So, how was your holiday break?

No, seriously. Humour me. Tell me! Tell us!

I’m clearly about to unleash a verbal torrent of unsolicited information about my holiday break, so it’s only fair that we hear about yours in the comments section below.

Perhaps a better question: what did you get for Christmas?

I got nothing.

Well, that’s not exactly true, which I’ll explain in a moment.

But my kids, on the other hand, wow, what a haul! Their presents barely fit in their Christmas Boxes!

Wait…….what in the world is a “Christmas Box?”

It’s merely a Fleming family tradition, revived!

Credit to my mother, who was a grade-school teacher and incredibly creative, both of which helped her invent this excellent exercise and tradition for kids. Every year, Julie, David, and Neil would head up to Bayview Avenue to “Mr. Grocer” and sift through the bin of cardboard boxes, like kids looking for the perfect pumpkin on Halloween. We would pick our box, then head home and decorate it! My mom was into recycling before recycling was a thing, so we’d have the luxury of choosing from various scraps of wrapping paper, ribbons, and random arts-and-crafts supplies to affix to our box, and then go to town on it with a variety of magic markers.

Once our Christmas Boxes were complete, we would spend two weeks fantasizing about all the gifts that would stack inside on Christmas morning! I distinctly remember playing with my brother and sister in the upstairs of our Parkhurst Boulevard home pretending to open presents, and pretending to put them in our Christmas Boxes.

Fast-forward to 2022, and I didn’t take Maya and Duke to Mr. Grocer, er, Valu Mart, but rather I bought two moving boxes from Home Depot and brought them home for the kids to decorate.

Call that a “change in technology,” if you will, comparing 1986 to 2022, but the Christmas Boxes were a success!

Not only did the kids play with them for two weeks leading up to Christmas, but they’re still playing with them! In fact, they’re playing with the boxes about as much as they’re playing with their new toys, which makes me think perhaps in 2023 I can just go with a cardboard theme and forego any actual expenditures?

That brings me to what I got this Christmas: nothing.

My wife and I decided this year that we would forego our annual gift exchange, simply recognizing that we have everything we need already, and that spending money for the sake of “having something to open” is pointless. Of course, now that we have two children, watching the kids open their presents is more important and more meaningful than any token gift for my wife and I.

Anybody else in this boat?

I mean, I see the love and care behind providing your significant other with a gift on a special day. But somewhere along the line, it ceased to be about that.

If you know me, you won’t be surprised to know that I have a spreadsheet of every Christmas gift, birthday gift, and anniversary gift et al that I’ve provided to my wife.

So let’s see………………Christmas 2013.

Black leather gloves from Michael Kors, a pair of Michael Kors shoes with “MK” on the toes, a beige Marc Jacobs purse, perfume from Sephora, a silly hat and scarf from Lands End, and a photo collage of our dog. Total: $739.82.

But that was in 2013. It was our first Christmas as a married couple. We had no children. Just Jenna, myself, and our dog, Bella.

But in 2022, is this necessary?

I have everything I need or want. And if I didn’t, I’d just buy it. Same goes for my wife.

Foregoing Christmas gifts is a great way to save a thousand bucks or more, and I’d rather spend that on the kids, or bank it.

Having said that, I didn’t truly get “nothing” for Christmas.

I did get one thing.

Occipital Neuralgia.

No, it’s not a cream for your face, or the name of a long-lost album from Nirvana.

December was a tough month for old Dave-o, let me tell you.

On December 8th, I hurt my back. And when I say “hurt” I mean I re-aggravated a lower-back issue that has been persistent for almost a decade. I’ve “hurt” this part of my body six times now, each time needing at least two weeks to recover. But this was the worst one, and I was in bed for three days, literally. I couldn’t move. It took me five full minutes to slide my body off the bed onto the floor, so I could crawl on my hands and knees to the bathroom in the middle of the night…

Two weeks later, I was sick. Not COVID, but brutally sick. Ask me how much I enjoyed my brother’s 40th birthday surprise in a private box at the Toronto Maple Leafs game. I know, I know, you’re all playing tiny little violins for me, and some of you are writing headlines for tomorrow’s paper, “Affluent Asshole Complains About First World Problems.” All that matters is that Neil had a blast, as did the other nine guys in attendance. But the irony wasn’t lost on me.

Then along comes Christmas, or Boxing Day, to be exact. I wake up with a pain in my neck, which is giving me shooting pains to the front of my head, and my left eye is killing me.

Tylenol does nothing. Same for Advil.

A day later, it’s worse, and I’m Dr. Google over here, self-diagnosing, which your family doctor absolutely hates.

Four days in, and I’m losing my mind. Everything from the heck up hurts like hell and I can’t focus my vision on so much as my iPhone. Now I’m self-medicating, taking leftover Cyclobenzaprine from years past, with a Naproxen chaser. No dice though.

