Is it weird that the “Top Five” blogs, that I have written, are being chosen by me?

I don’t know how else to do it, folks!

Perhaps next year we’ll come up with a system. Maybe a button to click on each post to nominate for a year-end award, although what reader is going to be clicking that button that in January?

In any event, I’ve been running this feature now for over a decade, but in its current form, with the top five blogs and the top five stories each being featured in their own post, I think we’re into our sixth or seventh iteration.

There’s no real methodology to my choosing, if I’m being honest.

I look at the number of comments. I look at the feedback from the readers (good or bad; both show interest). I look at how many other sites pick up the post, or if somebody in the media referenced the content. And then I’ll look at the level of controversy, if any, since many of the “best” or most-infamous posts have had some controversial content or an extremely mixed reaction.

In my mind, the #1 on this list was decided one week after it was written, and you’ll find out why about 4,000 words from now.

But I also like to consider how these blog posts age, and whether or not the content turned out to be relevant, eye-opening, or predictive.

So since this is going to be a long post, I won’t delay any longer. Let’s get started…

#5: “Behind The Scenes Of An Offer Night In Toronto”

March 1st, 2021

This just narrowly beat out a blog called “The Friday Rant: Stop Talking!” but I noticed that so many of my favourite blogs have an element of negatively (or at least that’s how they might read), and there were probably too many blogs in 2021 that dealt with buyer frustration so I much preferred this blog post that I think shined a light on what really happens on an offer night.

As you’ll see in my #1 post of 2021, this theme was so popular that I picked it up a few months later, only that particular blog wasn’t well-received by those portrayed in it, as you’ll read eventually…

Anybody who has won, lost, or sold in multiple offers will have a story to tell about the process, and whether they felt good or bad about the process likely depends on the outcome, but it can also depend on the process itself.

A colleague of mine submitted an offer last week in competition, and the process was absolutely chaotic. Poor communication, misinformation, mistakes, missed deadlines, and lies. Outright lies! The listing agents were horrible to deal with and represent everything wrong with the informal “process” of an offer night in Toronto.

But what can we do about it?

Very little, unfortunately. Every listing agent is free to hold his or her offer night as they see fit. If they don’t want to use the phone, and communicate by text, so be it. If they refuse to inform buyer agents exactly how many registered offers are on the house, even though that’s their duty, then there’s no “real estate police” to come along and enforce the rules. The buyer agents can choose to walk at any time, or play ball, and file a useless complaint later.

Organized real estate figureheads hate when I say this, but our industry is never going to be perfect! What industry is?

There are good agents and bad agents, both on the buy-side and the sell-side. A lot of “offer nights” are absolute shit-shows, but a great buyer agent can keep a cool head and use this to his or her advantage. Everything in this business comes down to knowledge, experience, and skill.

In my post, “Behind The Scenes of An Offer Night,” I outlined every single detail in the offer process for a west-end condo I had listed earlier this year. From the number of showings, to the number of offers, and eventually the offer prices and terms themselves.

But I also detailed conversations I had with buyer agents, which shined a light on the inexperience and confusion that was presented to me throughout the process.

Eventually, I presented the following in the blog:

So let’s review. Here are the offers we have in hand:

$700,000

$720,000

$720,000, conditional on financing and insurance

$721,500, conditional on financing

$725,000

$730,000

$740,000, “only one small condition on status…”

$750,000

$751,500, conditional on financing

$755,000

$765,000

$791,000, conditional on status

Has a real estate agent ever done this before?

Is it allowed?

More importantly, does the public want to see this?

Oh, hell yes, they do.

This is the transparency that the public has been clamouring for, and I was happy to provide it!

After presenting those figures, I then detailed every conversation I had with the agents and how we eventually got to the sale price that we did.

The post was obviously well-received, as there were 58 comments posted by TRB readers.

One of the readers asked me to put the shoe on the other foot and write about a time when I was on the buy-side and lost.

