Not even one comment about the new blog?

Geez, guys, I thought we were friends!

And nobody noticed that Monday’s blog extended into Wednesday and that I posted on Thursday instead.

Or maybe you did and you just didn’t care, or didn’t care to comment.

This was both a function of launching the new version of Toronto Realty Blog, as well as TRREB releasing the September stats on Wednesday instead of Tuesday.

Damn you, TRREB. You messed up my whole week!

Well, I hope you enjoy the new TRB theme, design, and layout more than the last one. The objective of the new site is to clearly promote today’s blog, the most popular blogs, the blog archives, the blog search function, and everything blog-related. The last design was looking to promote my expertise, my buying process, my selling process, and my team, but we have a different site for that: Toronto Realty Group.

So I’m taking a step forward by reverting back to the blog’s roots in its simplest form: a place where I can offer informed and honest opinions about the inner workings of the Toronto real estate market, and encourage and stimulate two-way dialogue with anybody who’s interested.

Today, I want to examine the TRREB stats from September, which I have been very much looking forward to receiving! It wasn’t quite Christmas morning in the Fleming household, but close. I was able to scroll through the stats on my iPhone, while eating Cheerios with my kids (for the record, I was the one eating Cheerios…), and I was very surprised at some stats, but not quite as surprised at others.

Here are the five figures that are most important to me:

1) 3.4%

2) 11.3%

3) $1,038,668

4) 4,642

5) 29.8%

Without context, these numbers are meaningless. But by the end of today’s post, you’ll understand. In fact, I’m willing to bet that some of the more informed among you might already recognize a stat or two, or be able to guess what they refer to…

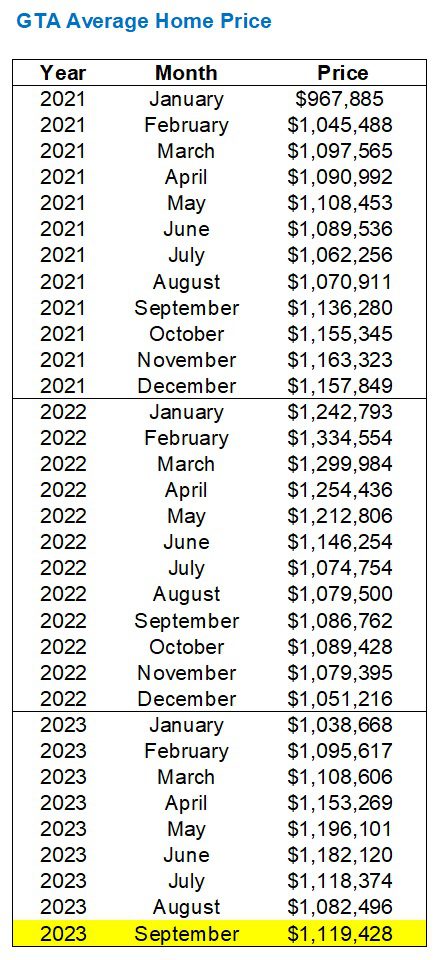

Let’s start by looking at the GTA average home price, and I’m going extend this back to the start of 2021 for context, so apologies if this takes up the entire screen on your phone:

The reason I’m including 2021 is because I want to show what prices have, in effect, “reverted back to.”

Some people are painting a rosy picture of the $1,119,428 average home price and saying, “This is great, it’s above last fall.”

But the alternative way of saying that is to look back as far as we can to see when this figure was last matched, and that was September of 2021 when the average home price was slightly higher at $1,136,280. If we wanted to use the benefit of rounding, we could say, “Prices are back to May of 2021, since the $1,119,428 average home price last month just narrowly tops the $1,108,453 in May of 2021.”

Some people might choose to see this as, “We’ve wiped out two years’ worth of gains,” but others will view this depending on when they purchased.

It could, honestly, be better or worse than that, depending on when you bought. Then again, depending on when or if you’ll ever sell, all this could be moot.

Only the people that are, or will be, in the market are affected. Somebody who purchased in 2008 and will sell in 2030 isn’t going to feel any of this.

