This story is going to incorporate so many different themes!

Exciting!

We’ll look at the risks of pre-construction “investing” being put on full display.

We’ll look at the intersection of greed and entitlement.

There’s sort of a wilful ignorance theme happening.

And then we’ll call into question this odd practice of assigning a higher value to real estate that is seemingly the same as its counterpart, except newer.

Last week, I was down in Liberty Village evaluating a property for a young couple who wants to sell and move out to the ‘burbs.

They purchased this property two years ago but are already feeling the itch.

A house is calling to them! A house with a backyard for the dog, multiple bedrooms for the future kids, and only a handful of other properties within their eye line, rather than the thousands of condos they can see from their living room window.

Based on what they paid two years ago, plus land transfer tax, plus real estate fees, plus legal fees, et al, they’re likely looking at a net loss. A small one, but a loss nonetheless.

But they understand that. It’s the cost of doing business. And above all it’s the sign of a market.

I evaluated their condo for around $900 per square foot which I think is great value for a buyer, given what the average price per square foot is in the downtown core.

From their dining room window, I can see a newer building right across the street; one which replaced the hole in the ground that stood in its place back when this couple purchased their unit two years ago.

Purely from a curiosity standpoint, I decided to look into the prices in this building, since it’s the newest building in the area. What I found was downright shocking, and it makes absolutely no sense.

Or, it makes absolutely perfect sense.

You will soon decide.

When a building is first “registered,” you’ll see a flood of condos come onto the market. Investors look to sell at the earliest opportunity, and although an “assignment” is the earliest opportunity, that’s flipping your paper. Selling a condo that you actually own is something different.

There are currently nine units for sale in the building.

Maybe that’s not as many as we could have expected, but I think there’s a reason we haven’t seen more.

The first thing I did was go into the MLS archives and see how many units have been listed and how many have sold.

There are 23 previous listings in this building.

Guess how many of these listings were sales?

Zero.

So the first realization I had was that no condo in this building has ever sold on the resale market.

Alright.

Then I looked at the nine units that were for sale.

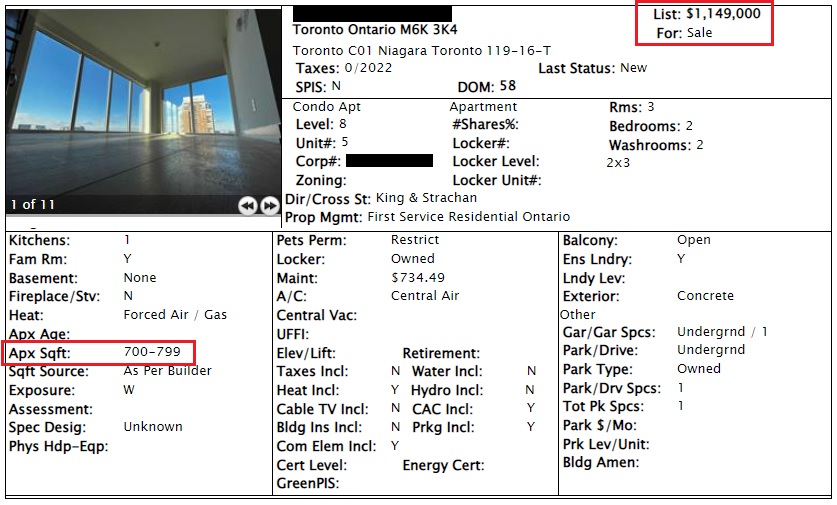

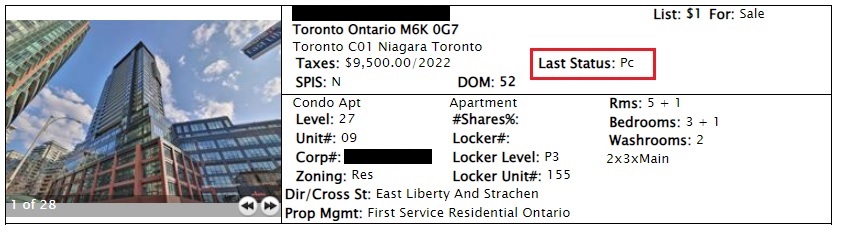

Here’s one:

