What do you think and feel when a 6-year-old puts one over on you?

I mean, when he or she outsmarts you, even if for just a brief moment?

I was putting my daughter to bed on Friday night and I said, “We’re going to have the best weekend, baby!”

She said, “It’s not the weekend, daddy.”

I paused and wondered if this was some sort of trick. You know kids and their riddles, and all that.

I said, “Yes, today is Friday, honey. It’s the weekend.”

Then my daughter said, “Daddy, I’m finished school. I don’t go back until September. So there is no ‘weekend’ anymore, because that would mean there’s a ‘week’ of school.”

She even used her fingers for the quotations. Ugh.

Just rub salt into the wound, she said, “I guess, if you wanted to, you could think of the next two-and-a-half months as my weekend, Daddy…”

Zing!

Those of you who have children, know.

Those of you who don’t have children, and say, “I”m never gonna be that parent,” will eventually be exactly that. Same as me.

Many of the kids are out for summer break and the rest of them are mere days away, but for those of us that don’t get to take two months off, life simply continues as it was.

Sure, the weather is warmer, we do more outdoor activities, we head north for a weekend or two, and we’re far more social. But as far as work goes, most of us don’t see a big difference as the seasons change.

I mean, most of us do feel some sort of “peak” or “slowdown” in our jobs or industries, as an accountant would attest to every April. But when summer comes along, is your industry completely different from what it was only a month earlier?

There’s a common misconception that the real estate market is “dead” in the summer but trust me when I say that it’s not.

In fact, we’ve had some exceptionally busy summers as of late. Look no further than the pandemic-affected 2020 market where August was absolute gangbusters and breaking records left, right, and centre.

There is cyclicality in real estate, as with many industries. But is it enough to move the needle for a buyer or seller?

Maybe. It depends on exactly what that buyer or seller wants to accomplish as well as their individual risk tolerance.

Let’s say that you’re an active buyer in the month of March and I tell you that there are two options for your housing search:

1) Purchase in April. Pay more but have way, way more choices.

2) Purchase in July. Pay less but have far fewer choices.

What would you do?

In reality, we don’t “choose” like this. We buy the right house when it comes available and when we’re ready. I’ll have a client reach out in January to start his or her search and I’ll tell them, “You could end up buying in two weeks or it could take you until the summer; we don’t know what the market is going to give us.”

Then, I’m reminded of another famous real estate saying. One that I think I coined, but I’m not sure:

“It’s better to overpay for a house you love than to underpay for a house you like.”

Sounds like sales B.S., right?

Only a person who sells real estate for a living would say this?

Except, it’s not. It’s the truth.

I paid $665,000 for my second condo back in 2010. I was in competition with another bidder and I got the place by only $1,200. I remember thinking, “I should have offered more.”

Why?

Because I lived there for seven years. I proposed to my now-wife in that condo. I had my first child in that condo. To think that I left it to chance and almost lost that place, I realize, I should have been more aggressive.

Hindsight is 20/20, but if you truly found your “dream home,” there’s nothing wrong with paying a premium in order to obtain it. Conversely, I don’t understand people that are so focused on price that they would gladly purchase a home they’re indifferent to, just because they could get a deal on it.

To each, their own. I suppose…

Now that we’re less than two weeks out from July, as crazy as that is, I wanted to sit down and go over some data to look at how the market generally responds in the summer months.

We refer to the market as being “slow” but what exactly does that mean?

Does it mean that buyers are away? Sellers? Agents? Is it “slow” because people aren’t transacting?

How do the sales figures look, month-to-month?

And what happens to prices?

As I noted above, you’re more likely to get a “deal” on a house in August than you would in March or April, but is that reflected in the average home price?

Let’s go through a whack of data today to see where the market has historically taken us in the summer months, and perhaps attempt to see where it’s going to take us.

