I’ve been told all too often that I’m “all or nothing.”

There are simply no compromises, there’s no middle ground, and I see everything in terms of extremes.

While the symptoms of OCPD might be present in my outlooks and opinions, I certainly hope it doesn’t undermine what I’m about to say.

We have a saying in real estate that goes like this:

When the market changes, it changes overnight.

See what I mean?

When the market changes, it’s not gradual. It’s never slow.

When the market changes, it happens in an instant.

Now, most of you are thinking that this is hyperbolic. And, alright, maybe it’s not one hundred percent literal, but a market change like the one we’re experiencing now doesn’t happen in a month or a week.

It happens in mere days.

It happens, seemingly, overnight.

Holdover buyers from the 2023 fall market are reading this right now with disdain. Perhaps they’re starting to slowly move from the “I trust David, he knows what he’s talking about” camp toward the “David is a salesperson and a cheerleader” camp on the other side of the equation.

But I had this conversation with my team earlier this week. It’s going to be really, really tough for the would-be buyers who were active in October and November to accept the price appreciation that has happened and is going to happen over the coming weeks and months.

When the market changes, it changes overnight.

And human nature does not allow us to accept losses on a whim.

I mean, if you bought shares of stock for $100 but they dropped to $90 and then $85, you might sell them, absorb the loss, and then tell yourself, “This stock is one in my portfolio of many, and my return is made up of losses and gains.”

But if you “could have” bought a condo townhouse for $950,000 in November, and now you’re told that the same unit is going to sell for $1,020,000, human nature is probably going to cause you to say, “Nuh-uh.”

No way.

Nope.

And then comes the litany of reasons why not…

“This is a dead-cat bounce. Interest rates are too high. People can’t really afford these prices. This shouldn’t be happening. There are multiple wars across the globe. The economy isn’t doing well. And what about INFLATION? Think about INFLATION?”

One of the stories of the spring market in 2024 will be “Buyers who won’t accept current market conditions,” just as one of the stories of the summer and fall markets in 2023 was “Sellers who wouldn’t accept current market conditions.”

I kid you not, folks, the market literally changed overnight one day last week, and with the sales that were recorded, there’s absolutely no doubt.

I can’t tell you how many text messages I sent or received with agents throughout the city last week that said, “The market is back!”

We all know it.

But a picture paints a thousand words, and a story to go with it doesn’t hurt either!

So today, let me show you a few of the sales from last week that caused me to go from a cautious optimist to a raging bull that would make Robert DeNiro look timid.

Now my disclaimer: due to archaic rules of organized real estate, notably TRREB and RECO, I cannot publicly post the properties and addresses of the following properties.

Shall we dance?

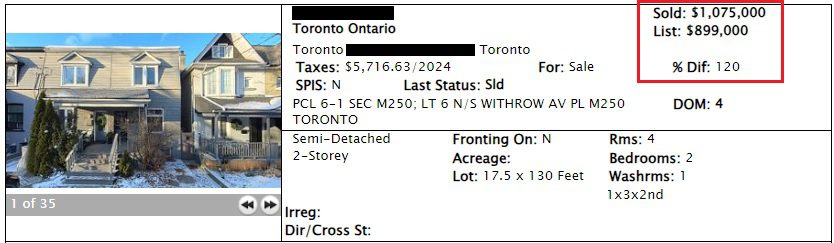

This gorgeous semi-detached, 3-bed, 2-bath took offers last week:

There were 18 offers.

My data is from BrokerBay, by the way. Maybe there was a late registration or a revocation of an offer, but for the most part, these offer counts are on point.

So then………..18 offers?

That didn’t happen in the fall market.

In fact, if this house was listed in the fall market, it might have received two offers. Or one. Or zero.

If this house was listed in the fall market, it might have been listed high instead of low, with an offer date.

But there’s absolutely no mistaking the fact that eighteen people were willing to “bid” on this house. Eighteen people knowingly entered into a multiple offer melee. And not a 2-offer situation or even a 5-6 offer situation, but rather eighteen offers.

This simply does not happen in a buyer’s market or a balanced market.

It only happens in a red-hot seller’s market…

–

How about this 3-bed, 3-bath condo townhouse?

There were 11 offers.

Keep in mind, this is a 2-storey townhouse but one of the storeys is below grade.

And yet eleven people submitted offers knowing that they were in competition.

I’m not knocking the house when I say that, by the way – that half of the unit is below grade. I’m merely pointing out that in some markets, “only the absolute cream of the crop” recieve eleven offers. This is an awesome property in a sought-after location, with a great floor plan, and lots of space. But it’s not perfect.

