I know I’ve used “The Fork In The Road” for a TRREB stats blog post before.

Give me a minute and let me look this up…

…ah, yes, it was August of 2022. So not even that long ago.

I was out for a run on Sunday afternoon (my first 16KM run of the year, as I work toward the Toronto Waterfront half-marathon!) and although I tried to keep my mind empty and simply take in the sights, sounds, smells, and enjoy the journey, I found myself thinking about this blog post.

I had spent Sunday morning looking over the July TRREB stats and putting together some charts in anticipation of this post, and although the charts and the corresponding data started out somewhat positive, by the time I got to the tenth or eleventh chart, I started to think, “This doesn’t look great for the market.”

Now, it’s July. It’s the summer. It’s one of the slowest months of the year. So to draw any conclusions from summer data is bordering on irresponsibility.

But as you’ll see further down the page, one of the data points looks extra-bleak. I won’t spoil the surprise here though, so pay attention as we move through the data and charts.

It was on my run, somewhere around Parkhurst Boulevard and Donegall Drive, that I started to think, “This could go either way.”

By “this,” I suppose I mean the market momentum. But the market goes as momentum does, so net-net, I guess I’m talking about the market then?

It’s very odd because the month of July wasn’t slow for my team and me. In fact, we had the busiest July on record as a group, and personally, I found myself busier than any July in recent memory, and that includes the insane summer of 2020 which was on steroids because of months missed earlier that year due to the pandemic.

The “word on the street” out there among colleagues and friends is that the market is mixed.

No kidding.

One colleague tells you that they got beat in competition against eight other buyers out in Durham Region, and the other colleague tells you they’ve had zero showings on their listing in prime Queen West.

Go figure.

But it’s this level of unpredictability, along with the stats from the month of July, that tells me the fall market could go either way.

We could see this negative momentum continue and have a sluggish fall, or, we could see the market do a one-eighty as it always does after a slow summer, and with little inventory available, it could be a seller’s market once again.

Hence “The Fork In The Road.”

I don’t know that there’s a better way of describing it.

Trust me, I thought of ideas for a whole kilometre as I headed east on Parkhurst Boulevard on Sunday afternoon, but nothing better materialized.

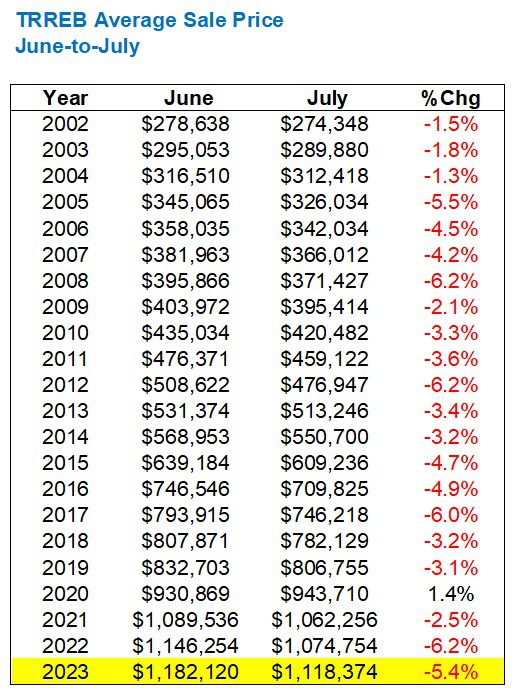

Here’s an up-to-date look at everybody’s favourite market metric, the average home price:

The average home price declined 5.4% from June to July and it now sits just above where the market was in March.

Compared to where the market sat last fall, this still represents a significant increase.

The average home price in Sept/Oct/Nov, aka “the fall market,” was about $1,085,000. So the July figure of $1,118,374 represents a 3.1% increase over that number, and that means that the current market – even the “slow summer,” has surpassed the fall of last year.

That’s important and should not be overlooked.

However, that 5.7% decline in average home price feels higher-than expected.

So let’s look back at the data and see just how much the average home price typically declines from June to July each and every year:

2020 was an outlier due to the pandemic, just in case some of you aren’t paying attention.

But overall, it seems as though 5.4% is on the higher end.

We saw a larger figure of 6.2% in the summer of 2022, but that was in the midst of a market retreat as quantitative tightening by the Bank of Canada was well underway

We also saw a figure of 6.0% in the summer of 2017, which ironically, was the previous market in which the government stepped in and made changes, like in 2022.

The average decline from 2002 through 2022 was 3.4%, so last month’s 5.4% drop is large, but it’s not like it’s a 9% outlier.

How the market moves from July to August will be very telling.

