Great news: I’m five dollars richer!

Well actually, if I’m being honest, it was one of those “I’ll betcha five dollars” bets where you don’t actually expect the other person to pay.

Back in the day, you’d use the term “Gentleman’s Bet” to describe a true, authentic, respectful wager, complete with a handshake but where there was no money wagered. I’m not sure if the term is still permitted in 2023, but let me know if academia has replaced it with something more inclusive…

Although, perhaps the better news is, although I don’t expect to collect my five dollars for the bet which I’ll describe shortly, I do have a true wager at risk which is looking promising.

On my football pool chat early in September, I suggested that the Colorado Buffaloes, the darling, Cinderella story of college football, would finish the season with an above .500 record, to which one of my long-time pool-mates suggested, “Not a chance.”

He suggested we wager, and I agreed.

But he wanted to wager five dollars, and simply stated that at 43-years-old, making a bet about sports, I can’t justify the wager without real stakes.

The other guys in the pool got involved in the proverbial mud-slinging as manhoods were challenged, and eventually, my pool nemesis, The SuperBills, agreed to a modest $100.00 wager.

Colorado currently sits at 4-2, but I digress…

My inauthentic real estate wager was far more satisfying, however, even if the money will only be collected in, “I’ll buy you a coffee” form.

There was a listing that came out on George Street at $599,900 and I thought, “That’s not a bad price.”

But I scrolled down to see the Brokerage Remarks, and there it was, as expected, “Offers Reviewed Thursday, October 12th At 6:00pm.”

“This is never going to work,” I told myself.

Then I asked a colleague who had recently sold in the building, what she thought, and she said, “Honestly, I wouldn’t even show it.”

The market has changed, as we all know, but many sellers and listing agents are not changing with it.

And I’m not only talking about pricing here, folks. I’m talking about process.

There are certain condos in the downtown core which, in a red-hot market, absolutely should be listed at a low-price, with an offer date, as a matter of strategy.

But in October of 2023, I would offer than 90% of condo listings should be listed with “offers any time,” again, as a matter of strategy.

When my friend said, “Honestly, I wouldn’t even show it,” she was referring to the fact that the property wasn’t going to sell via the “under-list, hold-back offer” strategy, and that it would undoubtedly come back onto the market at a much higher price after the failed offer date.

And I agree.

Where we didn’t agree, however, was with respect to what price they would re-list for.

Pay very close attention to the numbers I’m about to throw at you, and read this twice if needed to really let it sink in.

The property was listed for $599,900.

The owner purchased it for $660,000 in mid-2021.

So what is it “worth?”

What does the owner want?

The identical unit, one floor up, sold for $720,000 in June of 2023.

This is where my colleague and I disagreed.

“They’ll re-list at $679,900, if they’re smart,” she said. “Maybe $699,900?”

But I told her, “Don’t underestimate the entitlement that’s going on in the market right now.”

The same model sold for $720,000 in June, right? And the market has declined since then?

Common sense would suggest listing the property in line with what my colleague suggested, but there is a lack of common sense in this market.

The unit was re-listed for $729,900.

That’s right – above what the same unit sold for in June, even though prices have declined.

And that’s how I became five dollars richer, folks! Coffee Time, get my four cups ready!

You simply can’t stop an out-of-touch seller in this market, no matter how hard you try. I mean, you could, in theory. If I walked into the home of somebody who’s condo was worth $670,000 and they told me they wouldn’t accept less than a record price exceeding the $720,000 high-water mark, I would probably end up walking out. Not because I’m a jerk or because I’m unhelpful, but because I work in today’s market, not yesterday’s. Those prices will come back, have no doubt. But it’s not going to be tomorrow and it’s not going to be next week…

I’m seeing a lot of this in the market right now and the net effect is a massive decline in sales.

Sellers can choose to list for well above current fair market value or even seek a “record” price in the building, in a very soft market,” but they’re not going to be successful.

So what’s happening is units are sitting, many aren’t being reduced to prices that buyers would pay, and it’s a trench warfare between buyers and sellers.

To understand how we got here, let’s look back at the Q3 data (July, August, September) for both the 416 condo market and the 905 condo market.

Bear in mind that with our condo rental market feature here on TRB, we look specifically at C01 and C08, aka “downtown.” But with our condo resale feature, we look at all of the 416.

Here’s the updated list of units sold:

Recall that the trend in Q2 was an increase in 2023 over 2022, mainly due to the market slowdown that occured starting in April of last year.

We saw higher year-over-year sales in April, May, and June, and that continued into the summer with higher year-over-year sales in both July and August.

All of these numbers pale in comparison, however, to 2021, or even the previous years.

And notice the shift in September: the year-over-year data is now lower.

Those 850 condo sales in the 416 in September are less than half of what we saw in 2021, and represent only 55% of what we saw in 2020.

Let’s look at the data graphically:

As the green line shows, we started 2023 with the fewest sales in the month of January for the period 2018 through 2023.

By spring, the sales data was in line with previous years, save for 2021 where we can see every single month in that calendar year is well above the rest.

