Nothing quite like three blogs, 12,000 words, and a lengthy and spirited debate in the comments section to get us started this year, right?

After reviewing “discussion points” three-through-ten this week, I thought because it’s Friday, we’d scale things back a little and adhere to the theme, “short and sweet.”

Every January, no matter what the previous market cycle looked like, we all start the year by searching for those first few clues about how the market is going to shape up.

I remember back in 2021, I wrote a blog about a townhouse on Merton Street. These might not be exact numbers, but this townhouse was on the market for something like $1.5M in the fall of 2020, languishing on the market for months on end, without selling. It probably could have been bought for well under the list price, but it never sold. Then in the first week of January, the property was re-listed, received multiple offers, and promptly sold for $100,000 over the list price.

You just never know what the year ahead is going to look like when we turn the calendar page from one year to the next. And this year is certainly no different.

Not much was listed last week, partially because the schools weren’t back in session yet and many families took this as an opportunity to extend winter break, but also because many sellers and agents are afraid of being the “first” to test the market.

Of the handful of listings, I flagged maybe a handful at best.

But one stood out to me as a property that could really set the tone for the 2023 market; a litmus test of sorts.

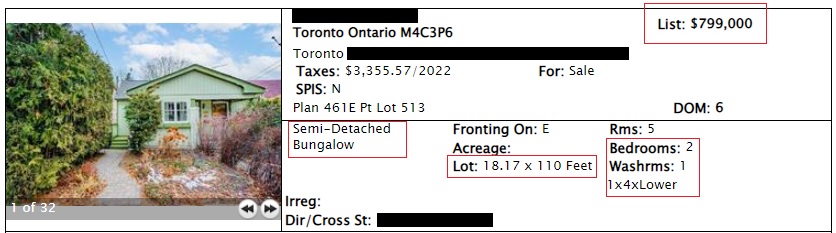

Listed at $799,000, this was a freehold property. A house.

And in this particular area, you don’t see many houses listed for $799,000. And if they were listed that low, it would represent a bait price so the house could sell 50% over asking.

At a $799,000 list price, it’s screaming “starter home.” It’s calling out a certain demographic of the market.

But does this demographic know the price isn’t realistic?

Wait…….do we know that this price isn’t realistic?

Apologies for the questions which seem rhetorical, but then are made not to be, but my point is that nobody knows where this market is headed, and that’s exactly why I flagged this listing and I why I want to share it today.

Here’s the property:

Disclaimer: because of TRREB’s archaic rules, I’m not permitted “disclose sale prices” or “advertise a competitor’s listing without consent,” hence why anything that could identify the property is blacked out.

But I have boxed the pertinent info in red.

This is a semi-detached bungalow.

It’s a 2-bedroom, 1-bathroom house, but here’s the catch: the living/dining are on the main floor, but the kitchen, two bedrooms, and bathroom are on the lower level.

Huh?

Come again?

Yes, this is how many houses on the street are laid out, and I have a client who is a few doors down. I recall showing her the house years ago and asking, “Is this weird for you?” She told me, “I might not have noticed if you didn’t point it out.”

Well, that makes one of us! Because it’s the first thing I saw when I walked inside!

The layout of this house is going to mean it’s not for everybody, but perhaps that will affect the sale price?

The lot size is quite decent at 18.17 x 110.

There is also a detached garage with parking for one car, and the backyard is great:

It’s not a huge house, but it has the cute-factor going for it.

At $799,000, it’s a starter home.

Most people looking at this house are comparing to condos, and I would think your “typical” 2-bedroom condo in the downtown core is going to run $800,000 and up, so how does this space compare?

Check out the living space, which to me, tells the story:

It’s cute, right?

Vaulted ceilings with a skylight!

Enough room for living and dining.

Bright, airy, and open.

It’s not a huge house but it’s “enough” for your typical starter home, whether the buyer is an individual or a couple.

When I wrote my January eNewsletter, which you can subscribe to HERE, I described how this one listing might set the tone for the 2023 market.

No, it’s not going to tell us how $3,000,000 houses are selling. But surely a cute, $799,000 “starter house” will provide us with some insights on the market, right?

Is this house going to get 18 offers like it would have in 2022?

Or will we see only 2-3 people submit bids?

All we’re reading in the news is how bad the real estate market is and how much prices have fallen.

