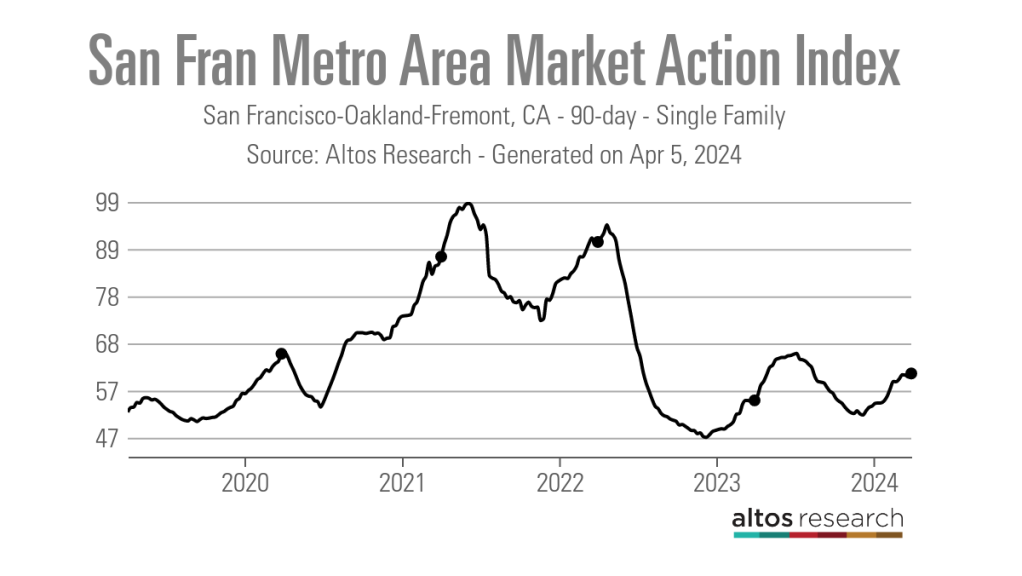

As of March 29, the San Francisco-Oakland-Fremont metropolitan area was the fourth-hottest housing market in the country. The Bay Area metro had a 90-day average Market Action Index score of 61.19, according to data from Altos Research. In comparison, Seattle-Tacoma-Bellevue, the top-ranked metro area, had a score of 64.53. Altos considers anything above a Market Action Index of 30 to be a seller’s market.

While the San Francisco-Oakland-Fremont housing market may be decently hot, local real estate agents feel that it could be hotter.

“There has been a little bit of a downturn, it was a little bit frothier earlier in the year,” said Andrea Gordon, an Oakland-based Compass agent. “The weather situation hasn’t been ideal, consumer confidence in the real estate market has weakened, interest rates are an issue and inventory is tight.”

Although other local agents said they wouldn’t characterize the market as being in a lull, they agree that interest rates and inventory are two major challenges to overcome.

“When interest rates were increasing, we saw a slowdown on inventory and buyers because sellers were afraid to bring homes on the market as they didn’t think there was going to be a big buyer pool and then buyers were hoping to wait it out and get the 4% interest rate their friends were bragging about,” Nicole Wilhelm, one half of Compass-brokered The Wilhelms Team, said. “But they’ve realized that maybe rates aren’t going to come down, so we are starting to see people coming back to the market both on the sell side and the buy side.”

Local agents believe that if the Federal Reserve lowers interest rates later this year, that will further help increase activity in the market. Regardless of the Fed’s decision, Nicole Wilhelm believes 2024 is still a good time for buyers to be in the housing market.

“I love election years coupled with high interest rates,” Nicole Wilhelm said. “I believe it is the best time for buyers to get a deal because everyone is scared, they don’t know what will happen so fewer buyers are looking, and you never want to be in a scenario where everyone wants to purchase because the competition will be high. If you are on the fence, just buy now and you can always refinance later.”

While Nicole Wilhelm feels that this may be a good time to buy, higher interest rates would keep many would be sellers on the sidelines, further pressuring an already tight inventory market.

“A lot of the sellers in our area refinanced their houses when they could get a loan rate of like 2.75%,” Gordon said. “If they want stay in the Bay Area, it doesn’t make financial sense to move across town and end up with a 7% mortgage rate.”

