My Father introduced me to The Doors at an early age.

And by early, I don’t mean when most kids would be able to absorb something as intense as Jim Morrison, like, say, eighteen-years-old.

I think I was like seven.

During our weekend escapades to sports-card and memorabilia shows all over the Golden Horseshoe, we would explore a host of musical acts from yesteryear such as the Rolling Stones, Beach Boys, Van Morrison, Creedence Clearwater Revival, Pink Floyd, and you can only imagine what else.

From about age seven or eight, I was pretty smitten with The Doors.

“Break On Through” is about as good as it gets

“Light My Fire” is epic, albeit lengthy, but it’s their best song.

“Roadhouse Blues” is my all-time favourite; something I share with my daughter now.

But the song, “The End” would both enlighten me and scare the living hell out of me at the very same time.

This is the end, beautiful friendThis is the end, my only friendThe end of our elaborate plansThe end of everything that stands

My father explained that Jim Morrison was more of a poet than anything else. Yes, he was a musician, but not like a drummer or a bassist. In fact, Morrison never played an instrument with the band, save for banging a tambourine or shaking a maraca.

Read the lyrics to “The End.” They’ll confuse you but they’ll probably scare you.

We didn’t have Google when I was seven or eight, so I had to transcribe the lyrics in a notepad while listening to the song in my dad’s Buick.

“The End” is often associated with Apocolypse Now because the song is playing during the final scene where (spoiler alert!) Martin Sheen has an, er, um, “meeting” with Marlon Brando.

But there’s a lot more to the song. It’s a poem. It has an unlimited number of possible meanings, from anti-war sentiments, to statements on society, to thoughts on a break-up, to early childhood experiences, and more.

Some of the best songs are those that have an indiscernible meaning. Every listener can feel something different or take something different away.

When I think of the song, all I can hear are those scary notes at the start of the song and a build-up to Morrison saying, “….this is the end…”

It became a running joke in my family.

“This is the end….”

And to this day, I find myself using this line colloquially in many walks of life.

Leaving the office for the day?

“This is the end….”

Kansas City intercepts Denver late in the fourth quarter?

“This is the end…”

Leaving Dad’s place after a joyous dinner on Boxing Day?

“This is the end…”

I say it in jest since the words echoed by Jim Morrison himself were almost haunting, so it’s almost sarcastic in nature.

When we approached December 31st, I couldn’t help but think of those words.

“This is the end…”

Not in the same haunting way, but almost welcoming.

As short-lived, one-hit-wonder, Semisonic said in 1999, “Every new beginning comes from some other beginning’s end…”

I had a wonderful time over the winter holidays, but after Christmas morning, and two family dinners, and the three or four days that followed, I was ready to say goodbye to 2022.

“This is the end…”

2022 was an odd year in our real estate market as we have now discussed to death, and beyond. And as we turned the page on the year, I was happy to see it in the rear-view mirror.

“This is the end…”

As I sat down to reflect on 2022, write some blogs for the year ahead, and think about the real estate market and what to expect, I suddenly became optimistic.

All I’m reading out there right now is negativity. I know that it sells, and I know that uncertainty can lead to fear, but my optimism is based on the fact that I truly think December will mark the end of this decline in home prices in Toronto.

Yes, truly, I believe that “This is the end…”

I’ve always said that you can’t put too much stock into December market stats, but let’s take a look at the month that was, just to see if we maybe, possibly, potentially, kinda, naively think we could have hit market bottom.

Here’s a refresher on the TRREB average home price:

As we know, the average home price in the GTA increased 7.3% and 7.4% in January and February, peaking at $1,334,554, and subsequently declining thereafter.

We saw a stable market in the late summer and into the fall where the average home price remained between about $1,075,000 – $1,090,000 for five months.

And in December, we saw a 2.6% decline which now brings us all the way down to $1,051,216.

But that was to be expected, right?

What did I say in THIS blog about the November stats, written on December 7th?

“I expect the month of December to be the slowest yet. We could see 3,500 sales, a decline to an average price of $1,050,000 (remember, you can’t take a December price as any indication of where the market is), and new listings could drop to 6,000.”