Here’s what I wrote in my eNewsletter:

Case in point: there’s a cute starter home at (address), listed for $799,000, that I think will be the first major indicator of where the 2023 market stands. They have an “offer date” set for Tuesday night, and the mere fact that there’s an offer date tells us that it’s still a seller’s market for this type of property, in this price range, in this location.

If this were January or February of 2022, we would expect that house to fetch $1,000,000 with ease, and maybe even push toward $1,100,000. Today, I have to expect the floor here is $925,000 – $950,000. Could it go higher? Sure. Is there any guarantee? Absolutely not.

If this house sells for a mere $850,000, I’ll quit my job. Or eat my shorts. Or swallow my pride. Or whatever metaphor you want me to use that doesn’t actually involve me quitting my job, because I kinda like what I do! If this house sells for a mere $900,000, I’ll admit that even in the central core, prices are way down. But if this house sells for the high-$900’s, I’ll say that the market is alive and well – despite prices having declined. And if it sells for over $1,000,000, I will worry that we’re in for yet another crazy spring market even though the storylines all point to doom-and-gloom.

It’s just one house and it’ll be just one sale, but it’s worth monitoring, and it will act as a litmus test for the early spring market.

One of the agents in my office had a buyer for the property: a single, 34-year-old female currently renting in the downtown core.

We talked about this listing at great length for a week, tried to find “comparable sales,” as though there are any that are directly comparable, and in the end, we went with our guts.

I felt that the floor was $950,000 and that if some buyer out there really wanted the house and had the required 20% down payment, that buyer could offer $1,000,000 even and block all the buyers who have a 7.5% down payment and can only go to $999,999.

In the end, my colleague’s buyer didn’t make an offer. Her dad said the property was only worth $860,000.

What’s a property really worth, by the way? What somebody’s willing to pay, or what somebody wants to pay?

Offer day came and we started to get the emails.

1 offer registered.

2 offers registered.

3 offers registered.

And so on.

When it hit nine offers, I said, “The floor is absolutely $950,000 now,” and my colleagues tended to agree.

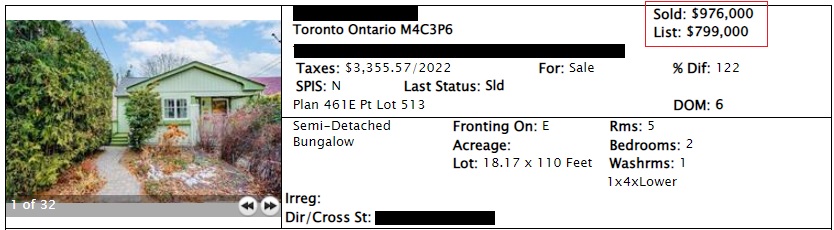

In the end, there were 15 offers on the house.

Any guesses what it sold for?

I predicted $1,001,000. I figured that somebody out there who was thinking about a bid of $975,000 or $980,000 would end up paying that $20-$25K premium to get to $1,000,000 and block any buyer who lacked the necessary 20% down payment.

But I figured wrong.

And when I saw the sale price the next day, I thought, “Hmmm, that’s not bad!

Alright, so what do we make of this?

First, let’s look at the number of offers. The fact that fifteen people submitted bids on the house is a sign that the market is alive and well.

Secondly, what do we make of the price? I think this was a $1,100,000 property in February of 2022. I have no doubt. That doesn’t mean it was “worth” $1,100,000 in February of 2022, but that’s what it would have sold for, because every house selling back then was selling for more than it was “worth.”

Wait….what did we just say about what a property is worth?

In any event, the sale price today is 11.2% lower than what I think it would have sold for in February of 2022, but to be fair, we can’t always compare prices to the “peak” of the market. Not everybody gets to sell at market peak, even if they demand it.

With the GTA average home price down 21.2% from February of 2022 to December of 2022, we’re going to see districts, neighbourhoods, and property types that have declined in price by more than that figure and by less.

Durham Region, for example, is down 28.8% on average in the same time period, and the 416 is down 16.0%. Of course, these are December prices, and December is a depressed month, so let’s see what January brings and we’ll know exactly where we are in the market.

But in the end, this property sold for exactly what I thought it should.

What does that say about the market?

Maybe nothing.

Maybe everything.

