Hey, how are you?

Did you just stumble upon this blog for the first time? You were Googling “The Road Ahead,” looking for the 1995 book by Bill Gates, of the same title?

Well, now you found this blog!

But not to worry, I have a story to tell about that book anyways…

I actually read this book, if you can believe it or not. I was in high school and I suppose that instead of going to parties and talking to girls, I figured I’d curl up with a hardcover and learn about the “information super highway!”

Really, I just wanted the book because it came with something called a “CD ROM.”

They actually put a sticker on the front of the book advertising this:

The crazy thing is: my computer didn’t have a CD-ROM drive.

But I wanted the disc anyways.

Bill Gates, among others, has always impressed me with his ability to see the future.

I remember reading an interview with him once where he said, “In the future, you’ll come home and you won’t have to pick what to view; your television will already know what you want to watch.”

I thought to myself, “Now, here’s a guy that’s just showing off. That’s such an asinine thing to say. That will never happen.”

But I also collected DVD’s in the mid-2000’s. I had several hundred of them.

Now, here we are, and my DVD’s are obsolete because we stream everything, and yes, Netflix has an algorithm that tracks what you watch and can make recommendations for you on shows and movies that would enjoy.

Bill Gates: 1, David Fleming: 0.

Predicting the future is hard!

Just ask Robert Zemeckis and Bob Gale.

They must be absolutely mortified and embarrassed beyond belief that, in 2022, we don’t have any of these:

Or these:

Flying cars and hoverboards aside, not everybody is in a position to look into the future with any guarantee of accuracy.

The same can be said as we meet here on TRB today with the first-half of 2022 in the rear-view mirror, trying to look at the road ahead in our Toronto real estate market.

The calendar has turned to July; I can’t believe it folks! It seems like just yesterday we were shoveling driveways full of snow and getting over our Christmas hangovers.

Canada Day has also passed us by, and before we know it, we’ll be planning for back-to-school in September. Although, if you’re like my wife, you’ll say, “Stop looking so far ahead, just enjoy the moment!”

Very true.

Having said that, the fall real estate market is just around the corner, the summer market is taking shape, and both of these markets will likely help determine what 2023 will look like.

So, let’s look at a handful of factors that I think will help us to predict the road ahead…

1) June TRREB Stats

By the time you’re reading this blog on Monday, the June TRREB stats might be released. If you’re an insider, you’ll probably have them. So as I write this post, on Saturday afternoon, I don’t know exactly what the figures will say, but I do know what to look for.

There are three stats that I’ll interested in: average GTA price, total sales, new listings.

Sure, I’m interested in supply and demand, plus the intersection therein, aka price. What else is there to look at, right?

But while we can use numbers to say anything we want after the fact, by looking at price, sales, active listings, new listings, days on market, absorption rate, month-over-month, year-over-year, et al, today, I want to look at May specifcally to see if June follows suit.

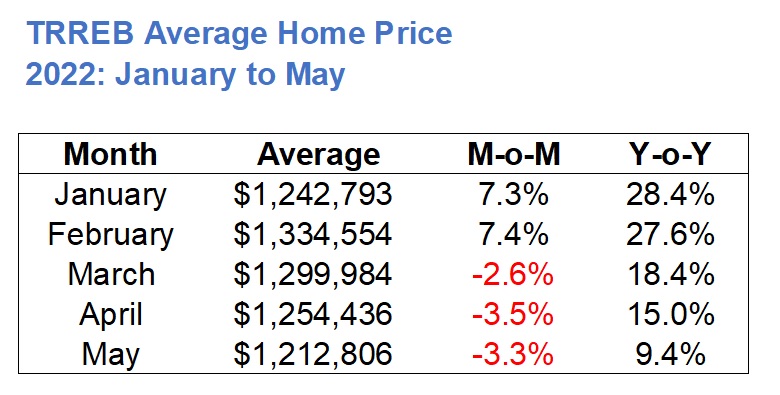

Here’s how the GTA average sale price looks through May:

When the January figures were released, it was one of those “where were you when” moments. I predicted we might see the figure top $1,200,000, but who thought we’d see another 4% on top?

February’s figure was mind-blowing. A 7.4% increase, month-over-month, after a 7.3% increase.

