Have I ever mentioned that I collect hockey cards?

Yeah? Maybe? A few times? Or, like, all the time?

Well, I’m forty years old. I know who I am. I know what I like. And I also know that I have no shame, so if somebody wants to make fun of me because I have every G.I. Joe action figure made from 1982 through 1987, then so be it.

What you might not know is that collecting sports cards as a child in the 1980’s with my brother and my father was not only a great male-bonding experience but also an early lesson in business.

I remember the time I found a 1990 Hoops David Robinson in the ten-cent bin, bought it, and flipped it to a dealer for $5.00 ten minutes later. My Dad was so damn proud of me! We barely made it out of the car in the driveway before he told our next-door neigbhour, Harry.

From the age of eight, I learned to negotiate and haggle, but I also learned what a “market” is.

Buyers and sellers interact in a free market and their actions determine price. Pretty simple. But then, you’ve got external influences, like the role of the government, CMHC, and Bank of Canada in real estate, for example.

In the 1980’s and 1990’s, we were all slaves to the Beckett Price Guide. But if a price-guide says a card is worth ten dollars, but you can’t find anybody to buy it for ten dollars, then it’s not really worth ten dollars. External influences be damned, the market makes itself.

That was a tough lesson to learn and one that took some time to set in. As a child, you’re sitting on a card that is, apparently, worth $30.00 according to a price guide, but dealers will only pay you $15.00 for it because they need to be able to sell it for at least $25.00 to make it worth their while.

In this market, I learned the roles of buyers and sellers, and what happens when one puts the shoe on the other foot. I learned about liquidity as well as physical markets, exchanges, or mediums.

Fast-forward to 2021, and the entire sports-card industry has changed.

In 1988, you’d see a card in a dealer’s showcase, ask to see it, then examine it closely. The dealer would say, “That’s mint,” and you’d reply, “I see a mark here, this looks near-mint to me,” and you’d both posture about the condition of the card, then haggle, and potentially agree on a price.

In 2021, every card is encased in plastic and graded by a professional grading company. I mean, not every card, but every card worth a damn. There are several grading companies out there, but one sits atop as the be-all and end-all of the industry. They’re called “Professional Sports Authenticators,” or “PSA.”

It costs money to send cards in for grading. Anywhere from $8 to $5,000. So for all of you out there who regularly email me and say, “David, I know you collect cards! I have some 1990 Score hockey cards in my garage,” trust me when I say you can safely throw them all out. They are worth less than zero, literally.

PSA grading can make or break a card, and thus make or break a market return.

If you found your 1984-85 O-Pee-Chee Steve Yzerman rookie card in your mother’s basement and sent it to PSA for grading, if the card came back graded a PSA-8, then you’ve got a card worth about $200. If the card came back graded a PSA-9, then you’ve got a card worth about $600. And if you were so lucky to own one of the one-hundred-fifteen 1984-85 O-Pee-Chee Steve Yzerman cards graded PSA-10, aka “Gem Mint,” then you’d have a card worth about $4,000.

Now how do I know what they’re worth in different conditions?

And how do I know that there are exactly 115 cards graded GEM-MT 10?

Because the entire trading card industry has been commoditized.

PSA’s website is essentially the trading card equivalent of real estate’s MLS.

You can look up the “Population Report” for any card to see how many cards have been graded, and at what grade.

But you can also look up the sales history of every card.

If you’ve read this far, great work. It means you’re not boring, if I’m being honest, since some people probably said, “David is talking about hockey cards,” and then buzzed off. But as you might have assumed by now, we’re going to talk about a “bubble” today and what that means. And since I’m damn tired of defending the idea of a “real estate bubble” here in Toronto, I’m going to show you what an actual bubble looks like; just in a different commodity.

July of 2010, Toronto Life put out this cover:

That’s rich.

“We’re in a bubble. Now what?”

I bet they sold a lot of issues of the magazine with that title, right?

Except there’s one problem: were weren’t in a bubble. We had never been in a bubble. Not then, not before, and not since.

In 2015, Hillard Macbeth published this book:

He too likely sold a lot of books with that title.

Except, much like the Toronto Life cover, and every single other example that I can show you, this was incredibly misleading.

We were never, ever in a bubble.

So what is a bubble?

Let’s say there’s a city called M.J. Heights.

In this city, houses cost $50,000, but all of a sudden, they went up. To $60,000, to $70,000, and within three or four months, to $100,000.