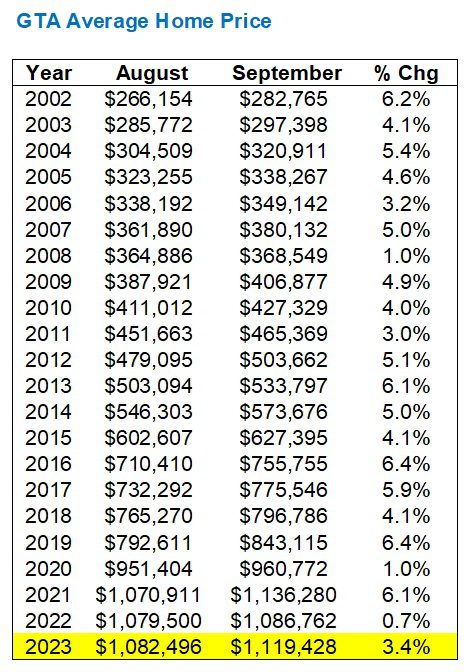

Now, I had casually mentioned in some circles that I felt September was so slow that we could potentially see a flat price appreciation, month-over-month. At one point, I may have even stated that, despite the average home price in Toronto never declining from August to September, we might see that happen this year.

I was wrong.

In fact, it wasn’t even close:

The average home price increased by 3.4%, month-over-month, and as you can see from the lack of “red ink” in the rest of the column, we still have yet to ever see a decline in home price from August to September.

But does that 3.4% increase point to a strong market?

I honestly don’t think so.

In fact, I think it points to a very, very depressed summer when, as I wrote in my August TRREB stats post last month, we saw a record decline of 8.2% from June to August.

Part of me believes that the only reason we saw a 3.4% increase, month-over-month, is because of how low the August figure fell.

Speaking of which, if we want to sub-divide that TRREB-wide increase of 3.4% into the five major TRREB districts, here’s how the month-over-month data looks:

Peel, York, and Durham all saw declines from August to September.

Halton was relatively flat.

And Toronto – am I seeing this correctly – went up 11.3%?

Trust me, folks, your home is not worth 11.3% more in September than it was in August.

This is a statistical outlier and I checked the data multiple times. The August figure of $1,005,945 makes no sense.

To explain, let me show you the GTA-wide average price in comparison to the 416 average home price – keeping in mind that the 416 makes up part of the GTA:

The figures for May and September are almost identical.

But how they got there is a very different story!

Look at how quickly the 416 fell in comparison, month-by-month.

And when we got to August, the GTA figure had declined by 9.5% but the 416 figure had declined by 16.0%!

Madness!

It seems that the 416 kept the average home price from declining last month, and I will be very interested to see where this trend takes us.

Lastly, with respect to price, it’s worth noting that we are further from our “trough” of $1,038,668 set in January of 2023, and those who believed, still believe, or voted in our TRB contest back in the spring that the average home price will decline below that figure, should note that it’s been made a little bit tougher last month.

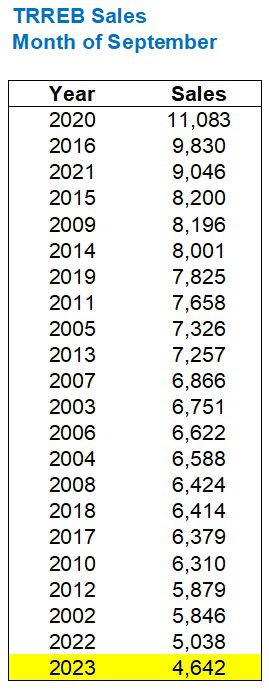

As for sales, we actually saw fewer properties change hands in September than we did in August, and to me that was very surprising.

However, when I went back and looked at the previous twenty-one years, I saw that in nine of those years, sales declined from August to September:

Yup.

Including last year!

So can we paint a rosy picture about those 4,642 sales?

No, I don’t think so.

Consider that the 5,038 sales recorded in September of 2022 was the lowest in any month of September, ever.