And then came the decline, although the $1,299,984 figure in March was nothing to sneeze at; a rounding error, from $1,334,554, if you will.

But since then, we all know that prices have declined, and it’s been led by a massive drop in prices in the regions outside the GTA.

So what’s in store for June?

I have to think we see a drop to $1,190,000 or thereabouts. I do think there’s a chance we see an increase, say, to $1,218,000 or something that makes us say, “Wow, I sure didn’t see that coming,” but that’s a small chance. I’d be remiss if I didn’t mention that it’s been known to happen.

A return to $1,190,000 places us somewhere into the second week of January, for comparison purposes.

The average home price last September, which is the onset of the fall market, was $1,136,280, so we’re well ahead of last fall. But June’s average home price will set the tone for the summer, and the summer will set the tone for the fall.

As for sales, I showed you this chart last month:

For those who weren’t paying attention, May sales were the worst in TRREB history, save for the pandemic, and pre-2002, which I don’t count, since half the city hadn’t been built…

So what’s in store for June?

Last June, we saw 11,106 sales.

If we held pace with the 7,283 sales in May, then sales would be the lowest in the month of June since 2002.

It’s worth noting that the 11,106 sales in June of 2021 was the third-highest of all time, but June sales averaged 9,413 from 2002 through 2021, so anything shy of, say, 8,000 would provide bearish undertones.

As for new listings, we used to see listings peak around May and June every year, as those were deemed the “best” months to sell. In recent years, we’ve seen the peak hit around March or April.

In May, we saw 18,679 new listings, which was on par with April and down from March.

In June of 2021, we saw 16,189 new listings, down from May, April, and the peak of over 22,000 in March.

For the sake of balance in our market, I would hope that new listings will show 15,000 or thereabouts, but again, I have no note that there’s a shocking number of properties been listed three times in a given month; once at an artificially-low price with an offer date, a second time after the failed offer date when it’s increased in price, then a third time when it’s reduced in price. So, new listings could hit 20,000, and I wouldn’t be surprised.

I’ll likely have a blog post on Wednesday about the TRREB numbers.

–

2) Inflation

You thought my second discussion point would be interest rates, didn’t you?

Don’t worry – it’s my third point.

But before we get to interest rates, we have to discuss the cause of the increase, which is inflation.

Are you tired of hearing the word “inflation” yet? In years prior, our buzz-words were “foreign buyer,” and “bidding war,” and “blind bidding,” but this year it’s that boring ole’ phenomenon that silently steals our savings!

Coming into 2022, we heard bits and pieces about inflation but nothing quite like what we’ve seen in the past few months.

And that makes sense, right?

Inflation was still below 4% this time last year, and when we saw marks of 4.7%, 4.7%, and 4.8% in October, November, and December, the words “cause for concern” began to float around.

You know the rest, right?

5.7% in February.

6.7% in March.

6.8% in April.

And when we started the talk of “interest rates increasing to help inflation decline,” back in March, did we really think it would happen that quickly?

Think it or not, inflation hasn’t subsided.

In fact, the May figure checked in at a whopping 7.7%.

This is after interest rate increases of 0.25% in March, 0.50% in April, and 0.50% in June.

But is inflation solely a function of interest rates?

That’s rhetorical for those in the know.

There are many causes and sources of inflation, and currently, the price of gas, supply chain issues, unemployment, exchange rates, and just a sheer addiction to consumption by Canadians are all major factors.

The price of gas is such a large factor in inflation that there’s a common statistic called “CPI Excluding Gasoline.”

But our government seems to be attempting to fight inflation by addressing one cause, and one cause only, and that’s the interest rate set by the Bank of Canada.

You might ask, “What more can they do?” but that’s not the point. I’m the last person who’s going to vote in favour of a “gas-tax vacation” for six months, but there simply must be other tools in the government’s war-chest.

There was a great article in the Wall Street Journal this weekend:

“Americans Have Had It With Inflation”

In the article, people are profiled and offer explanations of where they spent their money before, and where they’re cutting expenditures now.

Some are making coffee at home in the morning and taking it in a thermos to work, rather than spending $2, $5, or $10 on coffee from a chain.

Others are ceasing to go out to restaurants with the same level of regularity.

