Let’s start today’s blog post with another quote. Er, maybe this is more of an adage, saying, or idiom, but you know the one:

“If a tree falls in the woods and nobody is around to hear it, does it make a sound?”

Nobody truly knows the origin of this saying, although I was fascinated to read this in Wikipedia:

In June 1883, in the magazine The Chautauquan, the question was asked, “If a tree were to fall on an island where there were no human beings would there be any sound?” They then went on to answer the query with, “No. Sound is the sensation excited in the ear when the air or other medium is set in motion.”

I guess that just about sums it up!

So if a change is made to a CMHC program that nobody is using, does it have an effect?

Or perhaps we’d ask, “If a change is made to a CMHC program that nobody is using, what does it truly change?”

In this case, I don’t think it’s the change itself that matters, but perhaps the reaction to it and the rampant speculation on what it means.

This past week, the Canadian Mortgage & Housing Corporation announced that it was placing a ceiling of 8% on any gain or profit on a property purchased through the “First Time Home Buyer Incentive Program,” but also an 8% cap on any losses.

For those of you asking, “What in the world is the First Time Home Buyer Incentive Program,” that’s tantamount to asking, “What in the world is YouTube to MP3?” I mean, why would you know what something is that you would never, every use? Like, you’ve got Spotify or Apple Music. Who’s still downloading MP3’s to their hard drive? Asking for a friend…

The idea of a “shared equity mortgage” was first tabled by the Liberal government in 2019. It was, at the time, ludicrous.

I wrote about this on my blog, of course:

March 20th, 2019: “Should The Feds Introduce Shared Equity Mortgages?”

The idea of a shared equity mortgage, which the government called a “First Time Home Buyer Incentive,” was introduced in the 2019 Federal Budget.

The Government of Canada would offer 5% or 10% for a first-time buyer’s purchase of new home or 5% for a first-time buyer’s purchase of a resale home.

However, the government would also share in any profits that buyer makes in the event that the property appreciates. The government shares in losses as well, but who loses money buying real estate, am I right??

This program was, in my opinion, merely voter candy preceding an election.

Every party had to come up with a novel idea or two, or three, on how to “improve affordability,” and this was the brainchild of somebody in the Liberal government.

In 2019, I slammed the idea. I said that it shouldn’t be the government’s job to “co-purchase” properties with people who can’t afford them on their own, but more importantly, I suggested that nobody would use this program in the first place.

I was right. Sort of.

I have a pretty good pulse on the market and I can say that I didn’t have a single client that used this program since it was introduced in 2019. But I also didn’t have a single inquiry or a single conversation about the program with anybody.

So while I can say “nobody used this program” based on my own experiences, I, unfortunately, had no data to back that up.

Thankfully, an article appeared in the Globe & Mail last month that gave us some data.

Here’s the article, excuse the long title:

From the article:

Three years after the Liberal government’s 2019 federal budget promised to help first-time homebuyers with a major push in support of shared-equity mortgages, records show the take-up to date is far below expectations.

A $100-million program called the Shared Equity Mortgage Providers Fund has approved just $17-million in applications, and paid out $1.3-million. A much larger fund of $1.25-billion that is scheduled to expire in September is also well below expectations as of Dec. 31, with $270-million in approved shared-equity mortgages, of which $253-million of the federal funds have been paid out.

That means just more than 20 per cent of the $1.25-billion fund has been distributed so far and 1.3 per cent of the $100-million fund. The larger program is for three years, and the smaller one will run for five years.

This is laughable.

It’s like throwing a party and setting up six-hundred chairs only to have four people show up, and only one of them sat down.

How much time, effort, energy and taxpayer money went into the discussion, development, proposal, approval, and integration of this program? I shudder to think.

In any event, as some of you may have noticed, the Canadian real estate market has dipped a little bit in the last two months.

So I, and many people that I know, find the timing of the CMHC’s recent annoucement – that they will alter the cap on gains/losses through their shared equity mortgage program, a little suspect!

Here’s an article from the Financial Post:

“CMHC Rewrites Rules Of Homebuyer Shared-Equity Program To Limit Potential Losses And Gains”

I love the sub-heading that reads, “Changes come as first-time buyers have largely shunned the program.”

From the article:

Canada Mortgage and Housing Corp. adjusted its First-Time Home Buyer Incentive program on Wednesday, placing caps of eight per cent per year on both the upside and downside returns it would received on its share in homes participating in the program.

“Now, homeowners will pay back up to a maximum gain of 8 per cent per annum (not compounded) on the Incentive amount from the date of advance to the time of repayment,” the program’s information page said. “The Government of Canada will also limit its share in the depreciation of a home at the time of repayment … to a maximum loss of 8 per cent per annum (not compounded).”

The organization added the calculation on the appreciation limit only was retroactive to the program’s implementation date on Sept. 2, 2019 when it was announced in the federal budget.

The change comes as higher interest rates — including the 50-basis point hike on June 1 that brought the overnight rate up to 1.5 per cent — are adding upward pressures on borrowing costs, cooling the demand for mortgages. This had led the average home price to slide to $746,000 in April from the $796,000 the month before, according to data from the Canada Real Estate Association.