Ask me, “David, why didn’t you go to the hospital,” and you’ll get me started on a rant about Canadian healthcare. I mean, I guess I could have gone to Emergency, so I could wait four hours in the first room, only to be moved to the second room where I wait another two hours, then to be examined, and told – two hours later, “Go home and monitor it.”

That worked well for my mother in 2015 when she went in with abdominal pains, only to be sent home. But twenty-four hours, two return trips to the hospital, and one emergency surgery later, I’ll never forget the look on the surgeon’s face when he said, “It’s a good thing you came when you did, otherwise your mother would have died.”

Topic for another day, you say?

I’ll come back to this when we discuss “New Year’s Goals” and I mention the desire to be less cynical, sarcastic, and pessimistic.

Boxing Day through New Year’s was a waste. I “rested,” which is the worst and laziest cure for any ailment, slept, used a heating pad on my neck for hours on end, and felt completely unproductive. My wife went to Atlanta for three days so I had both kids and barely made it through.

And now…………….welcome to 2023!

2023. Yikes. That’s going to take some getting used to.

Remember when you were a kid and you’d put the date in each day’s school workbook, only to mess up the year for the first two weeks of January?

Today, it’s like: how long until you stop accidentally signing cheques with “2022” instead of “2023?”

Wait……who actually still signs cheques?

This guy.

So with my honourary deluge of holiday memories out of the way, shall we actually talk about real estate?

As is the custom with my start-of-the-year posts, I like to look ahead to what is or may be topical over the next twelve months.

The beginning of last year saw a two-part blog series called, “Burning Questions For 2022.” I barely got through two questions before I had to break for the day.

2021 featured a “Top Ten Burning Questions” that stretched into three blog posts.

And 2020’s first post of the year, also three-parts, was called “Real Estate Discussion Points For 2020.”

Whether we’re asking questions about the real estate market, outlining concerns, or detailing topics of interest, you know the first feature of the year is an attempt to look into our crystal ball and make note of expectations for the year ahead.

So at the risk of sounding unoriginal, let’s call this one our “Top Discussion Points of 2023.”

1) Home Prices

Thank God we’re not talking about inflation again, right?

Two topics that dominated discussions last year were inflation and interest rates, and I’m sure that you’re oh-so-happy to find they’re not atop our list to start 2023.

Not atop our list, I said. But for those that enjoy watching the same movie over and over, never fret, because they’ll both make an appearance later on…

Over the holidays, I received a call from a property owner in Mississauga who asked me about my outlook for 2023. I told him that while I didn’t have a crystal ball, I felt we were likely at the bottom of the market decline and that I felt 2023 would be a relatively flat year.

Every time I offered insight, he would respond with a leading question.

“But the market has to go up, right?” he asked, after I said we were likely looking at a flat year.

“There’s no supply out there,” he said, before he offered his take with respect to the lack of supply leading to an increase in prices.

“These interest rates aren’t actually high,” he said. “Five-year rates of 5.5% are historically really low,” he offered.

I’ve had these calls before many times, so eventually, I just asked, “Are you looking to sell this year only if prices go up?”

He didn’t answer in the affirmative but rather offered a response that underscores just how entitled today’s home-owners are:

“I would sell if I could obtain the true value for my home. The drop in prices last year was completely bogus. It was the direct result of the government driving interest rates through the roof and scaring off buyers. Houses ARE worth what they WERE worth.”

I asked him, “What do you think your house is worth today?”

To that, he responded, “You mean what should it be worth, or what has the artificial market drop told buyers it’s worth?”

I rephrased and said, “What do you want to get for your home?”

He said, “I need $1,600,000 and I’m a seller.”

I told him that I would do some digging and get back to him.

This was just before Christmas so I had time on my hands, and even though I knew this wasn’t going to produce any business for 2023, I also knew it was a great social experiment.

The first thing I noticed about his house was that he bought it for $612,000 in 2011.

So this house didn’t “owe” him anything. It’s not like he needed $1,600,000 because he paid $1,550,000 in 2021 and he’s trying to recoup what he paid plus land transfer tax.

The second thing I noticed was that a very similar house sold on his block in March of 2022 for $1,575,000. And to date, that stands as the high-water mark in his neighbourhood.

So let’s regroup: a home-owner sees that his neighbour sold for $1,575,000 in March, near the market peak, and has decided that he “needs” not just the same as his neighbour, after a 20% on-paper price decline in that area, but rather more! He wants to beat that record sale by $25,000, which is his lazy way of rounding up.

The average home price in Peel Region is down 17.7% from March of 2022 through November of 2022. Maybe his neighbourhood, housing type, or price point is down less but either way, let’s assume it has to be down by 10%. That would mean, comparatively speaking, his house is worth around $1,417,500 if it’s the same as his neighbour’s.

