Raise your hand if you didn’t get a real “vacation” this summer.

Let the record show that all of your hands are raised. Or at least they should be.

What is a vacation, anyways? What are the prerequisites?

In my mind, it starts with being away from home. A “stay-cation” is not a vacation, hard stop. Whether you’re flying to Paris for a week or simply going up to a cottage for five days, both are vacations, and both involve being away from home. Wait, actually, flying to Paris for a week is a “trip,” not a vacation, but that’s a topic for another day…

I would also add that to truly be considered a vacation, there must be an element of relaxation. Taking your laptop to the beach every day while periodically yelling “I see you!” to children that may, or may not, actually be yours, is not a vacation.

The mind must also be able to relax, and here’s why I think so few, if any of us, actually had a vacation this summer. Who among us is truly “relaxed?” With kids going back to school in the fall, or not, plus most people still working at home, and all this talk of a second wave of COVID on the horizon, can you really call a long weekend at your cottage, in that mindset, a “vacation?”

I had four days off work in a row this past weekend, which was an experience, to say the least.

As I wrote on my blog last Friday, I owed it to my wife and to my family to take a day off, since I really haven’t done that all summer. The Friday before Labour Day is a ghost-town in real estate, and I figured I’d have few blog readers paying attention. Then again, I’m often stuck in this old-fashioned mindset of my “readers” sitting in front of their desktop PC’s in an office building, sipping coffee at 9:10am, when in reality, they might be on their Samsung Galaxy, relaxing in a Muskoka chair on a dock up north.

See how old I am? That’s still how I think! It’s like I don’t realize that 53.2% of users access TRB through a mobile, compared to only 43.7% on a desktop. Who are the 3.1% on a tablet? My step-mom, no doubt…

We spent the last week of summer preparing for fall, as there typically isn’t much happening that week in the market. The few new listings that do come out don’t get a lot of eyes, and many of our buyers are already up north, physically or mentally.

Then come Friday, with every box checked, and disaster seemingly planned for, I was faced with two options for the Friday:

1) Go to work, drink coffee, download MP3’s from Napster, and answer emails, or,

2) Picnic in the park with the family that seemed to come out of absolutely nowhere, since I still feel like I’m 23-years-old…

Gawrsh.

And that was just Friday!

Imagine, Saturday, Sunday, and Monday?

That’s a vacation.

Or at least, as close as many of us will come to having one during a pandemic and in this new world, we seem to have found ourselves in.

The Tuesday after Labour Day, in my world, is like going back to school, except at this particular school, everybody is taking speed. And the days go three times as fast as usual, with a pop quiz virtually every night.

Going back to work in the real estate market in January isn’t the same. The start of a new year, yes. But it takes at least a week to get settled, then another week for market activity to pick up, and it’s not until the third week of January that you can really feel “back.”

But going back to work in the real estate market in the fall is a whole other story. The morning after Labour Day, the market absolutely explodes. The pace is frenetic, and it ramps up as September continues. October flies by, November is just as quick, and then suddenly you find yourself in the second week of December, with the market all but over.

It’s over like THAT (let the record show that I’m snapping my fingers…)

But what makes September interesting every year is that no matter how you think the fall market will go, it never goes exactly that way. It’s essential to keep your finger on the pulse of the market, each and every day, specifically in the first two weeks of September, as those two weeks will set the pace for the rest of fall.

Sometimes those two weeks are slower than expected, sometimes they’re faster. Some years, we see insane over-asking sales, with 20+ offers, and then some years, we hear of properties only getting a single offer on “offer night” and actually selling, or maybe we see more listings coming out with “offers any time,” whereas we expected the trend to be holdbacks and bidding wars.

There are never two Septembers the same.

And sitting, here writing this late on Monday night, with a laundry list of buyers and sellers to start working with tomorrow, I can’t help but wonder, “How will this fall go?”

