We have a basement lease coming out this week.

Do you know what that means?

Those in the know, know. You’re aware of where I’m going with this, and it’s not that I’m intentionally trying to sound unsympathetic, but rather it sheds some light on how tough our rental market is in Toronto.

Wherever the “lower end” of the market is, you’re going to have the most people looking to transact. I think that’s got to be true of every market, right? There are far more people looking for entry-level, $1,100,000 semi-detached houses in the central core than there are looking for luxury $5,000,000 homes.

So when we’re talking about $1,400/month basement apartments in prime areas like Riverdale, High Park, or Trinity Bellwoods, there are going to be all sorts of inquiries on the property.

That’s good, right? In any market, if demand greatly exceeds supply, then you’re going to see an uptick in prices!

Except that when it comes to basement apartment rentals in Toronto, you’re really looking for quality over quantity. And unfortunately, it’s the quality that’s difficult as the quantity is absolutely relentless…

With any of these leases, and experienced agents can attest to this, you’re going to not only get the “lower end” candidates who are present in the lower end of the market, but rather you’ll get the candidates below the lower-end candidates, and that’s tough.

I sell real estate for a living and I’m a market believer, but I’m not inhuman. I can’t tell you that with every sad phone call I receive on a listing like this, I don’t feel awful for some of these people who are struggling.

I get calls from people who are new to the country and have no jobs in place, begging to lease the property. But as a landlord, how can you lease to somebody who has no income?

I get calls from people asking if it’s okay that 4-5 people lease the property, all 450 square feet of it, so that combined, they can afford the rent. I’ve yet to meet a landlord who’s looking for this arrangement, and while it’s potentially a “discrimination” case, I don’t blame anybody that doesn’t want to a 1-bedroom basement to five people, and therein picture the sleeping arrangements.

I get calls from people who can’t afford the lease price and say, “I can give you $800 per month and I’ll be the best tenant your client has ever had.” You don’t get people calling on your $3,000/month rental offering $1,500, but it happens in the low-low end.

A colleague of mine was explaining last week that she had a basement apartment for lease and was getting eighty phone calls per day!

In the end, only one person leases the place. But there’s no greater grind in this business than the basement apartment lease.

And why does the client want us to do it? Why do we want to do it?

Because the variance among candidates is more vast than in any other segment of the market. I can’t have a problem tenant in my clients’ property. I just can’t.

Last year, the condo vacancy rate in Toronto was 1.1% and the purpose-built rental vacancy rate was 1.7%, according to the CMHC’s Rental Market Report.

That would be unfathomable in most cities, but in Toronto, we just take it as a given.

Every quarter here on TRB, we take a look at the Toronto rental market by looking specifically at condominiums in C01 and C08, aka “downtown,” and how the listing figures, leasing figures, and absorption rate look and compare with previous years.

We last ran this feature three months ago, so let’s see what has changed, if anything.

First a disclaimer:

Now that we’re in 2023 and the ‘pandemic year’ of 2020 is further behind us, I have deleted the 2020 data from these charts and graphs because it completely skews the data set. This makes far more sense without that data, so I won’t use it going forward. By the time we get to 2026, you won’t even notice, I promise.

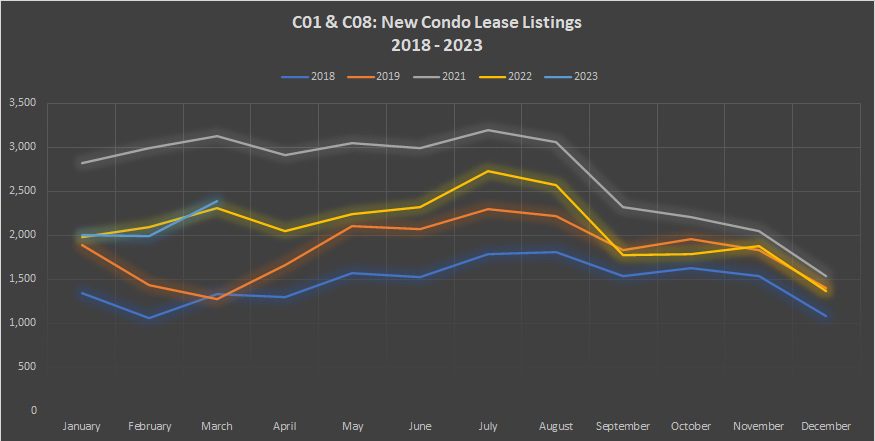

So first, let’s look at new lease listings:

It’s almost a wash, right?

A 2% increase in January, a 5% decrease in February, and a 4% increase in March.

For all intents and purposes, we’re on par with 2022, but that’s not a good thing.

While 2022 may have seen more listings than 2018 and 2019, it was 2021 when we really saw the volume of listings that’s desperately needed by our downtown market.

If you consider that more and more condominiums are completed every year, and that there should therefore be more units up for lease, then why aren’t we seeing this? It’s a fact that a large majority of units in newly-completed condominiums are listed for lease, so shouldn’t we simply expect the “new listings” figures to go up every year?