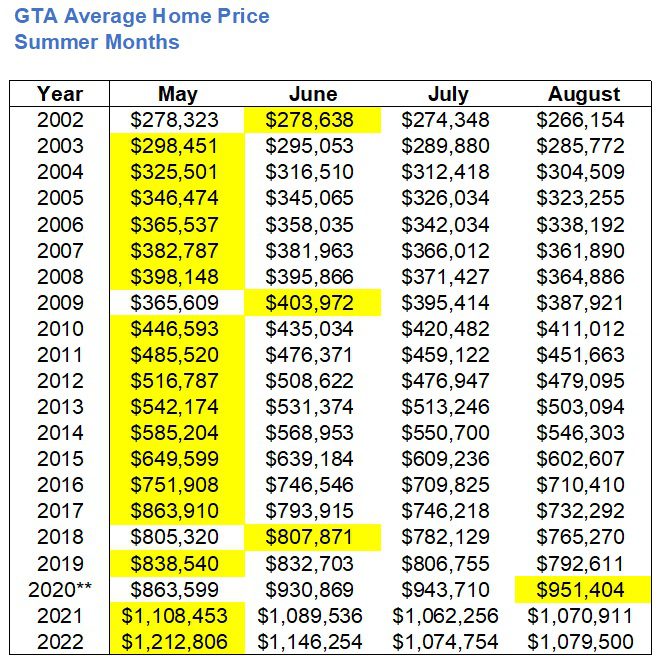

First, let’s look at the average home price in May, June, July, and August:

Sorry, but I can’t help but use an asterisk for 2020.

The pandemic might be over (for most of us, anyways…) but it will forever live on in the Toronto real estate statistics!

For those who don’t know or aren’t automatically assuming here – the real estate market slowed to a crawl with the onset of COVID in April, then started to come back by the time June rolled around. It’s very, very rare to see the July average home price trump August (since it only happened in 2020), but to see August trump July is even more bizarre.

That’s what 2020 did for us! And that’s why I think it’s only fair to use an asterisk.

In any event, you can see that from May to August, the market “peaked” seventeen times out of twenty-one from 2002 through 2022.

Again, I specify “from May to August” because the actual market peak may have occurred in April, or March, or even February as it did in 2022. But for the purposes of today’s blog, we want to look at what happens in the summer. That means we should use the one or two months beforehand, hence May and June.

So what’s the take-away here?

For buyers, it represents an opportunity. Maybe.

It looks as though prices drop in the summer months, and maybe that’s true. I’d like to see the data on percentage of sales by type (detached, semi-detached, row, condo) as well as by price range.

But I think even empirical evidence would suggest that your typical $999,900 listing for a 3-bedroom, 2-bathroom house in Danforth Village or Bloor West Village is going to sell for slightly less in August than in April, right?

How much less?

Well, to answer that question, I want to take the higher of May or June and pit it against the lower of July and August.

As we know, 2020 is going to show up as an outlier, but otherwise, we have a pretty solid look at the difference in pricing:

In every year except 2020, the May/June price is higher than the July/August price, and not by a little, either!

In fact, even if we included 2020 in the data set, the average change in price is 6.5%.

Consider that for a house selling at $1,200,000 in May or June, that means, on average, it might sell for $1,122,000.

Not all houses. Not in every area. And not every year.

But on the whole, prices are lower in July/August.

You can bank on it.

Now, as a seller what does this mean for you?

I suppose it means you should wait until September, in theory. But in practice, there’s more than just price to consider. For would-be sellers who have bought, unless you have a flexible closing date or don’t need bridge financing, then you’re going to sell when you need to sell. There are also a lot of property owners that are away in the fall/winter and would rather sell in the fall. And then, there are just those that choose to sell when there’s far less competition.

