It’s kind of funny: when I search “luxury” on Unsplash, Pixabay, or Freepik, most of the photos are of cars, watches, sailboats, designer clothing or consumer goods, or picturesque scenes from swanky villas in countries that most of us have never been to.

What is luxury?

How would you define it?

One definition:

The state of great comfort and extravagant living.

Another definition:

A condition of abundance or great east and comfort.

Yet another:

Great comfort, especially as provided by expensive and beautiful things.

Ah, okay. Now we’re on to something.

The last definition uses the words “expensive” and “beautiful.” It also adds “things.”

Expensive, beautiful, things?

Like a Rolex?

A Rolex is a thing and it’s expensive, but is it beautiful?

More beautiful than a newborn puppy? More beautiful than the first rose to bloom this spring? More beautiful than an embrace between a soldier and his family after a two-year tour of duty?

Beauty is in the eye of the beholder.

Just like art.

Anything can be art and it’s why I have trouble with the concept of expensive, brand-name, or luxurious art.

As many of you know, I have every G.I. Joe action figure from 1982 through 1987 and I put them on display in my wine cellar, since I don’t drink wine but the house came with one, and because I think these action figures are art. They are so colourful, so vivid, with so much detail, and so much effort went into the design and creation of each of them. Collectively, some 120’ish figures, on display, constitute art to me. And it’s prettier than a shredded print of “girl with a balloon” that, for some reason, is apparently worth $25.4 Million.

My point is that we could disagree on the appeal of “art” just as easily as we could disagree on the appeal of “luxury.”

I don’t see a $23,995 Hermes Birkin handbag as a “luxury” item because I think it’s an exceptional waste of money, since the purse simply carries your keys, wallet, and makeup, much like a $300 purse would.

But that’s my opinion, and anybody that values this purse as a collectible, an investment, a fashion item, or a societal statement would vehemently disagree.

Who am I to say they’d be wrong? I collect vintage hockey cards, after all…

When it comes to real estate, we can define “luxury” in different ways.

Somebody living in a basement apartment with a 5’10” ceiling who cooks dinner off a hot-plate would likely consider a 2-bed, 2-bath condo on the waterfront “luxurious,” whereas the person living in the 2-bed, 2-bath condo on the waterfront probably wouldn’t use the word “luxury” unless he or she was staring down a 50 x 150 foot lot in Lawerence Park.

It’s all relative.

Luxury used to be $1,000,000 and up.

“One-million dollars,” would conjure up images of sprawling mansions and 12-bedroom houses.

Today, we are inundated with TikTok videos that show a $900,000 estate in Georgia up against a $900,000, 2-bedroom bungalow in Oshawa.

A few years ago, $2,000,000 was considered luxury.

Today, I have to think the “luxury” market starts at $3,000,000, and even then, some might have a hard time accepting a 4-bed, 5-bath house in Riverdale for $3,100,000 as anything even approaching “luxurious.”

But let’s use $3,000,000 as our threshold for luxury and take a look at how the luxury market has moved so far in 2023.

A lot of agents out there believe that the luxury market hasn’t begun to move yet, and some even believe that the market statistics are skewed because a smaller proportion of luxury homes are selling.

Is this true?

Would there actually be an effect on the overall TRREB average home price?

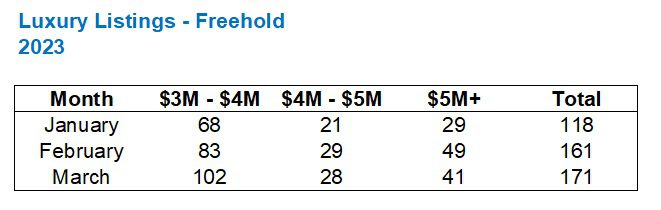

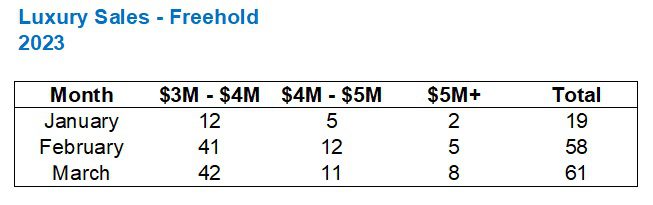

Let’s look at the number of luxury freehold listings so far in 2023:

There’s not much to glean from that, so let’s put this data up against 2022:

Alright, well now we know that luxury listings are down from 2022.

