I’m on an honesty streak of late, so let me admit the following: after choosing the title of today’s blog, I came to realize that I don’t actually know what the idiom, “grasping at straws,” refers to.

Do you?

I think that many of us routinely use sayings, turns-of-phrases, and idioms for which we don’t know the origin.

I mean, do you know what is meant by a “harebrained scheme?”

We use this sarcastically to describe a genius idea that isn’t so genius, or a foolish endeavour, but the origin is rooted in the fact that a rabbit (or hare) has a brain so small that if you told somebody their idea was “harebrained,” you’d be telling them it was a poor one.

So where does “grasping at straws” come from?

This dates back to the year 1534. In Thomas More’s “Dialogue of Comfort Against Tribulation,” there’s a proverb that says:

“A drowning man will clutch at straws.”

The straw in this case is meant to refer to the thin reeds that will grow next to the mouth of a river.

This feels like one of those “Now You Know” moments from the 1980’s…

But are sellers grasping at straws in this market?

What effect is the mindset having on pricing?

Today, I want to share with you some recent examples of listings that underscore the, um, creative measures that some sellers are going to in this market.

Not all of these are good ideas. You’ll identify that pretty quickly.

Some are fair and some are completely offside.

It’s up to you to decide which is which…

Listing #1:

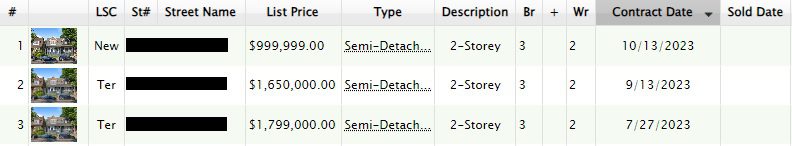

This property has now been listed three times, as follows:

Some of you already know what this is about, as you’ve read enough of my blogs to know the story before I tell it.

This property was listed for $998,900 on September 20th……with an offer date.

The offer date didn’t work.

In fact, very few offer dates worked this fall, and most houses were re-listed sometime after the failed offer “night.”

The property was re-listed for $1,198,700, as you can see above, on October 3rd.

The property didn’t sell.

So now what?

Do you see where this is going?

The property was re-listed for $989,900 on October 27th…..with an offer date.

Huh?

Didn’t they try that?

So I ask of you:

Is this a legitimate strategy, or are they grasping at straws?

If the seller is holding out for, or worse – expecting, anything close to $1,198,700, then this isn’t going to work. But if the seller is saying, “Let’s list low, see what interest we can generate, and take the highest offer,” then this could be a successful strategy in the end.

Listing #2:

Check out this property:

Freakin’ gorgeous!

Red-brick, Georgian, below-grade built-in garage!

Love it!

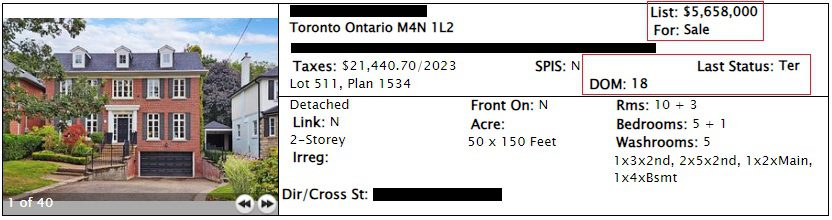

They listed for $5,658,000, and as you can see, they were on the market for 18 days.

But what happened next is one of the oddest strategies I have seen in quite some time.

They did this:

What?

Listed for $3,990,000?

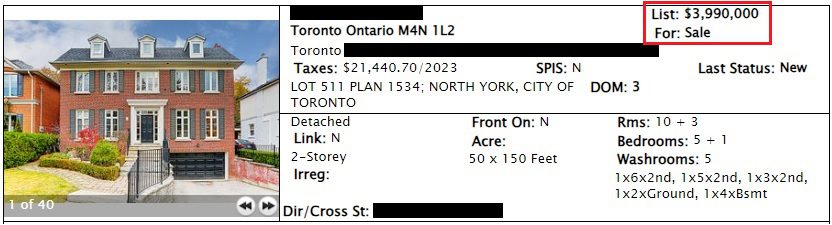

Yes, there’s a caveat, which you can see here:

They have an offer date?

Really?

It’s one thing to take a listing for $1,200,000 and terminate, then re-list at $999,000 with an offer date. That strategy won’t work, but fine, have at it.

It’s another thing entirely to take a house for which the seller presumably wants $5.5 Million, list for $3,990,000, and hold back offers.

What’s the thinking here?

Does the listing side believe that they can get affluent, wealthy, intelligent individuals to lose their minds and act like pigs at a trough?

Tell me that you can take a $600,000 condo, list it for $499,000, and produce 13 offers – resulting in a $630,000 sale price. I’ve done it before many times, and it relies on the naive, inexperienced, hopeful, bashful buyers to submit dummy offers of $499,000, $510,000, $520,000, etc.

