With a 90-day average median list price of $4.3 million, Santa Monica, California doesn’t seem like a place where one would expect to find many first-time homebuyers. But local real estate professionals would beg to differ.

“Most of the demand is coming from first-time buyers,” Trevor Levin, a local agent with Los Angeles-based Nourmand & Associates, said. “And we are seeing the down payment or some of the down payments come from an outside source — inheritance from a deceased grandparent, or parents helping out too.”

Nationwide, the share of buyers who are first-time buyers has risen in recent months. In March, first-time buyers were responsible for 32% of sales, up from 26% in February and 28% a year prior, according to data from the National Association of Realtors.

Real estate professionals in Santa Monica attribute the increased share of first-time buyers to having fewer move-up buyers in the market.

“People who already own homes are less likely to be buyers right now because they are holding onto their properties because of low interest rates,” Joe Cilic, the team lead of the Sotheby’s International Realty-brokered Cilic Group, said.

The influx of first-time buyers in the Santa Monica housing market has resulted in frequent bidding wars on lower price point properties.

“At the lower price points, they are pretty common,” Cilic said of multiple offer situations. “I’m selling a condo right now that has multiple offers, but especially in single family, if something comes on at that entry level price point, people will snatch it up and there will be a bidding war.”

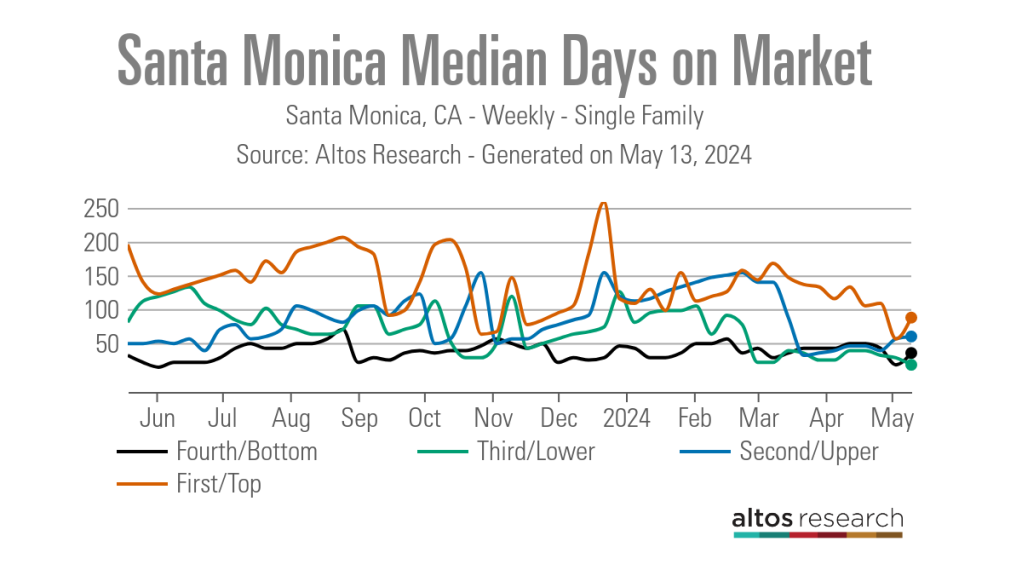

Data from Altos Research supports Cilic’s claim that lower priced homes are being snatched up. As of May 13, the median days on market for single-family properties in Santa Monica with a median price of $1.85 million (the lowest market segment) and a median price of $2.622 million was 35 days and 17 days, respectively. For the higher two market segments, the median days on market jumps to 59 days and 87 days.

While agents are happy to see first-time buyers in the market, it has also resulted in more complications getting a transaction to the closing table.

“All of the first-time buyers are a lot of the reason why things are falling out of escrow — being a backup offer is a good position to be in our market right now,” Levin said.

“These first-time buyers have a different mindset than where the market was three years ago. That $1 million purchase is no joke anymore and they are weighing their monthly payment with their rent, whereas before it was a no-brainer.”