So that December price isn’t anything to be surprised by.

But I won’t lie; I had some help with that prediction.

The average decline from November to December in the last two decades, on average, is 2.8%.

And the average home price has declined from November to December every year except 2010:

The question now becomes: does the market bounce back?

Using the same idea, let’s look at how December has led into January during the same time period:

Surprisingly, the average home price has decreased in seven of the previous twenty years.

Could have fooled me!

On average, we’ve seen a 1.0% increase in the years 2002-03 through 2021-22.

So even if we were in a strong market, there’s no guarantee we would witness a significant increase into January.

Personally, I think the market has to increase. December was depressed; the home price dropped 2.6% from November. We saw a level of stability for five months that was real.

But on the other hand, the luxury market in January is non-existent and I haven’t seen many sales in the $2M+ range thus far. So if only the lower-end is trading, we could see the average home price drop to just over $1,000,000.

As for sales, the media spent last week discussing the 48.2% drop in year-over-year sales volume, from 6,013 sales in December of 2021 to a mere 3,117 in December of 2022.

That’s significant!

But the year-over-year drop in November was 49.4% and in October it was 49.1%.

So it seems like the market was where we should have expected it.

Month-over-month, we saw a decline from the paltry 4,544 sales in November to the paltry 3,117 in December. That’s a drop of 31.4% and not insignificant.

But again, if we look at historical precedence, we see that this too is pretty much as expected:

Kind of amazing that sales have declined every single year from 2002 through 2022, right? I mean, there’s not even one outlier?

Say what you want about the market in late 2022, but to me, it seems that December was pretty much as expected.

It wasn’t busy but it wasn’t slow either.

And the relationship between sales and new listings was, again, as expected.

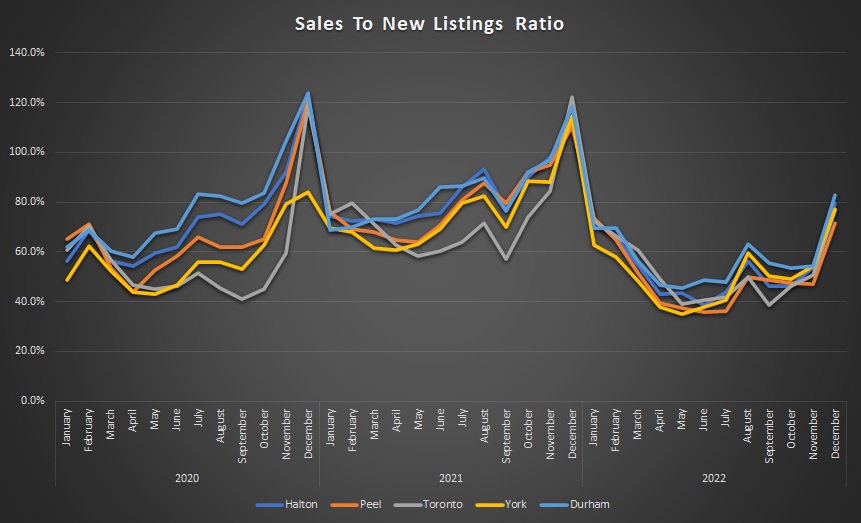

I looked at Halton, Peel, Toronto, York, and Durham all separately and the sales-to-new-listings ratio were within a pretty tight band:

Peel: 71.5%

Toronto: 77.0%

York: 77.4%

Halton: 79.4%

Durham: 83.0%

Peel and Durham are bookending three very similar ratios in Toronto, York, and Halton.

And while these SNLR’s are all down significantly from what we saw in December of 2020 and 2021, they continue to move as the market has before.

Check this out:

As I said, December’s SNLR in 2020 and 2021 were in the 120% range and 2022 was “only” 80%. But the trend of seeing a huge spike in SNLR from Sept/Oct/Nov into December continued regardless.

With every metric I see, the market is doing what it’s supposed to do – within that immediate market cycle.

This obviously isn’t to argue that the market hasn’t declined from 2020 and 2021, or even the first half of 2022. This is to argue that the market does not appear to be continuing its decline.

