My team secured four leases for tenant clients last week.

Big news?

Maybe. Maybe not.

Leasing isn’t the sexiest topic in Toronto real estate but we’re at that time of the year where every lease comes with a story.

Ask me how many leases were submitted on behalf of those four lease clients.

More than four?

Um, yeah.

How about twelve?

Six for one set of tenants, if you can believe it. Three for another tenant, two for another, and then a “one-and-done” for an extremely lucky tenant.

And it’s not that these are poor calibre tenants, but rather market conditions are just impossible right now.

Tara had a great story from last week. Er, maybe “not so great” is more accurate.

She submitted a lease offer for clients and called the listing agent to ensure he received the offer and to give him the rundown. Tara ended with, “…and best of all, my clients are offering a full year’s rent up front!”

There was a pause.

The listing agent let out a huff on the other end of the line.

Then he said, “Yeah, cool, well….I have six other offers and every tenant is offering a year’s rent up front.”

That’s what I mean by “impossible market conditions.”

Imagine submitting an offer on a $3,200/month condo with your friend and roommate, offering $38,400 up front, and being told that you’re not doing anything different than the six other people you’re competing against.

That’s rough.

But that’s the market right now and this happens every summer as downtown-dwellers seek August 1st and September 1st possession dates.

A colleague on the other side of the office just heard me talking about the stats associated with today’s blog post and she said, “The rental market is stupid.”

I asked for an example and she said, “I’m working with a guy who’s been in Canada for three months and he’s got an MBA and is a sought-after computer programmer, but nobody will rent to him because he has no credit score and zero credit history in this country.”

The question of where the 500,000 immigrants to this country are supposed to live, as well as how, is a topic for another day. Although, something tells me this will end up a topic in the comments section below before all is said and done…

Now that June is in the books, we can take a look at Q2 in the downtown condo rental market and get a sense of where things stand, and more importantly, where they’re going.

First, let’s look at New Listings in the condo lease market:

When we finished Q1, we were trending in the right direction, with a year-over-year decline in February leading to an increase in March.

That trend continued as we saw an increasing number of listings in April and May, but unfortunately, the trend reversed in June.

This might not seem like it’s significant, but when you consider that the tightest rental market is in June, July, and August, this is bad news for renters.

Here’s how it looks graphically:

As noted above, I decided to remove the 2020 statistics for all future posts as it makes this chart look ridiculous, and there’s nothing ventured, nothing gained, from using that data.

The 2021 numbers are also inflated as a result of the pandemic, since so many people left the rental properties they had entered into before/during the onset of the pandemic, but this is nothing compared to 2020.

New listings are higher, for the most part, than 2018, 2019, and 2022, but the trend is going in the wrong direction.

The only way this wouldn’t matter is if the number of units leased plummeted.

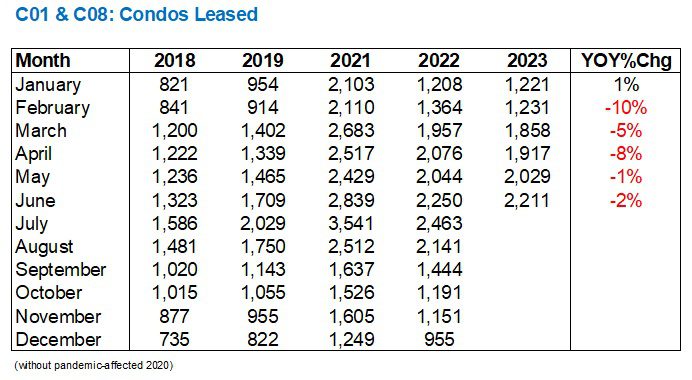

While I wouldn’t use the word “plummet,” the trend is in the right direction for tenants wanting more inventory and potential price relief:

Year-over-year, we’ve seen fewer units leased in every month, February through June.

The number of units leased is marginally less in May and June, and not enough to move the needle on price, theoretically or in practice.

And I choose to differentiate between theory and reality because even if we saw inventory increase 25% and demand stay the same, I don’t think we’d see any price relief. Prices should drop, in theory, but they won’t.

