I laughed when I read a comment on one of last week’s blogs that said something like, “So you’re only blogging twice per week this year, but each blog is twice as long?”

Well, that would be a net gain for Toronto Realty Blog then, wouldn’t it?

For the record, that’s not my plan. And that’s not how 2024 will go. But I did find it difficult to cover each topic from our three-part blog series, “What’s On Your Real Estate Mind In 2024?” while adhering to any sort of word count.

Thank you for the 16 individuals who participated in our “interest rate prediction game,” and there’s still time for those of you who missed last week’s post to chime in.

The earliest prediction for “date of first rate cut” was March 6th.

The latest prediction for “date of first rate cut” was October 23rd.

Well actually, to be fair, both JF007 and Jimbo predicted that we wouldn’t see any rate cuts in 2024, but I digress…

We’re now into the third week of the calendar year, and essentially the second real week of the real estate calendar, so with all the talk in the first three blog posts about themes, issues, stories, and events upcoming in 2024, we haven’t actually even talked about the market yet!

But is there a market?

It depends on who you ask!

And is it too early to be expecting a market?

Absolutely not.

Whenever I think of a market “changing” in January, I think back to January of 2021 and one particular property.

I actually wrote about this:

January 13th, 2021: “These Sales Tell Tales”

The story was about this property that absolutely, positively, could not sell in the fall of 2020:

Yup.

On the market for $1,525,000, for sixty days, this property probably could have been purchased at Christmas, 2020, for well under the list price. Say, $1,480,000 or so? Maybe less.

But then we extended our right arm (or left arm for 10% of the population) and turned the calendar from 2020 to 2021.

The property was re-listed in the first week of January!

And this happened:

Yes.

The “value” of the property, if you truly believe “a property is worth whatever somebody is willing to pay for it,” went up almost $100,000 in three weeks.

That is how January can go.

But what about January of 2024?

Coming into the year, I figured we were going to have a very, very slow month. I surmised that a lack of inventory would lead to a lack of sales, and that the chicken-and-egg battle between buyers and sellers would result in few listings, as sellers don’t want to list if they don’t think buyers are out there.

There’s a mentality among sellers right now that they want to list when “everybody else is.” It’s borne of this idea that when there are the most listings, there are the most buyers. But it conveniently ignores the fact that there will be the most competition.

I’ve heard from more than a few prospective sellers this year who “want to wait for spring.”

The result so far in 2024 has been a very slow market, but that doesn’t mean slow in terms of prices. It’s slow in terms of activity.

Over the past two weeks, I’ve been keeping track of some of the more interesting “stories” in the market which will shed some light on pricing, inventory, and overall market health.

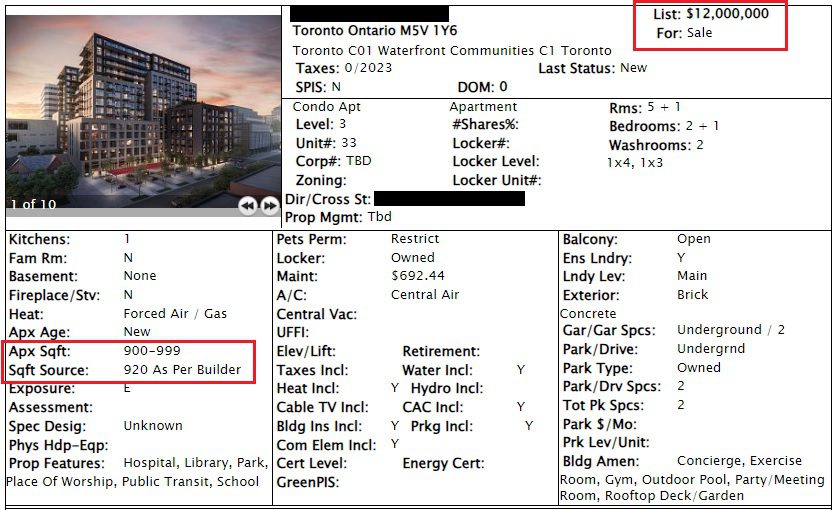

First up, check out the price of this unit:

Wow, over $13,000 per square foot!

Okay, okay, it’s a typo in the listing, but I wanted to inject a little bit of humour into today’s post!

But seriously…

I had a lot of questions coming into 2024, specifically about market dynamics.

What would listing strategies look like?

What would be the buyer pool’s appetite to engage in multiple offer situations?

And above all, I had to wonder:

How will 2023’s unsold properties fare in 2024?

We refer to these as “re-lists.” Quite simply, any property listed in 2024 that had previously been listed in 2023 (typically Sept-Dec) falls into our “re-list” bucket.

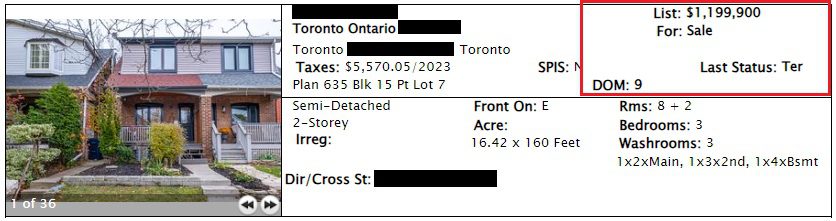

Here’s the first one I was watching:

This is a fantastic property!