So a few days later, I wrote this:

“Behind The Scenes: The Other Side”

Once again, the post was enjoyed, as it resulted in 54 comments from the TRB readers.

And while it wasn’t specifically asked for, I found myself writing another follow-up, this time from the perspective of a seller who was presented with several bully offers:

“Behind The Scenes: A Seller’s Bully Offer Dilemma”

Any blog post that results in a follow-up, let alone two, is usually one that stands out to me. And with this level of interaction with the readers, not to mention the taboo element of disclosing the real estate industries “secrets,” I felt this post was perfect for #5 on our list!

#4: The Market Crash Is Coming….Right?

March 29th, 2021

I didn’t pick this post because it was written on March 29th, which happens to be my buddy Galen’s birthday.

I didn’t pick this post because it produced 139 comments from TRB readers, which was the high-water mark for 2021.

I picked this post because as I look back on the nine months that followed this post, it seems even more true than when I first wrote it.

This could have been a “Friday Rant,” and it could have been a “Monday Morning Quarterback” theme, based on the Monday after………the last decade!

But in the end, it was an updated version of everything I’ve been saying since I started TRB in 2007, complete with a look back at Garth Turner, Nicole Voss, Hilliard Macbeth, et al.

The impetus for this blog post was the media coverage of the real estate market in March.

Here’s a snapshot of the articles I highlighted from that time period:

3/4/2021, Toronto Star, “‘By All Objectives Standards It’s A Bubble,’ Even Realtors Say Accelerated Prices Are Worrying”

3/10/2021, Financial Post, “David Rosenberg Says Canada’s Housing Market ‘In A Huge Bubble'”

3/11/2021, BNN Bloomberg, “Bank of Canada On Guard As Bay Street Warns Of Housing Bubble”

3/25/2021, BNN Bloomberg, “Toronto’s Hot Housing Market Raised To ‘High Risk’ By Regulator”

3/25/2021, Global News, “Canada’s Housing Market Is Showing Signs Of Overheating, CMHC Says”

3/26/2021, BlogTO, “Toronto’s Real Estate Market Is So Out Of Control That It’s Now Considered High Risk”

Everything I had read in March was about how the market was “out of control,” or how prices were “dangerous.”

To be honest, I do think prices are dangerous in the context of the future of our city, and I do think our market is out of control, since we simply can’t control it. So I have no problem with those media sentiments. The issue I have is with respect to the word “bubble” or worse, “crash.”

The crash is coming, folks!

You all know it!

You’ve always known it!

Some of you have known it for a decade or more, and even though prices have doubled since then, you’re still waiting for that 50% correction.

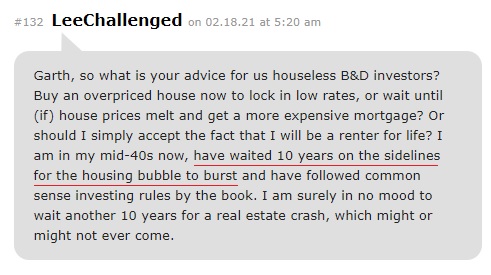

I talked a lot about Garth Turner in the blog post, and I included a comment on his website on one of his posts from March of 2021:

Respect to this person for accepting what he’s done and how he’s been wrong, but man-oh-man, is this tough to read.

Imagine being in your mid-40’s and having expected a crash in the real estate market for ten years.

What could “Lee” have bought ten years prior to making this comment on Garth Turner’s blog?

How about this:

That’s a semi-detached in Leaside which sold in February of 2011 for $685,000.

What would that have sold for in March of 2021? Probably $1,450,000. Maybe $1,500,000. And with the run-up in prices for Leaside semi-detached houses in 2021, today, it’s pushing $1.6M.

“Lee” followed common sense investing rules by the book, per his comment above. But what does that mean? What’s “common sense” these days? How does that actually differ from “irrational exuberance?”

The scariest part about Lee’s comment is that he says, “I’m surely in no mood to wait another 10 years for a real estate crash, which might or might not ever come.”

Oh, Lee!