It might cause me to state the obvious, based on my title and introduction:

“This is the end…”

We’ve seen everything fall off: prices, sales, and inventory – but not to the same extent, which shows that even the proportion of listings-to-sales has changed in a bullish nature. But how long it will continue to fall is a question that everybody’s asking, and I, for one, believe we might be at the end.

“This is the end…..maybe…”

Everywhere you look, there are newspaper articles about the “continuing” market decline.

It’s the usual culprits that are leading the charge:

“Toronto Home Prices Keep On Sliding And Experts Say It Will Only Get Worse”

BlogTO

But these articles are what many people want to read.

Those that hope for a decline are more likely to click that link than a headline showing optimism.

And even those who own a home and/or want to make a move-up are still more likely to click that link because negativity sells.

But not everybody is banging that drum…

“‘The Decline’s Already Happened:’ Why Royal LePage Thinks Home Prices Will Flatten Out In 2023′”

Financial Post

January 13th, 2023

On Saturday, I toured Toronto with an American who is planning his family’s move in the next eighteen months.

Eighteen months is what one might call “short-term” in any market cycle, but for people in Toronto who watch the market like day-traders, and who live on month-to-month stories and data, eighteen months is long-term.

I told him, “The GTA market is down 20% on average, with some suburbs down 30%, and the areas you’re looking in midtown, probably down 10%.”

He said, “Well, that’s all relative. We have to sell our house down south, there’s the US/CAD exchange that fluctuates, plus we could move in two months or in two years.”

That was a refreshing take, considering we live in a city where people are literally holding off home-buying plans today because they feel the average home price could be 3% lower in September.

I explained where we were in the market in February versus the summer, fall, and today, and then I told him what I told you above:

“This is the end…”

Probably.

And if I’m wrong on that, “the end” is, what, another 3-5%?

Tell me the market is going to drop another 20%, that’s fine. I’ve been hearing that the 50% drop is coming since before prices rose 250%….

Tell me about Canada-wide prices, or use a metric that incorporates areas of extreme weakness, but do keep in mind I’m talking about Toronto. And as is the case for most people who read this blog, we’re usually talking about the 416 and the immediately surrounding area.

Those investor-driven, pre-con townhouses in York Region that doubled in value/price in 24 months aren’t what I’m concerned about.

I do think, as noted above, that January & February could show a decline in average home price because nobody is listing luxury homes right now. But I believe the March/April/May/June market will show a market moving primarily sideways, with an average home price no lower than what we saw at the end of 2022.

And when all is said and done, I think we’ll look back at December as the true “end” to the market decline.

Sidenote here: I’ve actually never seen the movie “The Doors” with Val Kilmer as Jim Morrison. I see it’s on Amazon Prime Video. Well, I’ve got my Saturday night planned…

Different David

at 6:53 am

Real estate sales “always” decline from November to December, similar to toy store sales decline from December to January. Hardly newsworthy at this point.

What is important is that this connects with people like Mr. Mississauga from a previous blog post who is only going to sell if he gets the price that he thinks is fair. How will this impact sales going forward? Will the increase in number of sales from December to January be impacted by this? How about January to February?

Graham

at 8:11 am

The Doors? https://youtu.be/ED3mufU58bk?t=46

David Fleming

at 9:17 am

@ Graham

Great movie, although I forgot that scene.

Maybe he’s not wrong about Jim Morrison, but he loses all credibility when he chooses, of all things, Iggy Pop…

hoob

at 11:04 am

“The End” is actually played in the opening scene of the movie, and reprises at the, um, end, too.

Vancouver Keith

at 11:40 am

I doubt that the market has finished falling. The factor that is continuing to play out is liquidity. Interest rates haven’t finished increasing, and it takes months and months for their impact to come into play in the market. There’s a nonsensical two year ban on foreign buying, and provinces are still coming up with ridiculous new taxes – empty homes non local buyers etc

Call me a cynic, but I’m old enough to have seen how the government responded to quickly rising house prices by adding liquidity to the market in the bizarre belief that they were helping buyers. Remember zero down, 40 year amortization mortgages. It’s a fair bet that government will respond to real estate on the downside with decreased liquidity. Watch for more restrictive borrowing policy – at exactly the wrong time.

