Between the comments on TRB posts and the reader-mail I receive on a daily basis, I’m never without opinions, challenges, and insights.

Of course, somewhere therein lays topics for blog posts, and today is an example of exactly that.

Every week, I hear from at least a dozen people who aren’t in the market for real estate, but have something to say or share. I enjoy hearing from people, I really do. Once upon a time, I wrote back to everybody. Absolutely everybody, no matter what. Today, I just don’t have time to respond to all of the “I just finished university and I want to go into real estate” emails, of which there are many, and I’ll be honest, I don’t respond to the, “I just bought a house through another agent who’s my friend from school, but I’d love to get your opinion on the price we paid and if you think we got a deal” type posts, of which, believe it or not, there are many.

Some of the blog posts I’ve written this month were in response to emails from readers, who often just want to chat about a topic, or point out something they saw that could be of interest to myself and the readers.

On Sunday afternoon, I was at the Toronto Zoo with my family. This whole “taking Sunday off” deal was a relatively new endeavor about two years ago, and I often think it would be easier to go to the office and work. Despite the 35-degree heat, and those “you’ll laugh at it later” moments like the kids only consuming half of their popsicles while the other halves completely melted and rendered them sticky (which they both cried about), a great time was had by all!

I shouldn’t say “I took Sunday off” completely since I did sell one condo from my phone in between the hippos and the rhinos, but it was somewhere around the lions (which thankfully were sleeping right up against the glass) when I received this email from a TRB reader:

Hi David:

I appreciate that you’re a guy who tackles the difficult topics like the Friday Rant you just published this week. But I’m surprised you haven’t touched on this:

I’ve been waiting two weeks for you to write about this!! Funny MLS photos can wait. This could be the end of the real estate world as we know it and I would love to hear your thoughts. Personally I think it’s fair game until it’s not. You or I can buy one house to rent out, or two, or ten. But what if a company bought a hundred? Or a thousand? What if Amazon or Google bought them all?

Food for thought.

Hoping you can fit this into the blog schedule.

(Name)

Well, it was a busy day, to say the least. I also ran 14 KM mid-day which was really, really dumb, considering the heat, and by the time I sat down to write Monday’s blog (currently 8:45pm on Sunday night), I had zero energy.

Do I really want to tackle “the tough topic” while low on brain-power?

Ah, sure, why not?

My reader wasn’t wrong when she said that this is something I should have written about by now. I read the Globe & Mail article two weeks ago and I made a mental note to come back to it, but I just never had the chance.

But she’s also not wrong when she said “this could be the end of real estate as we know it,” and her sarcastic suggestion that Amazon could buy every house in the world isn’t so far-fetched that we should dismiss it out of hand.

I don’t typically spend much time on “what if” scenarios, but have you ever considered just how much we rely on Amazon and Google? Seriously, I need a 15 x 9 inch picture frame, thin-frame, in black. Twenty years ago, I would personally visit five or six different stores, and make an entire day of it. Today, I just sit at this computer and click the mouse over and over. How many items did you order from Amazon during the pandemic to make your life easier, hmm?

So if Amazon or Google buying every house in the world is the extreme, then what do you make of the idea that a Canadian corporation can buy 100,000 houses and keep them in a trust?

Just to say we did, here’s the entire Globe & Mail article:

“Condo Developer Plans To Buy $1 Billion Worth Of Single-Family Houses In Canada For Rentals”

The Globe & Mail

June 13th, 2021

Rachelle Younglai

A Toronto condo developer is buying hundreds of detached houses in Ontario, with the plan of renting them and profiting on the housing crisis ripping across the country.

Core Development Group Ltd. is building a large-scale single-family home rental operation, an unproven business model in Canada, where the market is fragmented and individual investors lease a small number of their own properties for income.

Institutional house rentals have become highly lucrative in the United States, with private-equity firms, pension funds and big companies throwing billions of dollars into the asset class. In Canada, deep-pocketed investors, as well as real estate investment trusts, have already acquired hundreds of apartment buildings to tap into the strong rental demand but have not moved into rental houses.

Core founder Corey Hawtin and executive vice-president Faran Latafat questioned why there wasn’t a similar business in Canada, which has had a rental vacancy rate below 3 per cent since the turn of the century.

“We were trying to answer the question: Why is nobody doing this in Canada? We could not come up with an objective answer to that. In Canada, it works as well or better than the U.S.,” said Ms. Latafat, Core’s president of single-family development.