You’re like the guy who’s stock broker loses him 80% of his money only to stick with that same broker when he tells you, “I just lost 80% of your money; there’s nobody who’s going to work harder to make that up to you.”

You think the crash still might come?

What if the crash comes in 2026? The TRREB average home price is $1,163,323 as of November. So if that figure hits $1,585,200 in March of 2026, and a “crash” comes and wipes out 30% of the value of all houses, we’re all the way down to……….$1,109,640.

But the average home price in February of 2011 was $454,423.

So how, exactly, do the proponents of “the crash” come out ahead?

Over the last couple of years, I’ve heard very, very little from the market bears. Blog reader Appraiser has made this clear in a few of his comments, asking where the detractors are, and I would ask that question aloud myself. Go back to 2008, or 2013, or 2017, and the bears were loud and proud. But today, real, live market bears are fewer and further between. No longer are they talking about the crash, but rather they’ve moved on to discussing the “health” of the market.

Well, some things stay the same, but at least that has changed…

#3: “The Straw That Broke The Camel’s Back”

March 15th, 2021

A question for the long-term TRB readers: did it feel like I stuck my neck out a little more this year?

Maybe. Maybe not. Or maybe I did, but it just didn’t feel that way because I’ve been doing it for so long…

By the time you get to #1 on this list, you’ll see why and how I feel that I took a lot of unnecessary heat this year, all in the name of transparency in Toronto real estate. And while # on our list isn’t nearly as controversial, nor did it get as much attention, I still feel that it’s something that will catch up with me eventually.

If you polled the average Torontonian and asked, “Do you like the way real estate is priced, listed, and sold in Toronto in 2021?” I think you’d have at least 60-70% dissenters.

Sure, if you’re a seller, you love the way it works. But if you’re buying and selling, you benefit from the sale-side while simultaneously being pissed off when you go to purchase. And if you’re only looking to buy, well then, you absolutely hate our market and our industry.

I started my foray into real estate in 2003 and was licensed in 2004, and even back then, houses were listed for $299,900 with an “offer date.” Nobody “staged” houses back then, and “bully offers” had yet to be born, but the idea of under-pricing a house to gain interest was alive and well.

When houses were priced at $299,900 with an offer date, however, you might get five offers and only sell for $312,000. We really didn’t see these $800,000 sales on $599,900 listings until the mid-2010’s.

With each passing year, the way we price, list, and sell real estate becomes more convoluted, especially for the buyer pool. Now, consider how many inexperienced buyer agents are out there, and combine them with naive, wishful buyers, and you’ve got a recipe for disappointment and frustration.

In the blog post, “The Straw That Broke The Camel’s Back,” I outlined a listing/pricing strategy that I felt would lead to the dismal end of our real estate industry.

How do you know when you’ve gone too far?

When you do this:

Motivated Seller! Please Send All Offers Before 7pm With Irrevocable Time 11:59pm On March 19, 2021. We Are Using Second-Price Sealed Bid Auction: Each Bidder Submits A Sealed Bid To The Seller. The Highest Bidder Wins And Pays The 2nd-Highest Price.

These were the offer instructions on an MLS listing for a house in North York.

This is complete bullshit. It’s garbage. It’s never going to work, never going to happen, never going to be honoured. And yet, there’s zero repercussions for those involved.

It’s a gimmick, at best.

It’s a lawsuit, at some point.

It’s the pin in the grenade that’s going to blow up our industry and force us to start over, as a nuclear, worst case scenario.

And I hate it so much, I can’t possibly explain it in this short space. Thankfully, you can go back and read the original post where I made my feelings known and pulled no punches.

The biggest problem that I had with this is that I knew with absolute certainty that the seller and listing agent wouldn’t honour the gimmick that they put into place! Because in the end, they didn’t…

This house had been listed three times in 2020 for as much as $3.5M.

So when this house was listed for $2,888,000, with this ridiculous “sealed bid, second place winner” nonsense, I knew they weren’t going to sell.

