Did I ever tell you that I climbed Mount Kilimanjaro?

True story.

August of 2010, which honestly seems like an eternity ago, I went to Africa with my father with the goal of conquering the highest peak on the continent.

My father was 63-years-old at the time and I remember looking through the log book of every person to summit for months, and I swear to you, I didn’t see anybody older than him.

I was 30-years-old.

Er, actually, I was 29-years-old, until we hit the summit.

August 30th, 2010, we hit the summit. August 30th, 1980, I was born. I didn’t know this until afterwards, but that was my “champagne birthday;” the 30th birthday for somebody born on the 30th. And what better way to celebrate than by standing on the roof of Africa?

The sherpas had a saying that they repeated over and over: “Polé, Polé,”

It means “slowly, slowly.”

That was the mantra at the time.

The air is so thin that to rush is to risk running out of breath, and when you run out of breath at 19,000 feet, you’re in trouble.

Polé, Polé.

From the very first day when you’re walking on air, through the last day when you’re grasping to breathe it; always polé, polé.

In early 2022, we saw back-to-back 7% increases in month-over-month TRREB average home price, and having gone from $1,157,849 to $1,334,554 in sixty days, it should come as no surprise that the market ran out of stream.

Of course, the massive interest rate hikes didn’t help, but I have to think that even without a single hike, we would have seen that average home price come down a little.

The fall of 2022 showed us a very slow real estate market, but it wasn’t just price growth that was slow, but rather sales as well.

Coming into January of 2023, I kept saying, “If there’s product out there, this market is going to move!”

It seems that there’s no product and yet the market is still moving, so perhaps I get half a point for that one?

Last week, I predicted that the TRREB average home price would increase 4%, month-over-month, and that was based on my gut-feel from what I’m seeing and experiencing out in the market.

Let me give you an example.

In February, I sold a house that saw a whopping twenty-four offers presented. My buyers paid more than twenty-three other seemingly rational, logical people would have paid, which could make them smart or could make them silly. It depends on your perspective.

They paid $1,680,000 for this house and while some market onlookers felt it was a lot, others felt it was completely reasonable. Who knew that one month later, we might be thinking it was a deal?

In March, a house was listed for sale right around the corner and it was inferior in just about every way. It was unrenovated, the main floor had all the interior free-standing walls (as opposed to the coveted open concept), no real upgrades to speak of, and instead of a deep, dug-out basement like the one in the house my clients bought, there was a dingy basement apartment.

Apples to apples, if my clients paid $1,680,000 for their house, then this house should have been worth closer to $1,500,000.

Did it sell for that?

No.

It sold for $1,670,000.

That’s right – a house that was at least $150,000 inferior, and upwards of $200,000 inferior, sold for only $10,000 less.

Did the market move 10% in one month?

Of course not.

But this is a sign of what’s happening in the spring market and I think it’s only the beginning.

We don’t want hyper-appreciation, however. We don’t want 10% jumps in price, but we also don’t want the 7% increases in TRREB average home price like we saw in 2022.

Polé, Polé.

If the market does begin to ascent, we want it slow and steady.

Despite my feelings about the market in March, it seems that the stats don’t agree.

The average home price in TRREB only increased by 1.2%.

Here’s a refresher:

Up only modestly from February’s $1,095,617 to $1,108,606 last month, you could almost call 1.2% a rounding error.

Nevertheless, the data shows that the market is now well above the fall of 2022, when September, October, and November ranged roughly between $1,080,000 – $1,090,000.

That’s what I’m feeling, for what it’s worth.

The fall was slow. It was sluggish. People bought, sure, but not at the same pace as they’re doing now. And the crazy thing is: there’s less inventory out there today!

The TRREB average home price is still down 14.6% from the “peak” in February of 2022, but we’re well past that slow, plodding market that we experienced in the fall.

The fall was like scree.

Mountain climbers know.