To see the early-2023 data on par with 2022 is encouraging, but compared to 2021 it’s discouraging.

Go figure.

Graphically, you can see what I mean:

Look at how much higher the 2021 curve is than the rest of the market.

That is why we saw nothing but red figures in this column throughout 2022.

Until that thin blue line you see above is well in excess of the grey one, our market will continue to starve for rental listings, the market will tighten, and prices will increase.

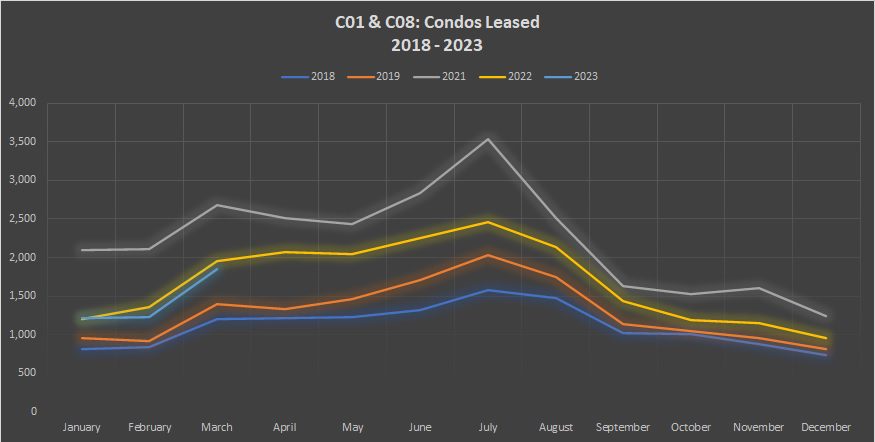

Now, as for what’s leased, that’s another story.

Leasing activity was down not only in February when new listings were down, but also in March when new listings were up. Compared to 2022, that is:

One might argue that the 2021 figures are inflated because more people moved after the pandemic year of 2020, but let’s not forget that in early-2021, we sent everybody home for a few weeks once the winter surge of positive cases set in. I have to struggle to remember that time. Parts of “the pandemic” are a blur, but didn’t we have a renewed stay-at-home order in early-2021? I know we sent our staff home for a bit.

So I don’t know that 2021 was affected by the 2020 pandemic enough to skew this data, but rather I think 2022 was just an incredibly slow year in the rental market comparatively.

When you look at the chart below, I feel as though we should be labeling each colourful line by year, as we move upwards:

And yet we’re not, since 2021 remains atop.

I believe that the rental market in 2022 stopped moving once the overall market stopped moving.

Each segment in our market is tied, in one way or another, to other segments. It’s all relative.

If there are 100,000 sales in Toronto in a given year, versus 70,000 sales in another, that’s going to affect the rental market.

Some renters buy, and that creates a new listing in the rental market.

Then there are investors who buy, maybe from an end user, and that creates a new listing on the rental market.

So when the resale market slowed in the late-spring, early-summer of 2022, and activity dwindled into the fall, that really slowed the rental market.

Now, put this all together, and let’s look at the lease absorption rate.

The trend sort of yo-yo’d through the start of the year, but if March is any indication of a trend, then we’re heading toward a very tight spring and summer market:

As crazy as that 2021 rental market was, we actually saw a higher absorption rate in March of 2023 than in March of 2021. 93% compared to 86%.

While the charts for new listings and leased units seem to move somewhat in tandem, the chart for the absorption rate has always been less predictable and far more volatile.

Especially with the two wild peaks:

We typically do see an upswing in March, but the 2019 peak is an outlier, as is the 2021 peak in July.

Outside of those two wild swings, we do have some consistency here.

May look like a period when it’s a far looser market.

Things really pick up and get tight in July, but that makes sense, given all the tenants looking for a September 1st possession date.

Then every year, we see an uptick in December as people look to tie up a rental before the end of the year, which is a goal for many.

We started 2023 with a very low absorption rate in the market and that could have signaled easier times ahead for tenants.

But with that huge surge in March, seen above with that light-blue peak that surpasses 2019, 2021, and 2022, it looks as though conditions are tightening.

–

Alright, well, by the time you read this on Wednesday morning, perhaps the March TRREB stats will have been released.

Gotta say, to the folks over there at TRREB: you guys really messed up my week!

Today should have been a stats blog, and since there’s no blog like there usually is on Friday due to the holiday (sorry to disappoint!), that means we have to carry over to Monday to examine the March stats.

Something tells me y’all won’t let me get to Monday without discussing though. By the time I post on Monday, it’ll be the world’s worst kept secret.

Raise your hand if you think that $1,095,617 average sale price from February is going to surge? I’m predicting it’s up at least 4.0%, month-over-month, which would take it to $1,140,000. Yes, a far cry from the peak in February of 2022, but substantially higher than the fall of 2022.

We shall see!