One woman said she would wear her gym clothes “Until they disintegrate.”

But at home here, what are we doing on a personal level to combat inflation?

How many people signed up for Amazon Prime when the pandemic began? My hand is raised.

How many people started getting groceries delivered in March of 2020, and have continued to do so, since then? My hand is raised.

Low interest rates are merely one reason for inflation, but I think the ridiculous amount of consumption in society since the pandemic began is just as large a factor. I recognize that low interest rates, in theory, could allow people to consume more, but carrying more debt at a cheaper rate, but I’m not talking about that. I’m talking about people who have no problem paying $5.00 for a bottle of water at the Metro Toronto Zoo. I’m talking about Instagram stories from people who seem to be at restaurants for three square meals per day. I’m talking about people that are spending out of control.

That’s a cause of inflation.

Although, so too is a federal government that is also spending out of control, while they lecture us about inflation, and raise interest rates to combat it.

Oh, the irony!

–

3) Interest Rates

What did we not cover above, you’re asking?

Well, for starters, how about the much-talked-about 0.75% increase in interest rates that’s coming on July 13th?

Oh, maybe it’ll only be 0.50%.

But considering we started the year at 0.25%, and will end up at 2.00% or 2.25% in July, I think many of us need to admit we were wrong.

Speaking of which:

Hello, my name is David Fleming, and I was wrong about what would happen with interest rates in 2022. I predicted no more than two increases, and no more than 100 basis points.

Actually, I think I said at one point, “There’s no way we’ll see back-to-back interest rate increases.”

I hate being wrong.

I might sound like an ass for saying this, but I’m just not used to it. It’s an odd feeling. It’s very humbling. Often, at times, embarrassing.

I guess I just didn’t think the federal government had the guts.

And as I said above, I never thought they’d attempt to address inflation solely by increasing interest rates.

But I also didn’t think they, or any government, would increase government spending while trying to combat inflation by raising interest rates.

And lastly, I didn’t expect 7.7% inflation. Yeah, that one’s a doozie.

So where do interest rates sit by the end of 2022?

We’re going to see the overnight lending rate sit between 2% – 2.25% in two weeks, but could does it end there? Is there another rate hike in the fall?

Scotiabank economist Derek Holt, predicted eight rate hikes in this Bloomberg interview back in October of 2021.

He predicted four hikes in 2022 and another four hikes in 2023.

However, and this is a big however, he predicted the rate would peak at 2.25% when the Bank of Canada was finished.

But we’re going to get to 2.00% or 2.25% on July 13th.

So is it eight rate hikes, or is it a rate of 2.25%? Because at this point, they can’t both be true. If it’s the latter, then it only took four hikes. If it’s the former, then we could see rates over 3.00%.

Raise your hand if you see a rate of 3.00% or higher by the end of 2022. Er, I mean, comment below…

–

4) Buyer Psychology & Buyer Fatigue

What do I mean by “buyer psychology?”

I mean the mindset that a buyer is in, whether that buyer is brand-new or has been looking for months.

Take the case of a buyer who was looking for a 3-bed, 2-bath, semi-detached house in January for around $1,200,000. Let’s say that buyer made six offers and lost every time, watching prices hit $1,500,000 for some properties that might have sold for $1,200,000 in December. Now, let’s say that buyer is seeing a slew of houses being list with “offers any time,” or houses experiencing failed “offer nights.”

What should that buyer do?

Well, I think the buyer should say, “Geez, I can pay $1,300,000 for a house today that somebody might have paid $1,500,000 for in February.”

In fact, I had clients who did exactly this only a couple of weeks ago!

But other buyers aren’t active in this market.

Why?

You’d have to ask them. Every inactive buyer, who was active in the spring, has his or her own reasons. But I suspect it’s buyer fatigue, fear, and confusion.

I’ve often said that, in the stock market, most people would rather buy a stock on the way back up, than the way down, even if they pay more on the way back up.

Why?

Comfort!

A stock is trading at $100. It drops to $90, then $80, then $70. You should buy it, right? But you don’t. It drops to $60. Then goes to $70. Then you buy it at $80. Then it goes back to $100, and you’re off to the races.

But this cost you $10.