Scree is a combination of rock and sand that’s makes climbing really tough. With every step you take, you slide halfway back down again. You could take a thirty-inch step up the hill with your right foot, and by the time you plant your left foot, you’ve only moved twelve-inches. Imagine doing that up the the steep mountain face on the final assualt toward Gilman’s Point, let alone at 5:30am after a midnight start…

But the fall is long over and the spring market is now upon us. There’s momentum here and I don’t see this stopping.

It’s like when you finally get up over Gilman’s Point, the only thing standing between you and the summit is a brisk two hour-walk along the rim of the crater to the highest point of the mountain, called Uruhu Peak.

That walk is very slow and very steady. There’s no point in rushing as you’re going to get there no matter what. Plus, you’re high as a mo’fo because the air is so thin, so it’s better to move slowly and enjoy it!

I’m not trying to draw a parallell to any “peaks” here, in case you’re wondering, nor are we interested in peaking in this market, but rather it’s the “slow and steady” analogy that I’m trying to draw.

That 1.2% gain in average home price is a good thing, as a 4% increase would have pushed the market up too much, too quickly.

And the amazing part is: we’re seeing sales despite low inventory.

Now, I haven’t read the media headlines yet, but I wouldn’t be surprised if they ran with the number: -36.5%.

That’s how much sales in March declined, year-over-year.

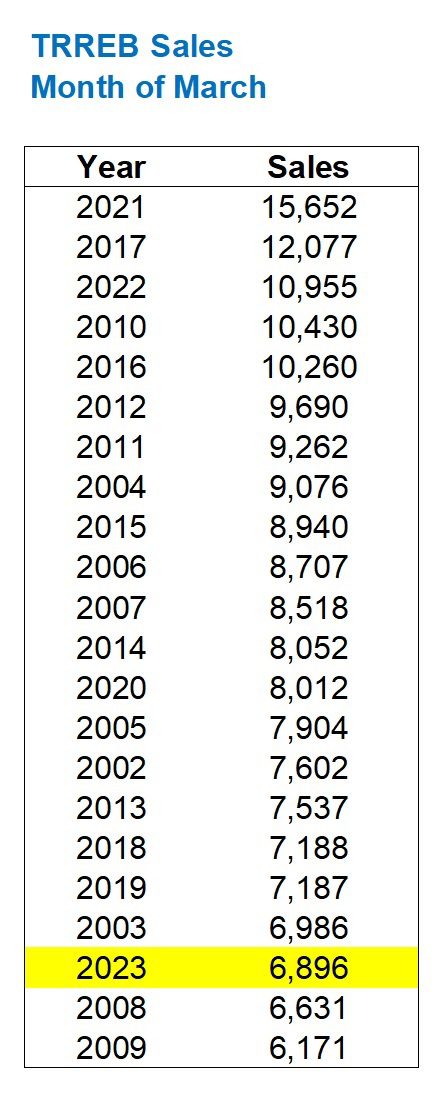

In fact, the 6,896 sales recorded this past March were the third-lowest in any month of March.

Have a look:

Just imagine: 15,652 sales.

That happened.

I have to pinch myself to ensure I’m not dreaming, but that actually happened. 15,652 sales in March of 2021.

Of course, that’s the all-time record for any month in the history of TRREB, and the second-place tally is a full 2,000 sales lower, as April of 2021 came in at 13,663, so that one month is an absolute outlier.

But even if we knocked the 15,652 off the list, we’d still see the 6,896 sales last month for what it is: low. The average number of sales in March, from 2002 through 2023, is 8,806.

So then why are sales so low?

Why am I on TRB every day talking about how the market is hot, it’s going to get hotter, prices are rising, and yet we’re just saw the fewest sales in any month of March?

Well, because there are no listings.

In fact, while we just saw the third-lowest tally of sales in the month of March, ever, we saw the fewest new listings in any month of March too:

This chart simply can’t be ignored.

If you want to buy a house or condo right now in the city of Toronto, you’re going to have fewer options than ever.

Literally.

