Looking back at my year-end posts from 2020, 2019, 2018, and so on, I swear I don’t think I’ve ever felt older.

Somebody told me once that when you have children, the years go faster because you start to view your life in terms of your children’s milestones. Growing from age one to age two represents a fifty percent increase in their time on earth, but it’s merely another twelve months for you. It happens so quickly, and you’re simply along for the ride.

Looking back at previous iterations of this feature, my stomach churns a little as I remember each topic vividly. Intimately.

Every year, there were five topics. And with each of these topics, I could pick one and literally tell you how my senses felt…

2015: Urbancorp “stealing” their condos back. I remember working out at a Crossfit gym in Liberty Village and running by this condo three times per week. The story broke in the media and later that day, I ran by and watched workers continue to work even though the project was apparently being canceled….

2016: Foreign ownership. I was having coffee with a group of folks at Marche in Brookfield Place and a banker from south of the border was telling me, “China is going to own your whole country in thirty years.” I nearly spit my coffee back into those awkward, oversized cups that always spill…

2017: The market insanity from January to April. I can picture the massive table in our conference room with dozens of MLS listings spread out as we tried to make sense of all these re-listed properties and a significant change in the market. I can still hear the sound of those glass doors opening and closing every time somebody came running in with another listing…

2018: TRREB versus the Competition Bureau. I was on vacation, playing in a park with my 2-year-old daughter in Jackson, Wyoming, giving a phone interview to a Toronto Star reporter about the Competition Bureau’s ruling. My daughter was pulling at my shirt. My wife was mouthing, “Do you really need to do this now?”

2019: Help. The photo I used for this was at Dundas and Jarvis on the southeast corner where a very sketchy, and often scary Tim Horton’s used to be. That corner had a certain aroma to it. Especially on a Sunday morning in the 35-degree heat of summer…

Each of those topics, although written several years ago, feel so fresh in my mind that I can almost taste, smell, and hear what was going on around me.

That sounds weird, I know.

But the next time that I say, “I live and breathe real estate,” perhaps you’ll have a better understanding of what I mean.

Here’s a look at the Top-Five stories that I wrote about in my final post of 2020:

Top Five: Real Estate Stories of 2020:

5) People Moving Out Of The City

4) Refusal To Accept Market Reality

3) The Rental Market

2) The Condo Market

1) The Pandemic

Of course, the number-one topic comes as no surprise.

But when you consider how insane the early-2020 downtown condo market was, along with the dregs of the fall-2020 condo market which was the worst I’ve ever seen, then the #2 topic on that list also remains unsurprising.

I won’t lie: some of those topics will be touched on again this year, and one, in particular, is essentially repeated but under a new name.

So without further adieu, here are the top five real estate stories of 2021, as chosen by yours truly…

#5: The Offer Process

I honestly don’t know if I’ve ever written more blogs in a single year about the offer process, multiple offers, or bully offers.

It started in February when I tried to educate the buyer pool, many of whom were just starting their searches, about bully offers.

February 16th, 2021, I wrote: “Bully Offer Observations”

This was a great ‘how-to’ guide for any market newbie, but as you’ll see in my #2 point today, many people stuck their heads in the sand.

It was only one week later, however, that I detailed an experience with a newbie agent who had no clue what she was doing.

February 22nd, 2021, I wrote: “Bully Bedlam!”

Then came the three posts that I mentioned in Monday’s blog which really pulled back the curtain on the offer process in Toronto:

March 1st, 2021, I wrote: “Behind The Scenes Of An Offer Night In Toronto”

March 3rd, 2021, I wrote: “Behind The Scenes: The Other Side”

March 10th, 2021, I wrote: “Behind The Scenes: A Seller’s Bully Offer Dilemma”

All three of those blog posts resulted in mixed opinions from the TRB readers. Some applauded the honesty, some lamented that this is simply the way our market works, and others called for change.

Change? In organized real estate?