Having bought the house for $612,000 in 2009, this would mean his home rose in value by 131.6% in twelve years.

That’s about 11% per year.

Not bad, right?

But not good enough, it seems.

I called him back the day after we spoke (he didn’t want to provide his email address) and walked him through the sales on the phone. He interrupted me every ten seconds to explain why I was wrong, and while I did find it annoying and unprofessional, I basically started writing this blog post in my head.

I started to ask him what I thought were rhetorical questions, such as, “If your neighbour offered his house for $1,400,000 in 2023, should a buyer be expected to pay $1,600,000 for yours?”

He said, “If they’re thinking long-term, they will!”

I said, “Why wouldn’t they just buy your neighbour’s house for $200,000 less?”

He avoided the question and said, “Well my neighbour shouldn’t be willing to accept $1,400,000! He should be furious about the artificial market drop too!”

When he was almost out of arguments, he reached back and pulled out the last resort of retorts: age.

“I’m a lot older than you,” he said. “I’ve been in the market a long time and I’ve owned a lot of properties. There’s one thing I know about real estate that it seems you don’t: real estate always goes up in value.”

I agreed with him.

But then I added, “However, it can and does fluctuate in the short and medium term.”

I wished him good luck with his sale, he provided me with one final chirp about how I “clearly wasn’t up to the challenge he was offering,” and that was that.

What a beauty.

And sadly, I feel like there’s a lot more folks out there who have the same blinders on.

Here’s a twenty-year chart of the average home price in the GTA:

“Real estate always goes up in value.”

Yes, it’s true. There’s simply no denying this.

However, this is a 20-year chart with monthly prices plotted. And within the long-term uptrend, we can clearly see two short-term downtrends in 2017 and 2022.

The market decline in 2017 is still fresh for many people but for others, it may as well have been before they were born.

I would estimate that half of all licensed real estate agents in Toronto weren’t in the business in 2017.

And when it comes to homeowners, there are a lot of people who purchased their first home in the last six years, not to mention all the prospective home owners who are starting their searches in 2023 with no recollection of what happened in 2017.

Both the 2017 and 2022 declines were motivated by government intervention. The 2017 decline, amazingly, was based on more talk than anything. Sure, there were some policy changes, but nothing remotely close to the interest rate hikes of 2022. History will show just how incredible and unprecedented seven rate hikes in a single year were, not to mention the start-to-finish increase from 0.25% to 4.25%.

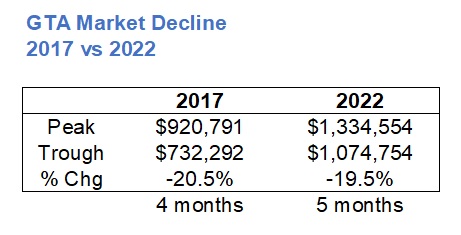

But how do the two market declines compare?

The 2017 peak-to-trough was April to August.

The 2022 peak-to-trough was February to July.

It’s incredible just how closely these two markets aligned.

And for those that might suggest, “The GTA includes the suburbs, and they were hit harder than the 416,” I would offer this:

In 2017, the 416 actually declined more than the GTA average, whereas in 2022, the decline lagged behind.

And while the “on paper” data always shows one thing, and what we see out there in practice shows another, I can tell you that I’ve seen very few, if any properties in the central core that have declined by 18%.

Throughout 2022, we determined that in addition to the interest rate hikes, one of the “causes” of the market decline was the ridiculous amount of appreciation in the first two months of the year.

From December of 2021 to February of 2022, the average GTA home price increased by an incredible 15.3%.

So how does this compare to 2017, you ask?

In the two months that led up to the “peak” in 2017, the GTA average home price only increased by 5.1%.

But the differences stop there.

In fact, if we were to look at peak home prices in both 2017 and 2022, then see how much those prices increased over time periods of 2-months prior, 6-months prior, 12-months prior, and 24-months prior, the stats are quite similar:

Work backwards, and you’ll see the percentages diverge.

The figures are 1.8% apart at 24 months, 3.0% apart at 12 months, 3.9% apart at 6 months, and then there’s just no comparing the prices 2-months prior to the peak, as 2022 was more than 10% ahead of 2017.

There’s no doubt that the seven interest hikes in 2022 were a cause of the market decline, but I would also offer that the 15.3% increase in prices from December to February was equally as important.

Now, for those with short memories, perhaps we should chart average home prices from the onset of the pandemic to today, right?

This is the point I have made about any “market downturn” over the last two decades.

The market bears, the wishful buyers, and the Garth Turner fan club have called for the “crash” since I was in university, but it’s never come.

With the average home price in the GTA declining 19.5% in 2022, that simply returns us to 2021 values.

Look at the chart above. Now look at that blip from February to April of 2020.