Statistically too.

People must be growing tired of the same narrative. “There’s nothing for sale; there’s nothing for sale!”

And yet that narrative isn’t old. It’s merely the start of the tale of 2023.

When you put supply and demand together, interestingly enough, it shows just how tight market conditions are in the city right now.

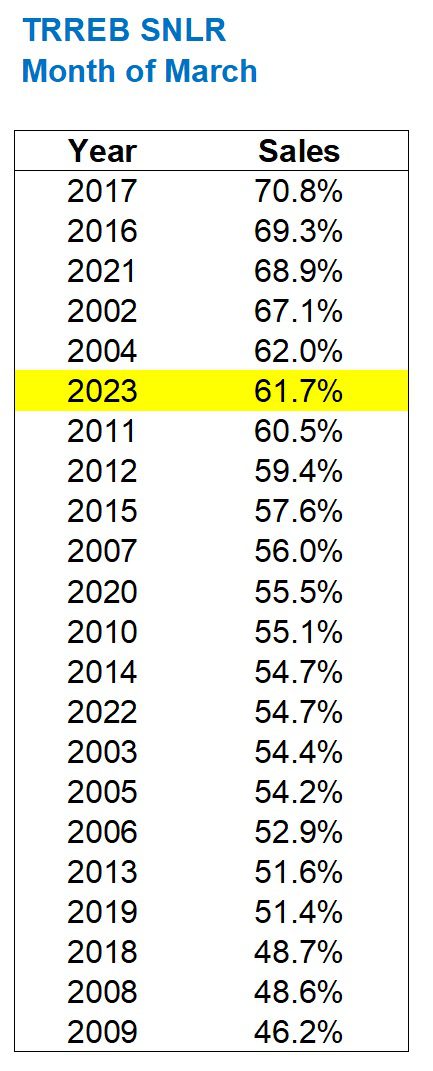

Here’s a look at the ratio of sales to new listings, or SNLR for short:

Sales are the third-fewest ever, and yet the absorption rate, or SNLR, is the sixth-highest ever.

In fact, we’re seeing an absorption rate that’s higher than March of 2022, which was near-peak for pricing.

How does that make any sense at all? How can last month’s “slow market” be tighter than 2022’s “peak market?”

Well, this is what I’ve been saying all along.

