Did you hear?

Hear, what, exactly?

Well, at the risk of alienation-via-wordplay, it’s not so much what you might have heard, but rather the words “Did you hear?” that’s the topic of today’s introduction.

I can’t tell you how many times I was asked “Did you hear” in the last 72 hours.

Yes, every time I was asked, “Did you hear…” it was followed by some form of, “…about that house that got eighty-five offers,” but the conversations didn’t always go the distance.

If somebody said, “Oh, by the way, did you hear…” I usually cut them off and said, “Yes, yes, I know what you’re going to ask.”

Then again, I was just on the other side of this equation literally seconds ago, when I was discussing the potential list price for a client’s home, and asked, “Did you hear about that house that got eighty-five offers this week?”

The client talked over the last few seconds of my question and began to answer in the affirmative.

Because everybody has heard at this point!

This was the talk of the real estate community all week, and it appears it might have been the talk of the outside-real estate community as well.

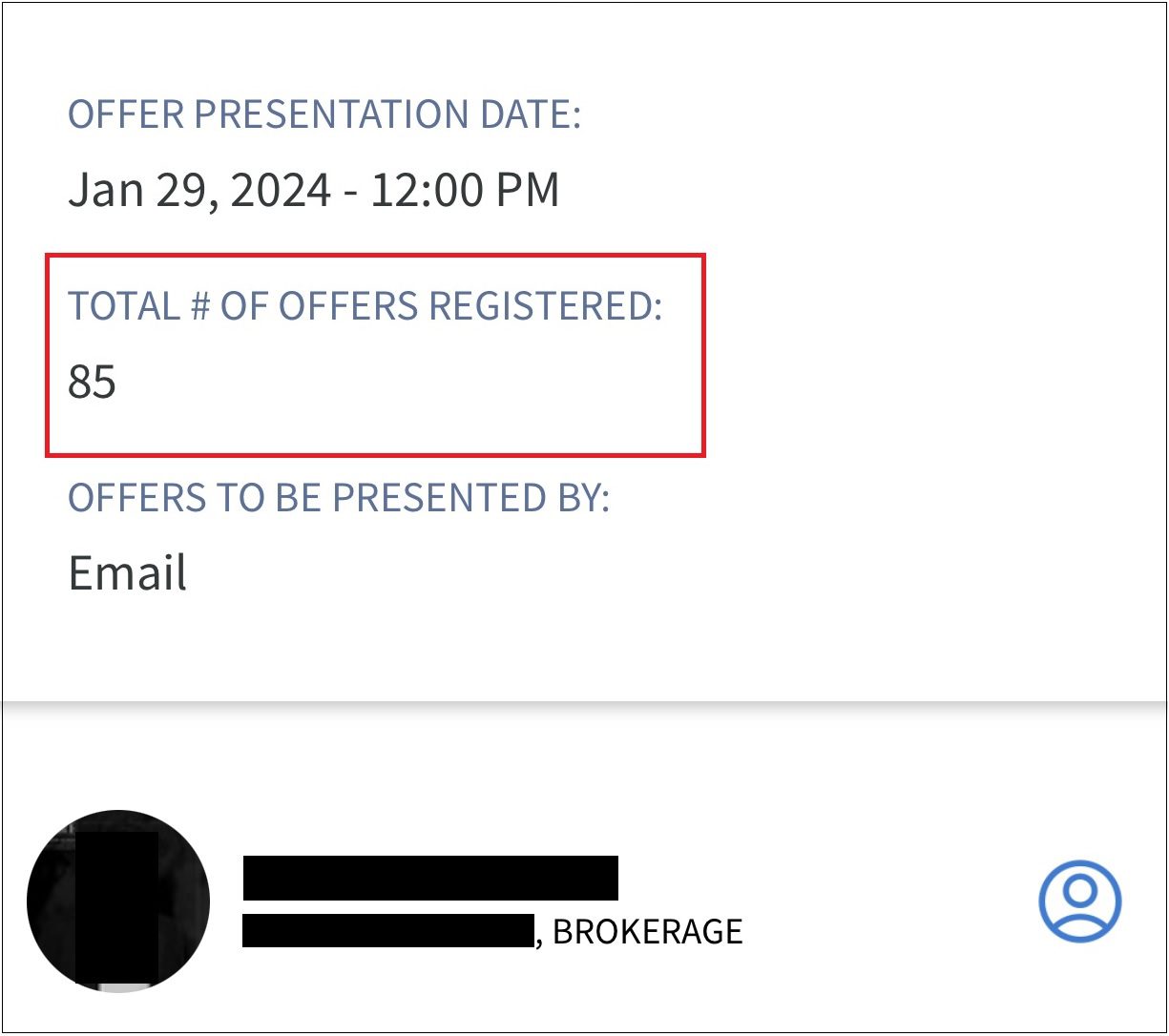

I was sitting in my office on Monday night when a colleague sent me the following screen shot:

I thought it was a typo.