You thought about buying at $70, but couldn’t pull the trigger, and when it hit $60, you knew you’d just made another $10 on paper – if you pulled the trigger, but didn’t. You instead waited for it to go back up, but not to $70, but rather you waited until it hit $80.

Why?

You paid for the comfort, security, and assurance.

Hindsight is 20/20, but tell me there aren’t buyers out there in the real estate market right now, looking at properties that they can get for a whole lot less today than in February, who are still afraid to pull the trigger.

Consumer confidence isn’t exactly hitting records right now:

But again, January versus May isn’t life-altering; 51.51 versus 50.42.

We may not be as confident a bunch in 2022 as we were in 2021, but it’s how the next few months shape up that are what I’m really interested in.

I have to think that buyers in the central core are going to figure this market out, and we’re going to see activity increase in the summer.

With an average of 7,445 sales in August from 2002 through 2021, I’ll go ahead and predict that we see 8,000 plus sales in August this year. Call it a hunch, but we’re going to see above-average activity in the latter half of the summer, once buyers figure out their financing, new buyers enter the market – with a new outlook on interest rates and affordability, and this will provide momentum into the fall.

–

So those are the four points I wanted to discuss as we look at the road ahead.

There are others, of course. The rental market, housing starts, condo completions, listing and pricing strategies, mortgage products – the list goes on.

I’m happy to entertain your predictions for the road ahead as well, so have your say below.

JF007

at 8:11 am

BOC rate to top at 3.5-4% range, average prices will drop by about 10% more and rest of the year sales wise remains tepid at best..my predictions David..????

Marina

at 10:06 am

House prices: I think we are going to see a further drop, with a bigger drop in the suburbs than the core, probably 10-15% average, but likely 20 in the burbs and 5-10 in TO. What I’m really curious about is what will happen to rent prices.

Inflation: Oh, we are so humped! I think with so many external forces at play, there is no stopping this train anytime soon. Food prices have realistically at least doubled, if not more, and I can see it happening again, unfortunately. Que more drought this year, and we are really going to be in pain.

Interest rates: I can see us going up to 5, but probably not that high. That’s the max in my mind.

Buyer psych: More caution. I’m curious to see what happens to cottage country prices after the summer. People will be holding off for one more great summer at the cottage, but I can see an avalanche of sales in the fall.

Bryan

at 2:51 pm

That rent price piece is what has me very curious as well…. in particular for me though, it is the impact rent trends will have on the selling side of the market.

Not so very long ago half the country was talking about how all those darn investors were the ones driving up sales and prices! If that is true (who knows), then the market should theoretically (to some extent) follow the ability of investors to come up with down payments , and remain cashflow positive or neutral.

The ability to come up with a down payment will likely remain unchanged unless there is a huge housing crash that means investors can no longer borrow against their existing assets… so the key is the ability to stay cashflow positive. Interest rates hurt on the monthly payment side of the equation, but do rising rents compensate? In Toronto, rent prices are up ~20% in the last year. That is certainly more than the difference in mortgage payments from rising interest rates…. and I think is likely the reason that Toronto has so far been somewhat spared from the red ink the last 3 months. I think, driven by a gradual return to work/life/fun downtown, Toronto rents have the capacity to rise back to or beyond the $2300 1 bedroom (currently about $2100) and $3000 2 bedroom (currently $2700) numbers that we had before the pandemic in the 416. If investors were buying like crazy at the depressed rent levels of 2 years ago, I don’t see them stopping if rents continue to rise to those levels… in spite of higher interest rates. I do not think the same can be said in York Region where rents are at or above what they were before COVID and have only risen modestly the last year, or in Oshawa and Pickering where rent may even be starting to come down after a long run of increases. It will be really fascinating to see what happens. If investors have the impact that everyone said they did in the fall market, it could be a drastically different late 2022 and 2023 for the city vs the suburbs.

Alexander

at 3:37 pm

Maximum 2.5% rent increase for 2023 in Ontario when inflation is around 7% will make me think twice before buying rental property, especially with uncertainties in mortgage interest rates. I doubt those rent increases can cover the jump in 800K variable mortgage difference – at least for a new purchase.

Bryan

at 12:32 pm

Not sure those number add up to be honest.

