I remember an instance last year that underscores just how much markets can change, and just how little the participants can know about what other markets look like.

In one of our company meetings, an agent was announcing a listing he had and he said to the group, “…and the seller is willing to take back a mortgage if anybody has a buyer who’s interested.”

One of the younger agents said, “What does that mean?”

The listing agent said, “He would do a VTB.”

The younger agent then said, “What’s a VTB?”

You could feel the uneasiness in the room.

A lot of the younger and/or inexperienced agents also wondered what a VTB was, or what it stood for, but as the older and more experienced agents started to snicker, none of the inquisitive agents spoke up.

Our Broker of Record smiled and said, “Okay, okay everybody. This is a crucial moment for us all, so hang on…”

Personally, I learned what a vendor take-back mortgage was in business school, and from reading books on real estate when I was getting into the business. But I have never executed an offer with a vendor take-back mortgage, so I can’t blame many of these younger agents for not knowing what it is.

In our company meeting, the murmurs led to discussion, which led to stories.

“Vendor take-back mortgages were the norm back in the early-1980’s,” one long-time agent said.

“I was doing a ton of VTB’s in the 90’s,” another agent announced.

When the market changed in the spring of 2022 and interest rates began to rise, some people thought that it was time to get creative. The idea of a vendor take-back mortgage to me was still somewhat unnecessary, but not entirely out of the question.

I honestly hadn’t seen much in the way of unique mortgage offerings until a few weeks ago, or maybe a couple of months.

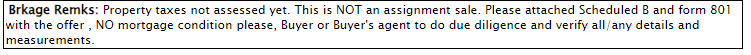

Then last week, I saw this on a listing:

![]()

Now, you might think that this is a case of the seller being opportunistic, and I wouldn’t disagree.

7% and interest-only payments? That’s not a bad place to have your money if you’re the seller of this property.

But it got me thinking: how prevalent is this in the market today?

So I searched the entire GTA market and simply looked for any listings with the word “mortgage” in the Brokerage Remarks field on MLS (which is not viewable by the public), and I found some very interesting offerings…

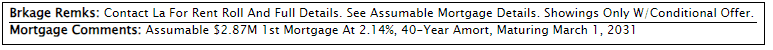

Here’s an investment property listed at over $4,000,000 that has an incredible mortgage offer associated with it:

Keep in mind, that this is commercial.

Commercial rates are higher.

So an interest rate of 2.14% that runs another eight years is an exceptional offering.

–

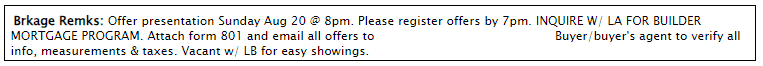

Here’s a new-build freehold where the seller is looking to get creative in attempts to pull in a buyer:

![]()

Would a lower rate be a huge incentive for a buyer?

Would a buyer choose this property with a 4% interest rate instead of a different property which would necessitate a 5.99% rate from a bank?

But what good is one year?

–

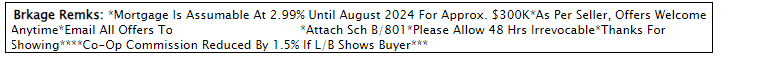

Here’s a nice rate:

But it’s only for another 12 months.

And only for $300,000.

So the buyer would have to do a “blend-and-extend” at prevailing rates, with the existing lender,” for anything over the $300,000 that’s left on the mortgage.

Is it worth it?

First of all, this locks you into one lender; the lender that has this existing mortgage.

Second of all, you’d have to qualify according to this lender’s criteria. There’s no guarantee here.

Assuming that a purchase today closes in two months, this really feels like a ten-month mortgage. I don’t know if it’s worth the hassle.

–

Here’s a similar rate, but with less information:

![]()

This is lazy.

Great that the buyer can assume a 3.12% rate, but is “1 year” exactly twelve months? This property has been on the market for a month, so is it now eleven?

And how much is on the mortgage?

Lazy.

If a seller is really interested in offering something valuable to the buyer, there should be a monthly mortgage amount, the balance on the mortgage, the interest rate, and the lender.