They had doubled in value inside of mere months!

Is that a bubble?

Only if the prices come back down, right?

Well, what if I told you that by the end of that year, houses were selling for $200,000?

At what point does it become a “bubble?”

In sports card collecting, there’s an argument to be made about what the “Holy Grail” of sports cards is.

Personally, I think it’s the 1952 Topps Mickey Mantle, as there are only three GEM-MT 10’s in existence, and none of the three people who own them want to sell. If they did sell, it would be at least $10-$12 Million, since a PSA-9 sold for $5.2M earlier this year. But maybe one of those three guys doesn’t sell for less than $30 Million, or $50 Million, or at all?

There are only two GEM-MT 10’s of Wayne Gretzky’s rookie card, and after one sold for $1,290,000 in December of 2020, the other owner decided it was time to sell, and netted $3,750,000 in May of 2021.

In basketball, there is a Holy Grail of sorts, but it’s not as scarce.

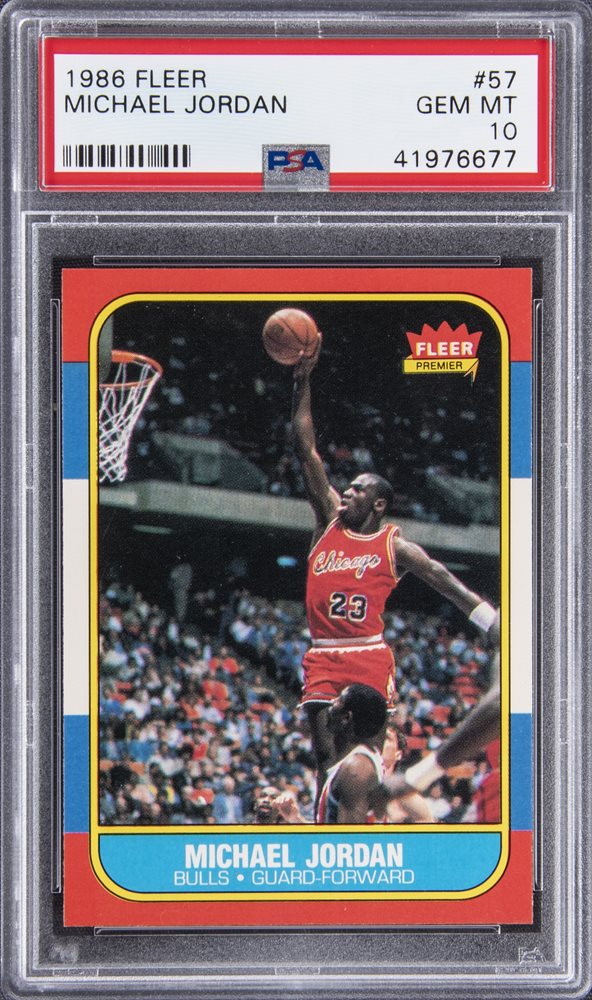

We all know that the greatest basketball player of all time is Michael Jordan, and there’s really no debate. Michael Jordan’s rookie card appeared in the 1986-87 Fleer issue, which is simply one of the most iconic designs of all time. During the pandemic in March/April of 2020, I found myself with way too much time on my hands, and I wrote a 220-page book, just for fun, called “My Top-Ten Sports Card Issues Of All Time.” Atop the list at #1 was none other than 1986-87 Fleer basketball.

Here’s the Michael Jordan card:

I can’t explain it to people who don’t collect cards, but there’s something about this issue that defines the word “iconic.”

In any event, there are exactly 319 Michael Jordan cards which have been graded a 10/10, GEM-MINT by PSA as of this writing, and even though they aren’t the rarest or most expensive basketball card out there (although that changed, as you’re about to read…) this is certainly the Holy Grail as it pertains to basketball cards.

So what’s the card worth?

Well, let’s see what it was selling for, say, two years ago? August of 2019 we saw sales of $33,600 and $36,100. That’s a lot of money “for a piece of cardboard” as many of you are thinking, but whether or not it’s a lot in a historical context, who’s to say.

In January of 2020, a card sold for $39,600, which is still in range.

But then in March, we saw sales of $48,600, $49,995, and $45,100.

And then what happened, in March and April of 2020?

Well, for one thing, a worldwide pandemic!

But there was also a Netflix documentary called “The Last Dance” which just about everybody and their mother watched! Actually, I know my mom did…

On April 20th, 2020, a card sold for $51,600.

