Every single month, without fail, I receive a phone call or an email from a client asking about a recent correspondence with an existing tenant.

And what do these tenants want, you ask?

Rent reductions.

All of them.

What began during the pandemic last year when an unimaginable number of Torontonians found themselves laid off or with hours cut back, thus unable to afford rent, has now turned into an opportunity, in my opinion, and I’ll go as far as to say that many renters are simply being opportunistic, twelve months after the pandemic began, with many of them gainfully employed.

Some see this as a chance to stick it to the hot Toronto real estate market, or sky-high rental prices, or their landlord, or all of the above.

Others are simply hearing about how friends or colleagues benefited, and are looking to “get theirs.”

A reader called me last week and said he was getting $3,200 per month for his condo and that the tenants had asked if they could get a rent reduction………to $2,500.

I’m sure there resources out there that would suggest rents are down by 22% in some places. Like I always say, you can make numbers say anything you want.

I tell every one of these clients, readers, and callers the same thing: that in today’s world, a renter can stop paying you, and you’ll never get them out.

So what’s the upside versus the downside?

I know that you don’t want to think that people have this in them, but some do. And you don’t want to believe me when I say this, but really, truly, if a renter stopped paying rent tomorrow, you’re going to have a long, uphill battle ahead of you, no matter the “merits” of the case.

A “family friend” of mine is a social worker and it’s her job to provide assistance to those in need, as determined by her employer. One of the persons in need is an individual who is on government assistance, with obvious mental health issues, and who is currently going through an eviction process. This person has not paid rent in thirteen months and has been evicted by the owner of the property who had bought the property two years ago to renovate and live in as a primary residence.

The eviction application was heard on Tuesday, virtually, and the tenant had a representative from the Legal Aid Society, and the owner of the property represented themselves. The legal aid representative pointed out one small typo on the eviction application – 2020 instead of 2021.

The legal aid representative suggested that this invalidated the entire application.

The adjudicator agreed.

Case dismissed.

What now?

Well, that’s not the government’s problem, is it?

My point is this: owning real estate as an investment can be extremely lucrative, but it’s not for the faint of heart. More to the point, the current legislation and the climate at the Landlord & Tenant Board is completely and utterly in favour of the tenants, and you need to do an absurd amount of diligence before signing that lease agreement.

When you have a tenant asking for a $100 rent reduction, don’t fight it. Just go with it.

Maybe that’s part of the reason why rents are down in Toronto?

Topic for another day, perhaps.

Today, I wanted to look at listing and leasing activity in the downtown Toronto condo market so far in 2021.

We’re only 2 1/2 months into the year, and since we don’t have a full month’s worth of data for March, I can only provide you with an analysis for January and February. But I think that, given the data I’m about to present, the conclusions that could be drawn from two month’s worth of data is certainly worth sharing!

Recall that I had featured this data in mid-2020 as we were heading out of the worst of the pandemic, and then came back to it in November.

Let’s continue with the same data set, all the way back to 2018! It certainly puts our market in perspective.

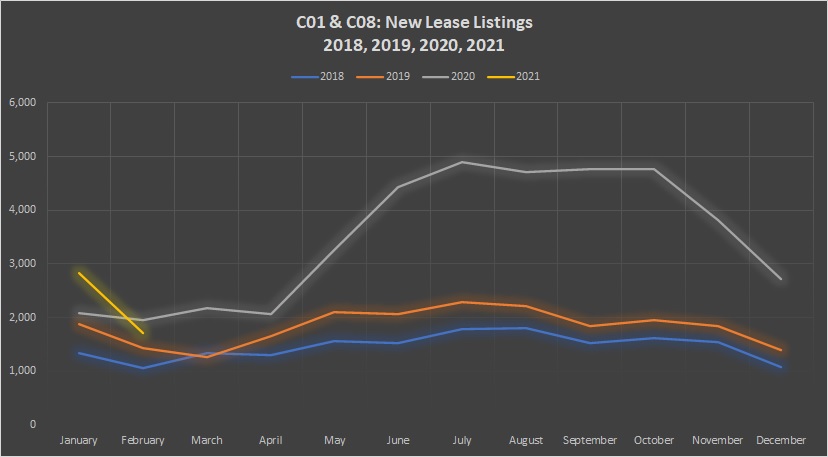

Here’s an updated look at condominium lease listings in the downtown core of C01 & C08:

Let’s start by looking at January.