And thus, I point to a seller’s market…

–

How about this detached house with a large tree on the front lawn?

There were 14 offers.

Great house!

But is it a 14-offer-house?

3-bed, 2-bath, wide lot. Alright, alright.

Listed low? Yeah, sure. But fourteen offers and $300,000+ over the list price?

How many sales did you see last fall of $1.4M on a $1.1M list?

Tell me that this evidence of a red-hot seller’s market in waiting…

–

Here’s a cute house. Only 2-beds and 1-bath, but we can’t all live in mansions…

There were 5 bully offers.

Yes, five bully offers, as this property did not make it to the scheduled offer date.

On the very first day, there were two bullies. Then three other people came to play – and did so knowing that there were already two bullies.

Buyers who want a deal, or want to pay a fall-2023 price, or think the market is slow, are not going to compete against four other bully offers.

Seller’s market, folks…

–

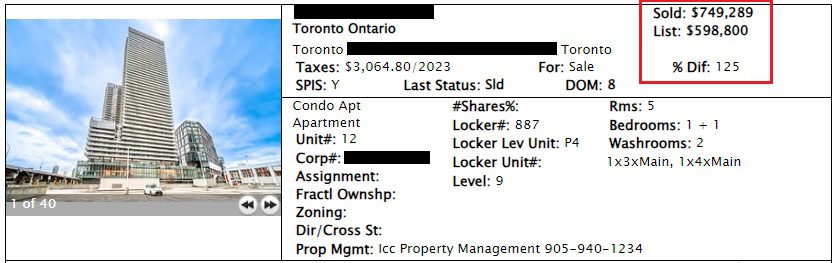

But it’s not just freehold properties that are seeing this type of action.

How about a condo?

There were 15 offers.

On a condo!

And to be honest, this isn’t exactly a “special” building or location, and I say that with due respect to the incredible unit in this building that I will be bringing to market next month. 🙂

I mean that this isn’t a brick-and-beam loft with 14-foot ceilings, right?

It’s a condo. It’s any condo.

And fifteen buyers submitted bids on the scheduled “offer night.”

You don’t see this in a slow, balanced market…

–

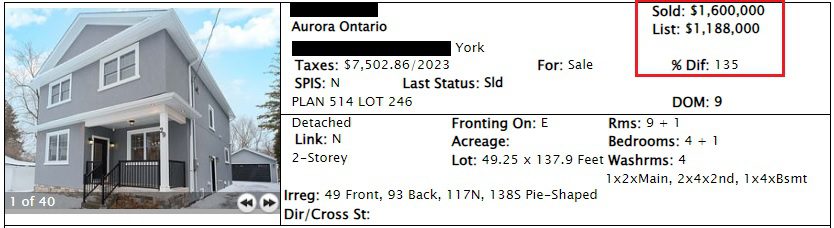

But it’s not just freehold and condo in the 416 either!

How about a lovely detached, 4-bedroom, 4-bathroom house in Aurora?

There were 22 offers.

Yes, the highest offer count I found last week was for a property outside the 416.

Not a brick-and-beam loft, not a Leslieville starter, but rather a house in Aurora that sold for $412,000 over asking.

Did buyers say, “I’m happy to pay $412,000 over asking” in October and November?

–

Let’s take a look at one last listing.

This isn’t going to make your eyes pop out at initial glance, but the underlying story might be the best indication of the market yet:

There were 3 offers.

Wait……three?

After all the sales above – with 18 offers, 15 offers, and 22 offers, suddenly you’re supposed to be impressed by this house which got three offers?

Yes.

But why?

Well, because this was a house listed with “offers any time.” This was a house listed, presumably, at or above fair market value, and the “strategy” wasn’t to list low and hold back offers…

…but that’s what ended up happening!

This house was listed for $1,089,000 and within mere hours there were two offers on the property.

But here’s the kicker: rather than work with the two offers, the listing agent set a listing date for the end of the week.

Think about it: this agent risked losing those two live offers by setting an offer date for later, but the market was so strong, and/or the listing agent’s read of the situation was so strong, that the risk was worth it.

In the end, there were three offers at the table and the house sold for a hefty premium.

So while 110% of the list price or $111,000 over asking might not seem like the sign of a “red-hot seller’s market,” the fact that houses are being listed at what the agent and seller believe is fair market value, and then these houses are organically selling for 10% premiums, points to a market where demand greatly outpaces supply and there’s massive upward pressure on price.

That was last week!

What will this week bring?

