Define “scathing.”

Or use it in a sentence.

When I hear “scathing” I usually think of the word “report” along with it.

I don’t know why, but for some reason, I think about a newscaster saying, “ABC Company was named today in a scathing report issued by the Pharmaceutical Alliance of Canada….”

Is that just me?

It’s not, it seems, since a colleague emailed me the link to the Auditor General’s value-for-money audit on RECO this week and said, “You have to check out this scathing report.”

Scathing, eh?

“An adjective meaning witheringly scornful; severely critical.”

Yeah, I’d say that’s how I think the word is used in most cases.

I honestly don’t know if I’d consider the Auditor General’s value-for-money audit to be “scathing,” but it’s far from complimentary.

In case you’re not familiar with the Auditor General of Ontario…

Their office is an independent, non-partisan Office of the Legislative Assembly who serves both MPP’s and Ontarians. Their role is to hold public-sector organizations accountable for financial responsibility and to audit Crown Corporations in the broader public sector that receive provincial funding.

You can read more about the Auditor General of Ontario HERE.

Earlier this week, the Auditor General released value-for-money audits on a multitude of different organizations, including the the COVID-19 Vaccination Program, Highway Planning and Management, the LCBO, the Ontario Energy Board, as well as others. Including, notably for our purposes, the Real Estate Council of Ontario.

In case you’re not familiar with the Real Estate Council of Ontario…

RECO protects consumers in the public interest by promoting a fair, safe, and informed marketplace and administering the rules that real estate salespeople, brokers, and brokerages must follow.

You can read more about the Real Estate Council of Ontario HERE.

It’s the Auditor General’s value-for-money audit that we’re interested in; those of us in the business of real estate, and/or those merely interested in how the industry works.

The report is a girthy 54-pages long and I read almost all of it.

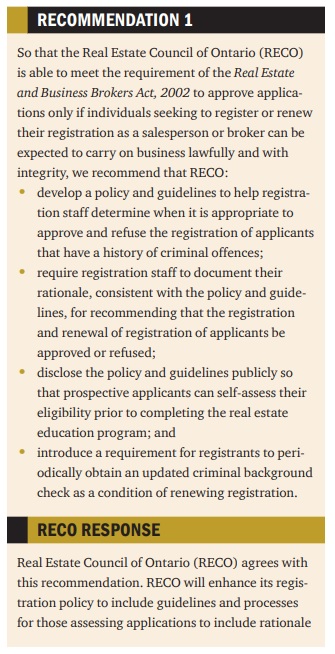

Essentially, RECO is not being run as well as the Auditor General would like, and RECO either knows this, or simply acquiesced in the report, since many of the AG’s recommendations come with a “response” from RECO.

Here’s an example:

“Real Estate Council of Ontario (RECO) agrees with this recommendation.”

Yeah, no kidding you do.

What is RECO going to do – say no?

The most interesting part of this report, in my opinion, had to do with RECO’s finances.

If you ran a business and you increased your net profit by 382% in a four-year period, would you say that’s good?

I’ll bet!

Check this out:

Operating expenses are only up by 10.5% from 2017 to 2021.

However, operating revenue is up 49.1% in the same period.

The result is a net income or profit that rose from $2,340,000 in 2017 to $11,290,000 in 2021.

Registration fees, education revenue, ‘other’ registrant fees/income, and investment income all rose solidly.

RECO is raking in the cash.

But are they doing a good job protecting the interest of consumers?

As a broker, I think “RECO” and I think two things:

1) Registration

2) Complaints and discipline

That’s what comes to my mind.

There are a lot of boards and associations, so it could be confusing to the consumer or the reader of this blog post.

Take the Ontario Real Estate Association, or OREA, for example. I honestly don’t know what OREA does, or why it exists. They used to be in charge of education, but now they’re basically a lobbyist that none of us asked for.

The Toronto Real Estate Board is our board. They serve a vital role.

The Canadian Real Estate Association is essentially a national association of Realtors, or an amalgamation of individual boards and MLS systems. They oversee Realtor.ca.

But none of OREA, TRREB, or CREA are public.

The Real Estate Council of Ontario is.

This is why consumers might care about who they are, what they do, and how they’re run.

And it’s why I want to provide you with the highlights from the Auditor General’s report…

Here are their summary points…

RECO does not have a formal policy, guidelines or a consistent process to assess whether to refuse to register applicants who have a criminal history.

Under the Act, RECO can refuse to register an applicant who cannot reasonably be expected to carry on business in accordance with the law, and with integrity and honesty. However, RECO does not have a formal policy, guideline or process to assess whether an applicant with a criminal charge or conviction is fit to conduct business in the real estate profession in accordance with the Act. We reviewed a sample of 25 brokers and salespersons whose applications were approved by RECO in the last three years who had self-disclosed a criminal conviction or charges in their application. In 20 (80%) of these cases, RECO did not have a documented rationale for why it did not pursue action to refuse or revoke a registrant’s registration. These cases included individuals convicted of serious crimes including fraud, physical violence such as assault and assault with a weapon.

