I got married back in June of 2013. An utter lifetime ago, based on the last seven years, but I think just about anybody can tell that tale.

A tale that (hopefully!) most of you can’t tell is the following…

We can probably all agree that many men don’t really care what they wear to a wedding, right? I suppose I didn’t get the fashion gene, but in any event, I’m really all not that fussed about what I wear to a wedding, and that included my own.

Ladies? That’s another story!

At the risk of sounding sexist here, I do believe that women inherently care more about their appearance and spend more time and planning than men, and depending on the level of involvement in the wedding, one woman might care a lot more than the next.

Like, for example, the mother of the bride?

The mother of the bride is an important role in any wedding and is a person who will attract a lot of attention over the course of an evening. I think it’s fair, therefore, to suggest that any mother of the bride takes great pride in how she presents, whether it’s her makeup, her hair, or her dress.

The mother of the bride may spend just as much time “saying yes” to the dress as the bride herself.

So imagine the ruckus that ensued at our wedding, when my mother-in-law appeared in the exact same dress as another guest!

Egad!

Another guest? You mean, like, a random attendee, seated in the 26th row of the ceremony, and buried at the back during the reception?

No. Unfortunately, not.

I mean, like, my mother-in-law’s dress was matched exactly by the last person at the event that she’d want it to be: my wife’s step-mother.

Imagine my wife’s father, right? His wife and his ex-wife, wearing the same dress. He just had to laugh!

But for my mother-in-law, it was a disaster. Whereas you or I might focus on the irony, the odds, or the hilarity, she felt cheated and upset.

To each, their own.

She had every right to feel slighted, even if there was no true material loss.

In real estate, on the other hand, wearing the same dress to the big dance as your best friend or nemesis from the other homeroom class can cost you big-time.

Consider the sale of your home and just how much work goes into it. How many weeks do you spend preparing? How many car-loads do you take to the dump, or the storage locker? How long did you spend painting, repairing, and getting ready for the stagers?

All that work, often upwards of a couple of months, and you’re finally ready!

Your scheduled listing day comes along, and you walk outside to get an up-close look at the “FOR SALE” sign on the lawn.

It looks amazing!

Except that……….wait……………what?

Your next-door neighbour has a “FOR SALE” sign too!

What are the chances?

It’s like………well…….maybe showing up at a wedding, and finding that your ex-husband’s new wife is wearing the same dress?

Yeah, I’m sure there are other analogies and examples, but none nearly as fun!

Folks, this happens a lot more than you might think. Over the years, I’ve taken screen-shots on MLS countless times of 198 Main Street being listed on the same day as 196 Main Street, and each time, I wonder, “How did this happen?”

Is it luck? Irony?

How did one neighbour not notice their next-door neighbour boxing up items, backing up a moving truck, setting up a lockbox, and what about the day that stagers arrive and make a mess of furniture on the front lawn? Isn’t that a give-away?

Or maybe, just maybe, some neighbours talk to one-another? About life, plans, and housing?

Who knows. And who am I to say?

But I always remain surprised when I see two neighbours listing on the same day.

In a slightly different version of the same thing, what about the same identical units being listed for sale in a condo townhouse complex?

It’s been known to happen. In fact, it’s been happening for the past week, and I’ve been watching!

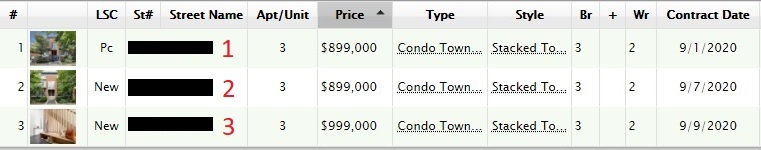

You know by now that TRREB and RECO rules prohibit me from “advertising a competitor’s listing,” but also “disparaging a competitor’s listing,” even though speaking openly and accurately about a listing may not be considered disparaging, but I digress. So for the purposes of this blog, I’ll refer to the listings simply as 1, 2, and 3.

Unit 1 was listed on August 26th for $999,900 with an offer date of August 8th.

Unit 1 was then re-listed on September 1st for $949,000, before being reduced in price to $899,000.

Then on Monday, September 7th, Unit 2 was listed for sale at $899,000, but also with an offer date, this one for Monday, September 14th.