But what’s the conclusion here?

We saw 118 luxury listings in January of 2023 versus 135 in January of 2022. How does this correlate with overall data?

Well, the number of new listings in the GTA declined by 3.6%, year-over-year, in January, and the number of luxury listings declined by 12.6%. So that means luxury listings are, proportionally, declining more than the market average!

But in February, we only saw a 16.5% decline in the number of luxury listings, year-over-year (from 193 to 161), and yet the number of listings in TRREB declined by 38.9% (14,147 to 8,637). So in February, the number of luxury listings is proportionally higher.

The same is true of March where we saw a 31.3% decline in luxury listings but a 44.2% decline in overall TRREB listings.

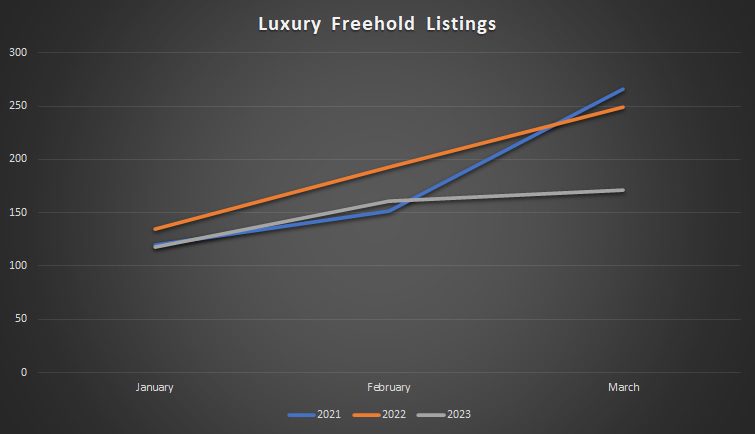

I’ll save you the 2021 data, and instead, move on to the chart which shows the two years, 2022 and 2023, noted above, as well as 2021 for reference:

Listings are down across the board, so this should come as no surprise.

But what’s concerning is that whereas January started with the three years within a small band (118, 120, and 135), we’re now seeing a major divergence in March.

A colleague of mine listed a property last week for $3.7M.

The property sold for full list in a day.

That is a sign of our market in full effect and the chart above, demonstrating how low inventory is, backs up what’s happening out there.

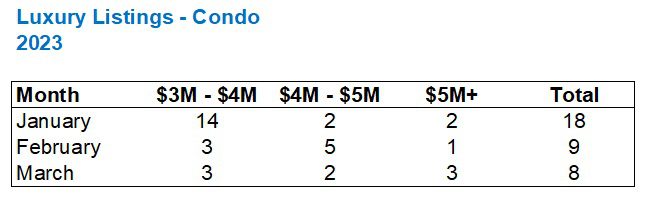

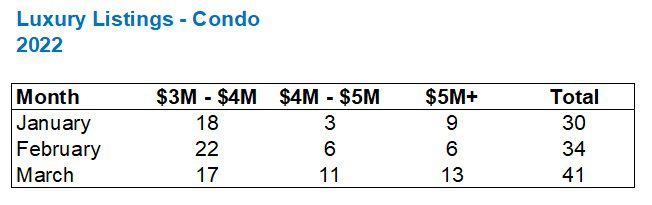

Now, switching gears to condos, we see a similar trend:

The drop-off here is uncanny.

Luxury condo listings are down 40% in January, 73.5% in February, and 80.5% in March!

