We’ve talked a lot about pricing this fall.

In fact, we’ve talked a lot about pricing throughout the entire year.

But where pricing becomes a “strategy” and where it becomes a hope, wish, and prayer, has been another interesting topic of conversation, specifically this fall when transactions slowed and sales became further and fewer between.

Critics of real estate agents will suggest that in a hot market, “Any moron can put a FOR SALE sign on the lawn, set an offer date, and sell the property.”

True. To some extent.

Better agents will sell the property for more, since the market is far from efficient.

But the argument that an agent doesn’t exactly need to know “what a property is worth” in a red-hot market has some truth to it.

On the flip side, in a buyer’s market, pricing and strategy is more important than ever. And throughout this fall, we’ve looked at various pricing strategies, as well as pricing “strategies,” which sounds like the same thing, but the parenthesis would suggest otherwise…

Here are two such posts, both very recent:

November 8th, 2023, I wrote: “Fall Pricing Strategies: Are We Grasping At Straws?”

November 14th, 2023, I wrote, “What The Heck Is A Marketing Price?”

At the risk of overblowing the topic of pricing and the intersection of listing, pricing, and strategizing, I want to look today at this phenomenon of extreme under-pricing.

What do I mean by that?

Well, when I started in the business in 2004, a property listed for $399,000 would receive five offers and sell for $422,500.

Years later, we grew accustomed to seeing properties sell for $100,000 or more over the list price.

Sometime around 2015, I gave a quote to a Toronto Star reporter that was featured on the front cover of the Business section, and signaled a massive shift in how pricing

“Two-hundred thousand dollars over asking is the new one-hundred thousand dollars over asking.”

It was true.

We went from seeing houses listed for $599,900 selling for $710,000 to seeing houses listed at $799,900 selling for $1,020,000.

And from there, the sky was the limit.

As TRB readers routinely point out, there’s nothing to stop a listing agent from pricing a $1,400,000 home at $999,000, setting an offer date, and selling for $1,380,000, then claiming, “SOLD FOR 138% OF ASKING!” Even though that agent didn’t do a good job…

What is the highest sale-to-list ratio you’ve ever seen?

What is the highest dollar amount sale over the list price that you’ve ever seen?

In the fall of 2023, we’re seeing agents price and strategize in reverse.

The result is often extreme under-listing.

Is it successful? Perhaps time will tell. I have a lot of these currently flagged and I’m monitoring them on the daily.

Here’s an example:

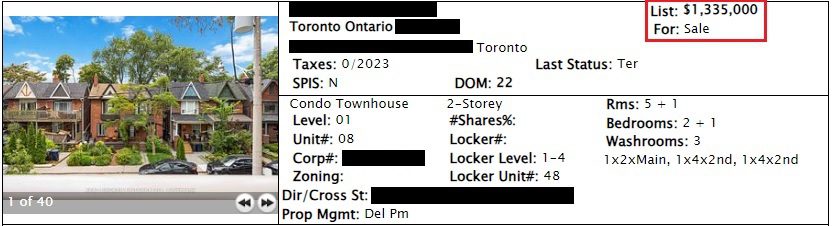

This is a gorgeous condo townhouse, brand-new, and in a fantastic location.

Priced at $1,335,000, the unit was on the market for 22 days.

This wasn’t listed low and then raised in price after a failed offer night, like many of the listings that we’ve identified and discussed through the last three months.

Instead, this unit was up for $1,335,000 without success, and the next step was to re-list at…

…this:

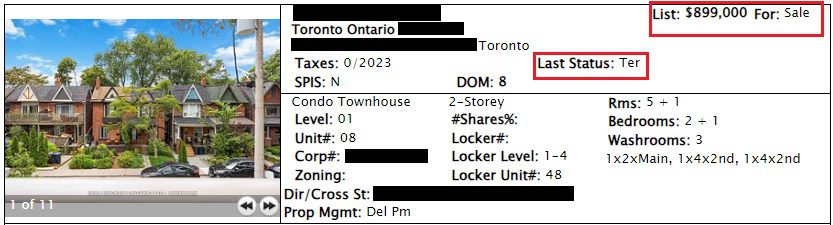

$899,000…..with an offer date.

That’s extreme.

Working backwards, an $899,000 listing selling for $1,335,000 would represent 148% of the list price.

Now, this property isn’t going to sell for $1,335,000, but I’m just making a point about the under-listing.

As you can see, the $899,000 listing was terminated after eight days on the market.

Was this going to work?

In hindsight, no. But I don’t fault the agent and seller for trying. This fall has been really, really tough. So can you fault somebody for trying something drastic? Isn’t that “thinking outside the box?”

My question isn’t rhetorical. I actually don’t know…

Here’s another one:

This property came out at $1,895,000.

It was on the market for 13 days.