This led to a very popular blog post with over 70 comments from the TRB readers:

March 31st, 2021, I wrote: “Is Under-Pricing Real Estate Unfair?”

Only a few days later, we examined other offer processes around the world.

April 5th, 2021, I wrote: “Is There A Better ‘Bidding’ System?”

If you don’t know what gazumping is, then read the blog. Seriously.

Also, if you’re one of those idiots that parrots what you hear others say, with no knowledge of the subject matter that’s coming out of your mouth, and you’ve found yourself saying, “We should use the auction system that they have in Australia,” then you’ll want to read the post.

This was around the time that we first started to hear this new buzzword: blind-bidding.

This was, apparently, the new devil’s child and the very reason for real estate costing so much money in Toronto.

Here’s the first article I saw on the subject that really made waves:

April 6, 2021: “Calls Grow To End “Blind Bidding” To Cool Red-Hot Housing Markets Across Canada”

This was just the start, unfortunately!

By the summer, Justin Trudeau himself, who had probably never heard of “blind bidding,” was making promises to END IT FOREVER!

At the peak of the spring market, I wrote a two-part blog series detailing a wicked bully offer dilemma that my sellers and I were facing:

April 26th, 2021, I wrote: “Yet Another Bully Offer Dilemma”

April 28th, 2021, I wrote: “Yet Another Bully Offer Dilemma (pt2)”

It looks as though I took the summer to find some other topics, but come fall, I finally addressed “blind bidding” in a section of this blog:

September 17th, 2021: “Topics That I Do Not Want To Discuss (cont)”

I outlined a scenario in which four people are bidding on a property and how many more issues would arise in the name of transparency. Conclusion: just have the government facilitate the sale of all property. It would be like the LCBO for real estate.

But I think we hit peak insanity near Halloween when the CBC put out some nonsense hit-piece on real estate agents because one lowly seller couldn’t sell her own home.

October 26th, 2021, I wrote: “Monday Morning Quarterback: ‘That’ CBC Marketplace Episode”

Just when I thought I had blocked out that awful memory, it resurfaces…

Real estate is as dynamic, fast-paced, and interesting an industry as you will find. And when it comes to the process of buying and selling property, there’s no part of the transaction that’s as complex as the offer process itself. Offer nights, multiple offers, bully offers, conditional offers, “being sent back for improvement,” it’s all part of the game. A game that many people hate, but a game that many of us know inside and out.

So what then, for everybody else?

More of the same in 2022, most likely…

#4: Prices Outside The City of Toronto

How ironic that one of the top five stories about Toronto real estate happens to be what’s going on in the market outside of Toronto!

Well, that’s just a sign of the times. And if you’ve followed the blog for the past few years, you’d see just how much we talk about real estate in areas outside our city.

As I noted above, the #5 story of 2020 was “People Moving Outside The City.”

But make no mistake: “Prices Outside The City of Toronto” is a completely different topic. In fact, it’s basically the consequence of the first topic.

In 2020’s year-end blog, I described a call with a client who called me late in the year:

Over the weekend, I received a text message from a client of mine about selling her home.

This client goes way, way back for me.

I rented her a condo back in 2007 when she finished university and got her first job downtown.

I sold her and her boyfriend a condo in 2009 when they were ready to jump into the market.

I sold them a house in Bloor West Village in 2011 when they were outgrowing the condo and looking to plan a family.

And now, like many others, they’re leaving Toronto.

“We bought a house,” she told me on the phone. “We’re heading up to Horseshoe Valley to plant some new routes, and start a new life.”

Well, fast-forward twelve months, and they’re out of the city. We listed their house in May; it was one that I wrote about in a couple of blogs about multiple offers, and now here we are, looking back at the year that was, and the year-end blog from 2020, connecting those dots.

But what’s the result of all these people buying outside the GTA?

Is it that prices here in the core are falling? No, of course not! Prices here continue to rise, despite the mass exodus, which just goes to show you how many other people are moving to Toronto. The next time you hear the term “net migration,” you should consider putting faces and names to the phrase.