Great location, a deep lot, and more than a “typical” 3-bed, 2-bath semi; it has a powder room, plus lane parking, and is nicely done inside.

But it was listed in November and didn’t sell!

They priced at $1,199,900, with an offer date, but terminated the listing after the offer night didn’t bear fruit. And credit to these folks – they didn’t re-list higher, then lower, then higher, then with an offer date, and on-and-on, like so many others did last fall. They simply “took their shot,” then pulled the listing and planned for another day.

That day came last week when they re-listed at $1,199,900, again.

They also set an offer date, again.

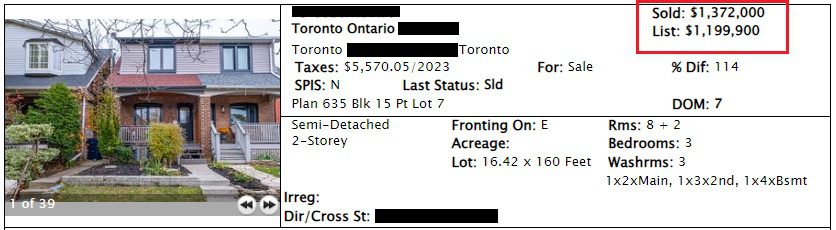

Only this time, the house sold:

They received four offers and the property changed hands.

But that’s it.

That’s the only freehold property I tracked that was unsuccessfully listed in 2023, then sold in 2024 with a “list low, hold-back-offer” strategy.

Trust me, I looked everywhere!

But the difficulty in finding examples for today’s blog post is that there have just been so few sales!

So few sales, and so few listings!

Put those together, and I think you have the story so far in 2024: the relationship between sales and listings, and it’s so complicated because what is being listed muddies the water.

Unfortunately, in order to find a “re-list percentage,” I would have to download all the sales so far in the GTA and then click on every single one to see if the property had been listed previously.

So I’ll have to use anecdotal evidence to provide this opinion on the market:

A majority of the listings in the 416 so far in 2024 are “re-lists” from 2023.

That speaks to the lack of quality of the listings that we do have, and it’s not say that the 3-bed, 3-bath semi-detached that I showed you above isn’t a “quality listing,” but rather that the buyer pool wants to see properties that are actually new.

I would add that the lack of a “quality” label to these re-lists might also have to do with the pricing, since so many of the re-lists are at the same prices as last year.

So if you’re a buyer and you see ten new listings, but seven of them are properties you already saw – and already turned down in 2024, and those seven properties are all listed for the same unsuccessful prices as in 2023, then what do you really have to get excited about?

To further examine the unique relationship between sales and new listings so far in 2024, and to further underscore the lack of quality listings, let me say this:

From January 1st through January 16th, there were 1,087 freehold sales in the seven TRREB districts.

The question I have is:

How many of those 1,087 sales were for properties listed in 2024?

You would think that most sales in 2024 thus far would be for that “new, hot, sexy” listing.

Of course, some might be for properties listed in December, which sat on the market, and only in January were ripe for a buyer to pounce.

But have a guess.

How many of the 1,087 freehold sales thus far in 2024 were listed in 2024?

Only 250.

That’s only 23% and it’s absolutely shocking to me!

Can you imagine what the appetite in the market would be if only we had more new listings?

And what if we actually had quality listings? What if most of the “new” listings weren’t re-lists from 2023?

That’s been the early story of 2024: few sales, few new listings, few actual new listings.

Shall we repeat the exercise for condos?

From January 1st through January 16th, there were 540 condominium sales in the GTA.

So then:

How many of those 540 condominium sales were for properties listed in 2024?

Have a guess.

Is it more or less than the 23% that we saw for freehold properties?

How about only sixty-two.

Out of a whopping 540 sales!

That’s a paltry 11.5% and it’s even more shocking than the mere 23% that we saw for freeholds.

Now, let’s run the exercise one last time to look at condos specifically in the downtown core.

From January 1st through January 16th, there were 106 condo sales in C08 and C08.

The question I have is:

How many of those 106 sales were for properties listed in 2024?

How many of the 106 downtown condos sales thus far in 2024 were listed in 2024?

Fourteen.

That’s 13.2%, so it’s on par with the overall metric of 11.5% for condominiums throughout the GTA.

This is completely counter-intuitive.

And I ask again, somewhat rhetorically now, can you imagine what the appetite in the market would be if there were more new condo listings?

Now, how do inventory levels look so far in 2024?

As I have noted now on several occasions, I came into the year suggesting that we might see an all-time low.

We’re coming off a fall market that could be described as one of the poorest fall markets I’ve ever seen, and more importantly, we’re coming off a year where there were less than 66,000 total sales – the fewest since the turn of the millennium, and a little more than half of the 122,000+ sales recorded in 2021.