And you can all read, right? You’ve already noticed that only 4,642 sales were recorded last month?

Yup.

Sales in September reached a new low:

I’m not at all surprised by this figure, and it lines up exactly with what I “felt” out there in the market.

As for new listings, we saw a 32.2% increase, month-over-month, but that’s not actually all that out of line with the prevailing trend:

From 2002 through 2022, the average increase in new listings from August to September is 23.7%.

So while the 32.2% increase, month-over-month, is significant, it’s not an outlier. We can’t say that listings have “skyrocketed.” Anything short of a 40% increase wouldn’t move me, and anything short of 50% wouldn’t have me suggesting that there’s a red flag.

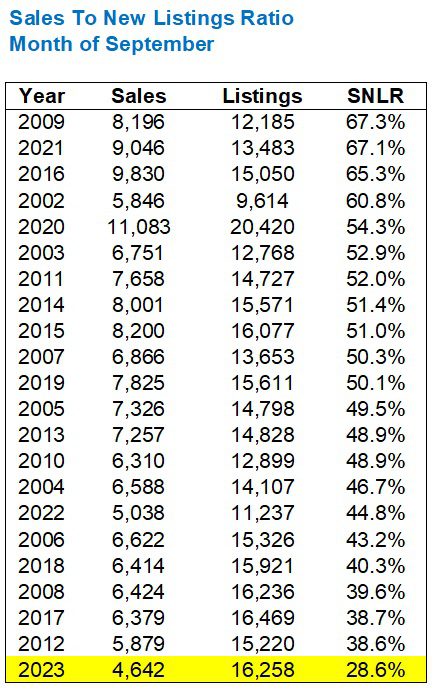

Now, we’ve already put context to four of our five numbers.

The average home price increased by 3.2%, month over month.

The 416-specific average home price increased, somehow, by 11.3%, month-over-month.

Our $1,119,428 average home price is still well above the trough of $1,038,668 in January.

We saw a September record-low 4,642 sales last month.

So what is our last figure?

It’s 29.8%.

That, amazingly, is the absorption rate for September, which is well below the previous low:

That’s simply the result of a decline in sales paired with an increase in inventory.

And while properties are being re-listed at a higher frequency, since “offer nights” aren’t working, I don’t think it’s enough to move the needle.

The September TRREB stats are mixed, to say the least. And while the average home price did increase by 3.4%, and it is still 3.0% higher than last year, I will remain impressed if the optimistic Realtors out there attempt to paint a rosy picture about the rest of the stats.

Don’t get me wrong, I remain bullish about Toronto’s real estate market both long-term and medium-term, and maybe even short-term too. But short-short term, as in right now, it’s hard to see these figures and conclude that there isn’t weakness out there.

ChT

at 8:01 am

Forget about the numbers… how about the new website design? And what’s up with posting on a Thursday?

Jeez man, this market is confusing… 11.3%, eh?

Buyers, sellers and even realtors are confused and these stats do not help 🙂

PM

at 8:51 am

I dont view it as all that confusing. Mortgage rates have gone up so much that buyers cannot afford current prices. But employment is so strong sellers aren’t in any sort of rush to sell and can continue to list at prices they want. The result is a mismatch in supply-demand which results in crazy low transactions, which is what we are seeing.

Id expect prices to remain sticky until sellers lose the luxury of waiting. Which will only happen when unemployment ticks up. Might be soon, might be awhile, that part is harder to predict

Francesca

at 9:10 am

Noticed the new design on Wednesday David but didn’t know if I should post on your Monday comments section or today’s. Very nice and fresh look! I don’t think anyone is surprised by these numbers with interest rates the way they are and many sellers still wanting past prices. Besides several terminated and re-listed properties I am noticing several properties bought between 2020 and early 2022 being up for sale again. I guess these sellers bought at the peak at variable rates and cannot afford the monthly payments anymore or wish to cash out before their properties decrease even more in value? What’s surprising is how much these sellers are asking. Seems like they want to make a decent profit no matter what the market will dictate. Nobody is even happy with just breaking even anymore after only a few years, everyone expects to make a profit seeing how unbeatable the TO real estate market has been.