We started 2021 here on TRB by talking about prices Ontario-wide:

January 25th, 2021, I wrote: “Ontario Housing Prices: A Five-Year Review”

I actually can’t believe that was eleven months ago. Again, I can picture myself sitting in my office at home making those charts.

In this blog post, we learned that Tillsonburg District had seen the highest rise in average sale price over five years, at a whopping 121%.

Of course, there was a natural follow-up blog post:

January 27th, 2021, I wrote: “Canadian Housing Prices: A Five-Year Review”

This blog post looked at all the cities outside of Ontario, and while the #10 city on the Ontario-wide list showed a 96% gain, the #10 city on the Canada-wide (non-Ontario) list only showed a 16% gain. Welcome to Winnipeg, folks! Number-one on the list was Chilliwack, B.C, at 76%.

These numbers were eye-opening, not only because they demonstrated the value that exists outside Ontario, but also because we began to see that, as hot as we think Toronto is, many areas outside the City of Toronto are even hotter.

In the spring, I helped a colleague buy her home in Courtice, Ontario. There were twenty-eight offers and she and her husband paid-up big-time! But you know what? That house is up 15% since they bought in February. No exaggeration, folks. That “stupid” market in the spring got even dumber by the fall.

I’d heard so many horror stories about what was happening outside the central core, mainly in Durham Region, that I sat down to dig through the numbers.

October 12th, 2021, I wrote: “Damn, Durham!”

This actually took quite a bit of work, but I had always wanted to do it!

It’s one thing to say, “Prices are up 60% in two years,” but it’s another thing entirely to show one actual house that sold twice in that time period.

We scoured MLS for duplicate listings and compiled a list. There weren’t many. After all, who moves inside of twenty-four months?

But we found houses that had sold for annualized rates of appreciation of over 30%.

That blog post only generated a dozen comments, but the hits from Google were massive over the last two months. It shows up in all kinds of searches, and I’ve received more random emails from prospective buyers in Durham Region than in any other area, or because of any other blog post, or market topic.

About one week later, I went back to the well…

October 14th, 2021, I wrote: “GTA Regional Housing Prices: Pick Your Poison!”

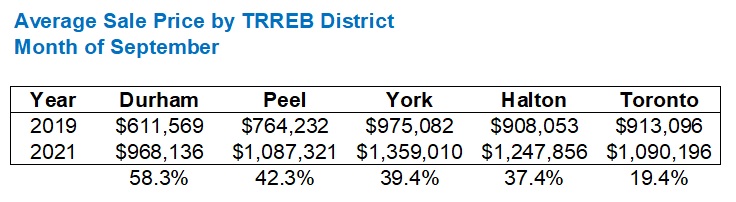

This blog post answered an important question: what’s happened to housing prices in the five major TRREB Districts?

This is necessary reading for anybody who thought that the City of Toronto is expensive!

In a two year period from September of 2019 to September of 2019, the average house price in the City of Toronto “only” increased by 19.4%.

But that’s 5th out of five TRREB districts!

And it’s about half of #4 on the list.

This is absurd:

Now do you see why “Prices Outside The City of Toronto” was worthy of a Top-Five ranking in 2021?

And where does this leave us?

With a “housing crisis” in Toronto, there’s really no escaping to Pickering, Burlington, or Unionville, is there?

How far do you have to go before you find price relief?

And how quickly are those houses appreciating?

Another factor in all of this is the secondary housing market that exists outside the GTA and which has been red hot since the start of the pandemic, as people sought refuge from COVID in their new ski chalets or summer cottages. But those sales aren’t included in the five above, which are TRREB districts.

All in all, I’d say that the topic of “people moving out of the city” is going to remain as current as “prices outside of the city of Toronto” as we move into 2022…

….and beyond…

#3: Market Frustration

I had considered a few different names for this topic.