Core’s main business is condo development, and it has 14 projects in the Toronto region. Last fall, Mr. Hawtin raised $250-million from investors to buy approximately 400 properties, add basement apartments and turn the houses into two rental units.

Core is targeting eight midsized cities in Ontario, and this year started buying properties in Kingston, St. Catharines, London, Barrie, Hamilton, Peterborough and Cambridge. It will soon start buying in Guelph. Its medium-term goal is to have a $1-billion portfolio of 4,000 rental units in Ontario, Quebec, B.C. and Atlantic Canada by 2026.

Mr. Hawtin said Core’s rental units will provide affordable housing for families and residents who do not want to live in small apartments. If Core succeeds, it could spur major investors to follow suit.

Ms. Latafat and Mr. Hawtin believe a major house rental business will flourish in Canada because of decades of low rental vacancy rates, desire for more space and high immigration. They also point out most of the country’s population is concentrated around a few job centres.

As well, the pandemic’s real estate boom has priced even more residents out of the housing market with rentals as the only option. National home prices are 20 per cent above pre-pandemic levels, with values 30 to 50 per cent higher in parts of Ontario, B.C., Quebec and the Maritimes. The typical price of a detached house in Guelph and nearby Kitchener-Waterloo is now more than $800,000, according to the Canadian Real Estate Association. That is about $200,000 more than a year ago.

Economist David Rosenberg said an affordable rental house could become more attractive to a potential home buyer because house prices are so high.

“The ratio of home prices to rental rates is so extreme that new entrants to residential real estate will gravitate to the rental market,” said Mr. Rosenberg, who leads Rosenberg Research & Associates, adding that if more potential buyers are forced to rent, that could eventually reduce competition in the residential real estate market and slow home price increases.

Ms. Latafat said Core chose the eight Ontario cities because they all have strong local economies, are close to larger job centres, have growing populations and low housing vacancy rates.

In Barrie and Guelph, the rental vacancy rate is closer to 2 per cent, according to Canada Mortgage and Housing Corp. data. Meanwhile, in the first year of the pandemic, rental rates have increased in the high single digits in Barrie, Guelph, London and St. Catharines, according to CMHC.

“They have tight vacancies, like zero vacancies,” said Mr. Hawtin. “Immigration is growing, population is growing and buying a house or a condo has become less and less attainable. That is really compounding the rental demand in all of our marketplaces,” he said.

So far this year, Core has spent $50-million on 75 properties, the executives said. Their two-bedroom basement apartments go for about $1,600 a month and a three-bedroom above-ground unit at about $2,100 a month. Those prices are higher than the average rental rate of $1,407 for a two-bedroom apartment in Ontario, according to CMHC data. Though Core’s rentals are newly renovated units in houses with gardens.

Institutionalized family home rentals got their start south of the border, after the U.S. housing bubble burst in 2007 and companies bought thousands of houses at fire-sale prices. Companies and their investors now own swaths of U.S. neighbourhoods and make money on the rent, similar to apartment building owners.

Toronto-based Tricon Residential, one of the largest operators of single family home rentals in the U.S., said Core’s decision to split the properties into two rental units makes sense given the price of houses in Canada.

“The problem in Canada is that homes are so expensive,” said Tricon chief executive officer Gary Berman, whose company has wanted to bring single family home rentals to Canada for years but has concluded that it is unworkable owing to the high real estate prices.

Tricon owns about 24,000 detached houses in 18 major U.S. cities. Most are in warmer climates such as Orlando and Phoenix. Mr. Berman said that makes the houses easier to maintain compared to Canadian properties, which have to withstand long, harsh winters.

Tricon keeps its purchase prices below US$350,000 a house and rents the entire property for about US$1,500 a month. Mr. Berman said the key to the business is scale, saying Tricon aims to have at least 500 rental houses in each city.

Core is also trying to build scale and is buying houses within 15 minutes of each other to form a cluster of about 50 properties or 100 rental units in each city. Ms. Latafat said it has taken Core about one month to rent their new units and their vacancy rate is below 2 per cent. She declined to comment on when the rental business would be profitable except to say that the rental units were “cash flow positive,” about five months after they were purchased.

Mr. Hawtin said he expects to start fundraising for the next stage of the rental business as soon as next year and may consider going public at some point.

The reactions to this story have been all over the place.

My first reaction was: “Core? These guys?”