Ace Goodheart

at 7:58 pm

RE: “It’s a fair bet that government will respond to real estate on the downside with decreased liquidity.”

Here it is, if anyone cares to read it:

https://www.osfi-bsif.gc.ca/Eng/fi-if/rg-ro/gdn-ort/gl-ld/Pages/b20-cd.aspx

The “industry killer” regulations. Coming down the pipe anytime now.

Horses already out of the barn? Shut the door anyway. Hell, burn the barn down and then shoot the horses.

This is BAD stuff here. They are going to crush mortgage lending.

Anyone in the industry should be scared.

Vancouver Keith

at 10:37 pm

Interesting … If five year rates are in the 5% range this year, it puts the stress test rate at 7%. That changes buying power considerably.

Ace Goodheart

at 7:55 am

There is an article in the Star about it this morning.

They are looking at limiting total loan to income ratios, which means even if you can make the payments, you can’t buy the house if the total value of the loan is more than a certain multiple of your yearly income.

Izzy Bedibida

at 9:28 am

In a way this makes sense. We can’t have people spending all their after tax income on mortgage payments. This is not good for the economy as a whole.

Appraiser

at 10:02 am

Time to tone down the fear-mongering there Ace. Perhaps you thought that no one would actually read the article.

First and foremost the process is at the public consultation phase, so none of the proposed changes are imminent. OSFI is looking for considerable stakeholder input before implementing anything.

Also you will note that the proposed changes are in part a response to the glaring inadequacies of the current MQR (mortgage stress test) lending regimen. Sound mortgage underwriting is more nuanced and effective than simply tightening lending restrictions through indisriminate, broad-based regulations.

PM

at 5:24 am

Actually interest rates have finished increasing, at least the ones that matter. Banks set their mortgage rates on the 5 year cost of funds (to match 5 year mortgages). The 5 year canada bond peak a couple months back and has rolled over. So while the overnight rate may keep increasing, bank mortgage rates shouldnt budge (in fact they should trend down soon).

f00kie

at 3:28 pm

Stable price with low volume is what I predict. January looks to even be worse volume wise than December, so far.

In this scenario, I don’t think we can say we’ve left 2022 behind. If it was steady price with normal volume, sure – but with volume, it still signals that sellers can’t sell and buyers don’t want to buy.

Appraiser

at 9:36 am

Inflation data is out this morning. While most other measures of inflation are declining:

“The mortgage interest cost index continued to put upward pressure on the CPI amid the ongoing higher interest rate environment, rising 18.0% on a year-over-year basis in December following a 14.5% increase in November.” https://www150.statcan.gc.ca/n1/daily-quotidien/230117/dq230117a-eng.htm?HPA=1

Rising interest rates are increasingly taking their toll on renewing mortgagors, as well as those with variable rate mortgages who have already been impacted.

Ace Goodheart

at 12:20 pm

My bet is on a 0.25 increase by BoC and then a hold.

May be the last BoC rate increase we see for a while…

Bryan

at 12:46 pm

I think the same, but I also don’t think they SHOULD hike again.

Some extra context for the inflation data….

Both CPI and core prices have been flat since June (ie half a year). For CPI we have gone from 152.9 to 153.1 (that is 0.13%…. so roughly 0.25% per year), and for core prices have gone from 147.8 to 149.2 (a 0.95% increase… or roughly 1.9% per year).

YoY inflation is a lagging indicator…. to an absurd extent for something that is so regularly used in policy decisions. It may be a dangerous thing to say, but it looks like previous rate hikes have already slain the inflation dragon. What is the story going to be if that 0.25% inflation rate from the last 6 months holds for the next 6 (or even a couple of the next 6)? I wonder if we might see an aggressive rate cutting period as we yo-yo our way back to some semblance of balance. Another rate hike just increases that probability.

Ace Goodheart

at 7:07 pm

Bit off topic, but this warms my heart:

https://www.bbc.com/news/world-europe-64309628

Don’t know why they didn’t do this years ago.

Now just someone has to go and round up Steven Guilbeault and my happiness will be complete….