We have an upcoming Throne Speech, an election in the USA in the midst of a small civil war, a worldwide pandemic that won’t go away, not to mention, a Stanley Cup to be awarded in October! So whether it’s the big-ticket events that will unfold in front of our eyes, and potentially change our lives or just the little things that make us feel out of place, this fall is going to be very different from anything we’ve experienced in a long time.

What does this say for the Toronto real estate market?

Perhaps I can’t answer that, or maybe I’m not the person to even try.

So how about this? Since I spend every waking hour of my life living and breathing real estate, and since my friends love to talk about all things real estate, let me give you the five questions that we have pondered the most in the past two weeks, and specifically, over the Labour Day weekend.

All five of these questions are being asked because of the extreme level of uncertainty around them, but also the implications they have once answered…

1) What’s going to happen to the rental market?

The rental market?

Booooooo-ring!

Right? Who cares! Why am I leading with this, you ask?

Well, I have a theory about the market and it goes something like this: I believe the soft rental market is intertwined with every other aspect of our current market, and we’ve been taking it granted. People underestimate just how important the rental market is when it comes to the overall health of our real estate market, and since it doesn’t make for conversations nearly as sexy and/or salty as the freehold market, the resale market, and just about everything else in real estate, we ignore it.

I’m guilty of this, if we’re laying blame here. There are two sides to the real estate home-ownership coin: you either rent or own. And yet, we talk about ownership probably 90% of the time here on TRB, but again, it’s because this is what is the most interesting to all of us.

But let me show you why I think it’s so important to dive into this data…

The condo market is suffering right now. Despite what you may read, or which stats you choose to hold near-and-dear, the sentiment out there among agents and sellers is that prices are down from the spring, units are taking longer to move, and overall sales are down as well. Anecdotally, I can tell you that I’ve reduced multiple properties in price this summer – something I don’t recall ever doing before, and that I’m getting lowball offers on listings, the likes of which I haven’t seen in years.

So while a few real estate agents (or developers…) will give positively-glowing quotes to newspaper columnists to paint a rosy picture of the market, I’m going to tell you that, unfortunately, the condo market has seen better days.

And with a dozen condo listings coming out this fall, I think my lack of bias is apparent, right?

In any event, this particular conversation is not with respect to condo sales, but rather condo rentals. And in time, I’ll show you how one affects the other.

The news outlets do have this correct: there’s a LOT for lease right now in Toronto! And when they say that rents have come down, they’re not wrong either.

In August, I had five condominium lease listings, and they were leased as follows:

333 Adelaide Street, Leased for $2,295, 2 DOM. Previously unleased.

50 Lynn Williams Street: Leased for $2,600, 35 DOM. Previous lease: $2,795, April of 2019, 31 DOM.

230 King Street East: Leased for $2,100, 18 DOM. Previous lease: $2,400, July of 2019, 6 DOM.

160 Vanderhoof Ave: Leased for $1,750, 67 DOM. Previous lease: $1,895, July of 2019, 33 DOM.

25 The Esplanade: Leased for $2,295, 10 DOM. Previous lease: $2,395, April of 2019, 12 DOM.

As you can see, the rents went down for all four listings for which we had previously leased out the unit. I told the owner at 333 Adelaide Street east that she has no idea how lucky she was to get full list in this market, after two days!

So what’s the problem in the 2020 lease market for downtown condos? Is it inventory? Demand? Both?

Let’s have a look at condo lease listings through August of 2020 and we’ll compare to 2019 as well as 2018, just for good measure.

As you can see, 2020 started with a modest uptick in supply – 10% in January. That increased in February to 36%, year-over-year, before shooting way up to 72% in March.

The pandemic hit by the end of March and paralyzed the real estate market through to early May. That’s why you see “only” a 25% increase in listings in April, and only 55% in May.

The irony is not lost on me here. We take for granted that every month of 2020 has seen more downtown condo lease listings than in 2019, and yet we’re looking at “only” 25% and 55% respectively.

Since the city opened back up in June, the numbers are staggering. New listings for leases have more than doubled in June, July, and August, and this is after 30-50% increases from 2018 to 2019. For example, July 2020 listings are up 112% over July 2019, but up 160% over July 2018.