That was the pandemic-induced “collapse” of 2020. And it lasted for two months.

The average home price in the GTA is up 18.6% since the onset of the pandemic in 2020, and while that’s not enough for folks like Mr. Mississauga who only wants to sell his house at the all-time high, it’s part of both medium and long-term uptrends.

I read so many online articles last year about the market drop, decline, crash, and correction, and all the while, I thought about how short-sighted these “authors” were being, especially as most of them were in their twenties and were writing for online rags, not unlike this one.

There’s this unabashed glee among many when the real estate market is anything but robust, and I recognize it’s part and parcel of the city of Toronto’s shift toward a London-esque housing market, but so much of it stems from entitlement and ignorance, not to mention immaturity and naivety.

Twenty years from now, owning a home in Toronto will be reserved for a few. Most will rent, commute from the suburbs, or learn to live in smaller spaces. Every time I watch a movie or show that takes place in Europe, I watch people step outside their apartments like it’s a normal thing to do, whereas we in Toronto expect to walk across a lush lawn, down our private driveway, and onto a double-wide boulevard.

Nobody in New York, London, or Paris expects to own a home the way we do here in Toronto.

The Guardian and Le Monde aren’t consistently running features on down-on-their-luck 20-somethings who can’t afford to buy a home in London or Paris.

Toronto is a city still in transition as every generation had, has, and will have a different experience in the real estate market. Early-stage Millennials were able to purchase homes, early-stage Generation Z is finding it increasingly difficult, and late-stage Generation Z along with the entirety of Generation Alpha won’t even try because they’ll know it’s impossible.

Twenty years from now, when the average home price in the GTA is $3,000,000, we’ll look back on a forty-year housing chart and see 2022 as nothing more than a “blip.”

Those feeling scorned by the market in late-2022 won’t see it as a “blip,” but if you add some context to what’s happened in the last two years or five years, the picture becomes much more clear.

My prediction for Toronto home prices in 2023: flat.

Less volatility, more predictability, but a slight uptick by the fall.

The average home price in November of 2022 was $1,079,395. I’ll bet you my favourite G.I. Joe t-shirt that the average home price in November of 2023 is higher than that…

2) Mortgage Renewals, Trigger Rates, & Interest Rates

I was talking to a friend of mine the other day and she noted, among other things, “Our trigger rate has kicked in!”

She sounded rather aloof about the topic and certainly didn’t seem worried.

I asked her what her mortgage payment was, last year and this year, before the trigger rates kicked in.

“Ummm, maybe something like six grand?”

I then asked her what her new mortgage payment was, and she shouted to her partner, “Hey, what’s the mortgage up to now?”

As I said: she didn’t seem worried. She didn’t even know what the payment was!

A muffled voice shouted something back at her and she told me, “He thinks, like, I dunno,” then took a long drag of a cigarette and like Juliette Lewis in the opening scene of Old School, exhaled while answering, and said, “He thinks something like ten-grand……….and change.”

How many of you are uncomfortable right now?

No, not because you’re visualizing that scene with Owen Wilson, Juliette Lewis, some people jumping out of the closet “like a goddam magic show,” and an excellent cameo from director, Todd Phillips, but rather because you’re thinking about a mortgage payment going from $6,000 to $10,500?

This is where the laymen often refuse to sympathize and suggest, “Anybody that can afford a $6,000 mortgage payment can afford a $10,500 mortgage payment.” I hear that all the time when I lament that land transfer tax on a $4,000,000 house is almost $200,000, and the response is, “Anybody that can afford a $4,000,000 house can afford a $200K tax.”

That’s not the point.

Imagine going from $6,000 per month to $10,500?

How does that affect your personal finances, lifestyle, and anxiety level?

“We’re not gonna change shit,” my friend told me. “Maybe we buy cigs in cartons instead of packs? I dunno.”

Luckily, she and her partner can afford to not change shit.

But what about everybody else?

I mentioned that I did a lot of reading over the holidays, and this article suddenly seems relevant:

“‘It’s Choking Me’: This Homeowner’s Mortgage Payments Have Shot Up By More Than $1,000 A Month. What Should He Do?”

Toronto Star

December 30th, 2022

First of all, kudos to the writer of this article for actually finding a person to go on record with this, and pose for a photo.

His name, image, and likeness are now associated with naivety, financial mismanagement, and woe-is-me syndrome for as long as this “Google” thing stays around.

As the article explains, his mortgage payment on his house went from $730 per month to $1,165 and his mortgage payment on his rental property went from $1,100 to $1,175.

That sucks, right?

Except that, it doesn’t. He’s up a paltry $1,110 per month on two properties.