Sirgruper

at 9:34 am

David.

Opened the page Wednesday, like the salivating dog that I am, and was disappointed not to see the blog (did I mix up my days?) but was impressed by the new look. Very slick. Though liked to see your listings too. That said….Well done.

Cheerios by themselves? I mix and add nuts and seeds and Fibre One if it wasn’t off the shelves for 2 months. It’s quite the mystery.

As for the market, I’m finding it very, very quiet all around.

David Fleming

at 9:53 am

@ Sigruper

“Did I mix up my days?” That’s how I feel when I realize I need to take the garbage out and I think, “Wait, isn’t that tomorrow?”

I was raised on the boring cereals: Cheerios, Corn Flakes, Rice Krispies, Shreddies. Imagine my surprise when I went to camp for the first time and saw the likes of Cinnamon Toast Crunch, Count Chocula, Trix, and cereals that acutally had marshmallows in them, like Lucky Charms. I couldn’t believe what these kids were eating! But we also arrived at breakfast to find a table with BOWLS OF SUGAR! One bowl of powdered white sugar and one bowl of brown sugar, and kids would spoon this stuff on top of their cereal. I couldn’t believe it. I followed suit once and it hurt my teeth for two days. But this was 1986-1989. I’m sure that sugar is banned at camps in 2023, along with half the stuff we had as kids…

Derek

at 10:00 am

I assumed something terrible happened to alter the sacred timeline. Glad everything is okay!

Ed

at 10:52 am

I thought David was going to two posts per week.

Daniel

at 11:17 am

TBH I thought the same thing.

QuietBard

at 11:43 am

I was actually thinking of a devastating quip to compare the new website to the hyper density blog post and how change is inevitable, but after 63 seconds it didnt seem worth the effort. Also, I preferred the style of the old blog, it just had a familiar ambience to it. Oops, sorry (but not actually). Although it can take time to accept new things and so I will post my post-initial impression thoughts in the coming weeks. Stay tuned!

It seems we have numbers pointing in different directions which leads me to believe we have still not hit the medium/long term trend. I think maybe in 2024 when more people are living in this higher interest rate environment we can get a glimpse of what the future holds. Or maybe not. Guess we all have to wait and see.

Also, do you eat the honey nut cheerios or the whole grain sugarless stuff? You’d be surprised how much sugar the former has and how healthy (and bland) the latter can be. Just some food for thought

David Fleming

at 12:47 pm

@ QuietBard

Nobody hates change more than me.

I cried when my parents told me we were moving in 1992, even though we’d be moving to a house more than twice as large, where my bedroom would be twice as large, and I would have an entire room in the basement to play Nintendo with my friends. I just didn’t like change. It was devestating.

I have lost count on the number of blog themes but I think this is the 7th since 2007. Maybe the 8th, but seven for sure.

I like familiarity and the “hero image” on the home screen was shocking to me, but it displays far better on your phone, which is where more than 50% of readers visit the site. I eventually accepted the reccomendations being made to me by people who are acutally in web design, because I’m just a wee realtor… 🙁

QuietBard

at 7:56 pm

I’m not great with change either, but recognize its importance. Well, actually, more like its inevitably and no amount of kicking, screaming, pleading, bartering (throw in your own adjective) can ever stop it.

The new site is definitely faster to navigate, with those extra 5 seconds I can watch an extra tiktok video! To be honest Im pretty sure most people just come to read your posts and dont really pay attention to the other stuff. Unless your website (or previous versions) was so horrendously offensive and people quitely backed out so no one would know they visited and deleted their history, which I dont think it was, whatever shape this website takes should be fine. You might be a “wee realtor” but people dont repeatedly come to this site because of the awesome features (dont tell the web heads I said this). Although the “hero image” does look snazzy. Just don’t get rid of the desktop version. I may not be old, but using a smartphone to read is not my style. Well not entirely true, once in a while Ill use my tablet when I am feeling especially spry!