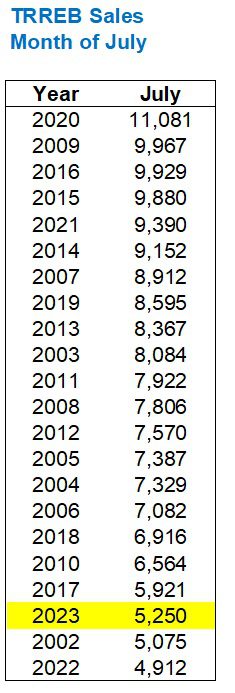

As for sales, this is where the data starts to look a little worse-for-wear.

We could easily tout the “year-over-year” data and announce that sales were up 6.9% from July of 2022 to July of 2023.

But that, in my opinion, would be misleading.

Because if we want to look at July in the current market context, then comparing it against previous market cycles tells a different story.

Let’s compare June to July and look at what historically happens with sales:

I don’t need to sort high-to-low, right? You can all see that the 29.8% decline represents the largest decline since we started tracking this data?

You can make numbers say anything you want, but trust me when I say I’m not trying to paint the market in a negative light.

Yes, the year-over-year data shows an increase in sales in the month of July.

But the historical data shows us that the decline this summer is the steepest on record.

Let’s put those 5,250 sales in historical context as well:

So sales in July are up 6.9% over last year, but that’s only because last year was the fewest sales in July ever.

Yikes.

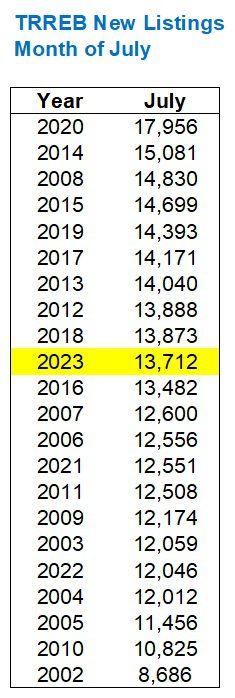

This wouldn’t be a concern in the slightest if new listings were also hovering around the third-lowest of all time, because that would mean that the ratio of sales to new listings, or the “absorption rate” would remain unchanged.

But alas, inventory was not significantly impacted last month:

New listings were up 11.5%, year-over-year, but sales were only up 6.9%, year-over-year.

Or put another way, new listings were down 13.6% month-over-month, but sales were down 29.8% month-over-month.

This means that inventory is being absorbed at a slower rate, which also means that inventory is building.

Let’s look at the ratio of sales to new listings for the month of July, and here is where I started to think “This doesn’t look great…”

And I don’t need to sort this one highest-to-lowest either, right?

What do we make of this?

An outlier? One bad month?

Or should we draw any conclusions from the lowest SNLR in any month of July since 2002?

I mean, July of 2022 wasn’t great either, but the fact that the SNLR this past July was even lower than in 2022 could be cause for concern. It just depends on where the fork in the road leads.

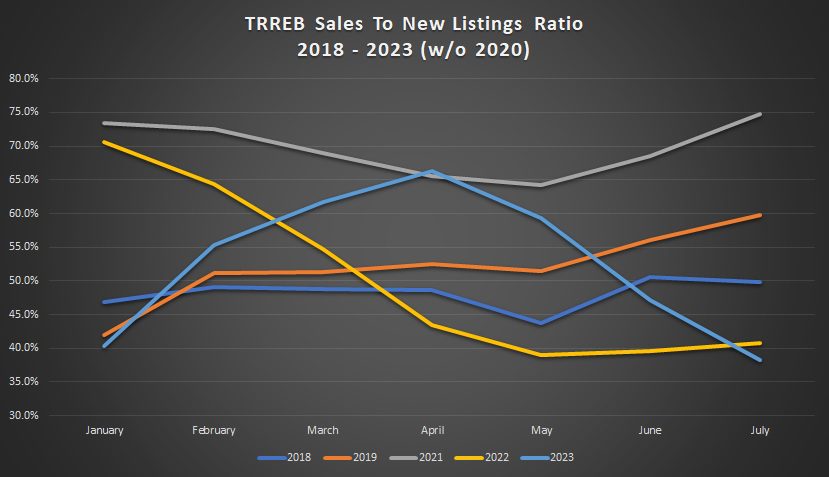

Looking at the SNLR so far through 2023, it’s quite interesting. On a graph, it literally shoots up like a rocket and then comes crashing back down like some sort of Elon Musk Space-X experiment.

Let’s graph January-to-July SNLR for the last five years, not including the pandemic-affected 2020:

Look at the light blue line for 2023.

April was a turning point, and whereas the SNLR actually improved from May through July in all other years, the SNLR crashes for 2023.

Maybe April was the fork in the road?

One fork, at least. But trust me when I say that there’s another one up ahead…

Derek

at 10:48 am

Hey, if you bought a house in any July, you were never ever down year over year, kinda sorta.

Bryan

at 4:30 pm

Rates rates rates rates.