Another disclaimer: due to RECO’s rules about “disparaging a competitor’s listing” and “unauthorized advertising,” I have to blur out the addresses. Even though every young agent in the business has no problem filming TikTok’s in other agents’ condos without asking permission (or forgiveness…) I think I have to at least pretend as though I’m adhering to the rules, even though y’all could figure out where this is…

Moving on then…

Does the price and the square footage make any sense to you?

$1,149,000 for something in the 700 square foot range?

This unit is 756 square feet, meaning the asking price is a whopping $1,520 per square foot.

Yes. To live in Liberty Village.

And you don’t need to spend $1,520 per square foot to get into a 2-bed, 2-bath in the area.

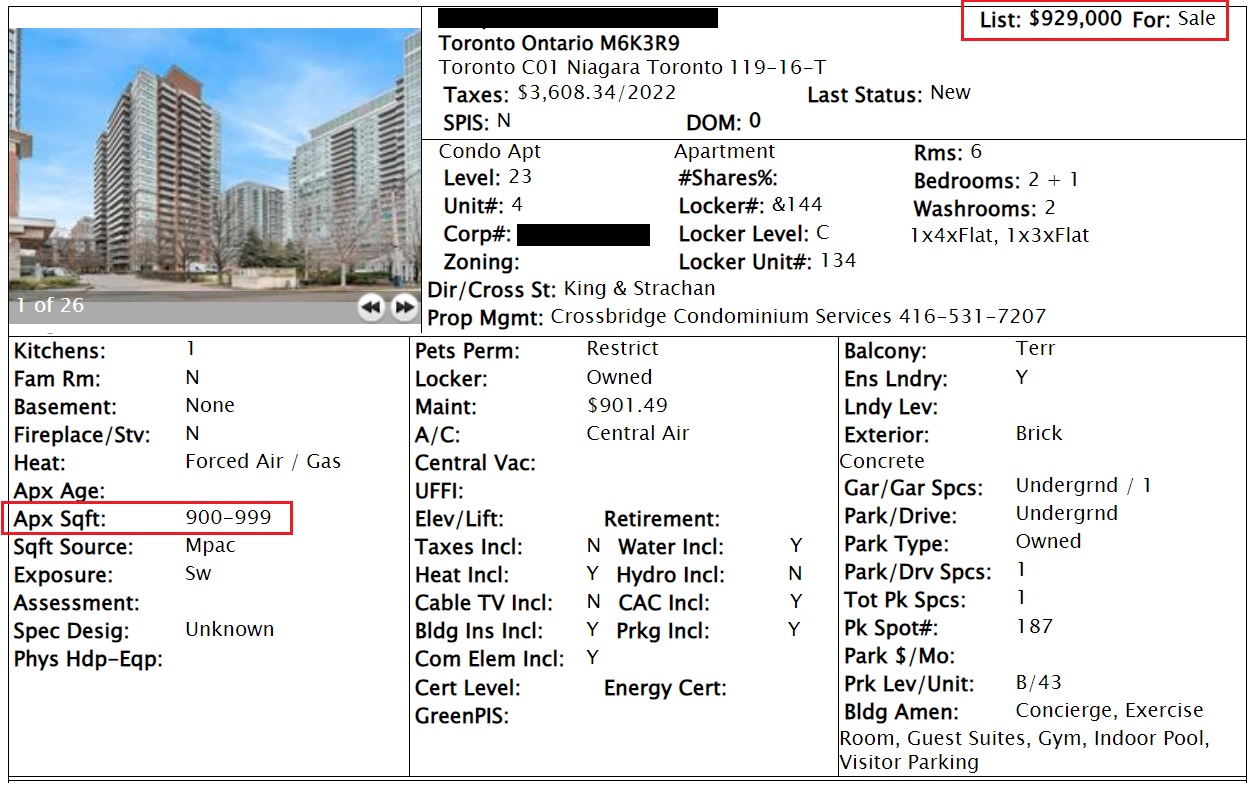

Here’s a unit listed for $935 per square foot just two buildings over:

Tell me that building is older, fine.