What if they got three offers: $2,888,000, $3,000,000, and $3,100,000.

Do you really think they would accept that offer of $3,000,000?

Not only that, if the three offers were $2,888,000, $3,000,000, and $3,600,000, there’s absolutely nothing to stop them from accepting that $3,600,000 offer. NOTHING!

Just because you post some nonsense on the MLS listing about accepting the second-highest bid doesn’t make it firm and binding. This was written on the MLS listing, not etched into a stone and handed down to mortal man by God.

In the end, multiple offers were submitted on this house, and guess what? The seller turned them all down!

The next day, the seller re-listed for $500,000 more.

It was all a waste of time, and I saw it coming a mile away.

I honestly don’t feel bad for the buyers who get taken advantage of here. It’s their fault for believing in Santa Claus over the age of five.

But I’m so frustrated by the audacity of the listing agent to contrive such a “strategy” and spit in the face of the dignity of our industry, no matter how much dignity you feel we have.

There are issues in our industry, no doubt about it. I’ve been very vocal about this on TRB since 2007 and will never waver on my mission to speak the truth, no matter how ugly.

But some of the brightest, hardest-working, most honourable people I’ve ever met work in this industry too, and with every additional, 10, 20, 50, or 1,000 new agents that Humber College spits out, we gain maybe a couple of folks that will eventually be held in the same regard.

This gimmick could certainly be the straw that broke the camel’s back. I don’t know how much worse it can get than this…

#2: “Problems, Solutions, & Everything In Between”

April 14th, 2021

“Problems, Solutions & The Problem With Those Solutions”

April 16th, 2021

Okay, this is cheating, since I’m including two posts together as my #2 best blog post of 2021. But for those of you who read the posts, you’ll recall that this was almost a Part 1 and Part 2.

This post also could have come off as a “Friday Rant,” but it wasn’t meant to me. I think I clearly stoked the fire a little when I opened with this:

Can we have an honest discussion here?

Can we, really?

What is the “problem” with the Toronto real estate market?

Does anybody care to admit what so many of us already know to be true – that jealousy and have-not’ism are at least partially responsible for the backlash against rising prices in the Toronto real estate market?

But in the end, an overwhelming majority of the readers agreed with my sentiments.

In the first post, I went on to express my frustration with this notion that continues to bother me to this day: that a ‘fair’ market, or a ‘normal’ market is one where everybody is happy.

It’s unrealistic. It’s a pipe dream. And yet, all the media coverage in the early part of 2021 was about sad, would-be home owners who couldn’t afford what they wanted!

In the post, I referenced a story about a couple who had been in the market for a full year and had made – wait for it – twenty-one unsuccessful bids on houses! But instead of these people going on camera and telling Ben Mulroney, “We’re so upset with how stupid and uneducated we are,” they went on camera and complained about how unfair the market is.

This bothers me.

In fact, I take personal offense to this.

The market isn’t the problem for these people. They are their own problem.

You can’t lose twenty-one bids on properties in any market unless you’re completely lost. But the media gave these people a platform and I know, deep down, whoever wrote this story for CTV is aware of this. But it’s great television, right?

“Problems, Solutions, & Everything In Between” produced 53 comments from the TRB readers.

But the follow-up, “Problems, Solutions, & The Problems With Those Solutions” produced 56 comments from the TRB readers.

So it seems like the topic did necessitate a second post, and in that second post, I provided five purchase “scenarios,” and I asked the readers to tell me which of those five scenarios were unfair.

I was chumming the water there, of course. But using some real examples which I knew would ruffle feathers.

Is it “unfair” that a resident of a very large, rich country overseas, where their money is worth infinitely more than ours, can come over here and buy a house in cash? No, it’s not unfair. It’s legal. And that makes it fair.

But so many Canadians think this is unfair, so it has to be, right? I mean, I don’t love it. But should we become completely xenophobic and nationalistic?

No matter what scenario is presented, whether as an example in my blog post above or simply any occasion in our country when an individual wants to buy a house or condo but can’t, there are going to be folks who believe the situation is unfair, and others who believe it’s not.