It’s actually remarkable to look at the correlation between rate hikes and SNLR in this graph. Look at that upside down U in 2023! With low rates throughout 2021, the SNLR did its usual summer dip, but it hardly really moved. In March 2022, the Bank of Canada went for the jugular with rate increases and the SNLR fell and stayed low… until they announced a pause in January and buyers jumped off the sidelines….. until they jumped back onto the sidelines in May/June as rate hikes returned. Seems like psychology to me more than anything. Did people really feel more comfortable buying during a rate pause at 4.5% than they did at 2/3% while rates were rising?? If in a year marked by incredibly fast interest rate hikes we have stayed flat in price, one has to wonder what is going to happen when rates eventually go down. I don’t see 1.5% mortgages on the horizon ever again, but what will this buyer pool do when the bank cuts to say…. 4%? Will they wait for rates to bottom out or jump in and go crazy?

Appraiser

at 1:10 am

The “buyer pool” if there is one, felt more comfortable buying when they thought that interest rates had topped out. Less uncertainty.

Then the “pool” was shocked by 2 more unexpected rate hikes. Now “it” tepidly awaits the next BoC meeting.

It appears to be a market that almost regardless of how high interest rates rise, prices will not plunge. Listing inventory is chronically low, while fundamental demand for housing especially in the GTA, remains unabated.

At this point mainly due to demographics, there’s still plenty of family wealth transfer money to share; and gobs of old-growth home equity sloshing around.

Bryan

at 5:13 pm

I think you are right… and it is very interesting to me that the market seems to react more to perceived downside than to actual economic forces. The “buyer pool” was so scared mortgage rates were going to kill the housing market that they refused to buy when rates were 3%, but once the bottom didn’t fall out they all rushed back in the pause at 4.5%. Now everyone is back to the sidelines and watching the BoC as you say. Is it really a fear that if rates go to 5.25%, buying a house will be a bad decision? Meanwhile, the Canadian economy just shed 45,000 construction jobs as the country continues with record immigration. I think those people who bought with interest rates on the way up (but not yet really high… think summer 2022) are going to come out as big winners.

QuietBard

at 7:43 pm

Oh boy, this was a fun read. Its nice when there is conflicting evidence and data so nobody really knows whats going to happen. I guess we will have to see what happens to interest rates in the short term and how the economy and more importantly what the job numbers look like.

Great read and glad to hear your running again

Derek

at 11:47 am

AG Report:

• The Ministry of Municipal Affairs and Housing (Housing Ministry) had already allocated the entirety of the 1.5-million-unit housing target to municipalities in October 2022—one month before the government’s proposal to remove land from the Greenbelt.

• The government and the Housing Ministry did not have evidence that removing land from the Greenbelt was needed to meet the government’s housing goals.

• Ontario’s Housing Affordability Task Force determined that a shortage of land was not the cause of the province’s housing challenges and that the Greenbelt and other environmentally sensitive areas must be protected.

• Chief Planners in the regions of Durham, Hamilton and York—which are home to all 15 sites removed from the Greenbelt—told us that Greenbelt land was not needed to meet the housing targets assigned to them by the Housing Ministry and that there is sufficient land outside the Greenbelt in their regions that is already or easily serviced.

• The Regional Planning Commissioners of Ontario, a group of senior municipal planning leaders from across Ontario, stated it does not support the removal of lands from the Greenbelt as a necessary step to address Ontario’s housing needs.

Derek

at 12:29 pm

This is a corruption story more so than a housing affordability story.

Derek

at 2:28 pm

I feel like one can be anti-greenbelt or pro-development, or agnostic about the greenbelt and still plainly see the disingenuous position of the government in response to the AG report. Premier and Minister may have stepped in a bit of a trap when asked if they had further plans to open up more land for development and both forcefully answered, “no”. Opening up these specific parcels of land for a potential 50,000 units, without regard to any objective standards or objective weighing against other potential lands (not owned by certain developers) is the extent of our plans to deal with the huge problem we are citing as our justification. So you’re saying there’s a huge immigration numbers problem for Ontario still? Yes. And are you going to open up any other lands? No plans, no. Just those lands the developers gave to the Chief of Staff to approve for removal. But your Chief of Staff crossed off any objective metric that those lands did not comply with. Yes, but those were the only lands we want to remove to address the problem so we could not consider metrics the lands could not satisfy.

Appraiser

at 6:04 am

Corruption you say? Yup!

“It’s exactly what it has looked like for nearly a year.”

https://www.tvo.org/article/ford-friendly-developers-influenced-greenbelt-changes-says-auditor-general

From the article: “…the auditor validates the arguments made by many critics that these changes are not plausibly related to the government’s overall strategy to build 1.5 million new homes over a decade.”

Ace Goodheart

at 9:51 am

Just for my sanity here, who do you all think builds houses? The auditor general? Sophie Trudeau? The Liberaks? The woke media?