Marty

at 12:12 pm

The king of the cereals was Captain Crunch *** with crunchberries***

Different David

at 12:31 pm

Sorry David, but I have to disagree with you. As Ace has alluded to previously, we are like a train heading full speed for the unfinished bridge, like in Back to the Future 3, but there isn’t a magic DeLorean to save us when it plunges into the canyon.

Take Bill and Jane. In 2021, they had reasonably good jobs, Bill in the private sector, Jane working for the City of Toronto, together pulling in $225K. They owned a 1 bedroom condo, and wanted to find a bigger home for their growing family. The got caught up in the FOMO wave, and through the equity in their condo and help from the BoMaD (bank of Mom and Dad) managed to pool together $400K as a down payment. During a 12 offer bidding war, they came out on top and got a Bloor West semi for $2.0M, nabbing a prime -1.1% 5 year variable mortgage. As the rates have risen, the have extended the amortization to 75 years, and are spending every penny they have to make the payments. Come 2026, all of a sudden they have a choice of their current bank’s prime rate, or a cool 6.99% fixed rate. Payments have gone from $6K per month to $10K per month. How can they afford an extra $48K per year, of after tax dollars?

These people HAVE TO SELL. Throw in the usual sellers (divorcing couples, estate sales), and you will see a lot more price drops, 3+% co-operating broker commissions and “motivated sellers” in the listing details

Then the question is who is buying? Besides foreign buyers, it would be almost impossible for first time home buyers to come in at the level that Bill and Jane would expect, given that they paid $2.0M for their semi 5 years ago. Current condo/townhouse owners would have a tough time qualifying, especially if they didn’t build up significant equity during the low-interest years. BoMaD beneficiaries are not as plentiful as the cost for parents to withdraw equity from their house is just as high.

Short and Medium term outlook is pretty grim. I see people losing hundreds of thousands of equity through forced sales.

David Fleming

at 12:52 pm

@ Different David

People really, really hate on Back to the Future Part 3, but there aren’t a lot of third-installments that are worthy.

Godfather III was awful.

Indiana Jones And The Last Crusade was so bad compared to Raiders of the Lost Ark. They had to pull in Sean Connery as Indy’s dad!!

I didn’t even watch the third Matrix movie.

And I don’t count any superhero movie as an actual “series” because they keep making the same movie over and over. Like, they made a Spider-Man trilogy in 2002, 2004, and 2007 with Toby Maguire then re-made it in 2012 and 2014 like the first ones never happened! Then 2018, 2019, 2021, 2023, and another in 2024. Who watches this?

I’ll take Back to the Future I, II, and III over and over again…

Sirgruper

at 11:54 pm

How about Goldfinger, the 3rd Bond movie.

Camp and my first Captain Crunch. Memories.

Marty

at 9:32 am

(Perhaps) little known fact. Back to the Future II and III were produced simultaneously.

Real Estate Analyst

at 5:39 pm

You’re forgetting to account for wage growth in your calculations. Auto workers are negotiating 10% wage increases now. Granted its auto sector but public sector will have to come up with something enticing as well if they want to retain talent, othewise Jane can split and income up I’m sure 10% above what the city was paying her off the bat. If we assume a more modest 5% annual wage increase that $225k combined salary looks like $290k in 5 years. Fed knows wages are going to go up with inflation, we see it happening now. By raising aggressively they are staying ahead of the curve to make sure you arent pocketing all that wage growth and getting some wild idea that MAYBE you dont need to work anymore. People will grin and bear it, but just cut back elsewhere in their lives, and ultimately that’s what our government is seeking to do.

Different David

at 6:01 pm

REA,

That might be the case at the blue collar end of the spectrum. But as you get closer and closer to the top of the pyramid, Bill and Jane would need to get promotions to get the 5-10% salary increase. And those don’t happen every year.

Throw in CPP and EI increases that are eating away at disposable income, carbon tax increases and food inflation, it is easy to see how the salary increases are barely keeping people at the real income level.