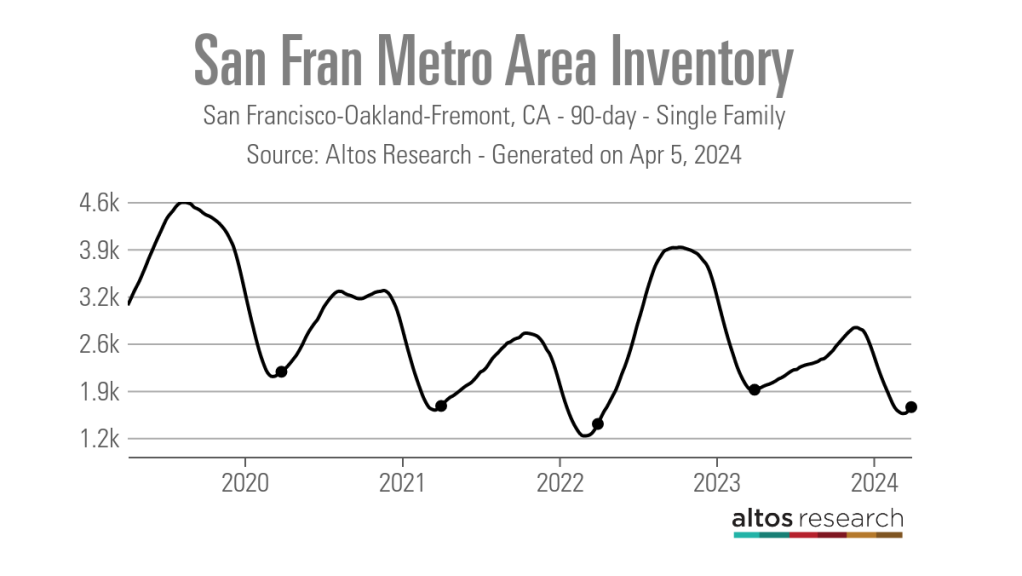

As of March 29, Altos data shows that the 90-day average of single-family listing in the San Francisco-Oakland-Fremont metro area was at 1,643 active listings, up from an all-time low of 1,229 active listings in early March of 2022, but below the 1,894 active listings reported a year ago and the pre-pandemic level of 2,083 active listings.

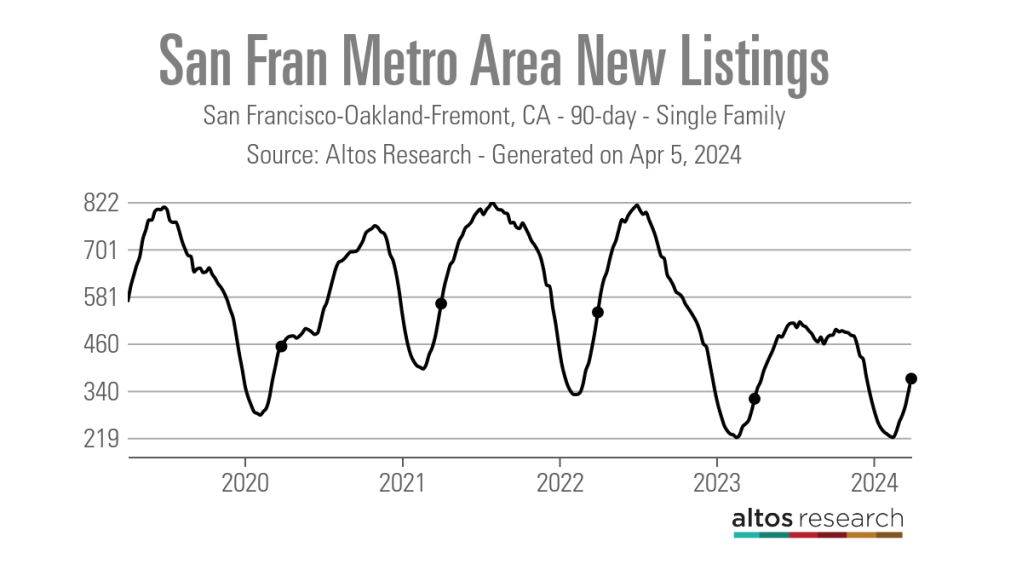

Additionally, the metro area had just 370 new single-family listings hit the market during the week ending March 29. This is up from 319 listings a year ago, but down from 466 listings at the onset of the COVID-19 pandemic. Although agents are grateful for the additional inventory coming to market, the believe it isn’t enough to keep up with demand.

“Even if we got an extra three or four houses every week, it would barely make a dent in the need,” Amanda Jones, a San Francisco-based Compass agent, said.

As such, Jones said it isn’t uncommon to see multiple offers on properties throughout the metro area.