The best quote from the article has to be from noted mortgage expert, critic, and pundit, Rob McLister who said:

“The government’s number crunchers and political analysts likely realized that price risk is real. They’re not stupid.

It’s probable that a significant correction would leave the government on the hook for materially more losses than they bargained for.

Losing taxpayer money doesn’t make for positive sound bites.

Moreover, the bureaucrats who designed this thing certainly didn’t want blood on their hands. Nor did they want to be scapegoats.”

Oh, Rob! Don’t hold back!

But if nobody is using this program, how much could the downside be at 10% versus 8%, really?

The whole thing is just ridiculous

It’s an ill-conceived program that was over-hyped and over-celebrated, not very well planned, poorly executed, which now is being altered when it probably doesn’t need to be.

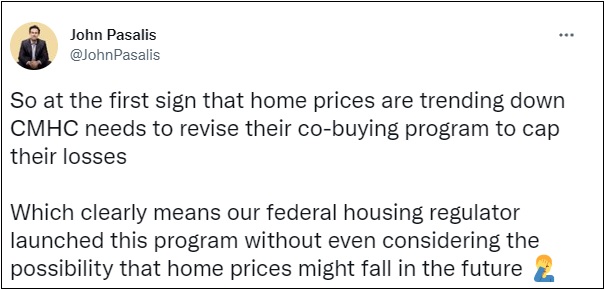

John Pasalis had a great Tweet, which the FP article above picked up on as well:

The comments on Twitter are amazing.

My favourite is this one:

“It’s going to be really inconvenient for the three people that participated in the program.”

Zing!

I was talking to my mortgage broker, Tony Della Sciucca about this on Tuesday, and I figured I’d get him to weigh in.

I asked him four questions:

1) Do people actually use this program?

Not so much. The government allocated a $1.25 Billion fund, of which $253 Million of those federal funds have been paid out under this program. A whopping 20.24% succession rate! A flop, to say the least.

2) Why not, in your opinion?

A couple of reasons to consider. First, the program was very poorly designed to begin with. Too many caps and restrictions associated with the program: ie must be a first time buyer, maximum qualifying household income of $120,000, and loan amount was capped at 4x your income. Second, and I think more importantly, there was/is a psychological factor. Consumers aren’t feeling too warm and fuzzy about having the government as a partner, and rightfully so, as we’re seeing why now.

3) Why would the government, all of a sudden, cap their gains/losses on this program?

I think the obvious answer is the fear of unlimited downside exposure. The government is clearly worried about how quickly home values are beginning to drop. Under the previous program, the gains and losses were uncapped. So, in an appreciating housing market, the government stands to only win in the uptick of home values. Conversely, the opposite in a descending market. Their loss exposure is unlimited. Capping their loses at 8% limits their exposure and shifts much of the risk back to the homeowner. Capping the gains at 8% when home values are trending downwards seems a little too convenient and political for me.

4) Could this program represent a risk to Canadian taxpayers?

More so under the previous program where the loses were uncapped. It’s never fun to see hard earning taxpayer dollars get eroded by poorly designed government programs.

–

If a tree falls in the woods, and nobody is around to hear it, does it make a sound?

But if nobody talks about that tree, and that sound that it may or may not have made, then does that tree even exist?

Some might argue that the mere discussion about this seemingly unused government program, and the changes which seem unnecessary given the lack of use of the program, is like talking about whether or not a tree fell and whether it made a sound.

But I’m sorry, it just further demonstrates how inept the government is right now with regards to housing policy.

My cup is half-empty today, folks, so sorry in advance, but I think this is the first (or second, if you count the conversation about interest rates rising too quickly) of many bad policies the Bank of Canada, CMHC, and Federal Government will enact in the coming months.

Well, at least it’s almost summer, right?

Ed

at 11:13 am

Adjusted for 2022- If a tree falls in the forest and you were busy watching Tik Tok videos on your phone with your ear buds in, would anyone even notice.

Condodweller

at 12:57 pm

I have questions.

What’s the paperwork look like on this program? People who did take advantage didn’t sign a contract? How is the government allowed to simply change it like this?

What does the government do with the unused funds? I’m sure it’s not simply sitting in a HISA. I mean a google search quickly shows the CPP’s 5-year return is listed at 10% on their website. I’m sure one of their fund managers can earn that entire 10% in a few years simply using bonds over a few years. Never mind the gains on the 10% up to now. Also, how many families are going to run and sell their homes due to some paper loss? As David said the other day, it’s their home and a long-term investment, right?

Is it just me or does this seem excessively petty on the side of the government given the amounts involved? Isn’t the entire at-risk amount smaller than JT’s home renovation budget? Never mind 2%?

Regarding why do it if it’s never used. I find it’s a great way to implement punitive/favourable (depending on your perspective) changes without much public resistance precisely because of the fact that people don’t think it will affect them so why bother. By the time a punitive situation arises for a taxpayer, it’s too bad/late to do anything about it.