But do we really expect those who can afford a $5.5 Million house to be so clueless that they would fall for what is essentially a “trick?”

“Honey, we have to see this house! It’s listed for $3,990,000.”

Fourteen people think the same thing!

Fourteen offers materialize, and suddenly, five people are saying, “Sweetie, bid your brains out on that house! Go get it!”

Then there’s a money fight in the sky, and BOOM – the seller gets two offers for $5.6 Million.

There’s just no logic behind this.

And check out the listing history:

Everybody can see this.

The $3,990,000 price isn’t fooling anybody.

In fact, I think it cheapens the offering and it would turn buyers away who don’t want “that house” with “that listing strategy.”

Listing #3:

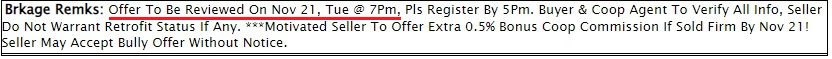

Here’s a really interesting one!

Great price here:

And it’s been listed for 22 days.

Do you know what that means?

It means, or at least it should, that there’s no offer date.

Most offer dates are six, seven, or eight days after the listing date. We list for sale on Tuesday, November 7th and we review offers the following Monday, November 13th.

That’s very common.

But when we see 22 DOM, we expect not to see an offer date.

That’s what we see here, in fact:

Offers any time!

Amazing!

So that means, by all accounts, that this property should be available for $999,999, or maybe a buyer could negotiate the price down?

No.

Not even close.

Look at the listing history:

They clearly want a price for this that is nowhere near the list price, based on the previous two prices.

Now, some of you might say, “David, you guys do this all the time! You just said that you would price a $600,000 condo at $499,900 as a strategy.”

True.

But I firmly believe that when you have an “offer date” specified in the listing, you’re signaling that the list price is merely the auction’s starting bid.

When you have been on the market for 22 days and have “Offers Any Time” in the listing, it’s a completely different story.

More to the point, this listing actually says “MOTIVATED SELLER” in the remarks.

At one time, I argued that this constituted blatant false advertising, but some well-known Toronto brokerage owners fought me on that.

And so, here we are.

Is this a legitimate strategy or are they grasping at straws?

Listing #4:

Here’s a beautiful house!

I love this property and I’m waiting on it, for reasons that will become clear, for an investor client.

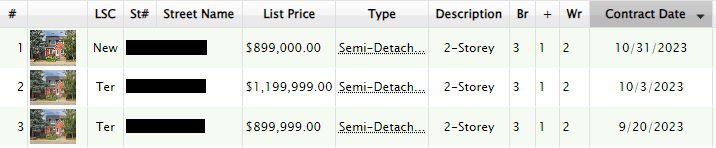

Here’s the listing history:

You’re going to say, “Didn’t we just see this? Isn’t this Listing #1?”

No. It’s similar though.

Both were listed for $900K with an offer date, terminated and re-listed for $1.2M, and then listed for $900K with an offer date, again.

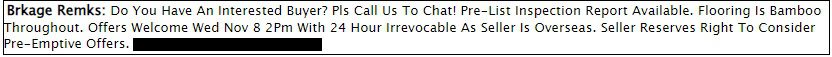

But this one has a note in the listing as follows:

It’s simple and yet so effective.

Communication in this market is more important than ever and here’s an experienced agent that knows how to sell.

“Do you have an interested buyer? Please call us to chat!”

Simple.

I believe that in this market, both the buyer agent and the listing agent have to change everything they do compared to a seller’s or “hot” market. More truth, more transparency, more understanding, and more common goals. But above all, communication.

The listing agent in this case is basically saying, “We tried $900K with an offer date, it didn’t work, and then we re-listed higher, but it hasn’t sold. So call us. Let’s chat. Do you have a buyer? Let’s start the conversation about how we can put the buyer and seller within striking distance of each other, and go from there.”

This isn’t grasping at straws, but rather an effective strategy.

Listing #5:

Here’s a listing for $999,000:

It’s been listed for 27 days.

So is this like Listing #3?

Is this truly “offers any time” or is it a bait-and-switch on the price?

Well, I guess it’s somewhere in between.

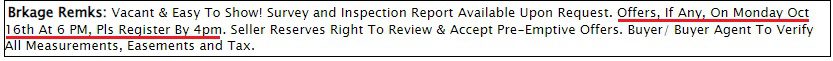

Here are the listing remarks:

(David checks calendar…)

Oh, hey, look at that, it’s actually NOVEMBER!

What the heck?

This property was listed with an offer date for October 16th; under-listed, obviously, or so the listing side thought.

But on October 17th, after the property failed to sell, the listing side didn’t terminate and re-list.

In fact, they did nothing.

They didn’t even update the listing.