–

Lack of exam protocols contributed to a major breach in the integrity of exams offered in the real estate education program.

We found that despite major breaches in the integrity of real estate exams administered online by Humber College in April 2021, September 2021 and March 2022, RECO has not

taken steps to independently verify whether the issues that led to the breaches have been satisfactorily addressed. To date, Humber College has notified RECO of 356 cases of large-scale, deliberate and organized misconduct involving 315 learners. These breaches occurred after exams were moved from in-person to virtual without adequate controls in place to protect the integrity of the examination process.

–

RECO does not review and monitor whether inspections of brokerages are carried out consistently and effectively.

The proportion of inspections that identify instances of non-compliance varies significantly between RECO’s five inspectors, ranging from a low of 29% of inspections in the case of one inspector, to as high as 82% in the case of another inspector.

–

RECO rarely follows up on violations found during inspections to confirm they have been corrected.

In 88% of the 2,643 inspections completed by RECO between 2017 and 2021 where violations were identified, we found that RECO’s inspectors closed the inspection file without referring the brokerage to the investigations department or conducting a follow-up inspection to confirm that the violations had been corrected. These inspections identified significant violations, including shortages in the brokerage’s real estate trust account where client deposits are held, and employing unregistered salespersons.

–

RECO does not check if salespersons and brokers are disclosing accurate information in property listings.

In our review of inspection files and discussions with RECO’s inspectors, we found that although RECO’s inspection process includes reviewing whether a brokerage’s advertising is compliant with legal requirements for accuracy, it does not require its inspectors to review and verify the information included in property listing to determine if the selling agent took reasonable steps to ensure its accuracy. Buyers rely on the accuracy of key information about a property to make purchasing decisions.

–

The real estate sector rarely reports cash and suspicious real estate transactions as required to the federal agency that monitors money laundering.

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) received zero reports of large cash transactions between the 2017/18 and 2020/21 fiscal years, and just 18 reports of large cash transactions in 2021/22, from real estate brokers and salespersons. A number of reports commissioned in recent years by the government of British Columbia repeatedly highlighted the risk of money laundering in the real estate sector and the need for stronger enforcement. Given Ontario’s large and lucrative real estate market, it is highly likely that money laundering activities are occurring in this sector in Ontario but remain undetected.

–

Lack of transparency in real estate transactions involving multiple offers puts prospective buyers at financial risk.

Under the Act and its regulations, when there are competing offers on a single property, a brokerage that represents the seller must disclose the number of competing written offers to every person making a competing offer but is prohibited from disclosing the substance of competing offers on the property, including the offer price, closing date and conditions to any person including other salespersons or brokers that represent prospective buyers. This is supposed to result in all interested buyers submitting offers to purchase a property without knowing any information about the content of competing offers from other interested buyers. This practice increases the risk that buyers can overpay for a property by offering a price that far exceeds the next highest offer.

–

RECO’s ability to review allegations of fictitious offers on properties is limited

The Ontario government introduced legislation in 2013 to make changes to the Act, and made changes to Regulation 579/05 in 2014, to require that all offers for a property be made in writing and that all brokerages acting for a seller must retain for at least one year all copies of offers received. These changes were made to prevent a salesperson or broker from making false or misleading claims about competing offers in order to pressure buyers of real estate to act quickly or inflate their offer prices. Although RECO has the authority under the Act to review allegations of fictitious offers, the Act does not require brokerages to retain original offer documents but instead permits brokerages to simply retain a summary of each unsuccessful offer. This summary is not required to include the offer amount or any conditions the buyer includes in an offer. Without this information, RECO’s ability to assess whether an offer is a real offer from a legitimate buyer is limited.

–

RECO does not follow up on brokerages it knows are holding unclaimed consumer deposits.

RECO does not have a process in place to require brokerages to periodically report the number and amount of unclaimed consumer deposits held in a brokerage’s trust account. Instead, RECO relies on brokerages to voluntarily comply with the requirements of the Act to remit to RECO any unclaimed consumer deposits that have not been returned to a buyer or seller after two years. We found that over the last five years (2017–21), RECO’s inspectors issued 599 non-compliance notices to 491 brokerages for failing to remit unclaimed consumer deposits to RECO. However, even after issuing these non-compliance notices, RECO did not take any action to follow up and collect the unclaimed consumer deposits.

–

RECO does not currently have general authority to collect transaction data from brokerages, limiting its ability to effectively regulate registrants and identify consumer risks.

In the absence of such information, RECO currently faces challenges in providing evidence-informed policy advice to the Ministry to address emerging risks to consumers. For example, RECO cannot produce detailed analytics to identify the prevalence of trends in real estate transactions that may pose a risk to consumers such as unconditional offers, transactions where a single salesperson represents both the buyer and the seller, and transactions that may involve fictitious offers.