(womp womp)

He bought his house in 2010, which means that it’s likely doubled in value, if not more. So he’s not without equity. And if he is without equity, then the story here shouldn’t be about mortgage renewal rates but rather about people using their house as an ATM, living lavishly, and ignoring financial responsibilities.

“I basically have no life,” he says. “Luckily my income is still strong but I’m very conservative when it comes to financial stability. If interest rates rise drastically, I back off on everything else to avoid filing for bankruptcy.”

Filing for bankruptcy?

Where did they find this guy?

The article is fear-mongering at its best, but it doesn’t mean that this won’t be a continued topic through 2023.

And if we really want to fearmonger, can we use the d-word?

Default.

Oh boy, here it comes!

Welcome to 2023 where we get very inventive with the news!

The Toronto Star article uses the word “default” a total of seven times!

But more on that later, since I had planned for this to be its own discussion point.

As for the “trigger rates,” which were a theme in late-2022 and will continue to be a theme moving forward, some believe we’ve already reached our peak.

This article is now a month old but it serves its purpose:

“Mortgage Rates Set To Soar Higher After Latest Interest Rate Increase, But End Of Hiking Cycle In Sight”

Financial Post

December 7th, 2022

This article came out after the Bank of Canada raised the overnight lending rate from 3.75% to 4.25%, which caused the Big-Five banks to raise prime lending rates from 5.95% to 6.45%.

With respect to trigger rates:

The central bank’s recent data showed that about 50 per cent of variable-rate, fixed-payment mortgages and nearly 13 per cent of the entire Canadian mortgage pool have already hit their “trigger rates,” or the point where monthly mortgage payments are only covering interest and not making headway on the principal.

Fifty percent in early-December?

How much juice is left in the squeeze at this point?

I do believe that “trigger rates” will be a huge topic of conversation in 2023, but I think that just like a drunk-dial in your early 30’s, it’ll be all talk, little action.

The worst is behind us in this regard, but it’s not unlike the media to beat a dead horse.

As for actual interest rates, which I think we’re pretty tired of talking about, what’s in store for 2023?

Most are banking (no pun intended) on another rate hike on January 25th, this time perhaps only 25-basis-points.

But is that the end of the line?

Many think so.

From the same Financial Post article above:

“Rather than suggesting ‘the policy interest rate will need to rise further,’ today’s guidance is that ‘Governing Council will be considering whether the policy interest rate needs to rise further,’” RBC Economics senior economist Josh Nye wrote. “That clearly opens the door to a pause as soon as the next meeting in January, and in our view frames that decision as between zero and 25 (basis points).”

As written in THIS article in the Financial Post:

“Looking ahead, Governing Council will be considering whether the policy interest rate needs to rise further to bring supply and demand back into balance and return inflation to target,” the statement said.

That language represents a shift from explicit guidance that interest rates were headed higher no matter what.

Now, the Bank of Canada is saying that 4.25 per cent might represent something of a sweet spot: an interest-rate setting that will deter households from continuing their post-pandemic spending spree, but maybe not by so much that weaker demand turns into a spike in unemployment.

The central bank’s moves from here will be based on data, not a predetermined path where the only question ahead of a policy meeting was how high? The option of pausing will be on the table when Macklem and his deputies next meet ahead of their Jan. 25 decision, depending on how the data breaks over the next six weeks.

I suppose that’s good news, right?

The idea that the Bank of Canada will look at actual market data before making a decision on further rate increases?

The best line in the article was this one: …”an interest-rate setting that will deter households from continuing their post-pandemic spending spree, but maybe not by so much that weaker demand turns into a spike in unemployment.”

That’s what we’re all after, right?

I spent a lot of time in 2022 writing about consumption and just how wildly our spending habits changed at the onset of the pandemic in 2020, thanks to Amazon Prime and grocery deliveries, but also because of people coming “out of the pandemic slumber” and deciding to live it up.

But the Bank of Canada’s goal shouldn’t be to drive us into a recession (that’s more the taxation policy of the federal government….) but rather to avoid shrinking the economy, putting pressure on businesses, contributing to downsizing – leading to unemployment, and all the while, crushing the national housing market. The Bank of Canada should be seeking to find balance.

Personally, I think we’re about to find that balance. I think the government has done all they need to do, and if a picture paints a thousand words, then look at this one:

How much higher can we go?

How much higher do we need to go?

The Bank of Canada’s job isn’t to teach us all a lesson. And even if there are millions of people in the country who still haven’t learned their lesson, their day will come. For now, I believe we need to let this new interest rate environment normalize over the next 12-24 months while avoiding a recession.

Can that please be the last we talk of interest rates in 2023?

Yikes.

In the words of an immortal, “Ooops, I did it again.”

That is just so typically me.

We’re well past anything that could be described as “normal” for the length of this post, so suddenly it feels like our discussion about the 2023 real estate market will have to span into next week!