Again, we can see the number of units leased in 2023 is essentially tracing the 2022 line:

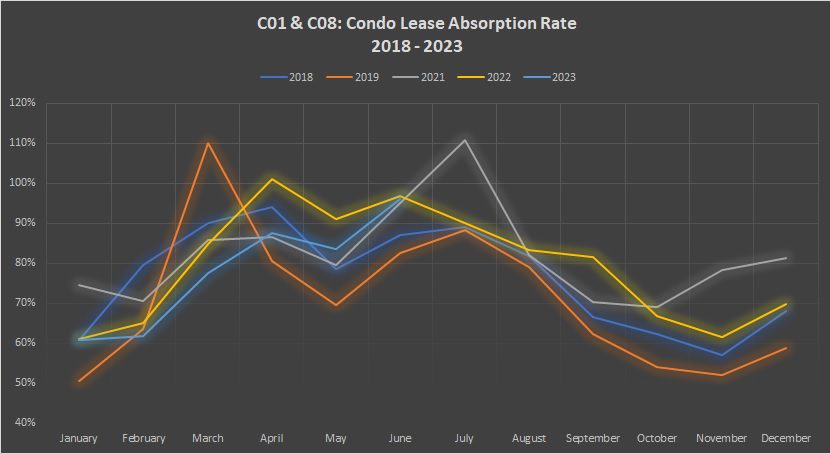

So how is this inventory being absorbed by the market?

Well, it would seem, based on the charts above, that the absorption rate is actually decreasing.

This is shocking to me, and if you asked anybody who’s working out there in the rental market trenches, they would probably say, “Can you check that data again, please?”

Do we have this correct? Listings are up and leases are down?

Sure seems that way…

With the absorption rate in June only off by 1%, it’s possible that March through May was just a sluggish period and that the summer will ramp up as it always does.

From what I’ve heard about the rental market out there, it’s chaos. Units are leasing sight-unseen, listings have ten, twelve, or fifteen offers, and agents are fighting over keys.

The data above doesn’t exactly dispute those stories, since it refers to the spring, but we won’t know how the summer actually turns out until the end of Q3 when we re-run this feature in…………wait for it…………October!

The chart below shows you that, at least in June, we’re approaching peak absorption rate:

Absorption rates in June have run at 87%, 83%, 95%, 97%, and 96% over the last five non-pandemic years, so we’re on trend here, but will we see the summer absorption rate peak like it did in July of 2021 at a ridiculous 111%? Or will we see it trend down into July and August as it did in 2018, 2019, and 2022?

That makes no sense, right?

Trending down in the summer?

What, with all those stories about tenants begging and pleading to be considered by landlords, adding guarantors to lease agreements, offering a year’s rent up front, and writing letters or doing Zoom interviews?

I suppose we’ll see…

Post Scriptum:

Just about to head off for bed on Tuesday night with this blog post set for Wednesday AM, and a member of my team emails me:

“This is a first….Made an offer on a lease and the agent is asking us to submit photos of their current place! Will this be a new requirement…wow”

Ed

at 10:39 am

Asking for photos of current residence is a great idea, for the landlord that is. Especially if you were renting out a basement unit.

Dusty

at 11:40 am

Asking for photos of the tenant’s current place seems like an insidious way to gather information that a landlord isn’t entitled to. Photos on the wall, belongings—they can hand over info on race, sexual orientation and other facts that should not impact a decision. Wow.

Ed

at 12:23 pm

I was thinking more along the lines of ‘is this person a slob who will trash the place’.

Izzy Bedibida

at 2:47 pm

I was thinking the exact same thing.

Artyom

at 12:35 pm

More rate hike today thanks to unhinged spending being done by liberal party which cause the inflation. Again shows 100 % clear that the Trudeau lovers who make messages here know nothing!!

Appraiser

at 7:46 am

As per the Bank of Canada:

“Strong population growth from immigration is adding both demand and supply to the economy: newcomers are helping to ease the shortage of workers while also boosting consumer spending and adding to demand for housing.” https://www.bankofcanada.ca/2023/07/mpr-2023-07-12/

Conclusion: More Housing.

Bernie

at 7:09 am

Due to a lot of hardships and circumstances beyond my control, my scores were in the ditch. It will literally take way too long for me to try sending (3 letters to the 3 credit bureaus) and waiting for the negative items to eventually be deleted. However, I decided to dig online for credit repair help and I came across a review on YouTube about a credit specialist and I must admit I was impressed. I quickly emailed him on BRAINTHOMPSON647 AT GMAIL DOT COM asking if he could help me and how much he would charge. He replied and after discussing the process, we moved on and guess what? He actually fixed my credit and raised my score to 812. All debts were checked as paid and the late payments appeared as on time payment. He deleted the inquiries, student loans, medical bills and the bankruptcy all fixed. I strongly recommend him for your credit repair. He also went ahead to recover my lost Bitcoin from my Coinbase wallet. You can contact him and enjoy his services. He’s really good at it