I asked my friend, “You’re joking, right?”

She wrote back, “Nope. This is happening. And the cool part is, the Facebook groups are all talking about it live!”

Yeah, about that – there are several very large Realtor-Facebook groups, some with thousands of members. And when something like an 85-offer melee happens, you can be sure that these groups are going to dissect it from every angle.

Over the last few days, questions have arisen.

Discussions, yes, but many, many questions. Some of these questions are being asked by Realtors, some by our clients, some by real estate onlookers, and some by media members (FYI – I did two off-the-records interviews this week…) who are trying to make sense of it.

So rather than stick you with a 9,000 word block of text about “the house that received 85 offers,” I figured I could address this by answering the questions that have been asked the most…

What happened?

In short: a home was listed for sale, an “offer date” was set, and the home received 85 offers on that scheduled offer date.

How did this happen?

We all know that “under-listing” is an age-old technique in the Toronto real estate market, but every so often, a property is extremely under-listed, and a situation like this occurs.

I don’t remember the last time I saw 85 offers. I do have this faint memory of writing a blog 10-15 years ago about a home that received 100+ offers. That’s kind of hard to forget, but for the life of me, I can’t find the blog!

Now how under-listed was this property that received 85 offers on Monday?

It was listed for what the owner paid for it in 2017.

That’s pretty low!

And in the process, every wishful buyer in the area came out to see the home.

I have it on good authority that there were a whopping 296 showings in one week that the property was on the market and that made many of us in the agent community ask, “Did these 296 buyers, their partner, and their agents wear a hole in the carpet, or what?” Then consider the hundreds and hundreds of people that would attend an open house like this, and it’s just wild to think about the sheer number of individuals that went through this property inside of seven days.

But how do you get to 85 offers?

As I have written before on this blog many, many times, the nature of the Toronto real estate market renders some buyers and/or their agents absolutely unwilling to let go of fantasy.

How many of those 85 offers were for the list price? Yes, the same list price that was the SALE price back in 2017!

In every multiple-offer situation, there are always the “throw aways.” There are always what I call “dummy offers.”

There were eighty-five offers on this home, right? Well, you just know that somebody submitted an offer with a price that is under the list price, and for that action to be logical, there would have to be a chance that the other eighty-four offers are all also under the list price.

I can’t tell you how many buyers throw away logic in these situations. Their agents too. In fact, their agents are often too afraid to speak up, ie. do their job and demonstrate knowledge and value, and tell their buyer-clients that it’s a wasted exercise.

Fantasy is a major reason why there were 85 offers on this home.

Hope is another.

Wishful thinking too.

“I have nothing to lose,” is often the thinking of a buyer in this situation, and while that might be oddly true, it doesn’t mean the action is justified, in my humble opinion.

Now, if you notice that to answer, “How did this happen?” I’m addressing the actions of buyers and not the seller, it’s because, as I have mentioned many times here on TRB, I think there is more “fault” on the former in this situation. Many will disagree, but that’s why we have so many other questions to answer…

Why would somebody price a home like this?

Well, because it works!

I mean, not always, but when you receive 85 offers on a home, it’s hard to imagine that you won’t find one that you like.

Listing agents and sellers choose to use “under-listing” as a strategy because it works. Not in every market, and as we saw last summer and fall, there are often markets where the strategy falls flat. But in a hot-market where buyers are out there and ready to pounce, and there are very few listings, an extremely under-listed home can create a situation like the one we’re discussing today.

Don’t get me wrong, I believe that a lot of thought went into this strategy.

The seller and the listing agent would have had to discuss this over and over while weighing the pros and cons.

There are risks and there are rewards. If you price too low, you might create a ceiling. If there are too many offers, you might scare away buyers who would have paid more than many or even most of the 85 bidders, since so many of those bids represent “dummy offers.”

But I wasn’t privy to the conversations between the agent and the seller. I can only surmise that different strategies were weighed and a calculated decision was made to take this course of action.

What was the process like?

Offers were to be reviewed at 12:00pm on Monday, and throughout the course of the day, eighty-five buyer agents registered and presented offers.

I say “throughout the course of the day” because in a case like this, you will never have everybody present their offer on time.

I swear, I could review offers at 7:00pm after specifically instructing agents to register by 5:00pm, and I will almost guarantee that less than half of agents will abide by the registration time, and less than half will submit by the so-called “deadline.”