Libertarian

at 9:20 am

David, you should have shown that last graph to that guy you were talking to who wants $1.6 million for his house. His house shot up in value because interest rates were zero. Now that they’re going back to usual levels, his house is going down in value.

Derek

at 9:52 am

Hope you get that neuralgia sorted. I’ve had the trigeminal variety and it was no fun.

Vancouver Keith

at 12:09 pm

Your conversation with Mr. Mississauga (heretofore Mr. M) offers a fascinating real world insight into markets, and how the psychology of participants comes into play. I regret to note that this dialogue will be repeated thousands of times this year in your industry.

Mr. M reveals so much with his language. He mischaracterizes the market price as an “artificial” price. The market price is not artificial, it’s real. His attachment to the all time high market price is a psychological investing state of mind, where each time the value of his house goes up, he anchors the price in his mind as to what the house is “worth.” He accepts price increases as increases in a construct in his mind he calls the “true value,” but only increases in “true value” count. He, and many thousands like him will suffer from recency bias. Most conversations on resale property between agents and sellers this year will involve a tug of war between seller’s recency bias and current market realities.

Real estate agents are going to have to educate clients about what the Bank of Canada does, which is balance economic growth at 2 – 3%, inflation at less than 3%, and unemployment at a non recessionary level. From where we are today, this will be a slower process than most people are willing to concede. We are a long way away from inflation being in the target zone, and higher rates than before will be the new reality. The markets are expecting the Bank of Canada rate to increase 1 – 2 more times, up to 75 basis points followed by a minor technical recession. With a ninety day pre approval on mortgage rates, the effect on the real estate market will take years to play out. We will not have emergency interest rates again for a very long time, and all kinds of markets are going to look quite different. Many remember the 21% interest rates of 1981, few recall how long mortgage rates were double digits.

Mr. M’s level of denial peaks when he suggests that all his neighbors should overprice their homes, and buyers should be willing to overpay because real estate always goes up. His belief that the market can counteracted in this fashion is naive to the point of foolishness. There’s an old saying in the markets, never fight the fed (Bank of Canada). I predict the 2023 real estate market will be a stalemate. Sellers will not be able to bring themselves to sell at the market price, and buyers will expect recent declines to continue and want a discount to market to cover some of the upcoming price decline. Days on market will skyrocket.

As inflation comes down, it will come down very slowly. The real estate industry will demand rate cuts happen faster, and changes to mortgage rules (hello 40 year amortization) in order to increase liquidity in the market. The adjustment to higher rates will be a different kind of pain than the adjustment to lower rates was, but it will be very real and the denial of the reality will be just as prevalent. Follow the psychology, as well as the numbers.

Bryan

at 2:24 pm

Very astute commentary here, as always.

I wish that the type of granular approach David takes with home prices was also taken by those who report on CPI inflation. If it was, there would be a lot of supporting evidence for an inflation “peak” in June. While, like house prices it is very useful to look at CPI on a year over year basis, doing that to the complete exclusion of monthly data does nothing but guarantee that your information is a year out of date.

At the start of 2021 CPI was 137.4. In the middle of 2021 (ie end of June), it had risen to 141.4, a 2.9% increase so already quite bad (we are looking for something less than roughly 1.5% in 6 months). From there until December 2021, it rose to 144, a 1.8% increase. Also bad. Inflation by the end of 2021 had already been sort of out of control for an entire year…. but the annualized CPI numbers look fine in the first half of 2021 because we had a healthy economy in the first part of 2020 that they were being compared to. Then in the latter half of 2021, annualized numbers started to be compared to pandemic months where we had economic contraction, and even though inflation had slowed down compared to the start of the year, the conclusion in all the news outlets was that inflation “returned” in late 2021…. when late 2021 was actually better than early 2021 and delaying action until then almost certainly made things worse.

From December 2021 to June 2022, it then went absolutely bonkers. We went from that 144 to a whopping 152.9, a horrible 6.2% gain in just half a year. Since then? CPI in November (December not yet out) was just 154, representing only a 0.72% increase in 5 months (and importantly, falling back within the bank’s target range when annualized). Hopefully, for all our sakes, it sticks.

Where is this level of detail in inflation reporting (let alone David’s excellent “how did the price change between 2 months this year compare to previous years” analyses)? The narrative basically seems to be that inflation went up to 7% in March and has remained flat since then. Technically true on a year over year basis, but a completely nonsense way to look at what is happening as it misses the fact that inflation in the second half of 2022 is well lower than the first half of 2022 AND the second half of 2021. If people had a little bit more insight into where inflation currently is, I think they would be much better equipped to plan for potential changes in interest rates.

PM

at 7:08 am

you’re looking at headline CPI, which is heavily influenced by gas and food (both extremely volatile). Core inflation, and especially services tend to be stickier. Its the core services going up so much that freaks out policy makers because you risk a wage-price spiral. Its better for the BoC to do a bit too much than a bit too little. Pain now or a lot of pain later, take your pick.