It’s merely one sale, but trust me when I say that a lot of people were watching this one…

Kindofabigdeal.

at 8:42 am

What a cute spot! If only the backyard had a hot tub..

Crofty

at 10:20 am

David, in your January Market Update, you gave the address of the $799,000 listing. Why were you able to do so in a mass email but not in your blog column? Just wondering.

Nobody

at 10:34 am

That email list is for people who signed up directly and there is some sort of client relationship between David and the people receiving the email. The blog is for everyone in the world and counts as advertising.

It’s a fine distinction but it is one TRREB defines so David plays along.

You’ll note that various listing sites require you to sign up to get access to information. As David says the rules are archaic and inane.

There was a discussion last year about how long old listing photos, floorplans, etc should be up. The rules flow, sort of, from similar concerns. If you’re the agent for a fancy property you don’t want a discount agent advertising it on robbersrus.net as the best new score for Joe Pesci and Daniel Stern! The rules should be totally revamped, as should governing legislation, but good luck getting that done given the various conflicting interests and the huge gap between markets – what works for 1 bedroom condos targeted at U of T students / investors renting to them is a disaster for 2 bedroom condos and detached homes a few blocks away, not to mention the needs /desires in Etobicoke or (for legislation) Windsor…

Nobody

at 10:41 am

That layout is crazy and the price is bonkers for the postal code.

At a 2019 price amd interest rate you could do a really nice reno to add a second floor and extension to put kitchen on main floor and 2+ bedrooms on the second floor. Would definitely make the most sense to buy the adjoining property and end up with 2 nice rational semis at a 1.4+ number per.

Of course if you have the money, skills, and desire to do that project there are definitely easier amd more profitable sites to work on!

hoob

at 10:50 am

In dense cities like Toronto, a full postal code basically narrows it down to about a dozen homes. So you you’re going to black out the address might as well black out the postal code as well.

Yes, I know the point is that the obfuscation is itself pointless regardless.

Jenn

at 11:24 am

Here comes the $$$ fine for David!!

Ace Goodheart

at 12:25 pm

To me, this would mean that the house was purchased by someone who was using CMHC and could not go past $999,999.00

Which then would mean that buyers who CAN go past $999,999.00 are not currently interested in this house (otherwise one of them would have pushed it to 1,000,001.00 and purchased it with little competition).

This would make sense, as once you get past the 1,000,000 mark, there is a lot of really cool stuff out there right now, that is not selling.

For example, on Annette Street, right down from where we live, a massive house, with 6 car parking, two garages and an owned right of way (they basically own the entire laneway) went for just over 1.2 mil, after sitting for about six months.

If you have cash right now, things look really good for you. You are the only person in the room.

Alexander

at 2:40 pm

I guess BoC can do another year of raising rates and tightening if people are still willing to pay almost 1 mln for a “cute” semi-detached bungalow with 2 bedrooms in the basement.

Alex

at 2:51 pm

Love it! I’m with you Dave, I think it will be a robust spring market. The pent up demand of both buyers and sellers is ready to open up. IMO

Ace Goodheart

at 10:34 pm

Will be interesting to see if this actually happens.

The OSFI seems to be putting the hammer down on mortgages (probably years too late, but oh well, close the door when the horses are already out of the barn, or whatever….)

The stuff they are contemplating doing, is scary.

If you are in the real estate business, you want to read this: https://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn-ort/gl-ld/Pages/b20-cd.aspx

This stuff is “planet killer” type level. Sort of like an asteroid hitting your real estate market.

If any of this actually gets implemented, then there could be big trouble.

They already banned foreigners from buying houses in our major markets.

Now the OSFI wants to crush mortgage lending. Unless a person actually has a cool mil sitting around somewhere, buying a Toronto home could wind up being impossible for most people.

At any rate, I guess remember the three steps of government interaction with an economic engine (like real estate, for example):

1. If it moves, they tax it

2. If it stops moving, they regulate it.

3. When it dies, they subsidize it.

We appear to be at the regulation stage, all opportunities for taxation having already been rolled out.

John Shields

at 11:31 am

Pertaining to the foreign buyers’ ban one thing is certain the loophole will be putting more homes into the names of foreign students. There’ll be a big influx of foreign students this year.

Tim Tulle

at 5:25 am

The purchase of a property must be well thought out. I recommend an Apartment Loan calculator to start with to catch up on any losses