The next recorded sale was May 11th, 2020 for $96,000.

Is that nuts? Somebody paid almost double for the same card only three weeks later?

From that date until the end of August, there were 19 more sales for an average of just under $80,000. Only one of those 19 sales actually topped the $96,000 paid in May.

But then on August 31st, 2020, a card sold for $111,000.

September 5th, 2020: $122,000.

October 9th, 2020: $125,000.

And in December there were four sales:

$211,560

$200,000

$208,100

$200,000

Tell me now about the price of this “piece of paper,” will ya?

From $39,600 in January to over $200,000 in December. What was driving this?

As I said, The Last Dance brought Michael Jordan back into the spotlight once again, and perhaps a new generation was introduced to a superstar who hadn’t been heard from in over a decade or more.

But I also suspect that during the pandemic, a lot of people were at home, bored out of their minds. Not only that, a lot of wealthy people found themselves with less disposable income because they weren’t traveling the world, visiting their vacation homes, or buying art at fundraisers.

So all of a sudden, buying a Michael Jordan GEM-MT rookie card seemed like both an investment and something fun!

But do you think that going from $39,600 in January to over $200,000 in December is in any way sustainable?

Does this represent a “bubble” to you?

I suppose it’s only a bubble if it bursts, right? We’d have to see prices crash?

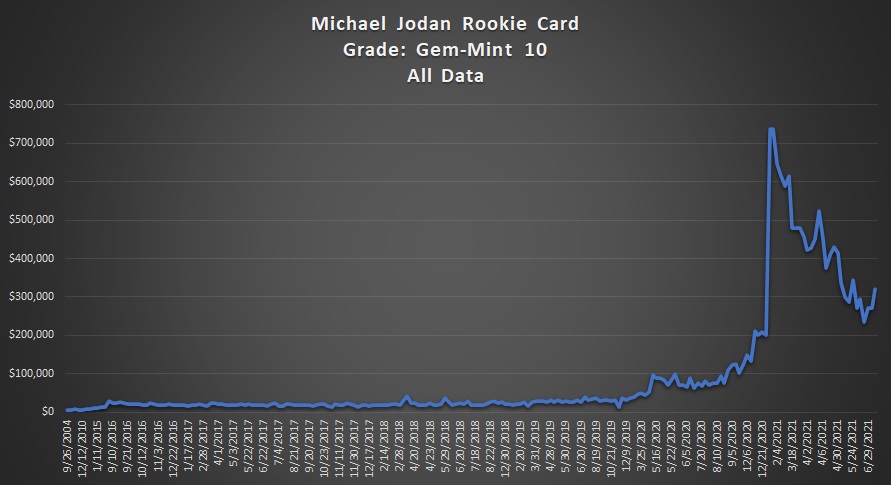

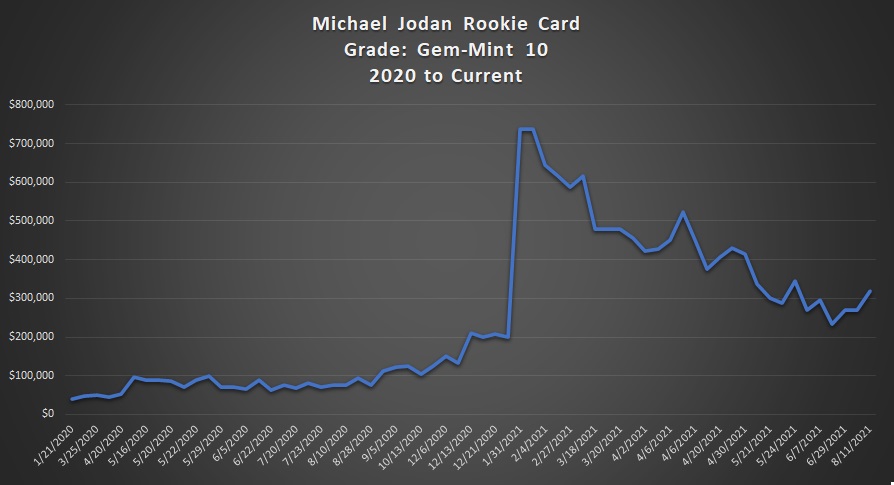

A picture paints a thousand words. So here’s the entire history of sales of the GEM-MT Michael Jordan rookie card from 2004 to the last sale on August 11th, 2021:

Is that a bubble?

Did it “burst?”