Core Development Group is not a Tridel, or a Menkes, or a Monarch. They are not a Great Gulf, nor are they a Daniels.

If the name sounds familiar, it might be because they’re building the two new condominiums on the west side of Laird Drive in Leaside, which I wrote about a few weeks back and featured in a Pick5 video this month as well.

If you look at their website, you can see that this is a company that may not have that many completed projects under their belt, but they have a lot on their plate right now. They have a site at Front & Sherbourne with a proposal for 37-storeys and they’re also partnering with Menkes to build a monster condo on the former Filmore’s site at Dundas & Jarvis.

But is this the company that you expected to see in the news attached to the headline “buying $1 Billion in single-family houses for rentals?” I honestly don’t know. If developers like Tridel are too busy building condos to become property managers, then perhaps we should come to expect this venture from a company like Core.

That’s neither here nor there for you, the reader. You, like most people who read the Globe & Mail article could care less about who is taking on this venture and are still trying to get over the “what-the-fuck” effect of the headline.

A billion dollars in residential, single-family homes, being taken out of the sale pool, and turned into rentals?

How can this happen?

How can we let this happen?

And who is “we” anyways?

The public is going to be split on this probably somewhere close to 50/50.

I can buy one house and rent it out. I can buy two houses and rent them out. I can buy ten houses and rent them out. But how many houses can I buy and rent out before a large percentage of the general public complain that it’s not fair?

There are, after all, some people in society who believe that housing should not be commoditized and that the idea of owning a home as an investment is unjust.

We’ve had this discussion before many times.

September of 2018, I wrote: “Should Housing Be Commoditized In Canada?”

We don’t allow the purchase and sale of kidneys, so why housing? Where do we draw the line? That discussion has gone on, and on, and on. Ripe with comparisons to other shortages around the world, like food, except we have an actual league for “competitive eating,” and like oil and gas, except we have motor-sports which are billion-dollar ventures where drivers needlessly burn gasoline.

So what’s different about housing?

Why can’t a Canadian company buy 100,000 houses and keep them in a trust, forever, to be rented out to individuals?

I’ll be honest: I don’t love the optics here, nor do I love the end result. But if I’m a capitalist and I believe in real estate as an investment, then I can’t have it both ways. I can’t argue that my clients, a couple of 40-year old teachers, should be able to own three condos in King West to rent out for investment purposes, but a corporation can’t do the same on a much, much larger scale.

I’m so curious to know what people think about this idea that I couldn’t wait for the TRB readers to comment on Monday. So I took a look at the comments on the Globe & Mail article, of which there were 400, and boy, oh boy, were they interesting.

Here’s one from somebody that sounds like he or she comes from a financial background:

Those of you who work in finance: agree or disagree?

There’s no breakdown of how the purchase of the $1 Billion in real estate will be financed. Is it all cash? In a world of 2% interest rates, wouldn’t that be foolish?

So what’s the play here? Is it rental yield? And if the properties are bought in cash, versus financed, how does that change the return?

Is this a long-term appreciation play? With land transfer tax alone, the buyer is already behind the eight-ball.

Will there be quarterly dividends to investors?

Are investment dollars locked into this fund/trust for a certain number of years?

The financial folks must be asking a myriad of questions as the Globe & Mail article really lacks any description of how this fund will work.

Now how about this comment:

One million dollars.

One MILLION dollars.

A person who has that much money is……………a millionaire!

Like this guy:

I grew up watching the 1960’s “Batman” in syndication every day after school.

The way the narrator said, “MILLIONAIRE, Bruce Wayne,” made me think that he was the richest man on the planet.

But it’s now 2021 and a millionaire isn’t special anymore. And when we’re talking about “estates” of one million dollars, like the guy who commented above, then how many people is that, really?

This could easily be financed by a 100% tax on estates over $1 million.

Did somebody really just say that?

How does this work, exactly?

A 100% tax on estates over $1 million. So if somebody has a million-dollar estate, it’s taxed at 100%, and then the person is left with nothing?

I’m not expecting a genius like the one who posted above to eloquently explain his or her idea, since it’s ridiculous to begin with. But this simply underscores how many people out there believe that a million-dollar “estate” is impressive in 2021 (when this could mean the value of the house and not the equity), and that any tax rate of 100% should exist.

I point this out because it demonstrates the mindset of many out there today. It reminds me of the time I played golf with an old friend who took a very different path in life, and after a brief discussion about economics and income, I asked him, “How many people in Canada do you think make $1,000,000 per year?” He told me: “Maybe six or seven million.”