We see a 36% increase in new listings over 2021, however, that number pales in comparison to where we finished 2020.

December saw a 95% increase, year-over-year.

November checked in at 108%.

October was 144%, and September was 159%.

It seems to me that the 36% increase in new listings in January, year-over-year, pointed toward a massive drop in inventory.

And then came February!

We actually saw fewer new listings in February of 2020 than in 2021. How about that? Only a 12% drop, but considering we were looking at year-over-year increases averaging 126% from September to December, this has to come as a shock, right?

I triple-checked that data, and it’s accurate.

Condo lease listings in February absolutely plummeted and I have to wonder where this will leave us in March.

Remember how crazy lease listings were in 2020? How they looked on a chart? I wonder too what this will look like in March:

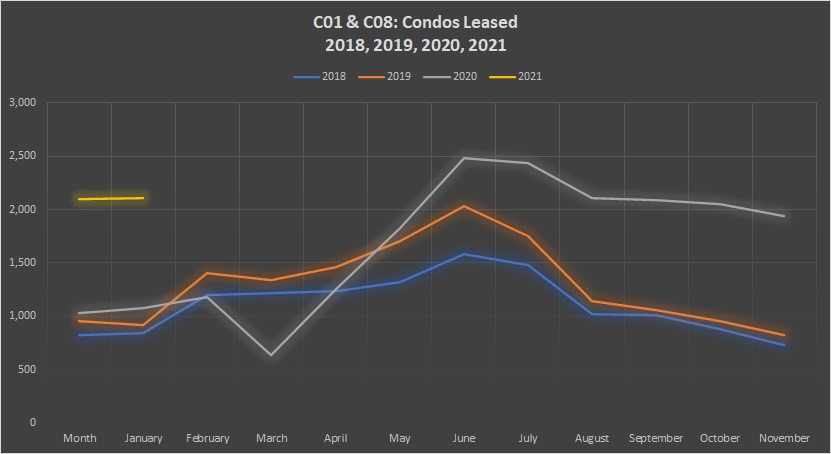

Listing activity tells half the story.

Leasing activity tells the other half.

We finished 2020 strong with 1,942 leases in the downtown core, representing an absorption rate of 71% (more on this later), and then came the surge in January: 2,103.

Compared to December, that’s nothing.

Compared to January of 2020, that’s a whopping 104% increase, year-over-year.

The increase from January 2020, over 2019, was only 8.3%.

Just look at the first two months of 2021 and tell me that those figures don’t seem outlandish to you:

From 2018, to 2019, to 2020, we see a gradual, modest increase in leasing activity in January and February.

In 2021, we see activity doubling.

Is this pandemic-related? Can it be?

Are these all the people who wanted to lease in 2020, but didn’t?

Did they all have the same New Year’s Resolution?

The above chart doesn’t do the story justice quite like this graph:

See that yellow line? The one that looks like a mistake? It’s not. It’s 2021, and it’s really, really out there!

That was what prompted me to write this post today. That single, two-centimetre yellow line. That’s the type of outlier that gets me excited. Where there’s an outlier, there’s a story!

Then again, look at how that grey line, representing 2020, compared to 2019 and 2018 from August onward. That’s really, really out there too. Perhaps January and February were just picking up where 2020 left off?

I shudder to think that we could see 2,300 or 2,400 leases in March, but it could happen, if these trends are any indication.

And what will that do to prices in the months thereafter? Well, in theory, it will push them up.

Let’s not forget that once upon a time, we were seeing multiple offers in the lease market. I had it happen on a few listings last year, but those listings were at lower prices than in 2019. I’m not trying to present a bullish argument about rental prices here. I have no horse in this race. But I’d be remiss if I didn’t point all of this out.