In the case of 85 offers, there’s no way.

I bet these offers came in all day long, and that really makes it tough for the buyers who registered at 9:30am and submitted at 11:30am.

The 12:00pm presentation time was smart on behalf of the listing agent, because if offers were at 7:00pm instead, this wouldn’t have concluded until sunrise the next day.

I heard that the decision wasn’t made until very late on Monday night, but that’s to be expected, right? How long does it take to review 85 offers? If you actually read them all, catalogue them, discuss the terms with each of the agents, and potentially negotiate with several of the buyers, it’s no wonder this was still going on after Wheel of Fortune and Jeopardy were over…

Is this allowed?

Is what allowed?

Pricing a property low? Sure, why not?

A seller can price a property at any price on the MLS system. If a property is seemingly “worth” $5,000,000, a seller can price at $2,000,000. Or $1. It’s up to them.

Is this ethical?

Ah. Okay. That’s what many people really wanted to know when they asked if this is “allowed.”

Many, many people in the general public will say that this is not ethical. But the problem that I have is: where do you draw the line?

How much can you under-list? Who decides?

Oh, what’s that, Marigold? You don’t think sellers should be able to under-list at all? You think that sellers should be “forced” to accept any offer at their list price?

Sure.

While I am sympathetic to both those who cannot afford the home that they covet in the city of Toronto, and while I understand that there are varying levels of financial literacy and real estate expertise in this market, I do not believe in “should” and “force” and “yeah but the government should step in and…”

If a buyer or a buyer agent doesn’t think this is ethical, they need not partake.

For the record, I would not advise a buyer to partake in an 85-offer melee, but I do not consider this instance of under-pricing to be “unethical.”

Is this fair?

Is life fair, Billy?

What was in this for the seller?

The highest possible sale price.

In theory, and who knows if it ended up this way in practice.

But other than ego, I don’t know why a seller would choose this strategy unless it was deemed that this was the best possible way to expose the property to the highest number of potential buyers, and gain leverage in a multiple-offer situation that could be used to push the sale price as high as possible.

What was in this for the agent?

Well, a canned answer would be, “The only thing ‘in this’ for the listing agent was working in the best interests of his or her seller-client and meeting the seller’s objectives, which, in this case, would likely be to maximize the sale price.”

But why would a listing agent do this in practice?

Irrespective of this agent and this listing, an agent might choose a strategy that results in 85 offers to gain notoriety or media coverage, or for marketing purposes. The saying, “There’s no such thing as bad publicity” rings true here, doesn’t it? Whether there are people out here who hate this, or not, somebody out there would click on a Google Ad that says, “We Got 85 Offers For Our Client. Want The Same For Your Home?”

I don’t think this agent was out for notoriety.

I think this agent figured that we’re coming out of a really tough fall market and in order to sell for top dollar in this market, they needed to make a splash.

Be bold. Be different.

This was about as different as it gets…

Would the house have sold for the same price if it weren’t listed like this in the first place?

This is really what everybody wants to know, right?

I mean, other than the people that want to know if this is fair…

In one of the Facebook groups, the consensus seemed to be that this home should sell for between $950,000 and $1,000,000, based on comparable sales and the prevailing trend in the area.

The home sold for $999,999.

So let’s ask again: would this house have sold for the same price if it weren’t listed like this in the first place?

Probably not.

The sale price was within the range that the Realtors in the Facebook group suggested, but it was at the highest end. Can we assume that if this house were listed at $999,999 it would not have sold at this price?

I have to vote, yes.

Some of the commenters on Monday’s blog thought this house sold for fair market value, and they are entitled to their opinions.

But one buyer in this 85-offer melee went to his or her absolute max to get this house. $999,999 speaks to a buyer who does not have the 20% down payment required to spend $1,000,000 or more on a home, and I guarantee that buyer didn’t go into this 85-offer melee thinking, “I’m going to spend to my last dollar.”

The 85-offers were the reason this buyer maxed out.

Could this work again?

Yes.

But that’s not any reason why a seller should consider this strategy.

Is this something a seller should consider?

Oh, FFS. I should have seen this question coming! 🙂

Should a seller consider this? Maybe, but that’s not the same thing as doing it.

And here’s the rub – this house “only” sold for 35% above the list price.

That’s nothing in the central core right now.

Despite the naysayers who posted on Monday’s blog, there are a lot of homes in Roncesvalles, High Park, The Junction, Leslieville, East York, Danforth Village, and other areas in the central core that are seeing sale prices of $300,000 or $400,000 over the list price, and many of these, on a relative basis, are more than the 135% sale-to-listing ratio of the house that received 85 offers.

The difference is that the house that received 85 offers is outside the City of Toronto and in an area where most properties are sitting on the market.