Their “strategy,” it would seem, is to leave the listing untouched and hope that buyers might show their hand with respect to price.

Is this a strategy or is this grasping at straws? Perhaps this one is a bit more obvious…

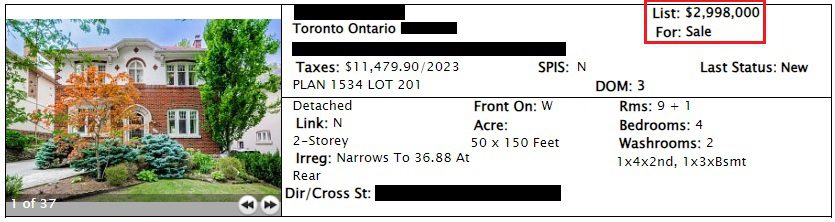

Listing #6:

Here’s a nice spot:

Wow, 51 days on the market, eh?

Alright, so it’s not selling.

And in fairness, this was listed for $3,295,000 and then reduced to $3,145,000.

So let’s assume that somebody was interested in this listing before it was terminated. What would they offer?

$3,145,000 on the market for 51 days? Geez, you’d expect to get it for $3,000,000 even, at worst. You’d probably hope to get it for $2,900,000, or even perhaps $2,800,000.

In this market, you might see people offer $2.6M or $2.7M as a starting point.

Well, all that is moot, because it was just re-listed:

When I first saw this, I assumed it was effectively a price reduction.

They were at $3,295,000 and reduced to $3,145,000. Then they terminated and re-listed for $2,998,000, which matches the previous price change.

Only, all that “logic” goes out the window when we read the brokerage remarks:

![]()

Oh, geez.

An offer date?

What?

An offer date signifies an expectation of “bids.” It projects a position of strength.

When listed for $3,145,000 and on the market for 51 days, the listing side would be lucky to receive an on-paper offer for $2.8M.

So how is $2,998,000 with an offer date within the realm of reason?

Legitimate strategy or grasping at straws?

There are pricing games galore out there, and as much as I detest some of them, I understand where the players are coming from.

Many agents have no clue how to transact in this market.

Many sellers won’t accept current market conditions.

Put those together and it’s a recipe for craziness.

If you’ve seen anything else like this, email me!

Marina

at 9:35 am

If your seller is refusing to face reality, you might have to grasp at straws. No amount of strategy will get you what you want if what you want is a time machine back to Feb last year.

That said, sometimes crazy things happen. There were 3 houses up for sale in my mothers neighborhood. Two were normal. One was overpriced, kinda dated, family room only had a couch and a saddle. No, that’s not a typo. A freaking SADDLE, tastefully mounted on a stand in front of the fireplace, like the set of a sad porno. I’ll give you one guess as to which house sold. I guess equestrians have money to burn. You never know,

Egghead

at 11:05 am

Not to mention, two of these offer dates are requesting “24 Hours Irrevocable”, which is…. contrary to conventional methods, to say the least.

Nobody

at 1:23 pm

The last listing has good reasons for not being a great strategy. It specifically notes that it’s being run by an executor and that probate is complete.

So the people in charge of the sale have a fiduciary duty to get the most money and aren’t feeling very confident in how to go about it. They aren’t selling their own asset and are trying to ensure that they paper the process to demonstrate that they tried to maximize value. This is likely to actually reduce the price achieved but not in a way you can demonstrate or are going to litigate. A fast sale which involved taking a negotiated offer under list risks getting dragged into court, especially if there are “interesting” heirs.

Some people are following strategies but for different purposes

Andrew

at 8:15 pm

David I think you should write a post on the idea of only listing at a price that a seller would accept. How it would work. The pros and cons. But how it would change the market and the process for the better or worse.

Nobody

at 8:26 am

You can’t force people to sell.

There are many reasons to cancel a sale – health issue, pregnancy, new job falls through, condo project you were buying gets cancelled, your bank says that they won’t give you a new mortgage but will roll over your existing one…

Plus the courts are ridiculously backlogged now. If you flood the system with all sorts of litigation aimed at forcing a sale it will just get worse, plus it would just drain the finances of the attempted buyer as well as the seller.

We have rules about honoring prices at retail because you’re selling lots of identical items (one box of crest is like the other). But then there are also escape clauses for obvious mistakes – if a store is off by 2 orders of magnitude on a price tag they won’t be forced to sell at that price. Houses are unique and the sellers (almost always) have one to sell. Courts are loathe to force people out of their houses without very, very good reasons and reasonably minor disputes about price aren’t remotely tenable.

Ace Goodheart

at 9:11 pm

A lot of these people are just running scared. The most common emotion that comes after legitimate fear is denial.

Many of them have purchased new houses and now realize their existing house won’t sell for anything near what they thought it was worth. Some are underwater and will be paying a bank to let them out of their loan.

What we are seeing here is frightened people in the denial stage.