Joshn Hryniak

at 6:43 pm

REA math is clown math

Josh Hryniak

at 6:42 pm

lol so income goes up from 225k to 290k, 28%

Monthly payment goes up from 6k to 10k, or 67%

Or from 44% of post-tax income to 60% of new post-tax income

lmao ya sure bud, they’ll just grin and bear it

Professional clown

at 2:07 pm

Ok “bud”. You know it all. Again they will simply cut back. No 2024 Lexus, no all inclusive holiday to Jamaica, no kitchen update. You think they will lose their house??? Making $290k, lol. You’re the f…..g clown. And there are many “adjustments” happening to wages in all levels of govnerments you dont even know about because it isnt talked about on the news or some doomer forum you jokers belong to. Chances are someone like “Jane” has already gotten a wage increase without a promotion or barganing for it in a collective agreement. You think this in 89′, its not. Keep believing the doom, keep following the sheeple on the net. Ill be buying up real estate while you suckers hide under your desks, no problem. I bought an office building in 95 for $800,000 when everybody thought i was crazy. Ill do it again this time.

JOSH HRYNIAK

at 3:00 pm

wooopsy no swearing allowed.

lm*ao shut the f**k up, individual with a clear and obvious diagnosed developmental delay

Go grab a calculator cuz you clearly can’t do basic math, f**kface

Towing and Storage Mitigation Specialist

at 4:11 pm

I’m fine with numbers, thanks. I’ve nade millions in commercial real estate i think I’m ok in math. And I use my gut most of the time, which has served me well. Math is good but it almost always just backs up my gut.

Johnny two time

at 4:25 pm

Add to that the millions ive lent out in private mortgages over 25 years. But keep arguing with me, it seves you well kid.

Vincent Bongard

at 10:51 am

There have never been less sales in the month of September since 1999 – when certainly way less homes did exist in the GTA. That for me is the most shocking number.

And also, what will happen when things turn around, maybe due to potentially lower interest rates or the elimination of the stress test? There will be such an overflow of buyers, absolute madness.

Ace Goodheart

at 4:47 pm

Here is some interesting chewing and tasting for the weekend:

https://www.toronto.ca/legdocs/mmis/2021/ie/bgrd/backgroundfile-168400.pdf

According to this, as of 2025, everyone who owns a single family home in Toronto will have to have their home rated as to green house gas emissions and water use, with the city then being able to penalize people who own houses that are rated to be “climate unfriendly”.

This should raise some eyebrows. With my current house, I wanted to insulate the walls and the attic. I was told that if I had an energy consultant come in and do some tests on it, I could qualify for some government rebates. It was like almost 5K so I said, sure, come on in.

They produced a report. It involved them asking me questions, digging around the house and then putting a blower in the front door and seeing how much air leakage there was.

The report indicated the house would use a lot of energy to heat. We were concerned. However we went ahead with the insulation and then had the house re-evaluated. Turned out, it didn’t meet the requirements for any of the funding. We got about $900 from Enbridge. That was it. Paid the rest ourselves.

We then got the report, which indicated significant energy use and very high heating bills.

However, we had done the insulation in September and when the report came out in April, we already had done a winter’s worth of heating. The numbers on the report were wildly inaccurate. The estimate for natural gas use was about 6 times what we actually used. I heated the house to 22 degrees 24/7. I used an old style thermostat that did not have a programmable feature.

The report STILL over estimated our gas use by, as I said, 6 times what we actually used.

I burned about $150.00 of gas each month to heat the house in the winter. The report indicated I would use about $900 per month in gas. The actual tons of CO2 were also way, way off, based on my calculations of gas use and CO2 released.

If these reports are going to form the basis of a carbon tax system as of 2025, we have a problem. They over estimate the house’s gas use by many times the actual use.

Appraiser

at 4:10 am

Another remarkable Canadian jobs report for an economy that just won’t die. https://www150.statcan.gc.ca/n1/daily-quotidien/231006/dq231006a-eng.htm

As for wage gains: “On a year-over-year basis, average hourly wages rose 5.0% (+$1.63 to $34.01) in September, following increases of 4.9% in August and 5.0% in July.”