The way I see it, there are 2 things that need to be true for a real estate investment to make sense. Firstly, the price of real estate needs to be going up over the term of the investment so that the money invested grows (duh), and secondly the investor needs to be able to put enough money down to remain at least cashflow neutral. Since most investors in real estate are playing the long game, and I am not fool enough to make a call on what real estate will look like in 10 years, I will only really talk about the second one.

Figuring we are saying 20% down and looking downtown, that means that for your $800k investment we are talking about maybe a 2 bedroom condo? Rent for a 2 bedroom is at $2700 a month right now…. but even at a fantastic 1.5%, the mortgage payment on $800k is $3,200. Add in the monthlies (maintenance, tax etc) and you are about $1,500 in the red every month. No one has been investing like that, so this isn’t a scenario that means much (again, in my opinion).

The people who were buying in fall 2021 when we were all talking about investors were all looking to be cashflow neutral or positive. Looking at 1 bedroom condos (the more common investment), rent was in the neighborhood of $1800/month and purchase prices were in the neighborhood of $600k (give or take). With a 1.8% interest rate (about what it was), and say a $500 of maintenance and tax every month, an investor needed $300k down to be cashflow neutral. That’s the key number. If we look at today’s environment, we are at $2100 for a 1 bedroom, something like 3% on variable mortgages, and say $650k for that same 1 bedroom condo. To be cashflow neutral, an investor STILL NEEDS $300k down. I don’t think this is a coincidence. The investor market has (seemingly) a level of down payment they will tolerate and they then pass the increase in monthly cost on to tenants to remain cashflow neutral. Since rents have been depressed during COVID, there is room for rents to rise without tenants going elsewhere…. up to a certain interest level. If rates go past that the investor market will collapse. I put it at about 6%.

Rent control is certainly an interesting part of the equation, but since it doesn’t apply to new tenants (vacancy decontrol), and monthly payments on a variable mortgages do not change with interest rates (most of the time), it doesn’t have an impact on monthly cashflow until the mortgage renewal…. so the 2.5% a year doesn’t need to “cover” anything on the monthly side for a new purchase. By the time the mortgage is up for renewal, it is overwhelmingly likely that the original tenant has left and the investor has been able to rent out the unit at whatever the new market rate is (which I postulate will be prescribed by the balance I described above). Again, assuming we don’t go up to the 6% interest level, the only impact interest rates have on investors in in terms of the long term profitability of the investment. Is the added payment to interest enough to kill profitability? Not if the market is the one we have seen for the last 20 years… but things can always change.

Condodweller

at 11:08 pm

Yes, I was surprised to see the 2.5% rent increase limit given the reported inflation rates. What will the dynamic be among new units coming onto the market who can charge what the market will bear vs old units with rent caps? I think the recent rent increases are overblown given they are simply returning to pre-covid levels. I don’t think that will compensate for increased mortgage payments due to higher and increasing rates.

Bryan

at 10:39 am

With vacancy decontrol, all units “coming onto the market” will by definition be at market rate. The only units that are subject to the rent increase limit are the ones that remain tenanted, and thus are not on the market.

Of particular note to what I put above about the impact of rent on the investor purchasing market…… investors who purchase an untenanted property (who are the ones that will be paying the “increased mortgage payments due to higher and increasing rates”) will be able to charge market rate. So far, market rent has risen with interest rates, and I expect it will continue to do so until rents hit pre-pandemic levels and begin to level off. As long as this continues, real estate will remain a good investment. The big question is whether or not the Bank of Canada will raise interest rates high enough that renters won’t bear the rent it takes for investors to remain cashflow neutral. I have that pegged at about 5-6%. If that happens, the house of cards may collapse.

That said, I think we will see some longer term investors feeling the heat in the next 6 months. People who have tenants locked in at last year’s rents and need to renew a mortgage at this year’s rates could be in for a rough ride. Rise in renovictions?

Bal

at 3:53 pm

Food prices are insane. I went to Grocery store last weekend and my jaw dropped when i saw red onion 10lbs bag for $15..it used to be $4 or $5..I couldn’t believe I ended up fixing my eye glasses twice….lollol

Alexander

at 10:33 am

I am more afraid Central Banks do not hike it to the nose than they pause at the fall or the end of the year and the thing with inflation continues to drag on for another 5-10 years. Then we will have 20% interest mortgages soon.