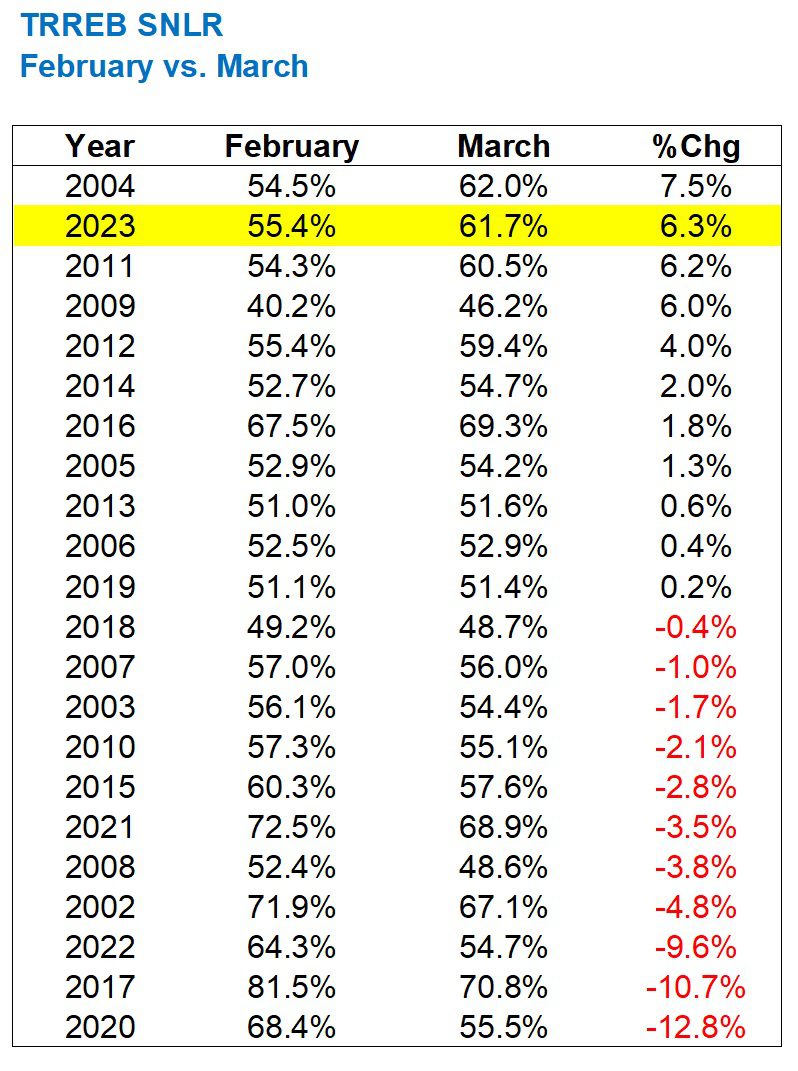

The SNLR increased from 55.4% in February to 61.7% in March, and that increase isn’t a given, by the way. In fact, in 11 of the past 22 years, the SNLR has decreased from February to March, so this past month’s increase is very, very telling of what to expect in the coming spring market.

Not only did we see that increase, but the 6.3% rise (from 55.4% to 61.7%) is the second-highest of all time.

Take a look:

As I said: the SNLR has decreased from February to March in half of the years surveyed above.

So an increase like the one that we just saw has to be telling the story of a tight market, and if we don’t see a huge increase in inventory this April, the market is going to get even tighter.

Tell me that you’re looking at same stats that I am and that you’re coming to a different conclusion.

Tell me.

Because if you do, I simply won’t believe you.

We know that markets can change; sometimes seemingly overnight. We’ve felt that “shift” happen very quickly before in past years, so I’m not guaranteeing a hot market as we move forward.

But that is my prediction. I can’t feel what I’m feeling in the market, compile the stats I’ve compiled above, and come up with a different view.

The one thing I will say about the market right now that it’s so rosy is that the condo market is a bit tricky. Some listings are selling, others aren’t. Some are getting multiple offers, and others are sitting. And I can’t see an identifiable pattern out there either. I’m watching listings that should get big prices, that aren’t selling, and then I’m watching listings that shouln’t get interest, that are moving quickly.

The condo market is still trying to find an identity.

But the freehold market is red-hot and it seems to be carrying the market forward.

April is going to move by quickly. Look, we’re already through a third of it and we’re through the Easter/Passover gauntlet that slows the market down.

I expect a lot of new listings to come out this week, as they always do after a long weekend.

But what’s that saying about hope turning into expectations?

Appraiser

at 7:15 am

“You must not let your hope turn into expectation.” ~Wendell Berry

“You have got to have hope, and you mustn’t shirk it. ” ~ also Wendell Berry

Jenn

at 10:11 am

@David

Photo of Kilimanjaro??

f00kie

at 8:27 pm

The SNLR change from Feb to March seems to mean absolutely nothing to the performance of the market, if I eyeball the years where this was positive or negative.

Ace Goodheart

at 10:01 pm

Good thing about Africa is you can still CLIMB the mountains.

In Peru, we climbed their 11.000 foot bump in a tour bus.

Climbed Taiwan’s highest peak (just shy of 13,000 feet) on the back of an old Yamaha two stroke.

In Africa you climb with your feet.

They know how to do it there properly

jerry

at 3:24 am

It was unrenovated, the main floor had all the interior free-standing walls (instead of the desired open concept), there were no major modifications to speak of, and there was a dingy basement apartment instead of a deep, dug-out basement like the one in the home my clients purchased.

Iron Work Companies in USA