Unit 1 was reduced in price on Monday, September 7th to $899,000.

Then on Wednesday, September 9th, Unit 3 was listed for $999,000, with an offer date set for Tuesday, September 15th.

Here’s the three listings together for you visual thinkers:

So we have three units, all essentially the same properties, listed at the same time.

Not exactly an enviable position to be in, if you’re the seller, right?

Unit 3 is the same layout, but with substantial upgrades, according to the listing. They’re also advertising this unit as larger, even though previous listings show it as the same size, and the maintenance fees are identical to Unit 1 and Unit 2.

What do we make of the pricing here?

And please, stay with me. Don’t skim this! You need to be in tune with what’s going on, every step of the way, to fully grasp what’s happened here in the last two weeks.

Unit 1 was listed at $999,900 and held back offers. Is that nuts? Did they think they were getting more than $999,900, especially considering that Unit 2 listed thereafter for $100,000 lower, with their own offer date>

Unit 1 re-listed lower at $949,000, so clearly they knew they were over-priced. But over-priced and with an offer date, was surprising. Unit 1 eventually came down to $899,000 as you can see above.

But why then, did Unit 2, also follow suit with the same pricing strategy? Why did they come out at $899,000, with an offer date, when Unit 1 did that and failed?

While all this was going on, of course, Unit 3 was being prepared for sale.

Having seen all of this, what did the owners of Unit 3 do?

They priced even higher!

Oh, and also with an offer date.

Let’s fast-forward one week and see what became of the three units:

In case you’re not an MLS aficionado, I’ll explain – “Ter” means the listing was terminated.

Not even Arnold Schwarzenegger saw this coming.

How in the world could all three properties fail to sell?

Or perhaps we should be asking how in the world all three owners could make the exact same mistake, in succession?

Just think about this…

Three cows are standing in a field grazing, and the first sees some fresh hay – over there.

Unbeknownst to that cow, there’s an electric fence over there.

The cow makes a move for the hay, and gets shocked.

The other two cows are both watching, and yet the second cow does the exact same thing; he moves his delicate little snout toward the fresh hay, and gets shocked by the electrified wire.

Then, after watching the first two cows get shocked, the third cow takes his turn, follows suit, and gets shocked.

Use cows and an electric fence, or kids touching the red element on the stove, or lemmings falling over a cliff. But however you want to look at this, and whatever analogy you want to use, the point will fail to be driven home. Or at least, it shouldn’t be.

This is hindsight speaking, and some of the regular blog trolls will take issue with that. But I’m fascinated with how all three properties were listed in the same way, one-by-one, and all three failed to sell.

So how do the three listings look now?

Different order, but I’m sure you can do the math here…

Unit 2, which was listed at $899,000 with a holdback on offers, was terminated, and re-listed at $979,900.

Unit 3, which was listed at $999,000, with a holdback on offers, was terminated, and re-listed at $1,098,000.

But the absolute best is Unit 1, which was listed at $999,000, with a holdback on offers, then terminated and re-listed at $949,000, then reduced to $899,000. Because after Unit 2 raised their price, and Unit 3 raised their price, Unit 1 basically said, “Well, if it’s going to be that kind of party….” and subsequently raised the price to $939,000.

That last one makes the least sense.

Not that I understand the original $999,000 list price with the holdback on offers, but after reducing to $949,000 and then $899,000, each time, failing to secure a sale, why raise the price to $939,000?

Now, for those of you playing along at home, you’ll notice that there’s a fourth property there at the bottom, listed at $998,000.

This is a different layout than the first three, and is actually larger, but one level is below-grade.

Call this one “Unit 4.”

After watching Unit 1, Unit 2, and Unit 3 all list low with an offer date, and all fail to sell, then come back on the market higher, what’s the strategy here? What is Unit 4 doing?

Well, Unit 4 is taking offers on September 24th.

This reminds me of that computer game when we were kids – the lemmings jumping over the cliff, one by one.

Folks, I don’t have an answer here as to how this should be done, but I certainly know that what’s already taken place is not the way! While I’m sure there are differences in finishes between the units, they’re all essentially the same. So where was the intrinsic demand for one unit, above another, that would organically push the market $100,000 over the asking price?