–

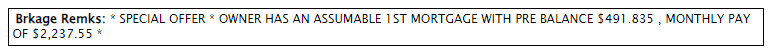

This one comes with more info, but still not everything we want to know:

Monthly payments of $2,237.55, great.

A balance of $491,835, outstanding.

But what’s the interest rate? Shall we get out the financial calculator?

–

This one is quite amusing:

![]()

It says that there’s a possibility to assume the mortgage, then mentions “See Mortgage Remarks.”

But the mortgage remarks are blank.

Where’s my emoji of a person shrugging?

–

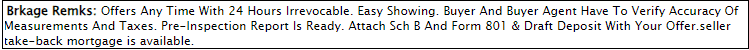

So now, let’s get into the VTB’s.

Here’s one offering, “seller take-back mortgage is available”:

Great.

But how much? What terms?

Come on!

This isn’t a case of making people call to inquire, but rather I think it’s laziness, and/or the seller doesn’t even know what he wants to do!

–

At least this one specifies an amount:

![]()

Up to $200,000. Great.

But “comparable interest rate to major banks,” so what’s in this for the buyer, exactly?

This makes zero sense.

–

This makes more sense:

![]()

“…below current rate.”

That’s usually the point of a VTB: to entice the buyer! Well, that is, assuming the property is a tougher sell…

–

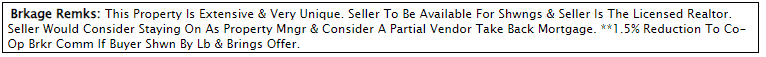

Here’s one where the seller doesn’t quite want to let go:

The seller is offering a partial VTB and wants to stay and manage!

–

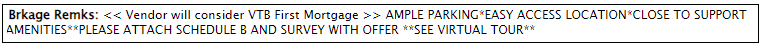

I’ve always hated the use of these < > arrows on MLS for no reason…

You’re offering a VTB with no terms. Great.

–

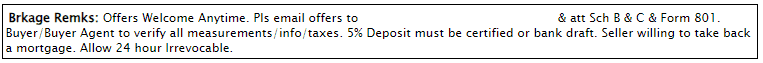

Just like this guy…

![]()

…and this guy…

![]()

…and this guy…

…and this guy…

There are too many of these to count.

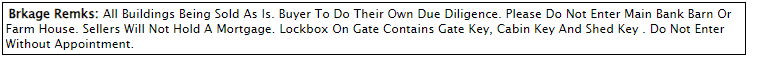

But this seller wants it to be clear that he or she will not consider a VTB:

Why the need to specify?

–

Heres an “attractive” one…

![]()

What an opportunity!

–

So now let’s get into some other mortgage offerings.

Speaking of “opportunity,” how about this one:

![]()

I have no clue what “mortgage pay down program” is, and I merely assume, since this is pre-construction, that it’s some gimmick that simply takes money from one pocket and puts it into the other, but I’m not interested enough to “ask for details.”

–

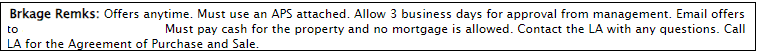

Imagine outright telling buyers, “no mortgage condition?”

Oh, wait…

Here’s a builder offering a “mortgage program,” but the listing has an offer date…

Quite odd…

–

Must pay cash?

This must be a co-op.

–

Is this offering a VTB? Or does the seller know people that know people that know people that get financing?

![]()

–

Well, folks, that’s all she wrote!

Have an awesome weekend!

Andrew

at 12:05 pm

Interesting photo choice today.

CA_Traffic

at 10:07 am

Noting that “12 months” from today isn’t actually twelve months of financing. By a year from now not only will the hiking cycle most likely be done, we there’s a good chance we’ll have seen a cut. (most market forecasts have been a bit too dovish on both the Fed an BoC so I don’t put much stock in the idea of an early 2024 cut, but by the summer it seems very possible)

QuietBard

at 6:45 pm

I’m surprised someone of your caliber has never been involved in a VTB. Maybe its because of your caliber you havent been involved in one. Well, one day you might be involved and thus a blog post will be born! Until then