I would be too cautious about rebounding in real estate sales in the second half of the year unless the Bank of Canada governor decides that he did enough already and the show continues.

cyber

at 9:03 am

THIS. (Un)fortunately, Bank of Canada will go in lockstep with the US Fed, or go even more “in” on monetary tightening – as BoC has generally been more conservative, e.g. during the “roaring aughts”. Due to the international bond markets, Canada basically “has” to end up at least as high as the US on the interest side, or higher.

Good news, at least on the macro side, is that the Fed seems terrified of stagflation – a very painful period of both high inflation, low-to-negative growth, and high unemployment that lasts way longer than a “standard” recession. The historic 75 bps increase is a signal they’re willing to use their toolkit on the interest rate side in order to contain inflation – if they do another 75 bps in September (next time meeting at which they’ll have an updated Summary of Economic Projections), it will send an even stronger message to the market that they’re willing to “go there” and risk a recession in order to prevent a “wage-price spiral”. Combined with softening labour market – e.g. starting to see layoffs and hiring freezes in tech, which in many ways is the canary in the coal mine that drove the wage growth in the last 2 years – that just *may* be enough to slow the demand down enough that the runaway inflation train at least slows down enough. (Consumer demand has already softened, if you have noticed “Christmas in July” deals starting to pop up at retailers

If that’s true, in December there should be 0-25 bps increase, signaling the worst is over but situation is being monitored.

By March 2023 we should be back to a close-to-normal spring real estate market in Toronto 416, and as long as the confidence and demand starts showing through, there will be another wave of FOMO to get the “good deals” before they’re gone. So, I’ll be going on record that we’ll be back to Jan 2022 Toronto prices by July 1, 2023.

GTA and cottage country, no idea.

JL

at 11:28 am

Re buyer psychology – I think you’re correct that people prefer comfort in knowing that prices are close to the bottom or on their way up, because right now (rightly or wrongly) people think there is more chance of further price drops rather than a quick reversal, so why rush to buy?

Which gets to the second element; there is no longer a rush to buy. People can take their time, look around, think things over… there isn’t that desperation anymore to buy now because next week it will be $50K more or already sold and no longer available. Which is all a good thing if you’re in favor of balanced markets.

Bal

at 3:54 pm

Agreed with JL

Appraiser

at 12:05 pm

“A point I’m trying to insert into the housing discussions: when people talk about reducing demand, they are really talking about reducing transactions. Demand is a different matter. Demand is how many people need and can reasonably expect to afford housing.”

“Those damaging anti-transaction measures start with the mortgage stress tests which have unreasonable parameters (a ridiculous qualifying rate and the failure to consider that by the time of the first renewal incomes will be higher): by unreasonably impairing buying,…” ~Will Dunning

https://twitter.com/LooseCannonEcon

Jordan

at 1:01 pm

Buyer psych: I’m curious of David’s perspective, but based on some anecdotes from a few people, there are a couple more subtle changes to the buyer psychology that (I think) are having an effect on sales. I’m guessing a good % of buyers are pivoting from Buy-then-Sell to Sell-then-Buy. That changes mindsets, requires more contingency planning (airbnb/family etc) and, in this market, probably completing some cosmetic (or worse) fixes you might not have bothered with in the lunacy of February / March.

Condodweller

at 11:10 pm

This makes sense. New listings will be lower if people are waiting for the sale first.

Commentator

at 1:12 pm

Moreso than interest rates, I think that buyer perception is impacting prices and will continue to do so. When prices climb continuously month over month, people are willing to do anything to get in the market.

Bal

at 3:04 pm

The road ahead is all depend on Interest rates …..if rates keep going up…the road will be very bumpy but incase if there is news about pausing rates….i think that will bring some life to market as buyers are waiting on sidelines

Mike

at 6:50 pm

David, you had a running bet back in 2020 about when the average home price would return to pre-pandemic levels of about $900,000. Or maybe it was the $950,000 peak from 2017, I can’t recall.

But it brought out a lot of readers and their predictions and I think there were multiple follow up blogs.

How about another wager? When will the average home price surpass the $1.334m recorded in February?