It was never there.

It couldn’t have been.

From the minute that Unit 1 failed to sell with that under-list strategy, Unit 2 was doomed.

Having seen Unit 1 fail, and Unit 2 take the same strategy, it shocking to see Unit 3 follow suit with the same strategy two days later.

And now that all three have been re-listed, why, oh why, did Unit 4 play copycat?

Merely for me to ask, but not answer.

There are some really odd things happening in the market right now.

A semi-detached on the east side, listed at $1,089,000, and for all intents and purposes “worth” around $1,250,000, received a bully offer on Thursday and sold for a whopping $1,370,000. It absolutely obliterated the previous record for similar homes, and just shocked the hell out of us.

One of the agents on my team lost in multiple offers on a small, 1-bedroom condo last night. Wasn’t I just lamenting the tepid feel in that market space? How did multiple offers ensue?

Everywhere you look right now, there’s a lack of predictability in the market.

It gives those four sellers of the condo townhouse above an instant excuse, since, “Who the hell knows what’s going to happen?”

Now is the time to be more diligent than ever, and that requires a hell of a lot more work. But for some folks out there in this fall market, it’ll be well, well worth it…

Bradley

at 8:12 am

David were these townhouses in a stand alone complex? Or part of a larger condo tower complex?

Francesca

at 8:24 am

This scenario reminds me of when we sold our stacked townhouse in 2009 when the market was a buyers market. We listed our unit only to have three doors down list The exact same unit three days later. Ours was competitively priced and more upgraded inside despite the identical layouts. We sold ours in a week and the other unit which was priced 45k more than ours took four weeks to sell and they ended up getting 20 k less than we got! To me it was a prime example of not accepting what the unit was actually worth in the current market. We were worried about having competition but it worked in our favour simply because of how we priced in relation to them.

Appraiser

at 8:55 am

I don’t think Evan Siddall will be quoting the Teranet HPI report today, so I will do so on his behalf:

“The August composite index was up 5.7% from a year earlier, an acceleration from July…

…As the table at the end of this report shows, the indexes of 30 of the 31 metropolitan markets surveyed were up on the month in August, the exception being Calgary. It was the strongest diffusion of monthly gains since 2009, i.e. over the whole period for which we have indexes for all 31 markets.” https://housepriceindex.ca/2020/09/august2020/

Verbal Kint

at 1:12 pm

So first I was like “don’t ever purport to do ANYTHING on Evan Siddall’s behalf.”

But then I was like “if you can’t be germane, or nuanced, at least you can be funny!” Progress!

P.S. Nice math in the comments on Wednesday’s post. 4/3 ≠ 3/4. We’ll chalk it up to the booze.

Chris

at 5:11 pm

Seems it would be wise for one to double check they have correctly calculated their rudimentary maths, before launching into accusations of delusion.

Appraiser

at 6:37 pm

It’s the weed.

Appraiser

at 7:11 pm

P.S. Siddall said the market would go down -18%

CREA says it went up+18%

What’s the math on that?

Chris

at 7:37 pm

You mean CMHC? Or do you also think Siddall personally created the organization’s forecasts? It was also for the next 12+ months from the forecast date, so maybe be a bit patient before declaring it completely missed the mark.

And my money is on Siddall at least being able to divide correctly.

Appraiser

at 9:01 am

Great time to be renewing a mortgage. Rates just keep on dropping.

“A widening of the prime – BA spread usually correlates with improving variable mortgage discounts and this time is no exception. We suspect we’ll see prime – 1.00% (1.45%) rates again as soon as October or November.”

https://www.ratespy.com/were-floating-closer-to-prime-1-00-091815917

Appraiser

at 10:45 am

“The number of Canadians working from home declines for the fourth consecutive month.

in April, at the height of the COVID-19 economic shutdown, 3.4 million Canadians who worked their usual hours had adjusted to public health restrictions by beginning to work from home. This number has fallen each month since May, when the gradual easing of public health restrictions began, and reached 2.5 million in August.”

https://www150.statcan.gc.ca/n1/daily-quotidien/200904/dq200904a-eng.htm

Bal

at 11:54 am

oh okay…then no chance for house prices to come down….