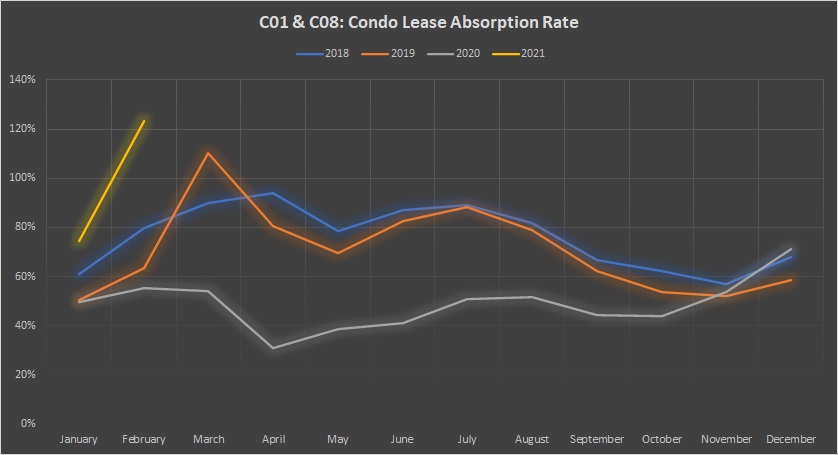

That brings us to the lease absorption rate, which did something funny in February:

Yeah, that’s 123%.

More properties were leased than were listed for lease, which sounds impossible, but for those not in the know – this includes properties listed in December or January that were leased in February.

That’s only the second time in the last 3-plus years that we’ve seen an absorption rate over 100%, and it’s the highest in any individual month.

The trend toward this outrageous figure began in October. Note that the 2020 absorption rates trailed 2019 significantly, year-over-year, until October when the pace fell to 10%. In November, the year-over-year absorption rate was actually higher by 2%, and then it shot up to 12% in December.

That increased to 25% in January (the math isn’t wrong above – those are rounded from 49.74% and 74.49%), and then shot to a whopping 68% in February.

Once again, I present a yellow-mustard outlier:

Two months into 2021; would you call this an “outlier” or would you call it a “trend?”

Answer that question, and you’d be equally as likely to be guessing as you would be predicting based on the preceding stats…

KJ

at 7:37 am

Being a landlord is not easy. I did it for my home in Toronto for several years while working internationally.

It was constantly a worry for me: would the tenants destroy my place, will rent come in on time, will something massive break and require immediate repair while coordinating from a far, international taxation issues, etc.

When my renters gave notice in early 2021, we did attempt to re-rent the home with a reduced rate compared to 2019 – but the house was overstuffed with the tenants belongings during showings and did not get a lot of action aside from a few low ball offers that did not make financial sense to accept.

Ultimately decided to sell the place, and David did a great job staging, marketing and moving my property at a number I did not think was possible. My moonshot.

I feel so much better not being a landlord and, the sellers market has taken by the sting away from selling a home I loved.

hoob

at 8:54 am

My mother has in her basement a fully legal, completely separate, modern 2br apartment. Given the completely unreasonable tide against being a landlard and all the risks and hassles with this, she decided a few years ago to just yank it from the supply.

Not worth the bother, she doesn’t need the income, and doesn’t want to end up forked by the system or being captive to it with a tenant in hand. It’s totally vacant, merely used as a guest suite for occasional visitors.

So the Lovejoys who clasp their hands and bemoan the “lack of housing supply” while agitating for ever more “tenant rights” should serious reflect that a good portion of “rental stock” is purely discretionary and will just evaporate when the risk ain’t worth it.

The Covid Rental party will be a historical blip within 18 months. Casual landlords need to seriously consider if it’s worth tenanting properties at locked-in discounts they will have to live with for years, or just leave the property vacant.