The problem, as I explained in those two blogs posts, is that we can’t actually define the problem in our market!

Is the problem that real estate costs too much? Maybe, but then how come it always sells? How much is “too much” and how does Toronto compare to other cities?

Is the problem that too few people own? Maybe, but isn’t Canada really high up the worldwide list of home-ownership rates?

Is the problem that there’s not enough supply?

Is the problem that there’s too much demand?

Is the problem that prices are appreciating too quickly?

Is the problem that the federal government hasn’t done anything to help?

What is the problem?

And that’s what these two blog posts were about.

We can’t define the “problem” in the Toronto real estate market. The media coverage of real estate in our city is so inherently negative, and when an individual’s personal misfortune in the market is cherry-picked and reported on, such as a couple who have lost twenty-one bids, it exacerbates the notion of a “problem,” which usually leads to the market being labelled “unfair.”

But unfair two who? And how?

And if we could answer those questions, what are the solutions?

You know that I fly off the handle when a solution is floated in the form of a new tax.

We can’t tax our way out of a problem. It’s never worked before, and the idea that a foreign buyer’s tax, or an increased land transfer tax, or a vacancy tax, or a speculation tax, or new capital gains tax on a primary residence, is going to cure our market woes, is painfully misleading on the part of the government.

Just as I take personal offense the stupidity that exists when a couple makes twenty-one offers and loses twenty-one times, I also take offense to the fool that the government thinks I am when they try to tax our way out of problems.

As blog-reader Appraiser always says, “Build, baby, build.”

The only “solution” to our problems, whatever they may be after we actually define them, is more housing.

This has been one of the overwhelming themes on TRB in 2021, and I’m sure it will make an appearance in Wednesday’s “Top Five Real Estate Stories.”

#1: “The Story That Nobody Wants To Hear”

May 3rd, 2021

This was a doozie, folks!

And it didn’t go over well with the real estate agent community, a handful of whom thought this story never should have been told.

If you didn’t read it, go read it now. A summary can’t do it justice.

But essentially, I had a listing, priced at $499,900, and eleven offers were submitted

We had offers of $560,000, $590,000, $591,000, $599,900, $600,000, $600,000, $600,530, $605,000, and $607,000.

Talk about an efficient market! Throw out the $560,000 offer, and we’ve got eight offers between $590,000 and $607,000. It looks like the buyer pool wasn’t deterred or confused by that $499,900 list price, and knew exactly what range the eventual sale price would be in.

But then out of nowhere, we received an offer for $712,000.

No, that’s not a typo. $712,000.

This was the only time in my career I’d had an experience like this, and while the inclination is to be excited, I was confused and concerned.

We ended up accepting this offer. It was unconditional, had a deposit cheque in hand, and, well, it was an absurd price.

There were 71 comments on the original TRB blog.

But more than that, the blog post was picked up by the peanut gallery, many of whom didn’t understand what was being written. I read one comment on a Reddit thread that said, “Look at this asshole, BRAGGING about driving up the price of real estate,” followed by multiple suggestions on how I should die.

I wasn’t bragging about driving the price up, but rather I was telling a story from the trenches of Toronto real estate. Simply presenting occurrences, experiences, dates, and outcomes.

But the story that I did not share with you is what makes this post number-one with a bullet!

I waited for the sale of the condo featured in this blog post to close, and then one week later, I wrote the post. One week after that, the buyer agent’s husband called me and left a furious voicemail on my phone.

I knew exactly what I was walking into.

But was I in the wrong here? Be honest, folks.

You know I change everything in my stories; change “she” to “he,” change “east” to “west,” change “$800,000” to “$700,000,” and so on. Plausible deniability.

Nevertheless, even though this blog post used a variety of altered facts, the buyer agent still knew it was about him or her.

I called the guy back.

After I said, “Hi Jane, it’s David Fleming,” she simply said, “Why? Why? Why-why-why?”