What’s more is the trend!

18 units listed in January, 9 units listed in February and 8 in March. The trend is going down, and it’s the complete opposite of what’s happening in the freehold market or what’s happened in the condo market in previous years.

Again, I’ll save you the 2021 data in table form but we’ll see it in the chart below:

You’re not shedding any tears for the would-be buyer of a $5,000,000 condo who has little inventory from which to choose, but the point shouldn’t be lost here.

While you might think there’s a glut of inventory in the higher end, there just isn’t. So for the few buyers who are looking for a luxury condo, the market has spoken and it’s said, “The laws of supply and demand will ultimately put upward pressure on prices.”

Let’s go back to freehold now, since the condo market is such a small data point.

I want to look at the actual number of sales in each month, in each price point, from 2022 to 2023

This is fascinating to me, since I wouldn’t have expected such a drop off.

Luxury sales on a year-over-year basis declined:

66.1% in January

56.4% in February

48.3% in March

Here’s our chart:

But wait a minute! Luxury sales declined 66.1% in January, 56.4% in February, and 48.3% in February, but remind me – how much did new luxury listings decline in the same period?

January: 12.6%

February: 16.5%

March: 31.3%

Do you realize what this means?

It means that inventory in the luxury market, despite being at far lower levels than in previous years, is being absorbed at a slower rate.

Let’s take a look at the absorption rate, which is the ratio of sales to listings, in each of the last three years:

If your glass is half-full, you’ll note that while the absorption rates in 2021 and 2022 declined substantially from February to March, 2023’s rate held firm.

If your glass is half-empty, you’ll note that despite the above, the absorption rate has been substantially lower in January, February and March.

So what’s the take-away here?

Prices are increasing, so it’s not like a lower absorption rate had led to properties sitting on the market and buyers being able to buy them for discounts.

Then again, consider that February of 2022 was our “peak.” So an absorption rate of almost 70% for properties over $3,000,000 is simply unsustainable. And whereas the absorption rate came crashing down from February to March in both 2021 and 2022, maybe now our 2023 data is showing stability? Maybe it’s showing upward momentum?

All told, the luxury market simply cannot be called “slow.”

Sales are down. The absorption rate is down. But if you’re a buyer for a $3,000,000 house in your target area right now, you’re just not seeing anything.

I do believe that in ten days when the April TRREB data is released, we’re going to see another increase in the average home price in the GTA. And if this trend of low inventory in the luxury market continues, I believe the absorption rate will climb and potentially surpass that of 2022 and 2023 in the month of April, and definitely in the month of May.

I’ll make a note to revisit this feature in July when Q2 of 2023 is in the books!

Appraiser

at 8:51 am

Perhaps it could be argued that the entire real estate market at present is a luxury market.

Interest rates have accelerated at an unprecedented pace. The MQR (mortgage stress test) is still in place, meaning buyers have to qualify for a mortgage at interest rates 2% higher than the actual contract rate. Only the highest income earners can play this game under these conditions.

No wonder there are so few listings. Fewer and fewer people can afford to move.

Bryan

at 4:39 pm

Probably a pretty compelling argument at that(sadly). If we make a reasonable extension of the definition from “Great comfort, especially as provided by expensive and/or beautiful things.” to something like “Significantly greater than average comfort, especially as provided by things that are significantly more expensive than most people can afford”, then almost certainly this is true.

On a monthly basis, what does the TRREB average ~$1M home look like? The mortgage is ~$5,000 plus at least $2,000 in utilities/maintenance. Add in about $3,000/month to not die of boredom/starvation and you need a before tax household income of ~$250,000. That’s somewhere in the neighborhood of the top 5% of households in Canada.

Ace Goodheart

at 7:47 am

Interesting thing happening right now with mortgages.

1/3 of mortgages held by the big five are now with amortization periods of more than 30 years (I personally have seen up to 75 years).