So while I don’t want to give too large a forum to the folks who commented mindlessly on the Globe & Mail article, I’d be remiss if I didn’t mention it.

There was a lot of wishful thinking too:

Yeah, I get it.

“Should” and “would be nice” type stuff.

These folks will always have a place in the opinion pool.

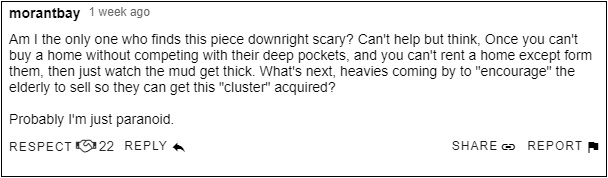

Most of the comments, however, were coming from a place of concern and uneasiness:

Those without strong opinions merely asked questions about how this would work, or where we would go. And there’s no shortage of people who read the Globe & Mail article and wondered the same thing.

One final thought on this: Core raised $250 Million to buy 400 properties, per the article, which is an average acquisition price of $625,000. If their plan to purchase $1 Billion in houses comes to fruition, this is only 1,600 houses. The article being “downright scary” as one reader commented has less to do with 1,600 houses being taken out of the housing pool in this venture by Core and more to do with whether this leads to countless other companies doing the same thing.

But will the powers-that-be allow it to happen? That’s the question.

Public uproar will surely be a factor, and it will ultimately fall on the federal government to decide what is fair and what is just.

But is it fair for the government to call Bob & Shirley’s purchase of three downtown Toronto condos as just, but to call XYZ Corporation a model of greed for buying three-thousand condos?

The public may decide what is just and what is not, but unfortunately, or fortunately, depending on which side you’re on, they won’t be the ones with the power to stop the big-buy from happening…

Marty

at 1:39 pm

Maybe one day you can expose “big popsicle” for the scam they’ve been perpetrating for decades now.

They full well know most are only going to eat half of it before it malfunctions. But they refuse to update their dual-stick technology.

Writer

at 3:19 pm

So interesting that there is such an uproar about this.

In the high-rise space it seems like there is a huge push to force developers to stop building all these condos which provide freehold housing – everyone seems to want them to build rentals.

So would it be good or bad if a large corporation bought a whole building worth of condos and converted it to rentals?

Seems like this would be considered by the world as an amazing help to society, providing more desperately needed rental stock.

And if they buy up a swath of houses and convert them to rental is that different?

In the area I live, the biggest issue is not enough rentals. Many people who want/need a house don’t have the necessary down-payment, income, or they are new immigrants, or maybe they just don’t want to buy. The only rentals available are owned by individual investors, who often don’t have professional management and therefore they always have issues.

In addition the tenants often get the call that the investor decided to sell, or they need it for a family member to move in and now these tenants are stuck looking for another non-existent house to rent.

What can possibly be wrong with providing well managed homes for people to rent?

Kyle

at 3:37 pm

Totally agree with you, from a societal point of view this has a lot going for it. One of the main laments is that there are too many small condos and not enough affordable options for families. Now families can move into neighbourhoods that they would otherwise be unable to buy into.

This could actually be a game-changer for a lot of families. A lot of the best amenities including good school districts are situated in predominantly owner-occupied hoods. And if you can’t afford to buy a house, then you’re basically locked out of those hoods. Now people can rent and still get access to those same amenities.

Kyle

at 3:40 pm

Not to mention they are adding a basement apartment in each of the houses they buy. Basically buying a SFH and turning it into two dwellings

DDofG

at 9:42 pm

@Writer

@Kyle

I totally agree with both of you.

Writer

at 8:45 pm

This article is exactly what I’m talking about.

https://www.cbc.ca/amp/1.6094412

We need more rental

Housing.

Peter

at 4:34 pm

Filmore’s is becoming a condo? First Jilly’s and now Filmores? What is happening in this world?

Joel

at 9:57 pm

If they are developers one would think it would be easier to build a new neighbourhood and rent out the homes. You could build them all as duplexs.

I would think that this would be the more profitable way to execute this.

Sirgruper

at 11:53 pm

Hmmmmmm. An obsessive personality and 14 k in a humid 33 in the sun. Sure, let’s add marathon training to your life. :). You’ll be up to a 36 k long run in no time. Can view a lot of real estate at the same time while listening to podcasts. Enjoy.