Everyone wants more houses. When the premier partners with developers (who, surprise, build houses) then people get upset. Because developers are “wealthy” (and so they should be, and so could woke communists be, I’d they chose to work rather than spending their lives attacking people for doing things they are too lazy to do themselves).

Ace Goodheart

at 4:05 pm

Ford is a bit of a doofus, and he operates in a similar way to how his brother Rob used to (but without the pathological lying – Doug tells the truth when he speaks).

He is a meat head, but a well intentioned meat head.

Back in 2005, Dalton McGuinty suddenly changed thousands of acres of privately owned, developable land, into undevelopable “greenbelt” with little consultation or notice to any of the affected land owners. People saw their properties reduced in value overnight. No one had any warning.

That land is now “the greenbelt”. It is not public land. This is a falsehood that the mainstream media is promoting currently: “Doug Ford gave public land to developers and the developers made tons of money on it!”. This is simply untrue. Ford simply changed the environmental zoning on certain parcels of privately owned land, so that they could be used for housing. Much of that land has been owned by the same folks for a long time (prior to McGuinty declaring it “greenbelt”). It is private land and always has been. It is not owned by the Province.

So what our beloved meat head Dougie did, is he had some of his top guys solicit offers from developers, to develop their greenbelt land. He got quite a bit of response from that. Turns out lots of developers want to build houses, they just can’t because the land is not zoned properly. So Doug says OK, I pick these developers, your land is out of the Green belt, build away!

And that is apparently what they are doing.

Now people might say that doing this was dishonest. But what was Ford actually trying to do? He was trying to get developers to build houses. He asked developers if they wanted to build houses. They said they did. He picked some to actually do that.

Anyone other than Ford might have thought about this a bit more and said to themselves “the woke media propaganda machine is going to have a field day with this”. Imagine all of the studies and reports and decades long civil servant led inquiries that could have been done, before any of this land was released. I mean, there is apparently a threatened turtle species living there somewhere. The government could have employed legions of cabinet ministers’ children and friends and relatives’ children, to study that for probably 20 years or more. The UN could have been involved! The WWE! Sierra Club. I mean, the possibilities for mindless studies and reports and decades of delay for legions of government agencies and services to do absolutely nothing of any use, were really endless.

But nope, Doug didn’t do that. He just asked if anyone wanted to build a few houses, and what do you know, the real Slim Shady stood up (all of them – we’re going to have a problem here!)

Oh well. Hopefully someone out there can drown out the noise and actually see what really happened here.

I like Doug. He is a meat head, but a good one and an honest one, and you don’t get many of those…..

Derek

at 5:06 pm

Much of that post (about Premier DF’s actions at least) is inaccurate. Premier DF denied any specific knowledge of the approval/removal process. The Chief of Staff denied telling any of the developers that the government was considering removing land from the Greenbelt, but would consider the requests if it decided to do so. This is not consistent with the suggestion that these developers responded to a solicitation by government officials. None of the facts are consistent with the suggestion that Premier DF asked developers (who owned GB land) if they wanted to build and he then picked some to do so. The Chief of Staff directly provided 21 of the 22 approved sites to the committee. 3 sites were designated “priority” by the COS and account for 91% of the land area. Even if you cut through the noise and conclude the GB is unjust and should be open to development in priority to non-GB developable land, it appears that only a select few GB land owners had any chance of cashing in. I wonder why that is and also why that should be okay?

Ace Goodheart

at 5:43 pm

Woke nonsense.

The “greenbelt” is private land with an environmental protection designation.

Ford just changed the zoning.

The Libs are upset because Dalton :Dad” McGuinty’s legacy got trampled.

All Ford did was allow people to develop their own land.

This is a tempest in a tea pot.

Ace Goodheart

at 5:49 pm

Ford stands between us and the woke propaganda machine and its endless coalition governments and special needs socialism.

Get rid of Ford and you and I will be filling out our yearly empty bedroom reports and paying tax on any room that we don’t use or rebt out in our houses, and saving up our carbon offset credits so we can go buy gas for our cars.

Derek

at 6:45 pm

Lol, nevermind

Josh Hryniak

at 2:54 pm

Woke woke woke woke woke woke woke woke woke woke woke woke woke!!!! Everything I don’t like is WOKE!!!!!!!!!

Ace Goodheart

at 9:50 pm

Watching what is going on with the Taylor Swift concerts has made me once again lose my recently regained faith in humanity.

Someone actually paid $21,000 for a seat.

I remember when she was playing to empty seats on the concert circuit (didn’t she play one of the small stages at Bonnaroo or Coachella?).

So between the Doug Ford woke propaganda storm and the “swifties” I really wonder if it is possible to find intelligent life on Earth.

Probably not…

Josh Hryniak

at 2:56 pm

Newsflash grandpa, nobody cares.