Chrysia Freeland did this. Forced the banks to extend the payment periods, even if it means people are now actually adding to their principal amounts as payments don’t even cover interest.

If you are a gambler, here is the game:

Who do you think will win the next Federal election?

If the Cons win, they are not going to force the banks to give these people renewals at 75 year terms.

If the Libs win, Freeland will just keep doing this and these mortgages will roll over for another 5 years.

So if the Cons win….significant house price correction on the horizon. There will be a lot of forced sales.

Libs…prices keep going up.

The trick seems to be predicting the result of the next federal election.

Kyle

at 2:26 pm

This is incorrect, it has nothing to do with the political party. Some variable rate mortgage holders’ amortizations have been increasing as rates go up, because the increased interest is not being added to the borrower’s payments. If i’m not mistaken, Scotia is the only big bank whose variable rate mortgage payments fluctuate with interest rates. The other banks fix their payments and increase the amortization up to a certain trigger rate. Only after that trigger rate, do they begin to increase the borrowers payments.

Ace Goodheart

at 2:39 pm

There is a “code of conduct” in the Federal budget that requires banks to extend amortization periods rather than increase monthly payments, for people with variable rate loans.

This has allowed people to stay in their houses.

Those folks will at some point have to renew, at which time they will need to requalify at the stress test rate on a 25 year term, which of them now cannot do.

You can expect the Feds to fix this by allowing longer amortization periods. But only if the Feds remain Liberal.

There is no indication from the Cons that they would do this.

It’s really a dumb idea because it just kicks the can down the road. And it keeps house prices high.

It also keeps people in their houses which reduces inventory.

Kyle

at 2:55 pm

Bryan (below) has it right. Like i said, Scotia immediately passes on any interest rate change to their borrowers’ payments. They are clearly not being forced to extend amortizations by Chrystia Freeland or required to extend by any sort of “code of conduct.

Different David

at 8:30 pm

Ace, do homeowners need to requalify if they stay with their existing lender?

Bryan

at 2:53 pm

Almost all of these long amortization mortgages have become that way because they are well past their trigger rates. The real story here is that the banks have chosen not to increase payments for most people anyways… because doing so is not in their best interest. If they cranked up payments for everyone over their trigger rate to the point where they are paying enough to meet the original amortization, a ton of people would default, the market would fall, and the banks would be the ones left holding all of these foreclosed homes that are not worth the value of the mortgage.

Bryan

at 2:45 pm

This was actually a decision taken by the banks independent of the government… and then later adopted as the guideline by the government who thought it was a good idea. BNN had a good article about it earlier this month called “Canadian banks’ flexibility is putting a floor under home prices” if you wanted to read about it. The long and the short of it is, if the bank just instantly passed these huge rate hikes on to customers, tons of people would default, the market would tank, and the banks would be forced to foreclose and sell these homes at a loss. That’s bad business, so instead, they just let variable mortgage holders keep paying what they were paying, regardless of amortization. The bank still gets most if not all of their interest payments on a month to month basis, and the principle will come eventually when rates go back down (this more than anything indicates to me that rates are going to go back down).

So in terms of your comment, I highly doubt that the government removing their recommendation would do anything… because it is not in the banks’ best interest to foreclose on a million homes. They will do everything they can to prevent a real estate crash.

Libertarian

at 3:04 pm

What surprised me about these statistics is how many luxury homes change hands. This year is low, but that’s still a lot of houses. So to see the numbers from previous years is mind blowing.

Maybe these numbers don’t mean anything to people involved in the industry, but to this average joe, it’s shocking. No wonder there are so many real estate agents in the GTA. A commission of 2.5% on $3 million and up is a nice chunk of change.

kiter peter

at 3:34 pm

That’s just my viewpoint; someone who thinks this purse is valuable as a collectible, a financial investment, a piece of clothing, or a social statement would violently disagree.

Affordable Business Loan Services in USA