Bryan

at 10:37 am

To my point above, it is far more difficult to find and track raw core consumer prices (separate from YoY core inflation). Having found them though, and even more pertinent to my point above, core inflation tells the same story as headline inflation. In the first half of 2022, Core prices moved from 142.6 to 147.8, a massive ~8% annualized rate! Since then, core prices have risen to 149.7 in 5 months, which is ~3% annualized rate…. again, in line with the Bank of Canada’s inflation targeting.

I share your opinion that doing too much early is more than doing too little, but where I diverge is calling this “early”. It isn’t. Mid 2021 would have been early, and inflation could have been caught then if the discussion wasn’t so enormously centered on year over year data and the type of approach David takes with real estate data analysis was also used instead. Not acting then is what caused inflation to get out of control. Now continuing to hike rates even though inflation is back in line (but we can’t see it when obsessing over YoY data) is going to hurt the economy more than necessary for the same reason….

Ace Goodheart

at 3:45 pm

If you put a chart of mortgage interest rates next to a chart showing house prices, and then you put a chart showing inflation numbers next to those two, you notice three things:

1. Mortgage interest rates move in the opposite direction from house prices. When interest rates go up, house prices go down. When interest rates go down, house prices go up.

2. House prices always beat inflation in the long term, but not in the short term. There is a catch up period. Often it can be 10 years or more.

3. The best time to sell a house is at the point of low inflation and low interest rates. If you miss that point, then it is a downhill situation from there, for 10-15 years on the historical graphs, before things catch up.

If you put next to that chart, a fourth chart showing government debt levels, you notice something else:

Governments as a rule will always attempt to inflate away excess debt. This means that during a period of run up in Federal debt, there will be a corresponding lack of willingness to engage in monetary policy tightening. When policy tightening does occur, it will be inadequate to address core inflation, and the result will be that a significant portion of the excess debt is simply “inflated away”.

For this reason, we see that house prices tend to have their “peak” during periods of excessive Federal government deficit spending and debt accumulation. During the corresponding period where Federal debt is brought under control, house prices will decline. The period during which Federal debt and spending is brought under control is always a period of rising interest rates and tightening monetary policy.

Watching this happen is like watching a play you have seen many times before, performed by a new cast.

It is the above situation that results in house prices always beating inflation in the long term, but not in the short term. You can’t print houses, but you can print money. And printing money does not always mean turning on the printing presses and actually creating new currency (like Trudeau and the Tiff’ster recently did). It can mean simply not adequately addressing core inflation, so that existing currency value declines.

That, I have found, is the trick to predicting “peak house”. When it is clear that inflationary pressures are at their utmost, when government spending is out of control, when money printing has recently occurred and when interest rates are at historic lows, that is the point when your house is at the highest value it will be. Following that point, the value will decease for 10 years or so, before going back up again. That point occurred in February of 2022.

We should now be entering a period of gradual price decline. That should continue for about 10 years.

The trick now is predicting the bottom.

The bottom should occur quite regularly at around a 10 year point from the peak. That is again what usually happens.

If you bought a house to live in, forget about all of this. It doesn’t matter. Houses should be owned for a minimum of 10 years, and better if you own them longer.

The news articles coming out about housing are getting quite nutty. Toronto Life had one recently about some poor soul who moved to Leduc, Alberta, thinking she had moved to Edmonton, and then lamented the lack of a Cactus Club (Edmonton has two) in what she thought was Edmonton (she actually bought her house in a small city a 1/2 hr drive from Edmonton). She then moved back to Toronto, which also has two Cactus Clubs, moving to a rented condo across from Square One (which is actually in Mississauga, not Toronto).

This was front page news. Don’t move to Edmonton, the social life sucks and they don’t even have a Cactus Club (they actually have two, but Leduc does not have any). Toronto social life is better (even if you are actually in Mississauga, not Toronto).

Interesting Christmas stories. The kids had a great Christmas here, Santa was very kind.

There is very little vetting of information going on. The idea seems to be, print something catchy and if the facts don’t line up, then oh well it’s click bait.

Jake

at 10:31 pm

The Toronto Life story was the absolute worst in journalism. To your point: they got the city wrong. Leduc isn’t Edmonton. But the writers don’t care. It sounded so much better. It’s like somebody moving from Edmonton to Toronto and complaining there’s no professional hockey team, only to find out that person moved to Milton. Most people can’t tell fact from fiction these days but what’s worse is they don’t actually want to.

QuietBard

at 7:00 pm

My holidays were fine.

A few questions/comments in no particular order

1) It would have been nice to see a chart spanning 30-40 years for the GTA Average Home Price. People often mention the late 80s early 90s decline being the “serious” downturn and a prelude to the houseageddon we will face this year.