“Buyer Frustration & Willful Ignorance” was one, but it sounded a bit too much like #4 in 2020’s list, called, “Refusal To Accept Market Reality.”

They’re different, in my mind.

Because most of what I explored last year had to do with greed and stupidity, whereas in 2021, it was more of a willful ignorance. Because by now, the book has been written on real estate. It’s just that so few choose to read it…

Also, 2020 dealt more with buyers, whereas in 2021, we heard from a lot of sellers as well.

Not only that, there’s been talk of the federal government stepping in to enact change in how the real estate market works, so all in all, I think one of the top stories of 2021 was simply a “market frustration” at all levels.

I covered this so many times this past year.

January 18th, 2021, I wrote: “Seeing What You Want To See”

This was a story about a young couple who were referred to me by my mortgage broker, who saw a townhouse listed for sale at $850,000, but refused to hear me when I said that it would sell for a minimum of $1,100,000. I explained it as best as I could, but they didn’t hear it.

They also didn’t want to hear me describe what they could afford. I mean, this house that they wanted – which sold upwards of $1,200,000 in the end, was so pretty! And what they could afford, was not.

But who wants to hear that? Nobody! Especially when there’s another agent out there somewhere who will tell this couple that they can afford that house! It doesn’t matter that this agent is going to waste their time making offers that get blown out of the water, force them to spend months spinning their wheels, and eventually sour them on the market so they become bears and decide the market is going to drop. Because in that moment, when they’re that sore, and that hurt, and that in need of a friend, the agent who tells them what they want to hear is the one who’s arms they’ll run into.

If 2020 was about stupidity, then 2021 is about ignorance.

February 8th, 2021, I wrote: “Monday Morning Quarterback: I Don’t Understand”

A colleague of mine had a listing in the west end that she massively under-listed, just because, why not? She inherited the listing from another agent, it was vacant, needed work, and the market was nuts. So list it at $0.01 and let people bid, right?

Alright, so it was listed for $1,149,900, but the fact that it had been listed in 2020 for $1,599,900 should have given people a good idea of where this thing would sell, what it was worth, or what the seller’s expectation was, right?

Nope.

It didn’t stop a dozen people from submitting bids at or around the asking price, even though they knew there were over thirty competing bids!

The public hates “under-pricing” and people want to blame real estate agents, but if you choose to bang your head against the wall, and you end up with a concussion, are you going to blame the person who built that house for putting a wall there?

My colleague said that people were calling her crying. They were begging her, asking her, “What do I need to do?” But these people were off on the price by a half-million dollars!

Maybe this is stupidity, but I felt it’s more of an ignorance than anything else; a willful ignorance. A learned one.

But it’s “market frustration” at its greatest, any way you want to look at it. Experiences like this, in 2021, were a dime a dozen.

In March, we were given one of the dumbest real-estate related stories I’ve read in a long time:

If that doesn’t say market frustration, then I don’t know what does!

Except, again, this was based on willful ignorance than market forces.

So naturally, I had to respond.

March 12th, 2021, I wrote: “The Friday Rant: Stop Talking”

I wanted to call it “Shut Up” instead of “Stop Talking,” to mimic the “Shut Out” headline, but I was trying to be nice(er) to the protagonist in the story since I knew he was about to take a shit-kicking from my readers…

The original article, as well as my blog post, essentially detail a young idiot named “Greg” who is in complete denial about the real estate market, who has made every possible mistake throughout his journey, who got burned timing the market, and then went crying to the media to tell his story. And of course, the media lapped it up like a dog left outside Starbucks on a hot summer day, slurping from the bowl that a dozen other dogs have slobbered in.

“Greg” sold his condo in 2019 and then tried to buy a house in 2021, and yet it’s the market’s fault that he can’t afford to buy a house, and not Greg’s for unsuccessfully timing the market?

Shut up, Greg!

Greg bitched and moaned about “percentage of bid price over list price” as though he could shape the narrative to his advantage, when all the while, ignoring the market.