Potato

at 12:22 pm

That’s a pretty easy math problem for two defined outcomes. P*T vs R*(T-D). Pandemic-level rent times the time the tenant will stay and you get a new one that resets the rent to whatever the future market rent is, vs regular rent times that time less the delay you’re waiting (where you collect zero). If you figure it’s 18 months to normal rents, and that P is 80% of R, you’ll have:

0.8RT vs R*(T-1.5)

0.8RT vs RT – 1.5R

So your breakeven is when T = 7.5 years. If your tenant is going to turn over anyway in 7.5 years or less, you’re better off renting now at current rates rather than eating zeros for 18 months and then renting at a higher rate. OTOH if you think you’ll have someone sticking around for much longer than average, you can justify waiting.

And of course it gets more complicated by all the uncertainties — what if it’s not a blip? Maybe it’s a pandemic blip, maybe the past few years of high rent inflation were AirBNB’s fault all along and the new rules will prevent rents from bouncing back? What if it is a blip, but takes 3 years to recover rather than 18 months (indeed, 5 months ago someone was making this same point about waiting and holding vacant, and rents have not recovered at all since then)? Then as long as your tenant turns over sometime in the next 15 years you’re better off renting now for whatever you can get. On the flip side, if rents manage to skyrocket at the same rate as prices, waiting is an easier decision — you’ll be back up by summer. So which cases are possible, which are likely?

All together, I don’t think casual landlords need to consider leaving properties vacant very seriously at all — there’s lots of uncertainty, but a lot of cases make taking whatever you can get right away look like the right call, while very long tenancies/very quick recoveries are less likely. Or as David would put it, you have to work with the market you’re in.

hoob

at 12:48 pm

Agree with the math, but my point was more around the discretion that a casual landlord around calculating what their risk tolerance is for having their property tenanted — at all.

ie if the “not worth the risk” threshold is $2000/mo and COVID rent drops from $2500/mo to $1500/mo, then a whole new set of math and timelines comes into play. If the rent drops out under that tipping point (which will vary even among persons who have that discretion) then it’s a different decision.

For “landlords” for whom tenant risk is reduce to a single lease — ie not portfolio of properties/leases to average the risk out (and who in turn don’t necessarily have to worry about the intricacies about being cashflow positive) — it is a different set of considerations.

Condodweller

at 1:47 pm

@Potato Inestors who bought during the recent years may not have a choice but take on a tenant at these prices. One thing people need to keep in mind though is that while it’s fine to think that it’s better to take less now and hope they leave if/when rents increase again, but tenants may become more “sticky” when they are paying below-market rent.

I thought rents above $1800 for a smaller than 600sqft condo was excessive and now that they have come back to these levels they could very well stick around for longer than many would expect. Future prices will depend on many things not least of which is Airbnb, but once immigration/students return and some people return to work at the office I think will see upward price pressures again.

Joel

at 5:27 pm

Yep, I think what happens with air bnb in the core is going to be a determining factor for what rents look like. They take away a lot of supply and cause increased demand for what is there.

Sirgruper

at 8:20 pm

Why not charge the pre COVID rent but give a month or two free. That’s what the apartment buildings do. Less need for math:)

Appraiser

at 10:25 am

But…but… nobody is ever going back to the city again, haven’t you heard?

Rents are going to zero, don’t you know?

Nobody will ever want to touch an elevator button or work downtown again. Right?

The city is supposed to be hollowing out, isn’t it?

Perhaps nature (and real estate) abhors a vacuum after all.

J G

at 1:41 pm

Haven’t I already posted about this? RE in smaller Ontario markets like London, Windsor, Kitchener appreciating MUCH FASTER than Toronto in the past 3 years, so please sit down.

Condodweller

at 10:29 am

Wait, are you saying that someone bought a tenanted condo with the intention of moving in and hasn’t been able to get him/her out for two years? Why would anyone do that? I haven’t been looking but aren’t most condos for sale vacant?

Are these numbers only MLS listed units? Could the dropping number of listings indicate that professional investors, like a REIT, were buying up units at the end of the year taking advantage of low prices, and are managing their own rentals? This would explain the high absorption rates as the numbers would be skewed by the removed pool and new leases would represent a large number of remaining units listed.