2) “Both the 2017 and 2022 declines were motivated by government intervention”. It’s not clear to me whether you believe the government sets the interest rate. But I have heard similar from many others. The BoC is a separate independent body from the government whose primary objective is to 1) Keep inflation within a target range (has been 1-3% for a while now) 2) Keep economic growth chugging along. Nothing else really matters to it. Lastly, there was a rate tightening cycle in 2017 that also may have been a factor in the “cooldown”.

3) You should have asked Mr. Mississauga if he would be willing to pay the true “intrinsic” value of a home based on February prices rather than the reduced prices of November for a new home for himself. I wonder if the cognitive dissonance would have discombobulated his brain. Or maybe he already jumped off the deep end with the kind of mental gymnastics he was doing. Hilarious nonetheless

4) “Luckily, she and her partner can afford to not change shit.” I will admit there are probably many reasonable definitions of affordability. But I think your friend and her partner, while seemingly nice people, are financially illiterate. It’s one thing to have monthly payments go up by 50% and not really care about the effect. It’s another to not really know the payment has gone up by 50%. Another thing they may not know is the portion of capital being repaid has drastically been reduced or at the very least that extra four grand is probably just going to interest. I won’t needlessly speculate any further but I wonder what it’s like to not really care about ones finances and just have enough money to do “whatever”.

5) RBC recently had a report stating affordability is at the worst it has been in decades. I will wait and see if you talk about it in later points.

6) You seem like the type of guy who values having a numerically accurate blog. ($1165-$730) + ($1175-$1100) = $510. Not sure where the $1,110 monthly difference is coming from (I know its petty but I couldn’t help myself). Agree with the rest of the analysis

7) Not sure about the situation with your lower back and what kinds of things you have been doing to remedy it. But as someone who also has suffered lower back injuries, addressing postural issues, muscle imbalances and inflexibility certainly has reduced the severity and frequency of the pain. You also may have some kind of nerve damage in your spine. In which case I recommend you read up on google for a few days and do the surgery yourself. You could also talk to a professional but I’m not sure I would recommend such a route.

Great read as always

Appraiser

at 8:01 am

Excellent analysis as usual.

Joined the no spouse Christmas gift club several years ago.

Jimbo

at 5:41 pm

My spouse and I have done the no gifts for 7 years, however, we fill each other’s stockings. Watching the three kids open presents is the best part.

I hurt my back shovelling my driveway and my neighBoris driveway one night last year. The pain didn’t come until later that night, I couldn’t even roll out of bed it hurt so bad. My spouse made me do a couple of stretches that felt unbearable, but the pain was gone and I could get up with relative ease after that. All that being said, I don’t have any history of back injuries so the mechanism could be different.

With 114,000 new jobs posted and unemployment dropping, there is a higher chance of rate increases, but I don’t know if I trust that number…. Everything in Canada seems to be broken. My family now has US health insurance and we make the trip to the US if we have any nagging issues. Can have an MRI in a day instead of 6 months when needed

PM

at 7:02 am

Real estate prices always go up IF INFLATION IS ALWAYS POSITIVE. Thats a big caveat. I don’t expect that to change, just saying in certain centuries of human history deflation was more common. Look at Japan which has struggled with deflation for 30 years. Prices are still 30% below their peak in 1990! So yes Id expect prices in Canada to eventually hit new highs, but wanted to play devils advocate here

Cool Koshur

at 10:50 pm

Thank you David for the insightful post

I am anticipating another 10%-15% drop in prices from current level. Toronto Condo market will stay solid. Another hike is certain with today’s job numbers. Once central bank stops hiking interest rates for straight 3 months. I would consider that as bottom. With new immigrants arriving in droves. I expect to see buyers coming back in early fall. Any type of housing between this price range 500K – 800K is expected to stay strong.

Ace Goodheart

at 10:33 am

Interesting topic for ongoing discussion: The YCC folks (Young Communists of Canada) are at it again.

They just got themselves into the Star. Article about how it now takes 27 years to save a down payment. “Generation Squeeze”.

The thing that strikes me about their argument is that none of them appear to be actually homeless. This is “middle class communism”.

Their complaint is, now that their parents paid their way through school, they got good, middle class jobs, with good, middle class salaries, they can’t just buy a detached house in their ancestral homeland of Bloor West Village or the Annex, and instead have to live in a condo first, and built equity. Before they can realize their birth right.

Their solution? Tax older people’s homes out from under them and get housing thar way.

I assume that the young folks don’t expect to pay the yearly escalating housing fairness tax themselves?

I look at these people and think “what has this got to do with homelessness? Actual unhoused people who require urgent assistance? ”

These kids are upset because they have to start out in a condo?

At any rate, a topic for discussion