“It is pretty competitive, but there is a little bit of whiplash right now,” Jones said. “On the one hand you may write an offer and be the only offer on something in South Beach or Soma, but then you’ll go and write an offer on a house in the western part of the city and there will be 16 offers on a property. You are navigating these realities everyday with buyers and we are still in a situation where some sellers expect us to waive everything.”

Although agents say buyer demand remains strong, some are becoming frustrated.

“It can sometimes be hard to be a buyer in this market because inventory levels are so low and there are multiple offers,” Shalini Sadda, a San Francisco-based City Real Estate broker associate, said. “If you are a buyer and you are not well positioned to present a competitive offer, it can be exhausting. So, we are seeing some buyer fatigue, especially in certain neighborhoods.”

Agents say a common Bay Area practice of pricing homes below market value has also contributed to the rampant multiple offer situation in some parts of the city.

“Historically there are known to be some neighborhoods in San Francisco that use a low-price strategy, but now I am seeing more and more neighborhoods using that because you don’t want to undercut your seller,” Sadda said. “You want to make sure you are getting them top dollar, so you don’t want to go in all the way up at the price that you think it may necessarily sell at, especially if you don’t have a comp.”

Local agents say using this strategy allows the market to dictate how much you can sell a given property for and it enables agents to set an offer deadline, allowing them to control how long the house sits on the market. However, there are some drawbacks, especially for buyers who are unaware of this custom.

“You can have clients that can afford to go to whatever stratospheric height they have to go to, but they need to know and understand what the parameters are,” Gordon said. “There are a few agents out there that are pricing everything at $899,000 or $1.299 million and expecting offers that are going to be 10% to 30% above that and it is really hard for buyers to gauge and it’s not fair to force them to spend their time and energy going to look at houses that are probably going to end up out of their capability to purchase.”

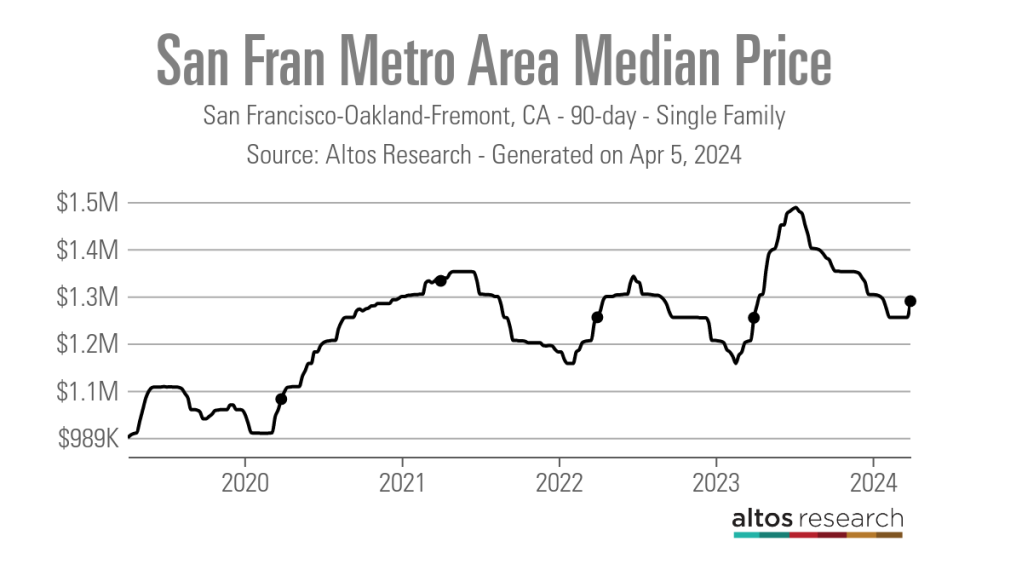

The high level of the demand and low inventory in the metro area, coupled with this pricing strategy, has led to a rapid increase in the median list price. Data from Altos Research shows that the 90-day average median list price of a single family home was $1.3 million as of March 29, up from $1.2 million a year ago and $999,888 just prior to the onset of the COVID-19 pandemic.

Despite the challenges facing them and their clients, agents are optimistic about the upcoming spring housing market.

“The level of demand is trickling in, and properties are also starting to come to the market as well,” Michael Wilhelm said. “Usually, the spring market is when we see this big rush of inventory coming in. We are seeing it at a slower pace this time around because sellers are waiting for when we can have even more bidding wars again.”