–

Majority of Ontarians surveyed are not aware of RECO and the consumer protections it offers.

RECO’s efforts to inform prospective buyers and sellers about its role under the Act have not been effective, and there is no requirement in place for registered brokers and salespersons to inform buyers and sellers of services available through RECO. For example, RECO administers an insurance program where consumers can make a claim against a salesperson or broker in the event of an error or omission. About 89% of Ontarians surveyed by RECO in 2021 indicated that they were not aware of RECO and the protections it offered to real estate buyers and sellers, and 65% of Ontarians surveyed by RECO did not know that real estate brokerages and salespersons were regulated by RECO.

–

Although RECO’s role is to protect consumers, its Board is composed mainly of real estate industry representatives.

At the time of our audit, only two of the 12 directors on RECO’s Board were not registered members of the real estate industry. RECO’s Board is required to have an advisory process for direct input to the Board on issues of importance to consumers. However, we found that for most of RECO’s existence, it has not had a functioning process to do so.

–

The Ministry does not collect sufficient information to monitor and assess RECO’s performance in meeting its mandate.

We found that RECO has not established performance indicators for key areas of its operations including areas where our audit identified significant operational issues such as whether all registered brokerages are inspected over a specific period of time and whether registrant misconduct is investigated within a targeted time frame.

The “conclusion” is the best part:

Our audit concluded that RECO has not been fully effective in administering the Real Estate and Business Brokers Act, 2002 to protect the interests of consumers when engaging in a real estate transaction in what is usually the single biggest purchase of their lives.

–

This is going to mean different things to different people.

Some, like me, will cynically respond with something like, “Oh, lookie here, you mean another wing of the government isn’t being effective? Well, imagine that!”

Others will suggest that the whole real estate industry needs to be burned to the ground, and choose to ignore the report, the findings, and the recommendations.

The problem is that “protecting the interests of consumers” is so incredibly broad that even the findings of a 54-page report, divided into sections, isn’t the baseline for that conclusion.

I found the report to be exceptionally thorough, but the one thing missing was a discussion between the Auditor General and experienced agents in the business.

I know that the AG’s job has more to do with an analysis of financial responsibility, but they are concerned with consumer protection. And there’s a lot to learn about what’s wrong in the industry, and what RECO isn’t doing or could be doing better, from speaking to agents.

A few years ago, I received a call from a firm that was hired by the Ontario Real Estate Association that was tasked with determining what OREA should do with the stockpile of money they had. When OREA lost education (which RECO awarded to Humber College), OREA had all this cash that they didn’t know what to do with. The poor woman on the other end of the line didn’t know who she was calling! When I said, “Just how anonymous is this, and can I be brutally honest with you?” the woman didn’t know what was coming! I swear, I kept her on the phone for an hour. And that’s after she asked me for “five minutes of my time to complete a survey.”

I’m not suggesting that every word from my mouth is gospel, but I certainly have made a living and a name for myself by calling out the practices in my very own industry! I was more than happy to share this with her, in hopes that OREA could find a way to spend that money to better the industry and protect and empower consumers.

I applaud the Auditor General’s value-for-money audit of RECO and I look forward to seeing RECO enact meaningful change in the way they conduct business.

Now, on a more interesting note: the November TRREB stats should be released in the next couple of days. If we get them by Sunday, I’ll write my monthly blog post and we can analyze and dissect the figures.

For now, does anybody want to opine on what the November average TRREB home price will check in at?

Higher or lower than October’s $1,089,428?

Appraiser

at 8:01 am

I would describe the audit report as fair and robust. Certainly far short of scathing.

Many of the noted shortfalls are no doubt due to staffing and budgetary constraints.

Keeping an eye on everyone requires a lot of eyeballs.

I predict the average price will be slightly lower than last month.

Marina

at 8:22 am

Are realtors afraid of any of these “regulatory” orgs? Like, can they really do anything?

Because without fear a lot of those boards are largely meaningless.

At a bank, you mention that OSFI is getting involved, and all sphincters tighten.

JF007

at 8:34 pm

“ For now, does anybody want to opine on what the November average TRREB home price will check in at?”—- Higher by not much though

Ace Goodheart

at 9:58 am

November TRREB average home price:

Looks like a buying opportunity.

Both the BoC and the Fed have been unusually open about their plans. It would seem that 5 year rates are now slightly over priced at the big 5 (particularly variable).

Of course, there is always a chance that the guy who runs the “Young Communists of Canada” website (“generation squeeze” I think he calls it) gets some traction with Trudeau (unlikely though as T2 has so many rich friends whose family seats would be heavily impacted by the communist housing equality tax levy).

To me, it looks like a buying opportunity.

Ebdaa

at 3:29 am

It’s really good information for those people who take interest in real estate. These days more and more people are taking interest in the property because in this business the profit level on the highest peak. Thank you very much for sharing this article. Ebdaa Developments