Oh, in case you’re wondering why the price is up over $700,000, but I stopped telling our parallel story about “M.J. Heights” when house prices reached $200,000, it’s because I wanted the shock value!

Yes, a card sold for $738,000 in January of 2021, which was exactly thirty-one days after a card had sold for $200,000 even.

In fact, during that auction on January 31st, 2021, there were two sales for identical Michael Jordan GEM-MT rookie cards. I know because I was watching this auction, having told a friend that it would sell for more than $300,000. Boy, was I ever light on that prediction!

In February, we saw sales of $645,000, $615,000, and $588,000.

In March, we saw sales of $615,000, $480,000, $480,000, and $456,455.

As you can see from the chart above, prices have come down.

The lowest sale is a mere $233,700 on June 29th, 2021.

The last sale, on August 11th, is for $319,800.

But we can see the “peak” though, right? At least, the peak for now?

Who really knows, long-term.

Personally, I think this card will not regain the lost ground and head back to, or over, $700,000. I think that was a “bubble” in the truest sense of the word. I think that people got very carried away and figured this card was headed to $1 Million, and I’m sure there was a speculator somewhere that decided to buy five or ten of these and might have helped drive the value up or down.

Of course, if the card goes over $1,500,000 next year, or the year after, we’ll look back at this as “the first wave.” I was charting COVID cases last summer looking at the “peak” of 640 in April, and the trough of 76 in July, and I bet Chris that we wouldn’t see over 800 cases in the fall. As we know, cases peaked this spring at 4,812 in April.

So it’s impossible to say whether or not $738,000 is the true “peak” for the Michael Jordan card, at least long-term.

But just look at this chart from 2020 to current:

That’s really, really tough to see and not conclude “bubble.”

Now, there’s another layer to this! And while this doesn’t help my parallel to the real estate market, I’d be remiss if I told the story about the Michael Jordan GEM-MT rookie card without mentioning speculating.

Each of these cards has a “Certification Number.” I have downloaded all 215 sales of the card and sorted by certification number. From there, I can tell when a particular card was bought and if/when it was sold.

You can imagine, a lot of people made money on this card, right?

Certification #43570575, for example.

This card was purchased for $90,000 on May 16th, 2020, well after the “first wave” of appreciation, but still before the market took off. The owner of this card sold it at auction a mere seven months later on December 21st, 2020, for $208,100. He more than doubled his money in seven months.

That’s pretty wild, right?

Certification #43569876 is even better. This card was purchased at auction on July 1st, 2020 for only $77,100, which is more than the above speculator paid for his card back in May, since the market can fluctuate! But this owner didn’t sell in December. In fact, he hung on until April 26th, 2021, and sold at auction for a whopping $430,500.

Yep. Bought for $77,100, sold for $430,500. That’s less than ten months. A 458% return, or 550% annualized.

But the absolute best example is Certification #25468896. The buyer got on this train early, back in April of 2019, and paid a paltry $29,100 for the card. Not only that, he sold at the peak: January 31st, 2021.

How much?

How about $738,000?

Yep. Bought for $29,100, sold for $738,000. That’s a 2,436% return, or 1,392% annualized, since he held the card for 21 1/2 months.

As you read above, $738,000 was the “peak.” So not only did this guy pay $29,100 for the card but he also got out of the asset at the perfect time. History will show he’s a genius, but looking at the sales above, you know there was a huge element of luck involved. Not only that, auctions start at $1, and you’re stuck with the sale price no matter what.

So what’s the take-away here, folks? Other than the fact that I’m on vacation, pre-writing blogs so you have something to read, and I’m clearly not finding any sexier real estate topics at the moment?

Well, I think it’s very, very irresponsible to use the word “bubble” in the context of real estate when we can look at true bubbles by comparison.

I also think that with any asset, whether stocks, houses, or basketball cards, you need to look at the use of the asset, the level of irrationality of the buyer pool, as well as the reasons for purchasing in order to determine whether a bubble is even possible.

With houses, buyers are looking for a place to live. Sure, there are investors too, but they might make up 5-15% of the average market, right?

With other assets, they’re often pure investments. They can be more liquid, and often intangible (like a stock), and traded with the click of a button, thus they can appreciate in seconds and exponentially.