I’m just brainstorming here but I’m also guessing that pandemic promoted a lot of migration of tenants to take advantage of low rents. Pre 2020 the numbers would represent new tenants whereas 2020 and on, could be a good chunk of the renter pool moving to cheaper units if the landlord wasn’t willing to lower their rent.

I wonder how all those people are fairing who bought houses with basement rental units and they depend on the income to pay their mortgages. I understand the reasoning but I would hate to have a rental property tied to my residence where I could lose my home due to a bad tenant.

Still, it doesn’t seem that these cases are significant in numbers as I’m sure we would have heard from all the landlords by now.

Appraiser

at 10:37 am

Home prices accelerate in February – Teranet HPI released today:

https://housepriceindex.ca/2021/03/february2021/

“The February rise is consistent with the increase in the number of home sales over the last several months reported by the Canadian Real Estate Association. For a sixth straight month, the number of sale pairs[1] entering into the 11 metropolitan indexes was higher than a year earlier…

…The February composite index was up 9.8% from a year earlier. This was a seventh consecutive acceleration and the strongest 12-month gain since September 2017.”

Chris

at 10:42 am

“I’m sure there resources out there that would suggest rents are down by 22% in some places.”

Do you disagree with that figure? Do you have data on pricing? Latest Rentals.ca states “Toronto recorded the largest annual decline in monthly rental rates, decreasing by 20% from February 2020 to February 2021”.

Ivan Gorbadei has some interesting charts on rental figures:

https://twitter.com/IGorbadei/status/1371492689695363074

He suggests that high leased numbers are a product of renters shopping around.

“Like I always say, you can make numbers say anything you want.”

Tad ironic to have this as the lead in to a blog post chock-full of numbers!

Appraiser

at 12:17 pm

And some people can stay in denial long after the market has passed them by, somehow comforted by anecdotes that renters are merely shuffling about looking for deals, or wild conspiracy theories about hordes of “professional investors” swooping down to scoop up the inventory.

Chris

at 12:53 pm

Which anecdotes are you referring to? Gorbadei shared data and his take on it. All you’ve offered is your alternative interpretation.

Speaking of the market passing people by, we’re almost a year out from your “bull trap” warning regarding the stock market. S&P500 sitting at +66% YoY today.

Chris

at 12:58 pm

Hmm Yahoo Finance’s chart showed S&P500 +66% YoY, but looks like it’s truly closer to +56%. 3,944 today, compared to 2,529 last year. Anyways, you get the point.

Condodweller

at 1:34 pm

@Appraiser Isn’t it too early to start drinking? David is talking about rentals today. You do realize rents are down ~%20 and not up, right?

Are you afraid to respond to my comment directly? Last year David did say that some agents thought condo prices were bottoming out and the time could be right to pick up properties. During the 2007/2008 meltdown, there was at least one reit created which bought up a boatload of houses for bottom $. There was an interesting article recently on our public pensions investing in these reits and the ethics of them evicting people during a pandemic because you know, professional investors want/need a return.

It wouldn’t be a stretch that the same could be done with condos after a meaningful price drop. Far from a conspiracy theory.

According to Chris’s link, I’m not the first to think these numbers could be due to tenant movement. Your comment about denial/anecdotes are, to borrow your word, is incoherent.

J G

at 1:38 pm

Appraiser hasn’t said anything about the stock market in the last 5 months, I think he learned his lesson.

Man, it’s just so much easier to sit in front of your computer and watch your asset appreciate 🙂 If there are any issues with properties, who is going to repair it? Not the tenant.

Condodweller

at 2:03 pm

Well, this is a RE blog. Since I bought my investment property I would not have been able to get the same return on my downpayment and I have had exactly 0 issues with my unit in over 10 years. I am getting to the point where the time for cashing out is coming and I will be reinvesting in the stock market. There was a tweet recently by a portfolio manager with a client whose initial $25,000 investment in a bank is now paying $125,000 annual dividends.