He was probably using his friend’s uncle from Niagara Falls as his agent too. Always a solid move.

I can’t stomach getting into more of Greg’s follies. It’s bringing back memories of the spring…

There were no shortage of blogs about all aspects of market frustration, in 2021.

The media didn’t help, although they never do.

May 7th, 2021, I wrote: “Telling Scary Stories!”

This was a blog post about how the media manipulate statistics to tell a story that’s different from what’s really going on.

It was comical, at times.

Imagine a headline that read, “Sales Dropped 13% In April,” only to find out that sales dropped from an all-time high the previous year. So that 13% drop actually represents the second-highest of all time.

But that doesn’t get clicks, does it? Negativity sells!

I happen to think that the media is a big reason why so much market frustration exists!

May 19th, 2021, I wrote: “What The Heck Is A Bidding War?”

Again, if you define “bidding war” as two or more people submitting offers on the same property, then who isn’t going to experience market frustration?

Of course, market frustration is never going to be quelled when you have people spending money on billboards like this:

May 27th, 2021, I wrote: “Helping Hand In The Housing Market”

That blog post produced 37 comments from the TRB readers, many of whom described how they received help with their down payments or home-buying endeavors in the past.

But the message to society was loud and clear: fuck you.

That’s the message being sent by the have-nots, to the haves. If you own your home, we don’t like you.

This billboard is a walking advertisement for “market frustration,” and I could have put this at #1 on my list for 2021 simply based on that photo above.

Another exercise in “market frustration,” which also gets a high-grade for “willful ignorance” was the following:

Really?

A parking space or a locker, eh?

That’s bad, but not as bad as the billboard above.

The only thing that could make it worse than the billboard above would be if the author of the article actually went to a condo, got inside a storage locker and took a photo…

…but that would be too inflammatory…

…right?

Oh FFS.

June 14th, 2021, I wrote: “Monday Morning Quarterback: ‘That Article’ You All Read Last Week”

The title said it all. I barely needed to write 2,800 words, and yet I did.

Seriously, who gave this person a forum?

This is the kind of crap she wrote:

In the GTA, listings for plots of land again appear for $1. Every so often, something jumps out between $50,000 and $100,000. Each time, I find another plot of land, sometimes with the caveat that the land is not yet attached to the town’s sewage system.

I know that some people read “The Wealthy Barber” by David Chilton before they read “Financial Planning & Analysis” by Jack Alexander. But to publish nonsense like this in a major newspaper is just giving young people a reason to suck their thumbs and cry.

October 29th, 2021, I wrote “Gifting For A Down Payment”

The CIBC paper written by Benjamin Tal, which all the media outlets picked up, gave those folks suffering from market frustration yet another “bad guy” to blame: buyers’ parents.

Yes, buyers get money from their parents. No doubt about it.

But as with every other person, group, or circumstance on which to lay blame, these faceless “parents” sure took one in the teeth!

Market frustration boiled over to attack “investors” for high real estate prices, as we read last month.

November 26th, 2021, I wrote, “The Friday Rant: We’ve Run Out Of People To Blame (Pt2)”

This was a follow-up to my first iteration by the same title in July, where Realtors were to blame.

July 30th, 2021: “We’ve Run Out Of People To Blame”

Blaming people for high prices is borne of market frustration, and not of logic. So these two posts are likely going to be followed by similar ones in 2022.

In fact, if you can dream up a group of people to blame, I’m willing to be you’ll read about it at some point. That is how big an issue and how big a topic market frustration is right now.

Hell, I might move this to #1. Lemme noodle on that…

#2: The Election & Real Estate

I wanted to leave this out, trust me.

I had honestly thought about pretending that this wasn’t a topical subject, and that we didn’t spend so much of 2021 discussing the federal government’s inaction and/or inability to “effect change” in the housing market, especially as it pertains to the election.

The word “election” appeared in 18 blog posts this past year.