The one thing that houses and sports cards do have in common is that both can be emotional purchases. I think a lot of people got carried away with the Michael Jordan rookie card in 2020, maybe because they were bored during the pandemic, or because they had more disposable income, or because the Netflix documentary brought back such fond memories of Michael Jordan. By the same token, it’s quite common for a home-buyer to daydream about children playing in the front yard, or romanticize a family function in the living room, or hitting a pinata hanging from the tree on somebody’s birthday.

I don’t think there’s an argument to be made that the housing market has been, or could ever be, as irrational and susceptible to a bubble as the Michael Jordan rookie card.

Although as I write this, there are 13 offers on 58 Parklea Drive in Leaside, but I digress…

A word to the wise: stop using “bubble” in the same sentence as “Toronto real estate.” It’s never, ever going to happen. Just like Michael Jordan winning the NBA Championship with the Washington Wizards…

Appraiser

at 8:07 am

Wow I learned so much about sports cards today. Really.

Great piece David. Puts me in mind of the bubble-mongers and real estate bears that at some point in the discussion inevitably bring up the great Tulip craze of the 1630’s as a relevant analogy.

Joel

at 8:48 am

Cool stuff man! Down memory lane alright.

Reminds me of the 1980’s when we put baseball cards in the spokes of our bike tires with a clothespin because it made a cool sound. Hopefully none of those are worth a million bucks.

Jenn

at 10:16 am

OMG this was fascinating! But yeah I’m one of the people that thinks it’s just a piece of paper!! So is art though.

David I have to ask what others are probably wondering: what is your ‘best’ sport card?

Tony

at 11:42 am

That’s like asking the guy what his kill count is.

David Fleming

at 2:15 pm

@ Jenn

Not a short answer here. I could talk about cards all day…

Define “Best,” really. Most expensive? Rarest? Favourite?

We put all of our cards into a safety deposit box around 1995 (my Dad did this…) and took them out in 2016. We had a 1933 O-Pee-Chee Aurel Joliat and Howie Morenz that were my favourites, and what I would call our “best.” We sent them for grading and they came back a PSA-6 and PSA-5 respectively. It was heart-breaking. I swear, I saw no imperfections in these! I was hoping they’d come back 8’s or 9’s. I cracked the Howie Morenz out and sent it in for grading again, and it came back a PSA-5 again. So at least we know the grading companies know what they’re doing! Those were my favourite cards, but I bought a PSA-7.5 Howie Morenz two years ago which is the second-highest grade in circulation, so that’s one of my faves.

We have a Gordie Howie rookie card from the 1951-52 Parkhurst set from our safety deposit box batch, and we sent it for grading but it came back ungraded, labelled “altered.” That was heart-breaking too. Did somebody really alter this card before we bought it in 1989? Or is it in such great condition that it’s tough to believe it’s real? I swear, I thought this could rate a 9. I’ll send it for grading again in a couple of years, maybe the grader just had a bad day that day.

We have a lot of “1-of-1’s,” meaning there is only ONE of that grade, and it’s the highest. So it’s the “best” in the world of that card. We had three of these in the 1933 Canadian Gum series come back from the grading company from our safety deposit box stash, so that was really cool to know that we had the “best” sitting in storage somewhere, and the previous owner of the “best” woke up one morning and checked the population report only to see that he had been usurped! A 1-of-1 might not be worth that much though, it depends on the set, how many people collect it, the demand, etc. I might have a 1-of-1 that’s worth $100 in a particular set but it’s special because it’s the only one.

In 2019, we bought a 1952 Parkhurst Tim Horton rookie card, graded PSA-8. There are fourteen of these, and two graded higher at PSA-9, so it’s not the most rare but we love this card! We’re collecting the whole set in PSA-8’s. Er, attempting to.

My favourite series of all time is the 1933 O-Pee-Chee hockey. Altought my favourite design ever is that 1986-87 Fleer basketball with the Michael Jordan you see in the post above.

Again, I could talk on end about cards. But people might think I’m crazy.

Chris

at 9:28 am

“With houses, buyers are looking for a place to live. Sure, there are investors too, but they might make up 5-15% of the average market, right?”

Fluctuates between 18-22% across Canada over recent years. Reached as high as ~24.5% in GTHA in 2018, currently just shy of 23%.

https://www.bankofcanada.ca/2021/05/financial-system-review-2021/#chart9

cyber

at 11:28 am

“Investors are defined as borrowers who obtain a mortgage to purchase a property while maintaining a mortgage on another property.” These figures seem to track DOMESTIC investors, and not even all of those (i.e. missing anyone with paid-off principal residence and investment property mortgage). Plus 4% of residential transactions made by companies (https://static1.squarespace.com/static/5df7c3de2e4d3d3fce16c185/t/5e3ad80ba8e0ad4a456e9bee/1580914703356/opacity.pdf). Plus trusts, straw men, and various cash purchases.