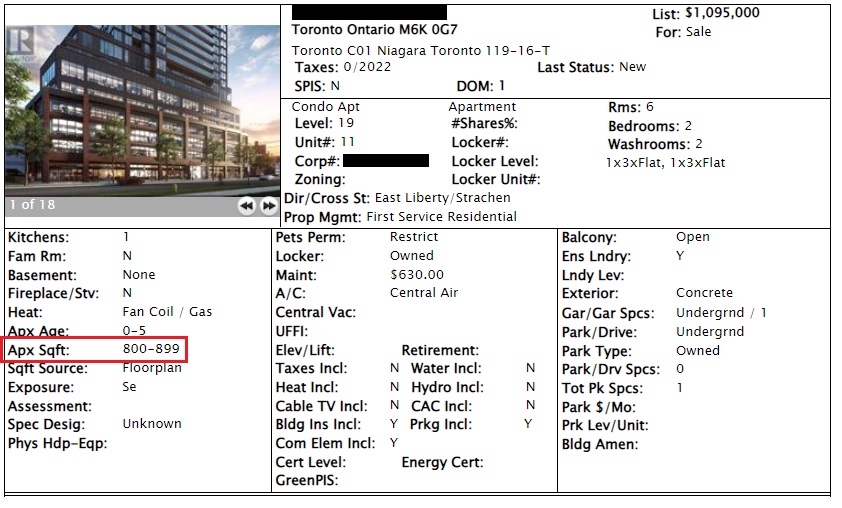

But here’s a one-year old building with a 2-bed, 2-bath up for $1,119 per square foot:

It’s just not even close to $1,520 per square foot.

Now, consider that my clients across the street are going to be selling for something in the low-$900’s per square foot, as are the folks with the unit currently listed above for $935/sqft, and suddenly our first theme is apparent: newer is better in Toronto!

But is it?

Is a 2022-built condo that much better than a 2010-built condo?

If we were looking at two houses, one built back in 1924 and one built in 2022, clearly we’d see the difference, not just in terms of the finishes but the build itself.

But I’ve never understood Toronto’s obsession with the new-factor, and there’s just no reason why a 1,000 square foot condo should be selling for $900,000 and a 1,000 square foot condo right next door should be selling for $1,500,000.

Now, you might also have noticed that the maintenance fees here are $734.49 for 756 square feet, or $0.97/sqft. For a brand-new building, that’s quite high! Just another red flag here on my journey…

I looked at the asking prices of the nine condos, er, um, eight, because one of the asking prices makes no sense – BUT MORE ON THAT LATER – and then I noticed a very strange pattern.

The asking price per square foot of each unit:

$1,266

$1,546

$1,138

$1,502

$1,109

$1,557

$1,520

$1,103

Notice anything odd about this?

I certainly did!

Look at those PPSQFT’s again and tell me what you see.

For those reading quickly, let me show you what I noticed:

$1,266

$1,546

$1,138

$1,502

$1,109

$1,557

$1,520

$1,103

There are four units with astronomical asking prices, on a per square foot basis, whereas the others are substantially lower.

Now, whether or not it makes sense to pay even $1,109 per square foot when you can purchase across the street in a slightly older building for $900 per square foot is still a conversation to be had. Especially when the fees in the newer building are $0.97/sqft and in the older, established building are $0.69/sqft, in addition to many other reasons.

But whether or not it makes sense to pay $1,520/sqft compared to $900/sqft, well, I think we’ve come to the conclusion that it doesn’t.