I said, “Why, what?”

“Why’d you do it,” she asked. “Why? What’s the point? What good could come of this?” she asked.

She threatened me, of course. “I’ll give you until the end of day to take that blog post down or I’m coming after you, hard,” she said.

She told me that she didn’t find the blog post, but rather “one of your colleagues who thought it was in poor taste” had sent it her way. “People don’t like this,” she said, which is based on at least one person who didn’t like it, that we know of.

I don’t respond well to threats, so I said, “I assume time is of the essence here on your end because you don’t want your buyer-client to read the post…”

He interjected immediately, “No, we don’t care. Our buyer is fine, he’s happy. He’s good with the price he paid, he’s happy with the condo.”

That’s a load of bullshit if I’ve ever heard it.

These agents are out of the area and probably couldn’t find a condo on a map. With eight bids between $590,000 and $607,000, their $712,000 bid reeked of inexperience, which is amazing, considering their combined years in the business. So when he threatened me with a RECO complaint, I fired back…

“Aren’t you afraid of a RECO complaint?” I asked. “Section 5 deals with ‘reasonable knowledge, skill, and judgment,’ yet you submitted this bid that now, for some reason, you’re afraid of me writing about.”

She didn’t like that, of course. And she fired back even harder.

I’ll save you the personal attacks, and get to the meat of her argument which was simply, “Bids have to be undisclosed.”

I agreed.

“Bids cannot be disclosed,” I said, “During the course of a negotiation. On ‘offer night,’ I cannot disclose the terms and conditions of a competing bid to another agent,” I explained, “But in this case, we’re talking about disclosing a bid, for a condo that sold three months ago, in a blog post, with the number changed.”

Then I added, “Are bids supposed to be kept secret…….forever?”

“Yes, yes they are,” she shouted.

She told me that she had been in the business for over thirty years, and I said, “Well, I’ve only been doing this for seventeen, so I guess you’re right about everything then?”

I pulled back a little and said, “We have never met, you and I. We have never crossed paths. My name is David Fleming. I’m a Broker of Record of my own sub-brokerage. I have a team of six. I’ve been licensed for over seventeen years. I’m in the top 100 of 65,000 agents in the GTA. I have an excellent reputation within the industry and outside of it. Ask around, and your colleagues will tell you. So, can we start over? Perhaps we can find some common ground?”

She said, “I’m not interested in finding common ground with the likes of you,” and that was the answer I had feared.

I said, “You don’t know me. Why don’t we get together for a coffee and talk about the real estate industry and all the things we can change to make it work better? Who knows, maybe you and I could be friends.”

Yes, I said that. And it sounds facetious, but I meant it.

She just sneered and said, “Sure. Friends.” And sneered again.

I asked her, “Can you tell me exactly what sections of RECO I have breached?”

And that’s when she said something that told me I had done nothing wrong, even though I already knew that was the case. She said, “I haven’t done the research yet.”

Bingo.

“You haven’t done the research?” I asked. “So you don’t even know if I’ve broken any rules. You had an experience that you didn’t like and you feel wronged, so now you’re going to find a way to justify your position. You’re going to scour RECO and look for a square peg to jam into a round hole.”

I told her that she should file a complaint, and that I looked forward to the complaint process, which I would document here on Toronto Realty Blog, every step of the way.

Here we are, seven months later, and I’ve never heard from this agent, her brokerage, or RECO.

It’s very possible that a complaint was filed and that RECO threw it out immediately without notifying me. After all, the agent was vehement that she was going to file.

I asked her, “What will you think if RECO throws out the complaint or finds in my favour?”

She replied, “I will honour and respect their decision.”

Now, you might read this as a good thing, but I don’t. I see a thirty-year veteran who can’t think outside the box and who looks to the real estate figureheads for guidance and direction. Because in my world, organized real estate remains exceptionally flawed and change is being thwarted by the old guard.