But right as Q3 began, we see weakness in July, August, and then September.

Let’s compare to the 905:

You might suggest that the 905 is marginally stronger than the 416, relative to 2022, since September sales moderately outpaced those recorded in September of 2022.

But the trend is essentially the same, with the year-over-year strength in Q2 leading to weakness in Q3, not to mention – also starting January with the fewest sales in any of the years analyzed.

There seems to be less volatility in the 905 since the sales are generally half of what we see in the 416, but the trend is no different.

As you can see in the graph above, Q4 is always downtrending.

But we’re accustomed to seeing a spike from the typically-slow summer to the typically-busy September, and that didn’t happen in either the 416 or the 905 this year.

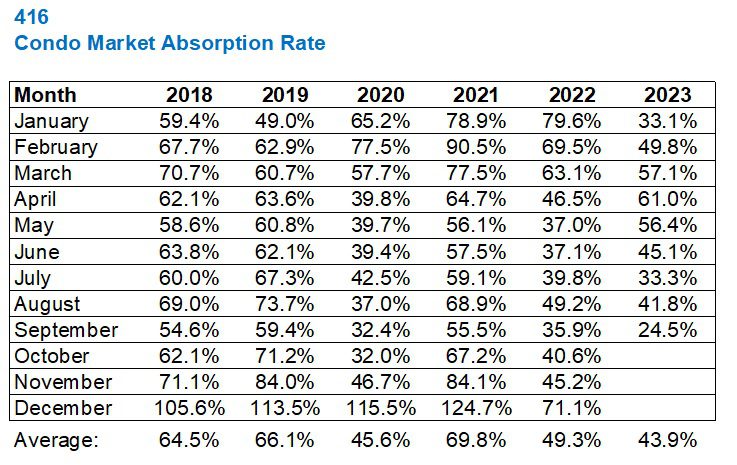

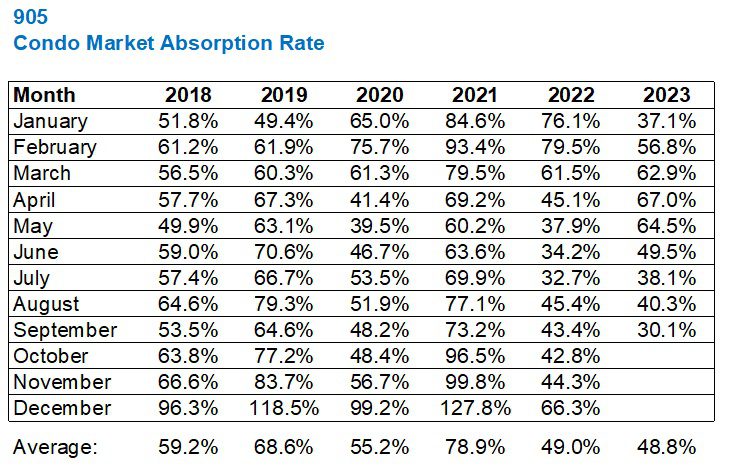

When we look at the ratio of sales to new listings, or the “absorption rate,” the story of the 416 and 905 condo markets becomes very clear.

First, let’s look at the 416 market:

January was very telling, as you can see, with an absorption rate of 33.1%, compared to 79.6% in 2022 and 78.9% in 2021.

That could have been “a sign of things to come” but it also could have been an outlier, since that 46% spread in absorption rate between 2023 and 2022 narrowed to 20% in February and then 6% in March, before we saw a year-over-year absorption rate that was higher in April, May, and June. Of course, that is partially because the market cooled in those months in 2022, but it’s also because we did see a strong condo market in Q2 this year.

But look at July.

Back to 33.3%, down even from the depressed 39.8% that we saw in July of 2022.

The SNLR did pick up in August, but it plummeted in September.

24.5%.

That has to be the lowest SNLR I have ever seen.

And yet, condo prices haven’t moved in tandem because so many sellers refuse to sell!

Ordinarily, you would expect a 24.5% absorption rate to result in a major drop in prices, but we’ve really only seen a modest drop.

If sellers continue to hang on, will we see buyers give in and prices stabilize? It’s too early to tell.

Here’s the absorption rate graphically and it’s a real shock to the system:

March, April, and May were fine as a fiddle.

But that position of the green line in September is rather eye-catching!

As for the 905, the trend is similar but the end result last month isn’t as dire:

Maybe we’re splitting hairs over a 416 absorption rate of 24.5% and a 905 absorption rate of 30.1%.

But when you look at the graph, you see that the gap between 2022 and 2023 in September is even wider in the 905 than the 416:

The good news is, the market usually tightens as we move into October, November, and December.

I mean, just look at all those 45-degree angles from November to December!

But can the market follow suit this year?

I suppose if condo owners stop listing their units for sale, either out of refusal to accept current pricing or out of a lack of faith in the buyer pool, then we could see new listings dry up in December, and deal-seekers purchase in droves to spike the number of sales.

Time will tell, and the next time I see you in this space, it’ll be 2024!