But are we forgetting that there was a federal election in 2019 as well?

It almost felt like I was repeating myself!

January 28th, 2019, I wrote: “Liberal Government To Make Home-Buying Easier For Millennials”

That was merely the start of the intersection of “real estate” and “federal election” that seemed to vomit all over TRB in 2019.

But what else did we discuss in 2019 in relation to the federal election?

March 13th, 2019, I wrote: “Morneau, Millennials, & Mortgages”

March 20th, 2019, I wrote: “Should The Feds Introduce Shared Equity Mortgages?”

June 6th, 2019, I wrote: “Much Ado About Mortgage Announcements”

2019 was littered with discussions about the federal government trying to “make home-buying easier” for Canadians, er, voters, and the Liberal government prevailed in that election as we all know.

But then, as we also know, something amazing happened: Justin Trudeau saw an opportunity to take his minority government to majority status, and while nobody in the country wanted an election, he called one.

And then all the promises, hand-outs, voter-candy nonsense started all over again…

I avoided talk of the election and real estate as long as I could. Although we had an inkling as early as the spring of this year that an election would be called, I didn’t address it until after the summer.

September 7th, 2021, I wrote: “Burning Questions For The Fall Market!”

Of course, #1 on that list was: “How will the federal election shape the future of the housing market.”

I didn’t want to discuss this. I promise you now as I told you back then.

It ate me up inside.

Why?

Because I knew that nothing was going to change.

From the blog:

It’s “silly season” out there right now. The great “give away.”

$2 Billion for this, $700 Million for that.

The individual voter isn’t thinking about the big picture or the greater good; they’re thinking about what politicians will do for them. Free dental? Free child care? Free gouda cheese? Sounds good(a) to me! Here’s my vote!

This is how elections work. Make promises, offer handouts, and just like a tuna fisherman with multiple lines in the water, you’re hoping one of them catches. And when it comes to the housing market, everybody is affected, so politicians are going to offer ideas, solutions, and in many cases, handouts, in an attempt to fish voters in.

But the problem, as you and I know, is that most of the impact to be made in the housing market starts with the municipalities. Then the province. Then, and only then, the federal government.

The Liberals prevailed, there was little movement in the number of seats for each party, and the entire election was a monumental waste.

However, it wasn’t until after the election that I realized I simply had to address the intersection of the election itself – specifically the ideas and promises that came out of the election, and real estate.

September 15th, 2021, I wrote: “Topics That I Do Not Want To Discuss”

The name is so fitting because I literally had a list on a Post-It note with the title underlined and bullet-points underneath.

The first topic?

The Insanity Of Election Promises About Bringing Down Real Estate Prices

From the blog:

The government can’t “tank” prices. All those $500,000 condo buyers, with 5% or $25,000 down, can’t withstand a $150,000 price correction or the economy would collapse, and then society would collapse, and the government is never going to let that happen.

The CMHC is simply too big and has too much exposure, and what many of you are reading right now angers you, but you know I’m right.

I’m sorry. I don’t run the CMHC. I don’t like it either.

But you know as well as I do that candidates vying for office are simply yelling things into a microphone, all day long, and will continue to do so until September 20th. None of this means anything!

And yet, we continue to talk about which candidates will do the most to bring prices down.

But the topic of “The Election & Real Estate” didn’t really hit its mark until I lost my mind and had to take on the subject, first-hand, for once and for all.

October 20th, 2021, I wrote: “Federal Government Promises: A Surefire Way To Heat Up The Market!”

I wish I had a direct line into the Prime Minister’s office.

Because I don’t know which is worse:

a) That the government isn’t aware of what effect their policies would have on the real estate market.

b) That they do know, and they just don’t care.

Read the post if you haven’t done so already.

It was 6th or 7th on my short-list for “Top Five Blog Posts,” but I was trying to avoid negativity and it’s just such a painful topic and so hard to read.