So was I really going out on a limb suggesting that sales figures would be weak in January?

Maybe.

Then again, we saw a mere 3,100 sales in January of 2023, so what would make us think that this January would be any different?

Those 3,100 sales in January of last year were the second-lowest since 2002.

The fewest actually occurred in January of 2009 when only 2,670 properties were sold.

Here’s a refresher:

Nevertheless, I had this theory that a dearth of inventory would result in 2,500 – 3,000 sales in January, not because buyers don’t want to buy, but rather because inventory levels are so low! And as noted above, most of the inventory we do have are re-lists from last year.

I further theorized that after seeing near all-time-low sales, the media would run with this and the headlines would proclaim, “Worst January Ever For Toronto Housing Market,” without really discussing inventory levels.

So where are we with respect to sales data?

Let me search MLS and see how many total properties were recorded as sold from January 1st through January 16th in TRREB districts:

1,627

At an initial glance, this might seem quite poor. But consider three things:

1) There are many conditional sales that haven’t been firmed up yet, and when firm, those will fall into this timeline of “Jan 1 – Jan 16.”

2) The onset of January is brutally slow. The 1st, 2nd, 3rd, and 4th days of January are more than four slowest days of the month for sales.

3) With a market that picks up momentum as time goes on, we would undoubtedly see more sales on the 30th of January than, say, the 20th. And we would undoubtedly see more sales on the 20th of January than, say, the 10th.

All told, I believe that 1,627 sales from January 1st through 16th, considering the three points above, will lead to 2,000 – 2,500 sales in the second-half of the month.

4,000 sales would still put January of 2024 fourth-lowest on the list above, but look how many years in that chart resulted in between 4,000 – 5,000 sales. With a bit of a push in the second-half of the month, we could see January of 2024 end up right in the middle of that list.

I definitely wouldn’t have seen that coming.

Now, how about the “stories everybody’s talking about?”

A property in Maple, Ontario received 31 offers on Monday night.

Listed for $899,000, what do you think it sold for?

If we were in February of 2022, and this was a $899,000 listing in Leslieville, we would expect a $1.3 Million sale price.

This isn’t quite as exciting, but consider where we are:

Ah, Maple!

So nice this time of year!

And while you might ask, “What was this house actually worth?” I would add that simply seeing 31 offers and a sale – not a re-list, tells us that the market is in far better shape this January than it was in October and November.

Here’s a fun stat for you:

Excluding Dufferin and Simcoe (ie. looking at the “big five” districts in the GTA – Halton, Peel, Toronto, York, and Durham), there have been 914 freehold sales so far in 2024, throughout the GTA.

Only 13 of those were under $600,000.

Only 34 of those were under $700,000.

Only 112 of those were under $800,000!

And we’re talking about the entire GTA here, not just the 416!

I’m not looking to view these numbers on a relative basis, comparing them to previous years, but rather frame the GTA market in an absolute context.

Just how hard is it to buy a freehold under $800,000 in the GTA? Yikes!

Well folks, I wish I had more to share today, but there’s just so little market activity out there!

Less than one week until the first Bank of Canada interest rate announcement.

Did anybody pick January 24th in the pool? 🙂

London Agent

at 8:33 am

I had the same thought last week in London. Of the 155 new listings we saw in a 7 day span, 110 of those were relisted from last year. Not a whole lot to look at for interested buyers so far this year. It used to be that all of the leftover listings from the fall would sell in December and we would enter January with very tight inventory. Now, because of the lack of sales last year, the leftover sellers are being pushed into the new year. I wonder how long it will take them to figure out their house isn’t worth what it’s listed for. Over a hundred days now for some of them.

Francesca

at 10:07 am

I follow the condo market along the Yonge corridor closely between Sheppard and finch cause this is where I live and I can’t believe how few actual New listings there are! When we were looking to purchase in January 2021 we thought our pickings were slim but this year the inventory seems even worse. More terminated listings from last fall than anything else I’m noticing. It just seems like sellers won’t lower their price expectations and buyers are still too nervous to make a leap. Some units for sale are actually very nice large renovated units. I think price is the problem. The sellers who bought and then renovated to flip are possibly being too greedy wanting too much to make it worth the time and money spent on renovations. This is why it’s always risky to renovate to flip if you find yourself in a market completely different than the one you bought in. Renovate cause you plan to live there not to make an easy quick buck or you could be disappointed!

Anonymous Realtor

at 8:56 pm

Did you see 52 Moore Avenue?

Listed yesterday for $1,950,000 with offers any time.

Sold for $2,300,000 today.

That wouldn’t have happened in the fall eh?

Marina

at 11:01 pm

In my neighbourhood so far this year there is nothing. A couple of $5M+ and a couple of re-lists and that’s it. No semis. No detached in need of a good reno. No nice family homes looking for a new owner because the current ones are moving. Zip.

You can bet if something nice comes up it will be snapped up.

But I also wonder how indicative that is of the market, when the market is so damn slow. Makes it so hard to judge where things are headed. April should get real interesting though.