I have a feeling we’ll be talking about these same market conditions when we meet next…

Appraiser

at 7:24 am

Looks like buyers are convinced that interest rates have topped out and all of that pent-up demand is being unleashed.

JF007

at 8:28 am

A comparison with similar around the above listings might have been better to see how much was the actual bounce Vs final sale being close to what was the going rate in these areas. Listing low for multiple offers and then getting a premium doesn’t paint the real picture..but agreed the fact that we are seeing multiple offers again in itself is a huge things w.r.t GTA market.

Marina

at 9:17 am

Curious to see if this is true throughout Ontario, or only GTA / other big cities. Also how much of it is trickling down to all properties, vs. the best ones selling higher because there is no inventory to speak of.

I will be keeping popcorn on hand – Spring is looking to be a wild ride.

Ed

at 9:43 am

I’m certainly not seeing action that in Welland, yet.

KP

at 2:10 pm

Praying that my condo will reach Feb 2022 prices soon as I want to sell.

Question Guy

at 4:58 pm

This is comical, cherry-picked picked data on homes priced well below comparables.

In Etobicoke, lots is selling… and the vast majority is well under ask. And often the asking prices have already been reduced from last Summer/Fall.

I know you want this to be true, but it’s not.

Sentiment rules all.

Andrew

at 11:16 am

I think cherry-picking was the point?

This was a round up of the big offer nights in the city last week.

What’s the issue?

Dafrog

at 6:24 pm

I am not sure you can call it a heated market. To me, this feels like home sellers coming to terms with current market conditions and bargain hunters.

The first property is 1029 Craven Rd. This detached property was listed at what semi- are averaging in the area, and the ending price of 1.4mm is in the ballpark of detached sold lately.

The second property is 119-51 Halton street. A 3 bedroom unit listed at 100k lower than what a two bedroom unit in the same complex sold back in Aug 2023. So the buyer paid about 200k more in the end for a 50% larger unit.

Bal

at 5:20 pm

I disagree i won’t call it a seller’s market….House sigma is still showing tons of inventory just sitting for months and no offers……Realtors are so eager to start FOMO

Rich

at 6:17 pm

Bingo bango

Absorption still super weak

Cherry picking 5 houses and trying to claim it’s now a sellers market is as dumb as picking 5 houses that sold for low prices and claiming the market is in free fall. Gobsmacking stupidity.

Anwar

at 8:20 pm

Renters and non-owners alike unwilling to accept the market is heating up? No way!!

Rich

at 11:17 pm

Maybe the market is heating up or maybe it’s in free fall?

Point was using 5 sales to make either conclusion is moronic.

And not that it matters but I own my place.

David Fleming

at 9:39 am

@ Rich

You’re right with respect to absorption rate. I was tracking this all last year on TRB and the SNLR was down throughout 2023.

Can we see a January SLNR above 50%? Unlikely, based on the fall, which was 29%, 32%, and 40% in Sept/Oct/Nov.

January of 2023 was 40%.

But January of 2022 was 71% and January of 2021 was 73%.

I think the 905 is lagging and that will skew the SNLR below 50%, but today’s blog post was primarily referring to sales in the central core.

As for “cherry-picking,” that’s generally used when there’s an attempt to deceive, which isn’t what we’re doing here. I specifically picked these properties BECUASE they’re the crazy sales! They’re no indicative of the overall market, but rather they show market conditions that were not present in the fall. I had a listing on Monday “only” recieve three offers, but that’s a house that would have received zero offers in the fall, and would have sat, like everything else.

The market is “back” because we’re seeing multiple offers with regularity. Last night we watched 8-15 offers on Rhodes, Kildonan, Ashdale, et al.

I appreicate your contributions – and your contrarian viewpoint. Please keep it up!

Jane

at 5:49 pm

David, wait till you see the semi in Mississauga that got 85 offers this week!

Rich

at 6:15 pm

You mean the semi that listed at its 2017 purchase price, and wound up selling for less than other similar semis in the neighborhood went for over the last year?

Woooow so amazing, they managed to waste a ton of peoples’ time and energy and still not push up sale price lmao

David Fleming

at 9:39 am

@ Jane

This will be Thursday’s blog.

There’s just way too much talk about this right now to skip over it…

T A

at 6:58 pm

In the process of renting my new home 🙁 met the clients realtor 4 days ago. We talked about the house etc. She said, market is back. 7 houses she was representing sat on market for months. 6 sold within the previous ten days. Some fielding 10-15+ offers.

Said it started on east end and should pick up across city. She was on point.

Mikedimitriadis

at 10:33 am

Good job!