Here are the six promises/pledges/ideas that I addressed and subsequently destroyed in the blog:

1) Increasing the CMHC mortgage insurance ceiling from $1,000,000 to $1,250,000.

2) A new “Tax-Free First Time Home Savings Account”

3) Increasing first-time home buyer tax credits from $5,000 to $10,000.

4) Reduce CMHC insurance premiums by 25%, saving an average of $6,000.

5) Introduce an “anti-flipping tax” that requires a home-owner to hold a property for 12 months.

6) Ban foreign buyers for two years.

This was probably the most contentious topic for me, personally, in 2021, and that’s because I have so little faith in politics. I know how politics works. Lie, make promises, win office, and stay in power. But I also know how real estate works, and if you put those two things together, you get somebody who is really angry at all the bullshit coming out of the Prime Minister’s office. To be fair, this would happen regardless of the political party. But it didn’t make it any easier to swallow.

So then…..election in 2023?

#1: The “Problem” In Our Housing Market

Those of you who read the blog regularly know why “problem” is in quotations.

And those of you who wondered what #1 on this list might be are now likely nodding along as you come to realize what this point is about.

It’s 2021. Real estate prices continue to appreciate. The average home price in Toronto of $1,163,323 in November is up 29% since the pandemic began in March of 2020. The average home price is up 142% in ten years and 227% in fifteen years.

And yet we still can’t seem to define the “problem” in our market.

I mentioned this in Monday’s blog, but at the risk of sounding repetitive, I urge you to read these two blogs from April:

“Problems, Solutions, & Everything In Between”

“Problems, Solutions & The Problem With Those Solutions”

The problem in our market is that we can’t actually define the problem.

We could try, but we’d disagree.

And if we start from the very beginning, you’ll see where the problems lay.

Is the problem in our housing market that housing is too expensive?

Sure, that’s an easy one, right?

Except that it’s not, because who defines what’s “too expensive?” Is Toronto expensive relative to New York, Paris, and London? No, it’s pennies on the dollar. But who gets to pick that list of cities? And who decides if Toronto should be held in a similar regard, let alone the same regard?

And too expensive for who?

That young 20-something posing for a photo in a goddam condo locker? Should she be buying real estate? Do 23-year-olds in Tokyo expect to be able to buy real estate on their entry-level jobs out of university? A lot of the TRB readers have commented over the year that they waited until they were in their late-30’s to buy a house, and yet today’s Gen-Z wants to buy now.

So who should be able to buy and when? But also, why? And where? Should we expect that every single person who works downtown should be able to buy or rent downtown? It would be nice, but not every banker on Wall Street lives in Manhattan. In fact, most can’t afford to, and they’re bankers. Whatever happened to commuting?

Do university students in downtown Toronto all have to live in condos? My mother went to U of T in the 1960’s and she lived at Bathurst & Wilson, in her parents’ house, and commuted every day.

I’ve gone on record and said that entitlement is its own epidemic in this country, specifically this city, where everybody wants, wants, wants, and expects to get. I’ve also noted that our federal government has exacerbated these desires by effectively promising the population that they can all have.

The end result is that we deem “housing too expensive” as a whole, but never stop to think about what that means.

Is the problem that people can’t afford to live in the city anymore?

That’s a problem for sure, but the solution is simple: don’t live in the city anymore.

I feel as though “deserve” is a tough word to use in a real estate context.

Does a person, born and raised in Toronto, “deserve” to afford a home as an adult? I don’t think so. I think circumstance, plus the free market, determines who can and can’t afford to buy in Toronto. It’s incredibly unfortunate, but it doesn’t make it any less true. The funny thing about Canadians is that we anchor onto our city of origin like nowhere else. Ask any American where they were born and I guarantee you it’s not the city they’re currently living in.

As I said in the first point: people don’t “need” to live in the city just because they work here. It would be highly convenient, but that’s a want, not a need. And those who have jobs and skills that are geographically transferable have the luxury of moving to a more affordable city. How is that a problem? For a guy like me who is tied to Toronto until death, I’m actually jealous.