Chris

at 1:15 pm

Agreed, cyber. If anything, the Bank of Canada’s figures probably skew too low. But even their more conservative measure is well above the numbers David suggested.

Condodweller

at 1:29 pm

General rule of thumb, my experience, and anecdotal information suggests that in Toronto most buildings are around 50% rented. Clearly, there are exceptions but 40-60% is a good estimate if you don’t have data for a specific building.

Appraiser

at 7:50 am

Investors gravitate to what is rare and valuable.

Perhaps if there was adequate housing supply, there would be fewer investors.

Chris

at 9:11 am

Investors gravitate to where they think there’s a return to be made.

Appraiser

at 12:23 pm

Perhaps then if returns on real estate were not so attractive, there would be fewer investors.

The solution remains the same.

Chris

at 12:56 pm

Are we going to resume comparing returns? We haven’t had a stock market update in a little while, from either you or I.

Libertarian

at 2:26 pm

David, what a coincidence, you post this on the same day a Honus Wagner card sells for $6.6 million.

Peter

at 1:52 pm

Isn’t this the infamous card that Wayne Gretzky and Bruce McNall bought in the early 90’s?

David Fleming

at 2:24 pm

@ Peter

Great memory! To answer your question, yes and no…

Gretzky and McNall did purchase a T206 Honus Wagner in 1991 for $451,000 but it wasn’t this exact card. The card they bought was in Near-Mint condition, which was unbelievable, and eventually a collector/dealer named Bill Mastro admitted to trimming the card in the 1980’s. He went to jail in 2012.

The card auctioned off on Monday was graded a 3, and graded not by PSA but by SGC which is a lesser-than grading company so I’m shocked by the price.

The crazy thing is, there is a PSA-4 and a PSA-5 out there, so if one ever came up for auction it could fetch $10M, $15M, or God only knows how much.

David Fleming

at 2:27 pm

@ Libertarian

I watched this auction on Monday night.

Here’s the link:

https://bid.robertedwardauctions.com/bids/bidplace?itemid=86408

Condodweller

at 4:50 pm

In order to declare a bubble in anything, it would be nice to have a definition of what a bubble is exactly. If the price goes inexplicably high and then comes back down, would that be a bubble? Would the subsequent low price have to be lower than the low before the jump in order to call it a bubble? If a price steadily increases over 25 years and then their is a drop of say 10-20% would that qualify as a bubble? Or does a bubble have to resemble an actual soap bubble that increases quickly in size then it pops just as qucik and disappears? I mean housing is not going to disappear so by that definition we’ll never have a bubble.

Interesting perspective on cards. I was never really interested in them however I have invested in the company that owns PSA. It’s also worth looking at if you can find the price history as it was recently taken private. It was called Collectors Universe and the first time it hit my radar was during the 2008 crash when I noticed that it went from around $15 down to the lowest close of about $2.40 after the market pretty much froze and they elimiminated their juicy dividend. They also graded newly issued coins by the US government which was a big chunk of their business.

The interesting thing there was that if you had bought the shares around the bottom you would have collected around 40% dividend once it was reinstated after a year or so. Of course as soon as the dividend was reinstated the price shot back up and that’s when I first bought it at around $11 when the dividend was still about 10%.

It was quite a rollercoaster ride though as at one point they weren’t earning their dividend and started to run out of cash meaning the dividend was at risk again. I cashed out just above $20 to lock in my gains only to watch it soar past $30. Of course, the day did come when they cut the dividend, though not entirely, and it fell back to $10. It started to climb back and as covid hit, it kept slowly going higher. It passed $40, $50, $60, $70, $80 in about a year. I believe the last trade I saw before it went private was $93.

Imagine the person who paid under $10 for it and collected the dividend all along and sold out at $93. I didn’t own the shares then so I don’t know if it was possible to convert the shares for shares in the private company. Who wants to do the math of the return on $2.40 to $93 plus a 20-40% dividend along the way in about 13 years? But a more plausible $10 to $93 in a couple of years is even better. It would be interesting to know how many people held it for the maximum gain.

Oh, for another similarity between PSA and the RE market take a look at the commission they charge on grading/certifying those multi million $ cards!