Derek

at 10:51 pm

I can’t remember who the legend was who won that contest (I was wronger than wrong, as I recall).

David Fleming

at 12:13 pm

@ Mike

The bet began in this blog post from April of 2018:

https://torontorealtyblog.com/blog/how-are-sales-during-covid-19/

Blog reader “Derek” came up with the idea:

“Should we try to amuse ourselves with a game? I don’t know what metric would be best to use, i.e., avg price or HPI or freehold or condo or GTA or 416 etc., etc., (David or the other smart people can decide the goal posts) Do we take the Feb numbers as the top and work from there? Anyway, someone could define the parameters and we could post our guesses as to how much, if any, prices will change for the chosen metric(s) between top and bottom. Maybe even guess the month the bottom comes?”

We settled on the following:

“A very simple measure of the market on which to vote: in what month will TREB average sale price rise above the $910,290 we saw in February?”

These were the predictions we recorded:

Thomas: June or July 2020

Kyle: Fall 2020 or April 2021

Tony: January or February 2021

David: April 2021

J G: April 2021

Derek: April 2022

Condodweller: Feb 2023

Mxyzptlk: April 2023

Chris: April 2024

Pragma: 2028

Potato: Sometime in the 2030s

Jeff: Never (adjusted for inflation)

Here’s the post about the eventual winner, “Thomas,” who picked June of 2020:

https://torontorealtyblog.com/blog/winner-winner-chicken-dinner/

Condodweller

at 11:48 pm

The interesting thing from my perspective is that my premise was that RE would recover after Covid and when we return to normal. Looks like I was pretty close on that. What I completely didn’t see coming was this need for people to move into larger spaces IMMEDIATELY after a few weeks of lockdown.

J G

at 6:43 am

For the record I also predicted stocks would recover a lot faster compared to RE, which it did.

SP got back to Feb 2020 peak in Aug 2020.

J G

at 6:45 am

And my RE prediction of April 2021 was pretty close, looking at GTA overall average price!

Derek

at 10:57 pm

David, don’t feel too bad about your 2022 interest rates mea culpa. How many “permabears” would say the same thing, but reversed, i.e., they didn’t expect, or there’s no way they’ll… keep emergency interest rates so low for so long.

Daniel

at 8:12 pm

Not sure what to make of this article.

Says the way to beat inflation is to increase inflation target from 2% to 4%.

What the….?

https://www.thestar.com/business/2022/07/05/high-interest-rates-will-trigger-a-recession-just-look-at-history-for-evidence-new-study-argues.html

Condodweller

at 10:52 pm

I have mentioned multiple times that inflation is much higher than what was being reported. So the government has been lying to us, what else is new. They are also lying about no recession. Now that it’s painfully obvious they admitted we have inflation and must raise rates fast. High rates typically cause a recession yet they tell us they don’t expect a recession. The US is technically already in recession after two Qs of negative growth. They indicated they are focusing on taming inflation and don’t mind pushing the economy into recession. Expect a news release from Canada in the near future saying, oh, a recession couldn’t be avoided. I’m curious how long it will take before the new rates will start having the desired effect, but an educated guess is at least 6 months from the initial rate increase but likely end of year or next year. Given the oil situation and how it’s causing inflation everywhere with no end in sight with all the ESG policies, I think it will take a long while. Regarding the forecast of 8 raises, clearly, no one expected higher than .25 increments. Once they found themselves behind the curve they had no choice but to speed things up and do it in less time. I think 3.5% is a given but could be higher.

We went from no or minimal increases to how high will it go.

The psychology in my view will be people will hold off as long as prices are stagnant or even decreasing. If high rates trigger people/investors to force sell things can spiral down quickly. Again, as I mentioned before, it will be the reverse of FOMO. No rush take our time and the question will become just how soon will buyers step in to buy. I agree with David that people will be waiting for an uptick before buying in large numbers therefore again, prices could drift down.

Also, I have eluded to this in the past, with high enough inflation, one doesn’t need decreasing prices to lose the value of their home. IIRC from grade school math, two negatives make a positive so 8% inflation coupled with a 12% price decline equals a 20% value decline, correct? Do that for a few years and it becomes meaningful.