JF007

at 6:31 am

5% up

Appraiser

at 7:20 am

TRREB average price for March 2023: $1,108,606.

New listings down -44.3%

Sales down -36.5%.

JF007

at 7:51 am

Meh so flat..mere 1.2% would be interesting to see the breakdown by area and type.

Appraiser

at 8:10 am

https://trreb.ca/files/market-stats/market-watch/mw2303.pdf

JF007

at 7:59 am

Two things pop out though fact that now the avg price is less that 15% down from March last year meaning soon we should see it tending upwards when compared to last year cuz prices tanked really fast come April’22 and second the SLNR is up 8% compared to last year.

Appraiser

at 8:41 am

Yup prices down a paltry 15% from crazy all-time highs.

What pops out to me is how remarkably resilient the GTA real estate market is. Seemingly insatiable – no matter how many demand side regulatory obstacles are placed in the way. Hey, could be a supply issue. Just ‘sayin.

Let’s not forget that interest rates are 4% higher than they were last year!

Also let’s keep in mind that many buyers have to qualify at 7% to obtain mortgage financing due to the MQR (mortgage stress-test). Yet prices are climbing, poised to reach higher as the spring market intensifies.

London Agent

at 10:03 am

David, I’ve got to think that a trend in tenants remaining in the same property for a longer period of time would result in lower new listings.

I would be curious to see what the average time period of a tenancy has looked like over the past 10 years and if there is a movement to stay in the same place longer to capitalize on the initial rent agreement.

Marina

at 10:15 am

I would think the same.

Anecdotally, my kids’ school is next to a bunch of apartment buildings, one of which we used to live in like 10 years ago. Many of their friends live there, including her best friend.

The dad has been there for about 5 years.

So when we lived there, we paid $1500 a month for a two bedroom.

He is paying $2500 for the same unit.

If he was to move now and rent the same unit with a new contract, it would be $3500 a month.

So of course nobody wants to move. Because you can bet that salaries have not gone up proportionally.

Ed

at 11:05 am

Came here to see this. Bingo!

Condodweller

at 6:09 pm

I have a tenant who is paying at least $400 below market value and I know they’re not going anywhere. At least with higher inflation the increase this year is 2.5%. At this rate, I can reach market rates in 7-10 years. The idea is to keep rent slightly below market to ensure a long term tenant. I agree the low movement is due to rent control.

Kiter Peter

at 5:19 pm

People who are new to the country and do not yet have work call me pleadingly asking if they can rent the property.

Virtual Fitness Consultation in New York NY

Appraiser

at 8:52 am

Another solid Labour Force print from Statscan this morning:

Employment rose by 35,000 new jobs (all private sector). Wage gains are +5.3% year over year. Number of hours worked also up 1.6% annually. https://www150.statcan.gc.ca/n1/daily-quotidien/230406/dq230406a-eng.htm?HPA=1

Appraiser

at 9:11 am

P.S. From the report:

“The Toronto census metropolitan area (CMA) saw employment increase by 23,000 (+0.6%) in March.”

Ace Goodheart

at 11:48 am

The plan at the Federal level seems to be to “inflate away” the pandemic debt.

They are just going to gradually let the air out of the currency.

If you own a house now, it will be like owning in the 1980s. You paid $25,000 for that Toronto four bed semi in 1982. In 2023 it is worth $2,500,000.00.

Currency devaluation. It’s the name of the game in over indebted, over leveraged first world democracies.

Ace Goodheart

at 12:52 pm

This is the reality for all of those “renting is better than buying” folks.

Sure, if you can find something to rent. They just rented a large four bedroom house near where I live…..for $7500.00 per month not including utilities (that is $90,000 per year).

If you can get 6% off your portfolio, you would need $1,500,000 invested to produce that. And that is just your cost of living in that house (doesn’t include food, clothing, entertainment).

The reality is that renting, in Toronto anyway, is hellish. Buying is also to some extent, a nightmare, however it is better than trying to find a landlord and a three bedroom rental residence, basically anywhere in the city.

Best bet for anyone who wants to live here (and who wants to get in on the ground floor of the property ladder) is find a piece of crap house in a not so prime neighbourhood, and sit on it for ten years (that is what we did – actually multiple piece of crap houses in not so prime neighbourhoods), put tenants in them, and wait… In ten years’ time you can then sell the lot of them, and purchase yourself a sweet spot in one of Toronto’s leafy Victorian wonderlands entirely for cash.

You are then doing better than literally everyone. Property taxes are low (they have to be, mortgage interest is ridiculous, no one can afford to pay high property tax), utilities are cheaper here (if Toronto Hydro purchases in bulk, they can sell for less than your small town city counsel can), and you can walk everywhere (so you don’t need to run expensive, high maintenance vehicles that come with expensive, high interest vehicle loans).

The secret of life is……planning. Who would have thought (someone better tell the young folks, who as a rule, never plan anything…)

jerry

at 2:56 am

In most cities, that would be inconceivable, but in Toronto, it is simply assumed.

Top Marihuana Companies In USA