I actually wanted to cash out last January when David started writing about the hot market and man the timing would have been beautiful to buy the banks after an almost 50% fall. Well even a broad market index would have been fine, but the market is not going to increase it’s dividend at the rate the banks do. Back to RE….

Chris

at 2:29 pm

“I would not have been able to get the same return on my downpayment”

CREA GTA Apartment HPI for Feb 2021 was 293.2, compared to 138.7 in Feb 2011, for an increase of 111.4%.

From ten years ago to present:

S&P500: +199%

DJI: +166%

NASDAQ: +384%

TSX: +34%

You might not have been able to access the same degree of leverage by putting your down payment in the stock market, but percentage returns for many indices were robust.

Condodweller

at 7:42 pm

You picked up on my hint about leverage. Markets pale in comparison to my returns taking leverage into consideration. Leverage is definitely the x-factor for RE.

J G

at 10:09 pm

I wouldn’t say Market is pale compared with RE even with leverage.

I don’t think you’re beating NASDAQ: +384% (where most of the Tech stocks are) over the last 10 years even 20% down payment.

Also with stocks I have no carrying cost (Insurance, Maintain, Property Taxes).

Chris

at 9:13 am

As we discussed in a previous post, leverage isn’t exclusively available in real estate.

Whether through margin investing, options trading, leveraged ETFs, etc., there are many ways one can amplify their gains and losses in the stock market.

Admittedly, most people are far more familiar and comfortable with a mortgage on a property than they are with options trading.

Condodweller

at 10:28 pm

@JG. The NASDAQ is not my benchmark but I’m actually pretty close to it without leverage. Once you add leverage it’s blown out of the water. Even though the mortgage is 80% I leveraged almost all of the downpayment as well.

While I have leveraged the markets I would never use margin or do it to the level of RE. It looks to me that the tables may be turning though.

jeanmarc

at 11:24 am

Possibly renters who are shifting around at the start of the new year and negotiating a better monthly rent expense? Basically taking advantage of the situation? What about the stats for the average monthly rent in these areas? Have they gone up or down?

My friend who owns three rental properties (two in 416) and one in 905 has been lucky getting renters and has never been asked to reduce the monthly rent charge.

J

at 11:34 am

“We actually saw fewer new listings in February of 2020 than in 2021.”

The LTB would eat you alive for this error (the years should be reversed).

The LTB can definitely be quite lenient on a tenant in the case where the tenant is a total bum, which no doubt leads to much frustration for landlords. But based on my experience and understanding of parts of the RTA, when the tenant isn’t a bum who’s willing to pull all kinds of shenanigans at the expense of their dignity, the playing field is much more level, in fact favouring landlords in many ways.

“I’ll go as far as to say that many renters are simply being opportunistic, twelve months after the pandemic began, with many of them gainfully employed.”

If a tenant is asking for a decrease that brings their rent to market level, I wouldn’t call that opportunistic (in the negative sense). Would a landlord prefer that the tenant terminate the lease and move somewhere else at market rent, leaving the unit vacant for a couple months (or perhaps longer) only to eventually lease it at the same amount the tenant was negotiating for.

J G

at 7:29 am

There’s absolutely nothing wrong with asking for rent reduction even if renter is still working (or getting raise). That’s the way the market goes, condo renter can easily move down the hall for $250 cheaper.

Just like the landlord will increase the rent even if the cost of ownership has not gone up.

HVAC Mike

at 7:42 pm

Landlords can only raise rent what Ontario allows yearly which is peanuts anyways, tenants always have the upper hand

Charlie Bradford

at 5:07 am

I wonder what it looks like now, this April? I also heard that a lot of people are coming down from the cities just to avoid the risks and to be closer to family. Good thing that my contract with my landlord is flexible and that I was able to get out of it when I bought my own place from this page. I’m still living here at my apartment but only on a monthly basis since my house might be finished within months’ time. It’s sad, though, on the other hand, because some of these landlords base their living on tenants. I guess it’s okay to lower the rents but not to the point that it’s basically 0. Hope that this trend of going down from cities is just a phase during the pandemic.