So what’s the pattern here, folks?

Why are some of these units priced so much higher than the others?

I looked and looked for a pattern but I couldn’t find one! Is it the layout? The finishes? The views? Multiple parking spaces?

What could it be?

Then finally I noticed who is selling each unit, and a pattern was identified:

$1,266 – builder

$1,546 – owner

$1,138 – builder

$1,502 – owner

$1,109 – builder

$1,557 – owner

$1,520 – owner

$1,103 – builder

Ah, right!

And why in the world are the owners asking such high prices?

Well, because they “need” to.

This condo was registered a couple of months ago. That means the folks in here have been waiting and waiting to get their units to market so they can “cash out.”

But when the market began to change in mid-2022, these folks failed to adapt.

In fact, they failed miserably.

It’s probably wilful ignorance more than anything. It could be an entitlement. It could be arrogance. It could be greed, except I don’t think it is. I think in order to be greedy, you have to be somewhat rational and logical, and these folks have simply chosen to ignore anything happening around them.

Had this building been registered in January of 2022, and had these units come onto the market in February of 2022, I still don’t think they would have sold for $1,500/sqft. That price is absolutely insane.

But in January of 2023?

It makes no sense.

When this happens, I always make a comparison to the stock market.

Let’s say you bought a stock for $42.

Then it went up to $54.

Then it went down to $44.

The chart would look something like this:

Free coffee to whoever can tell me what stock that is, btw….

If you were looking to sell that stock today, with thousands of other stocks trading, and millions of shares of this stock trading, at what price would you put in your order?

Probably at $44, right?

But what if you put in your order at $58?

That would be off the charts, right? Pardon the pun, but I’m entering the dad-joke phase of life now…

In the stock market, this would be silly. Nobody would do it. It would be a waste of time.

But in the real estate market, it’s totally normal.

What’s also normal, it seems, is for sellers in this situation to start taking liberty with the accuracy of their offerings.

Case in point, this unit:

What’s the problem with this listing you ask?

Well, the condo is 729 square feet.

And they have checked the box for 800-899.

Sure, why not?

Dance like nobody’s watching, because trust me – nobody is watching this unit at over $1,500/sqft!

Desperate times call for desperate measures though, and one particular unit owner has either become very desperate, or very savvy, or very naive.

Which one?

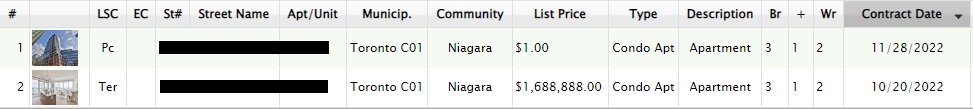

Well, remember when I said that there were nine units for sale but only eight prices that I would display?

That’s because while we’re calculating price per square foot,” I didn’t feel the need to include this one:

Wow, a dollar?

I might buy a whole bunch of ’em then!

Yes, this unit is actually listed for one dollar, and it’s so stupid for so many reasons.

First of all, there’s an offer date, obviously:

I absolutely hate when people say “motivated seller,” especially in the midst of a moronic pricing game that will not result in a sale.

But seriously, just how dumb is this?

Do the listing agents and the seller think that buyers are going to line up to “bid” on this unit?

And if so, how much?

This would be really stupid, if not for the fact that they already listed this for $1,688,888 last year. And that’s what makes it really, really stupid…

Those are the two listings above.

One for $1,688,888 and one for $1.00.

One listed on October 20th, 2022 and one listed on November 28th, 2022.

But……….wait.

Hang on.

Hold the phone.

Do you see what I see?

Do you also see the “PC” for the $1.00 listing?

Oh my, they did it. They really did it. This changes things. This takes us from really stupid, to really, really stupid, into the level of really, really, really stupid.

Check this out:

This property was listed for $1,688,888 in November.

It’s been on the market for 52 days.

They wanted to list for $1.00 and have an offer date.