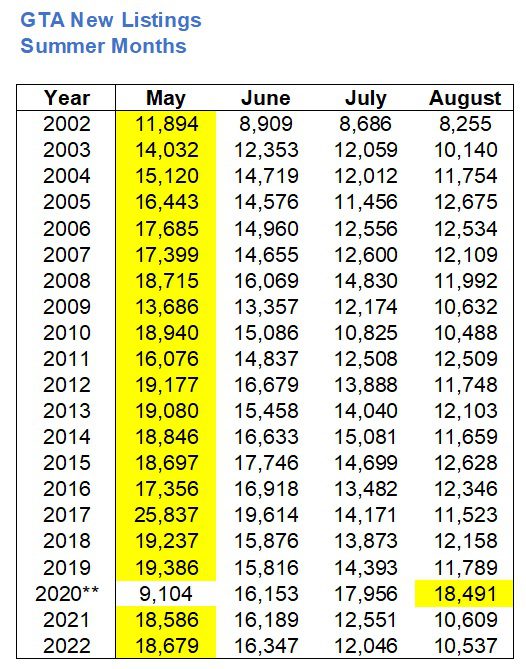

Speaking of less competition, let’s have a look at new listings in the summer months, shall we?

Using the same chart as above:

This time around, save for the pandemic-affected month of 2020, there’s no doubting the “summer slowdown” from an inventory perspective.

New listings always peak in May, compared to the rest of the summer, and it’s not by a small margin either.

If we repeat the same exercise as we did above with respect to price, we can see how much less inventory there is in the summer than in May:

I eliminated 2020 since it makes absolutely no sense, but regardless, you can see that the average decline in inventory from May through July/August is 34.4%.

In recent years, the decline has been much more pronounced, with a 42.9% decline in 2021 leading to a 43.6% decline in 2022.

So, I go back to what I asked at the onset:

“Would you rather pay more and have the ability to choose from a peak number of available options, or would you rather pay slightly less but choose from a far inferior selection?”

And I don’t just mean inferior in terms of the number of listings.

There are a lot of people who believe that the highest-quality listings don’t hit the market in the summer.

I mean, not to be insensitive here, but if you’re looking for a 1-bedroom, 1-bathroom condo, then I’m sure you could find just as many quality options in July/August than as you would in May.

But if you’re looking for something special, something unique, or something that’s really rare, it’s more unlikely than not that you’ll find it in the summer.

As for sales, I feel like this post wouldn’t be complete without running the same chart as we did above for the number of GTA properties that transact during the summer:

Nothing really sexy about this one.

The 2020 outlier exists again, but oddly, we see that July sales outpaced May and June in 2003.

Weird, eh?

Well, many of you were children back then so I’m not sure what we can glean from that!

But all told, with the prices, listings, and sales, there’s no question that the summer is slower.

We’re getting quite data-heavy here, so let me come back to the rest on Thursday and we’ll look at the type of listings we should come to expect…

Derek

at 11:07 am

Is $1,196,101 the correct number for May 2023 GTA Average home price? Based on the foregoing, would that be expected to be the peak (subject to this month beating it), at least through the summer? Or through the rest of the year?

QuietBard

at 11:12 am

I have heard over the years that summer (and December/January) are usually slower. But no one ever mentioned having to face reduced inventory. Interesting. Wouldn’t there also be some sellers who wouldn’t want to wait the additional 6-10 months to list in the spring due to the carrying costs over that period? Although I guess it would be a case-by-case scenario.

Ace Goodheart

at 12:34 pm

Re: paying more for your “dream house”

I have found that this makes no sense, when applied to human behavior.

People tend to “drop” their dreams for housing when they see:

a) a hardwood floor

b) a granite countertop

c) staging

d) anything flashy, pretentious or otherwise “rich”

This seems to be true across the board and even applies to adult human relationships.

Flashy and sexy rules. No one wants what they actually want (or at least, they drop those “wants ” when flashy and sexy appears).

I have seen line ups down the street for impractical, well staged, flashy houses.

Take the sane house as a dowdy bird presentation, full of junk, unstaged, un-renovated, and you are the only bidder.

So if you are paying more for a “dream house” make sure it actually has the layout you want, the set up you want, all the items you want.

Don’t pay more for flashy and sexy