What has caused this massive increase in supply?

Well, perhaps some of the people hit financially by the pandemic gave notice on their condos in April or May, and then left in June or July, but I would be willing to listen to other suggestions as well. Because this can’t just be about COVID-related vacancies.

Three other reasons why I think new lease listings could have increased:

1) An increase in new condo completions

2) AirBnB listings taken down and put up on MLS for 1-year terms

3) Would-be sellers deciding to hold and lease instead

Now how does this look, for you visual thinkers?

This is nuts:

Have you ever seen anything like that?

Okay, so what about the other side of the coin?

Talk to me about how many of these units were leased!

So let’s run the same chart as above, but this time with the number of units leased in each month:

This looks right, initially.

We see that in March, April, and May, the number of leases has dropped from 2019 to 2020, with that number peaking in April at the height of the pandemic.

But what I did not expect to see is leases increasing 22% in July and 39% in August!

I double-checked this, folks. I’m shocked.

How can 2,440 units have been leased in August when only 1,750 were leased last year, and 1,481 in 2018? That’s mind-boggling.

I suppose this points to a build-up in demand from would-be renters who didn’t pull the trigger in March, April, or May. What else could it be?

Again, here’s how it looks graphically:

2020 is just all kinds of nuts.

The orange and blue lines follow each other like two synchronized swimmers, and yet the grey line for 2020 just does whatever the hell it wants, not unlike Chazz Michael Michaels…

Okay, so we’ve looked at new listings and we’ve looked at units leased.

What’s missing? What’s the conclusion to be had here?

Yes, you guessed it: absorption rate.

Because if the number of units leased in August of 2020 was more than the number of units leased in August of 2019, this doesn’t point to a competitive rental market if the number of new listings in August was up substantially more, on a relative basis.

And do you know what?

This is exactly what happened.

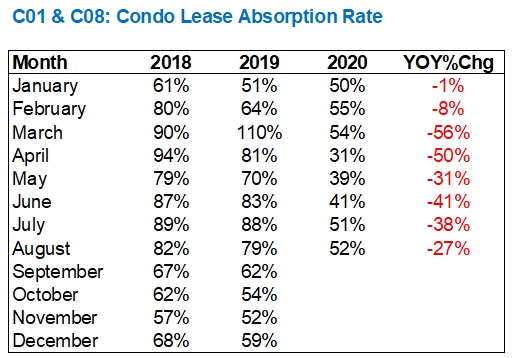

There’s enough red in this next chart to make a matador proud:

Absorption rates are shown for 2018, 2019, and 2020, and as with the first two charts, the YOY%Chg looks at 2020 over 2019.

And 2020 over 2019 shows nothing but negatives.

It’s also worth noting that save for March of 2019, which is an unreal 110% absorption rate (this is possible, FYI, since listings brought onto the market in February can hold over to March), every single month from January to August saw a higher absorption rate in 2018 than in 2019.

That alone deserves a sidebar, for a moment.

If absorption rates in the rental market didn’t just go down this year, but also last year, then what does this say about the downtown rental market? I would suggest it says that the inventory levels are continuing to climb, and the market can’t absorb the inventory quite as fast as it used to.

This chart sums up the rental market in 2020 perfectly:

The grey line looks like a wallflower at a Grade-Eight dance!

Just down there on its own, no other lines near it.

That, to me, tells the story of the 2020 rental market.

And while the absorption rate does seem to be on the uptrend, it’s still so far below 2018 and 2019 that condo listings will continue to sit on the market for longer than they have before, and attainable lease prices will continue to lag behind 2018 and 2019.

One landlord actually “fired” my colleague last month, which was something new.

The client had her lease listing up for about six weeks with no takers, in a building with nine other units up for lease. She would have been looking at a $300 drop from what she had leased this unit for last year, and she simply refused to accept this.

My colleague said, “You have to come down $300 or this is never going to lease. There’s a larger unit, with parking, and a second bathroom, listed for $200 less than yours.”

