that borrowers who are in trouble always think “I can get out of this,” and soon make their situations worse.

In many of the examples above, we saw sellers try to sell when they realized they were in trouble, only to get greedy and/or unrealistic, and make their situations worse in the end.

If any of the readers herein work in private lending, I would love to hear some of your stories!

JF007

at 8:18 am

Well put summary in the end there David on what could lead someone down the foreclosure path. We are fortunate not to be in that position but with rates as they are my suggestion to ppl would be to think at least 2 years ahead of renewal as to what would it take to keep your monthly payout where it is today and start planning to it…atleast that’s what I am doing right now.

MStar14

at 10:18 am

Great examples. But im honestly confused as to why you steer your buyer clients away from these? For the most part in Toronto these are well and good properties (not trashed houses) that you are getting a decent discount as the bank just wants it off their plate and recover the bad loan. I actually think the opposite and look for them – especially for resale condos where the risk for capital expenditures is very low (only interior finishes at most). As for the clauses (which are all standard) are not that high risk once you know the history of the home and area sales. You take on a digestible risk for the lower acquisition (less competition). As an experienced realtor that you are, I’m surprised you would give this blanket advice without looking at each case. I would love to get some clarification or what am I missing? Thanks

David Fleming

at 11:16 am

@ MSTAR14

It depends on the buyer and their appetite for risk.

It also depends on the clauses that the lender/seller insists on including in their Schedule B.

Take a look at the blog post that I wrote in October:

October 10th, 2023: “So You Want To Purchase A Power Of Sale, Do You?”

Most “typical” buyers aren’t in a position to take on the risk and uncertainty associated with a bank sale. Your first-time buyer, your young couple, your first-time investor – there’s no way that the risk/reward equation ends up in their favour.

Are there buyers out there that I would sell these to? Sure. But it’s a small percentage.

Marina

at 10:26 am

Generally, banks do not want to foreclose. They don’t want to own properties because that comes with a whole slate of costs – from paying taxes and insurance, to increasing loan loss provisions. I always tell people who have life events – call your bank! Tell them your situation. They really don’t want your house.

And the bank will work with you. Because on the other side of foreclosure is one giant headache. Aside from the costs, there are a multitude of regulations that prevent the bank from getting top dollar. They have to have all the red tape David mentioned. You think the bank wants all those conditions? No they don’t but their hands are tied. Waiting to list?

No! Repairs? Nope! Staging? Hell no.

And then there is the home itself. If someone forecloses on your home, how willing would you be to leave it clean and in good repair? I saw stuff in the 2008 crisis ranging from unpleasant, to borderline illegal, to just revolting. I wouldn’t buy a foreclosure property simply because I would lose sleep wondering what the original owner did to it and how long it will haunt me.

As to how people end up there, I think it’s mostly one of two things. Either, as David said, they think they can get out of it so they borrow more until they drown in debt. Alternatively, they KNOW they can’t get out of it, so they spend as much as they can, and burn it all behind them.

Jennifer

at 12:40 pm

I wonder how much the stress testing helped limit the amount of foreclosures we are seeing now.

Ace Goodheart

at 2:06 pm

Might see more of these.

I once watched a movie where a person with an old shot gun in a third world county shot at and downed an airplane, starting a large war event.

It’s the little things.

Right now we have a group of rebels in Saana, capital of Yemen, a county very few people could find on a map, shutting down international shipping and forcing ships to take a ten day detour around Africa (a continent that thankfully most of us could find on our maps )

What is the issue with the Houthis? They put military operations inside schools and daycares and then tell the USA to go ahead and blow them up, while the kids are in class.

Or not. And then they’ll keep shooting at commercial shipping.

People I don’t think have a great understanding of what this means. The rebels have learned something. They can inflict a wound on the USA and do so repeatedly. They have power now.

This is the problem I keep seeing. The world is going from being a globalist corporate controlled free market, to an armed camp of military alliances and power struggles.

This will cause inflation. When it does, interest rates will rise. And rise. And rise.

Anyone who thinks the BoC has any control over this is dreaming a fantasy.

Ace Goodheart

at 8:29 am

Watch the rate announcement tomorrow very carefully.

BoC is funding the Feds purchasing mortgage bonds from the big six right now.

Printing money to do it

Why is the BoC creating new money to buy mortgage bonds?

Isn’t this inflationary?

At the media scrum tomorrow probably a journo will ask this question. Watch for Tiff’s response. If he looks uncomfortable we are in trouble.

BoC is behaving very strangely.

Sirgruper

at 7:06 pm

Not shocked to see CIBC leading the pack by a huge margin. They are very aggressive in special loans. Also, all of these are power of sale not foreclosures which banks just don’t do in practice.