But they didn’t “list” the unit. Er, they didn’t “re-list,” ie. terminate the existing listing and then start a new listing at $1.00.

These guys just changed the price!

Let me explain, for those who aren’t already facepalming.

If a tree falls in the woods and nobody is around to hear it, it does make a sound. But nobody hears it. That’s the point of that riddle.

So if you’re an agent or a seller who wants eyes on your listing, a “new” listing might get 100 eyes for every one eye that a “price change” gets.

This means if you’re going to do something as ridiculous as listing at $1.00 with an offer date, you need people to see the listing! You need this listing to show up as a “new listing” on MLS, and then on House Sigma, and Zillow, and every other real estate site out there.

But my merely changing the price from $1,688,888 to $1.00, nobody is going to see it.

So this pointless exercise has become even more pointless, if that’s even possible.

And we haven’t even got to “offer night” yet, where presumably, somebody offers $1,400,000 and the listing agent says, “Oh, no, sorry, this unit is worth way more than that,” and then rejects the offer, terminates, and re-lists the next day at $1,688,888.

Of course, that offer isn’t coming, for many reasons.

But it’s moot.

As are all these listings that are coming out at over $1,500 per square foot.

Look, I know I might sound like an asshole for failing to express sympathy for those who bought at inflated pre-construction prices and merely assumed that they would receive their financial windfall in 4-5 years, but there’s a reason I have never sold a single pre-construction condo in my entire career.

The real estate market is a market, and many people conveniently forget that.

If you purchase a single share of stock, you can sell it today, tomorrow, or the next day.

If you invest in a private equity vehicle that specifies you can’t touch your principal for seven years, it’s a completely different investment.

When you purchase a resale condo, you have liquidity. When you purchase a pre-construciton condo, you don’t. In fact, you’re locked in for 4-5 years until such time as the condo is complete and you can sell – after the occupancy period, which can be up to two years, by the way.

I don’t know what the break-even point is for the five people who have their resale condos listed in this building, but if it’s $1,300 or $1,400/sqft, I can’t fathom why they’re listed over $1,500/sqft. That combines all sorts of entitlement, greed, and wilful ignorance.

But more to the point: it’s a great example of individuals failing to adapt to a changing market…

Francesca

at 8:14 am

With the rental market at an all time high wouldn’t it be a better decision to rent out the units until the market regains value? However as you mentioned David even with last years prices it makes no sense to pay so much per square footage when older buildings in the area cost so much less. This is why I don’t understand why people are buying pre construction now unless they intend to rent out or live in long term. The times of buying like this and flipping for a profit are long over. I understand that building a condo costs more money now and the developer needs to make a profit and people need somewhere to live ( with all our talk about lack of supply) but it seems absurd to pay so much when cheaper alternatives do exist. Your clients should have no problem selling their place if they are competing with these sellers in these brand new buildings.

Steve

at 10:53 am

Potentially, but now someone who may not have wanted to be a landlord in the first place is a landlord and of course also has to figure out how to get a tenant back out again in the future if they want to sell whenever the market turns.

Nobody

at 1:56 pm

It can make sense if you don’t have cash/credit quality to buy today but have a VERY good reason to believe your income, assets, and credit will be better in the future. Say you just aigned an offer to work at Osler as a new lawyer, or are a surgical resident.

You have a negative net worth and little cash on hand but in 4 years will be in a very different place. You’re worried real estate prices will be even dumber in 5 years.

I think it’s a dumb trade because of the risk, inherent leverage, and obligations to close. Tons of people made money doing it and scared the hell out of lota of young people so they got fomo but it’s all picking up nickels in front of a steamroller.

Financial markets use that steamroller aphorism because it happens regularly – people see “free” money and ridicule other more experienced/sophisticated/cautious investors. People brag about their lambos then they blow up and go bankrupt wailing “who could have known???!!” See FTX, Genesis, Voyager, Bitcoin in general, NFTs, infinite number of different carry trades over the years, Oramge County California in the 1990s, anyone trading Gamestop in last 2 years, etc.