To be honest, I actually expected more backlash and attention from this blog post. Nobody has ever pulled back the curtain on an offer night like this one – where there was one massive over-bid, and while I’ve written similar posts about bid prices, we’ve never actually acknowledged that these sort of over-bids can happen.

Calls to end “blind bidding” then?

Oh, topic for another day…

So that’s it, folks!

Those are my Top Five as I see them.

If there was another post that you felt should have made the cut, or even one that you enjoyed or found memorable, please post in the comments section below.

We’re back here on Wednesday with the “Top Five: Real Estate Stories of 2021.”

RPG

at 7:51 am

Your monthly TREb stats blogs don’t belong in a top five list but they deserve a mention because I don’t see anybody else out there providing this level of insight. Congrats on another great year of storytelling!

Moonbeam!

at 9:10 am

An epic post, great choices!

London Agent

at 11:31 am

What a nice trip down memory lane, shoutout Appraiser for not one, but two mentions!

I wonder if those buyers were ever successful on offer #22, 23, 24 or beyond… I doubt it.

Appraiser

at 4:54 pm

As a result of an attempt to end “blind-bidding” I foresee a time when every new listing on MLS will be priced at $100 Billion or best offer.

Instead of extreme underpricing…

JL

at 8:37 am

I’d actually take that. At least it gets rid of the false hope for those that are ignorant of the market mechanics and market realities, and negates that “misleading advertising” element inherent in underlisting. (e.g. not accepting even above list because bidding war didn’t escalate high enough). Perhaps the first step to moving towards a default “best offer” model, and it would finally disclose to the public that list prices in most cases aren’t meaningful anymore.

tw

at 8:12 pm

https://www.cbc.ca/news/canada/toronto/cancelled-sales-agreements-preconstruction-ontario-1.6278526

Here’s something that was discussed a few times before and could have made top 10 blog topics, pre-construct homes. This CBC story reveals the termination clause appendix was missing in the PACE development so the sales agreement could not be cancelled. A lesson to builders they can’t be so lazy as not to double-check their unfairly one-sided contracts. And could we be seeing future legislation banning builders from having full discretion in cancelling projects? The same way law favours tenants over landlords?

Condodweller

at 12:13 am

I don’t know if #1 deserves to be #1 except for the fact there is more dirt to disclose. Deep down inside we knew this was happening but it was nice to see the confirmation.

I would have included the posts with the interviews for sure. That was this year, correct? 🙂

Also, I would have included the rent-to-own posts as well since they not only provided new information to most of us but also may be a viable way to get on the ladder for some. Well, at least one of them anyway. One would have to do their due diligence for sure but one of the options seemed reasonable to me if there was no other way to own outright.

David Fleming

at 10:12 am

@ Condodweller

Which interviews?

I did an interview with Lucie Brand from Toronto Condo Staging & Design, and an interview with Mark McLean from Key Living.

If you meant the interviews with Jon Pasalis, Ben Rabidoux, et al, those were in 2020 if you can believe it!

Also, if you meant the epic interviews with my mother and father, those were 2020. They were also my #1 posts of 2020, as chosen by me. 🙂

Condodweller

at 10:45 am

Yes, I was thinking of the Pasalis/Rabidoux ones lol. One year flows into the next at this point. But, yes I was also referring to the Key Living post/interview. It should definitely be in the top 5 for me especially as a potential reverse mortgage play as I mentioned back then. It would make a great follow-up post next year as to how viable it is in reality.

Jenn

at 8:50 am

Hi David,

I really liked the two part blog called “All’s well that ends well.” It was just really touching and a rare feel good story in a city where most stories are sad.

Andrew

at 10:13 am

David, which were the top five blogs in terms of posted comments?

David Fleming

at 3:30 pm

@ Andrew:

139 Comments – The Market Crash Is Coming, Right?

72 Comments – Is Under-Pricing Real Estate “Unfair?”

59 Comments – Behind The Scenes Of An Offer Night In Toronto

56 Comments – Problems, Solutions, & The PRoblems With Those Solutions

54 Comments – The Straw That Broke The Camel’s Back