That’s it! Only 13 days!

That listing was terminated and eventually, the seller and listing agent decided to try something….extreme.

They did this:

Wow.

$1,195,000 ……with an offer date.

Were they going to get somebody to bid $700,000 over the asking price?

Probably not.

Working backward, a list price of $1,195,000 that generates a sale of $1,895,000 would represent a sale-to-list ratio of 159%.

Who pays that kind of premium in this market? Or in any market?

Was this strategy destined to fail?

This isn’t just happening at the lower end of the price spectrum either.

Check this one out:

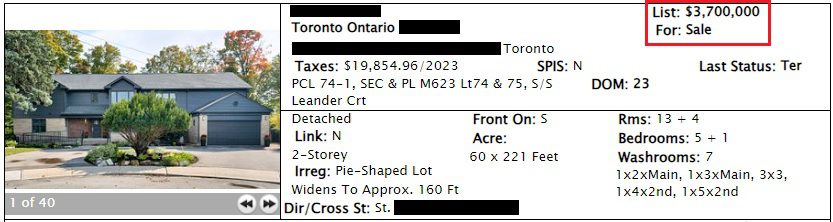

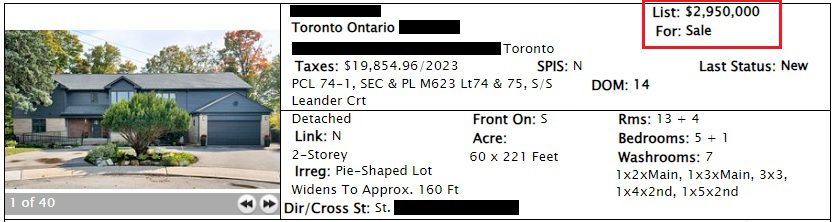

That’s a spectacular home on a 60 x 221 foot lot.

The $3,700,000 list price didn’t result in a sale, but rather than reduce to, say, $3,595,000, the seller and listing agent did something….extreme:

They listed at $2,950,000………with an offer date!

Who is going to “bid” on this home?

If you take a placebo, but you’re told, “This is a placebo,” is the pill going to have the intended effect?

Here’s another interesting one.

Check out this listing:

It’s a great unit in a fantastic area, well-presented, and well-represented by the listing side.

But the unit wasn’t selling!

So after multiple price reductions, the strategy became this:

$499,000……with an offer date.

That’s crazy, right?

Couldn’t work?

Well, this is the one case so far that I’ve seen where it actually did!

Here’s the sale:

Remember, this property was priced at $899,000.

Would the seller have sold for $866,010 at that time? Maybe, maybe not.

But if the seller wasn’t able to achieve $866,010 when priced at $899,000, and the seller did get this price when listed for $499,000, then this strategy did, in fact, work.

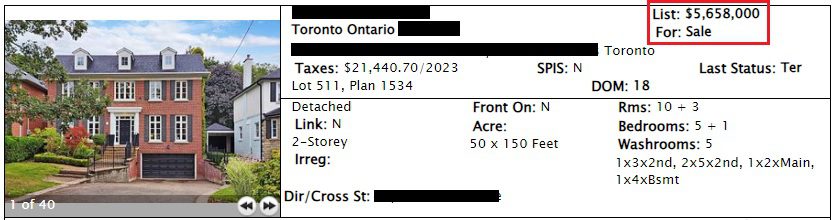

Now, at the risk of being repetitive, I want to go back to this property:

I wrote about this in a previous post a couple of weeks ago, but it’s part of what got me looking for these examples of failed listings that result in “extreme under listing” as a Plan-B.

This house was up for as much as $6.2 Million.

Last listed for $5,658,000, they also decided to go with the list-low, hold-back offers strategy.

Really?

Even in the luxury market?

Yes, really.

Check it out:

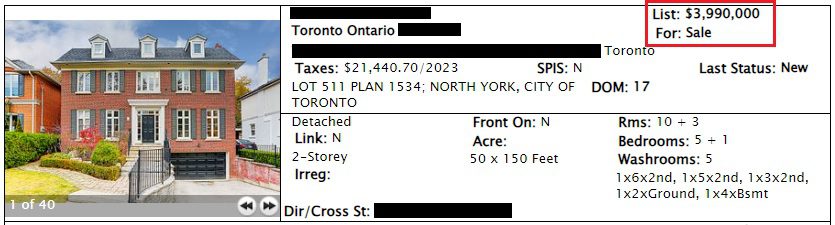

So they listed for a whopping $1.65 Million below what they were listed at prior, and set an offer date.

Incredible.

And what happened on that offer date?

They received one offer.

I had a client looking at this listing and I told her that this strategy would backfire.

People looking for $6 Million houses don’t want to buy a “gimmick” house. They would be turned off by this strategy. It simply cheapens the offering and sours the taste.