Is the problem that prices are appreciating too quickly?

Sure, we can all agree on that, right?

Except perhaps prices were too low to begin with, and the fact that you could buy a new-build, detached, 4-bed, 4-bath house in Leaside for $850,000 in 2006 tells us that Toronto was exceptionally under-valued.

This is a problem, but what’s the cause? It’s supply and demand, right? And where does supply originate? How about demand?

Is the problem that there is too much demand?

Many people will shout “yes,” and suggest that our market is supported and inflated by all-time low interest rates, and they’re not wrong.

But what about foreign buyers? Is their demand organic? No. Does it belong here? Topic of much debate.

Is the problem that there is too little supply?

Yes, that’s a problem.

I mean, didn’t I just write about this?

“The ‘Problem” With Housing In Canada Is Lack Of Supply”

But is supply the problem in our city?

And what’s the root cause of that?

Is the problem that the three levels of government can’t assist with the supply issue?

Again, yes, this is a problem.

The larger problem is that the federal government postures that they have the greatest ability to enact change, when they actually have next to zero ability to do so.

Is the problem that the government can’t actually affect the market?

Outside of increasing interest rates, I don’t see what, if anything, the government can do.

They could build 10,000,000 homes, but they won’t. It’s too hard, and governments don’t do hard things. Also, the housing they would build wouldn’t satisfy “demand,” in that much of the population wouldn’t want to live in purpose-built rentals, laid out in blocks, outside of any major city centre, and that’s probably what the government could actually build themselves. Would they partner with the private sector? Could they incentivize the private sector and institutional money to build for them? I won’t hold my breath.

We have a lot of problems in our housing market but we can’t really ever agree on what that one problem is.

The general consensus has to do with affordability, and I get that. But I don’t look at things at face value. I like to dig deeper, and I personally think that stagnant supply is an issue, lack of supporting infrastructure in our greater city centres is an issue, and societal norms in 2021 are an issue. There’s not enough being built, our cities are poorly designed and aren’t improving, and too many people think they deserve to afford what they want.

Problem solved, or no?

Alright, I’m sorry, that was way too long.

And as a friend told me after Monday’s post, “By the time people are finished reading this, they’re too damn tired to post a comment. That, and they’re a month older…”

Once again, I would love to hear from you with respect to these five topics and whether there are any that you felt were more deserving.

See you Friday!

Libertarian

at 10:29 am

David, good job in articulating the issues in your #1 story of the year.

Gov’t promises about doing something, people expecting to be able to have it all, and the media reinforcing both of those has me believing that nothing will change during our lifetime. No matter how many condos are built, how many farms are turned into subdivisions, and how much public transportation is expanded, people are still going to complain that housing is too expensive.

Until we as a culture change our philosophy/beliefs about real estate, progress will not occur.

Condodweller

at 10:42 am

Busy time of year, no time to read this much but I read the #1. This is a nebulous problem and it’s difficult to nail down but as with any other large/difficult task, this should be approached one step at a time to at least start tackling it. Step by step progress should be able to be made.

“Is the problem that the government can’t actually affect the market?”

I think the problem IS because the government is affecting the market. I mentioned immigration as a problem as we tend to focus on supply, but I think that the government is not able to or doesn’t want to deal with the supply issue that only leaves the demand issue and they are in control of the biggest demand issue. Perhaps this needs to be voiced, even here, so that people are aware of this. Each person who comes to Canada takes up the limited supply. Perhaps immigration is an easy solution for the government to solve other non-real estate issues and if that is the case they should come clean and take a hard look at the possibility of addressing those issues in other ways.

Income will always be an issue and this will be an issue even if people move out of the city. How are people expected to work in the city if a significant part of their income is spent on transportation? Never mind the time commitment. Who is wants to spend 4hr a day to commute and approaching $1000 for train/bus passes for 2-4 people?

Ed

at 4:39 pm

TLDR