So 135% of list price out there would be like 160% of list price in the neighbourhoods I mentioned above.

Should a seller in Leslieville consider listing his $1,350,000 home at $999,000 in today’s market?

Yes.

But should a seller in Leslieville consider listing his home at a price that’s lower than what he paid in 2017?

No.

And if you don’t understand the difference here then do me a favour and just read it again.

–

Any other questions?

By all means, please ask away, and I will answer in the comments section below!

To borrow a theme from the comments on Monday’s blog:

No, this 85-offer incident does not mean that every property is going to get 85 offers from now on.

The point I attempted to make in Monday’s blog was not that – because five listings I cherry-picked from MLS happened to get 15-20 offers, that meant every property from here on out was going to experience the same.

The point was intended to show that the market is back.

Back…..where?

Back…..from what? Or to what?

Well, I suppose I choose to say “back” because, in the twenty years that I have been selling real estate, almost all of this time has seen us in a seller’s market.

You might say that this infers a seller’s market is “normal.”

Regardless, let’s say that last fall was an anomaly as far as the last two decades go. Nothing was selling. Forget about multiple offers – how about one offer?

Now, with the examples from last week that were shown in Monday’s blog, we’re seeing instances of things that simply did not happen in September, October, and November of 2023.

Is the ENTIRE market back? Like, every area in the Golden Horseshoe?

No.

Is the market back for EVERY home? Like, house or condo, high-end or low-end?

No.

But this week alone, agents like myself have added another twenty or thirty properties to the list of houses with 10+ offers, and I say again: this didn’t happen last fall.

By next week, we should have the January TRREB data, and with any luck, we’ll be examining it here on TRB in Monday’s blog post…

JL

at 8:50 am

A couple of themes jump out, after reading the original report of the sale:

1) Uninformed buyers and buyer agents are partly to blame for causing these headlines (mirroring David’s conclusion):

“[The selling agent] said approximately 80 per cent of the offers were nowhere close to being in the running, which he said is telling of the lack of research some realtors conducted prior to bringing their clients to the nearly 300 showings that were booked. ‘I would have loved to get the same result with 10 offers,’ he said.”

2) People accept the tactic for what it is, but deep down many think there has to be a better way:

Another agent commented; ” ‘There was another way to do this,’ he said. ‘They could have listed this property for $999,999 and still got this property for $999,999.’ “

Addison

at 11:22 am

Herein lies the problem, so many buyers (or their representatives) continue to be detached from the market reality. If you are proceeding with a below list offer for this property in the hopes of security a “really good deal” then I suspect you’re the same chap who’s relying on winning the Lotto 649 to fund his retirement. It’s not going to happen. Alot of these offers were not only hopelessly unrealistic but indicative of buyers chasing an already past market. Scoring a property for 2017 prices in 2024 is frankly ludacris.

Vancouver Keith

at 10:03 am

Every three or four months a business reporter writes a story about how Canada is a low productivity nation, struggling to grow our economy. Then I read a story like this, and I understand why. A sales process of much sound and fury, signifying little. It did create a bigger contribution to Canada’s GDP than most real estate sales, if you think about it.

Looks like the demand side of the equation is alive and well, at least in the sub $1 million price point.

Ed

at 10:06 am

Couple of questions.

-You said this house previously sold in 2017. Which month? Considering the market died in mid April there was some good deals to be had later in the year.

-Were there any renos done in the meantime?

Ed

at 5:32 pm

sold in sept of 2017, had it been if Feb of that year it would have gone for 100k more.

No renos.

Sue

at 2:14 pm

The big question is how an agent walked in Seller through listing thier home at $900 less than it was listed for in 2017

Francesca

at 2:49 pm

https://www.blogto.com/real-estate-toronto/2024/02/mississauga-home-sold-250k-above-asking-85-offers/

This made it on blog to already so everyone must be talking about this indeed!

R

at 3:54 pm

Tell me again why anyone needs an agent?

There were 86 agents involved here and all of them were useless.

Appraiser

at 8:12 am

Thankfully in Ontario you can represent yourself when either buying or selling real estate. An agent is not a legal requirement.

So much freedom.

Trent

at 11:20 pm

Market seems to be on fire. My house has been For Sale for almost 90 days (Days on Market) and we have had about 20 showings since BOC held rates at 5% – 8 days ago.

Showings were steady (Nov and Dec) at 2 or 3 showings per week but shot up to 1 showing per day starting literally on Jan 1st.

Showings stopped 6 days before announcement then trippled day after rate decision until now.

Supply = Low and Demand = High

Oh and house hasn’t sold because it has a tenant. Enough said???