Precon has been idiotic for over a decade, and David has the embarrassingly dated videos to prove that he’s been saying that for a long time! FOMO and never seeing an interest rate cycle for 30 years will do that.

f00kie

at 4:59 pm

@Nobody: “Precon has been idiotic for over a decade, and David has the embarrassingly dated videos to prove that he’s been saying that for a long time! ”

As someone that believed the RE market was overpriced back in ~2011, only to see everything continue to go up, I don’t know if I buy that statement anymore. Buying precon 10yrs ago would have netted a very healthy profit up to now. I intuitively agree that today’s precon prices of $1,700-$2,200 per sf in the downtown core seem very overpriced, but hey, I did say the same thing about prices 10 years ago, and here we are.

Condodweller

at 6:14 pm

by 2011 pre-con prices were already higher than that of existing condos and you would have been taking on the liquidity risk. The risk is the same then and now except the higher the prices went the higher the chances of prices going against you. Though the time to ownership would be similar.

Ed

at 9:57 am

Suncor?

Alex

at 10:24 am

“Even though every young agent in the business has no problem filming TikTok’s in other agents’ condos” hahahaha – so true!

Alex

at 10:28 am

The stock is Tesla

Condodweller

at 6:16 pm

Nah, Tesla would have been over $500 at the top even post split and it fell much more. The pattern looks like oil/natural gas pattern so I’d guess an oil/nat gas producer.

Ace Goodheart

at 11:45 am

Pre cons are basically futures contracts heavily weighted in favour of the builder.

I knew some folks who bought one as an “investment” (no plan to ever live in it, or rent it really, not sure what they actually wanted to do with it, they seemed to have been taken in by the brochure showing such a pretty little condo, and bought based on that). They were quite shocked to realize that, as their condo was close to the ground and finished first, that they had to pay rent on it, to the condo company, for quite some time, before they could actually close on it or occupy it, as the condo was not finished in general and they could not move in, but their unit was mostly ready.

Read the entire condo purchase contract and have a good real estate lawyer go over it with you. Don’t just sign these things.

JF007

at 3:10 pm

Pre-sale condos i feel long ceased to be a viable investment option if at all once the per sq ft rates started hitting bonkers category…if one is not able to flip them to another gullible soul investor will be stuck paying lots out of pocket even if the rents are higher..all the folks who bought at anything over $1000 p/sqft i feel will be in a world of pain for sometime to come..

that aside @David any thoughts or a blog or two on this sale by fraud trend starting to pickup in GTA..etobicoke house condos in downtown. would be interested to know your take and also what happens after..is the property really stolen or is there a recourse for the true owner..

Sirgruper

at 3:54 pm

Agreed. A blog on fraud and prevention on the real estate agents side would be interesting. Wonder how many times David was tried on for size.

The Owner can’t lose its title but has to go to court to get it back and discharge the mortgages. The Owner will not be able to refinance or sell in the interim. Title insurance protects the Buyer and the bank (probably) subject to their negligence in the case of the bank. Title insurance companies are asking more questions on closing and asking the lawyers if they know the clients, for how long and if they don’t they are investigating further.

I think with Zoom meetings and no physical contact, it has become so much easier and with little risk to do this. If someone catches on, the fraudster disappears. Real Estate Agents are first line of defence and its important that they take their ID seriously and also physically meet the Buyer and Seller. Once you do that, the fraudster will move to easier victims. I suspect that David has been contacted and his spidey sensed it asap.

Condodweller

at 6:08 pm

I never understood the discrepancy between similar condos but different ages (a few years) in the same area. I can think of several reasons why I would prefer a few year old condo. I used to live next to a building that was about 5 years newer and our units sold consistently lower. The only reason I can think of is if the newer building has newer/better amenities but even that wouldn’t be worth a large difference.