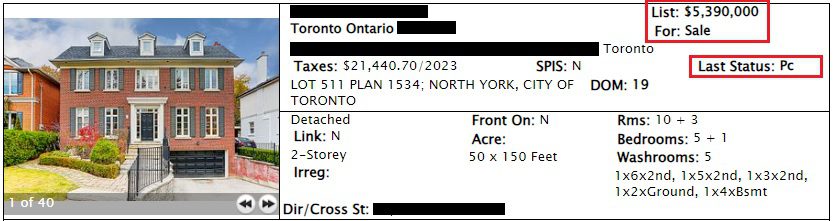

Sure enough, they put the price back up:

Notice I said, “put the price back up,” and not, “re-listed.”

Also notice the last status says “PC” for price change.

They didn’t bother re-listing this new, which I think was a mistake.

My client, whom I told, “I guarantee you this extreme under-listing strategy won’t work, and they’ll re-list at $5.5M,” emailed me a screen shot of the listing on Tuesday.

I wrote back, “Sooooooo?”

I was waiting for her to say, “You were right, David.”

But she didn’t.

She wrote back, “I believe you said $5.5M, and this is clearly $5.4M.”

All that was missing was the winky face…

Folks, this has been a very interesting fall market.

It’s kept me on my toes from Labour Day onward, and although it wasn’t as fortuitous as many had predicted or hoped, I thoroughly enjoyed the challenge.

Will we be seeing this listing nonsense in 2024?

I highly doubt it.

But if we do, perhaps it’s no longer “nonsense” and rather an expected, accepted strategy. Oh boy, I shudder to think…

Jimbo

at 7:16 am

If you start by extreme under listing, you may find what the market is willing to pay without showing your cards.

If you don’t get the price you want, you resist higher; however, you are probably going to be within range of your highest bid if you want to sell.

Gallop

at 9:50 am

Local property listed for $1.00

Was told they had multiple offers in the mid to high $3M’s.

Then they price changed to $4.3M

Now it sits. 42 days and counting.

I guess the strategy was to go for “open to offers” expecting low ball/stink bid action, then with at least some market feedback for the floor they determined a list price instead of taking a stab themselves.

Riley Keller

at 8:43 am

The highest sale-to-list ratio I’ve personally seen was during the peak of Feb/March 2022 – in Waterloo region, we had a couple of properties sell for around $900,000 over asking. I’m guessing the GTA could provide much more extreme examples.

tspare

at 9:15 am

I think when the market is in hyper FOMO mode, it makes sense to under-list a lot so that you don’t reveal your actual preference (as another poster said) since you don’t actually know what you may get. Now with the market more pessimistic, I think you should be more transparent with the buyer as its unlikely some buyer is dying to pay above the price in you head. Unless you don’t really care to sale and is just doing price discovery. The other thing I notice is that people don’t get the price they want, then they turn to leasing the home at what I think is really high prices. I don’t see that working very well but I am wondering if you think it does work.

Shannon

at 10:05 am

I’m a bit confused by the 4th example, you say it was first listed at 899 and eventually sold for 866. The first picture seems to clearly show it originally listed at just over 1M, am I missing something?

David Fleming

at 10:08 am

@ Shannon

I didn’t screen-shot the other listings, just the first one at $1,074,000.

It was subsequently listed for $999,000, then $899,000.

Then it was listed for $499,000 (screen shot provided) and sold for $866,010.

James

at 12:25 pm

Thanks for the update on that last property. The documentation on the pricing history and vendor conditions has not been preserved for posterity by Housesigma. (Good for TREB for protecting buyers from information that might inform a decision)

RICK MICHALSKI P.APP ACCI

at 12:55 pm

NEWS FLASH!!! Bank of Canada top governor Macklem announces today that rates are on their way down!!! As foretold here by me!! He has confirmed they will be cut sharply down, saying in media availability that they will “probably be down to 0.25 or 0.50% by February 2024”!

PM

at 6:59 am

um no, you’re either wrong or just plain old lying for some weird reason. Macklem didnt say anything to that effect

Gallop

at 10:14 am

Home owners should be charged a monthly fee to list on MLS.

With it being “free” to a home owner (I assume the costs are paid by realtors somehow) they definitely play fast and loose with their strategies. And desperate realtors just say “whatever, maybe we get lucky, better to have a listing than not have it, I’ll talk sense into them later”

Even a minimal fee like $300/month that had to come out of pocket from the owner would create a psychological pressure to not waste the $300 in stupid schemes and “let’s give it a try” nonsense. (It will never happen, just sayin’)

At auctions they have a listing fee. You go to sell, maybe with a reserve, but not many go to sell at auction just to see what happens, which is what I think is mostly going on with the weirdness.