Amazingly, she said to him, “I can’t do that. I’d be cash flow negative.”

Really? Does that matter? Or is it some imaginary line in the sand that you’ve drawn? So instead of accepting $3,600 less per year, she may risk carrying this unit vacant for three months and losing $7,000 instead? It makes no sense.

Anyways, she emailed my colleague and asked to terminate the listing, which he did. Then it came out on MLS the next day at the exact same price, with some fringe agent. Because obviously, it was the agent that was the problem, right?

Classic case of, “Don’t tell me what I don’t want to hear.”

Alright, so we’ve established that the rental market is weak, which is going to shed some light on the next couple of questions that I have.

Only, I’ve reached my word count here already. That’s okay, I’m sure there will be no end of banter on today’s post, so let’s come back here on Thursday to examine Questions #2 through #5.

Ed

at 8:04 am

But what I did not expect to see is leases increasing 22% in July and 39% in August!

I double-checked this, folks. I’m shocked.-David

////////////////

I would suspect that many who were currently in leases decide to move in order to take advantage of the lower lease rates available in the market.

Professional Shanker

at 9:38 am

My thoughts exactly, the other side of the coin is how many lease terminations there were. I would suspect a doubling, quadrupling, maybe more in 2020 vs. 2019.

J G

at 3:28 pm

Of course, people see cheaper rent and they will move. These days you can probably get it withIn the same condo building.

J G

at 3:41 pm

“Amazingly, she said to him, ‘I can’t do that. I’d be cash flow negative.’”

That’s what happens when you listen to perma bulls and buy an investment condo without doing realistic calculations.

Appraiser

at 10:00 am

More rental supply is leading to more transactions, better market balance and a much-needed correction in the monthly price of rental space. Toronto is still hella-expensive to live in.

The bears see it as a crash to zero with no chance of recovery. Yawn.

Verbal Kint

at 10:07 am

You sound just like Garth talking about the stock market.

J G

at 3:32 pm

Ok, go buy an investment condo right now yourself.

I think an interesting topic would be how to spot desperate sellers, or how to successfully low ball. Investors/buyers in this condo market would definitely find that useful.

Appraiser

at 9:01 am

Looks like the fall market is starting off with a bang, as per Scott Ingram CPA, CA

“Most interesting development for me was rolling 30 days of sales jumped a lot for freeholds & condos last week. First week of Sept much stronger than first week of Aug. So MOI decreased for both ownership types.

Freeholds lowest since March 24 (24 weeks).” https://twitter.com/areacode416

J

at 1:43 pm

Full thread is here:

https://twitter.com/areacode416/status/1303394532105609219

Pragma

at 1:25 pm

How do you reconcile the idea that the rental market looks bad( and seems to be getting worse) but the condo market is going to do well over the short term? The last stat I saw was that around 60% of condos in Toronto are owned by “investors”, so is it safe to assume the condo market is driven by investors much more so than the broader housing market? Are you counting on a second wave of investors to come in? The last 2 years has seen investors willing to take on the risk for a 0 to 1% yield, are we now counting on investors to come in and accept negative yields? Or are we counting on a great rotation where investors hand off their investments to end users? I am genuinely curious about the bull case for buying a condo in Toronto right now. Immigration? Job growth? WFH? great yield?

Jimbo

at 4:56 pm

Where did you see the 60% statistic?

Pragma

at 8:26 am

60% might be on the high end. The problem is that we don’t collect data so nobody knows. Stats Canada estimated that 38% of condos in Toronto are investor owned. Still a pretty high ratio.

Appraiser

at 8:27 pm

MLS Sales on TRREB for the first week of September are running at 33% higher than last September.

Over 2,550 sales in the first week alone! Are we headed toward an earth-shattering 10,000+ sales month for September? Looks likely.

Incidentally freehold sales are 41% higher and condos are up 6% .

Also, housing starts and building permits are way up. And contrary to LG’s assertion on twitter today (a.k.a. the meticulous data analyst), most economists agree that both stats are leading economic indicators, not lagging.