But it isn’t just first-time buyers. Across all market segments, Levin said buyers are more cautious than they were a few years ago.

“They spook easier. If something comes up on inspection that wasn’t a big deal when interest rates were closer to 3%, now it is more magnified and pushes them out the door a lot quicker,” Levin said.

In addition to making buyers more prudent in their purchases, local real estate professionals also say interest rates are to blame for the area’s lack of inventory.

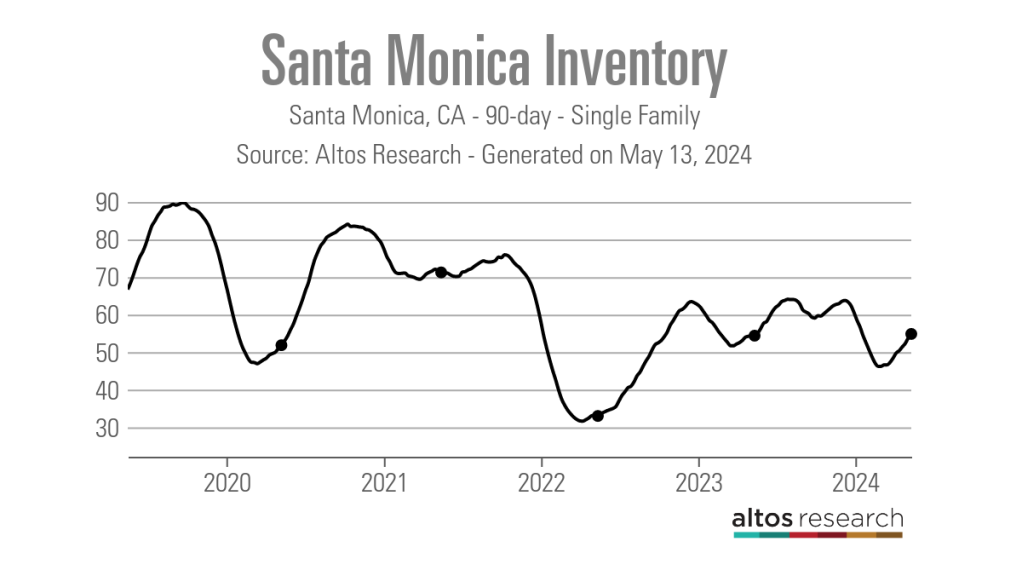

As on May 10, inventory in Santa Monica had a 90-day average of just 55 active single-family listings, up from an all-time low of 32 set in April of 2022, but still below the roughly 70 single family listings reported in May 2019, according to data from Altos Research.

In the Greater Los Angeles metro area, which includes Santa Monica, as well as cities like Irvine and Pasadena, Altos data shows that there was a 90-day average of just 6,712 active single family listings in the area as of early May. In comparison, in May of 2019, there were nearly 15,000 active single-family listings.

“Those who locked into those 3% interest rates on their houses are not quite motivated to sell and trade into something with these higher interest rates,” Levin said. “They are looking at the monthly payment and it just doesn’t make sense. So what was already a tight market is now even tighter.”

Cilic added that some would-be sellers are choosing to become landlords instead, renting out their properties with 3% interest rates.

“They are capitalizing on the spread between what they are paying for their mortgage and what they can lease for because they are locked into low interest rates,” Cilic said.

Long term, Cilic believes that many of these properties will come back onto the market, as their owners are typically not interested in being long term landlords, which would eventually adding a much-needed boost in inventory.

In the meantime, however, real estate pros believe inventory will remain tight, but that the market will remain relatively fluid.

“I just hope we can get through the year at the same pace we are at now,” Charlee Nessel, one half of the Berkshire Hathaway HomeServices California Properties–brokered Dan & Charlee Nessel team, said. “We are focused on just taking it one client at a time. There really isn’t a sense of urgency in the market. It feels much slower paced than it was, but it is very steady. I’ve been in the business for over 25 years and whenever there is a pullback, like was saw in 2023, there is always a massive tidal wave of business right after, so I am working on prepping for that, which I’m expecting in the next couple of years.”