Who in the world is Sabrina Carpenter?

Stop me if you’ve ever heard of her. I can’t help but feel like I’m not alone here, but then again, a few readers have recently commented that showing my age, and I’ve been referred to as “boomer” by at least one reader, so maybe I’m out of touch here.

69,188,907 views on Sabrina Carpenter’s music video on YouTube must certainly mean that this artist isn’t a one-off?

Having spent my Wednesday morning downloading songs by Color Me Badd that took me on a wicked trip back to 1991, where everything was neon, and Brandon & Brenda Walsh were household names, I suppose I will concede that I am not caught up on musical flavours of the week.

But Sabrina Carpenter? This is no Miley Cyrus, right?

In trying to find the origin of the phrase, “You can’t blame a guy for trying,” I was taken down several internet rabbit holes. From the childish memes associated with men failing at picking up women, or worse, to the song by Sabrina Carpenter which is now stuck in my head, I was unable to find any origin or deep meaning.

But is the phrase itself somewhat flawed?

Doesn’t the usage of the phrase almost underscore or imply that you can blame a guy, or a girl, for trying?

The phrase is supposed to suggest some sort of innocence or lack of any harm or culpability whatsoever in the attempt, once eventually failed. But I almost feel like the phrase infers that failure was a likely outcome, if not, a probable one.

I was called in to price a King West condo this week, and has been the theme here on TRB over the last two months, the data that I provided to the sellers did not line up with their expectations.

The condo was a 1-bed, 1-bath, 690 square feet, with the highest ever recorded sale for this model at $700,000.

I put together a package of all the sales in the building, regardless of size or style, over the last 12 months, and came up with an average price per square foot based on a series of adjustments, with time being the largest.

The adjusted PPSQFT spit out a value of approximately $648,922 for their condo.

Then I went with the good old, recency approach, and showed them that a slightly smaller unit had just sold for $630,000 two weeks ago, and based on size alone, this would point to a value of somewhere around $650,000.

Finally, I asked them what their expectation was for the condo, and the young man spoke.

“We need to get at least $700,000 out of this place.”

I asked, “Why not $725,000?”

I wasn’t being a jerk or facetious in any way. I genuinely meant this as an exercise to understand the thinking behind that $700,000 number.

“Well,” he said, “We want to buy a small house for a million dollars, and we need to get $700,000 from this place to do that.”

This is quite common, believe it or not, and I think you’re more likely to believe than not anyways.

The definition of “wants versus needs” is something that we’ve discussed before, and while in this case, the want and need are exactly the same (they want a certain price, and they apparently need that much in order to buy their house), it still doesn’t change the market.

Ah, yes, the market!

That inanimate, untouchable entity that you can’t yell at, can’t convince and have absolutely no control over.

The market can change, but you can’t change it. Only the interaction between market participants, notably buyers and sellers, can move a market up, down, or sideways.

In this case, the market just wasn’t going to bear the price that the would-be sellers wanted/needed, and I explained this.

“The stats say $650,000, the last comparable sale says $650,000, and you’ve got six competing units in the building. We’re not getting $700,000. You’re not getting $700,000, and that’s with me, another agent, or doing this on your own. Shoot the messenger if you’d like, but I’d rather be an honest target than a misleading friend.”

The next day, the young man called me and said, “Thanks for your time last night, we appreciated it. We hear what you’re saying, but we want to give $700,000 a shot.”

Then he added, “I know it’s unlikely we sell at that number, but you can’t blame a guy for trying!”

And that’s where the origin of the saying comes into play, since I think you actually can try a guy for trying, especially this guy, in this case.

Call me insensitive, or brash, or any number of things, but there’s no chance of a $700,000 sale. Zero. No amount of work – cleaning, de-cluttering, painting, staging, marketing, networking, and praying, can get the property sold for that number, or anywhere near it.

So can you blame a guy for trying?

I’m not one to undertake pointless, fruitless, or impossible ventures, and I fashion myself not an optimist, not a pessimist, but a realist above all else.

The level of competition in that building is slightly above average at the moment, but even if there were zero competing listings, nobody is going to pay 8% more than the going rate or the previous sale.

I feel for these folks, I really do. Should they stay there for the next year and wait this out? Should they take on more debt, or look outside the neighbourhoods they want? Topic for another day.

But a lot of guys and gals are “trying” out there, and while we shouldn’t blame them, we do have to question the purpose of the excursion.

Case in point, this listing that just came out, and the most recent comparable:

As you can see, these units are identical.

One sold in February, which was a “peak” market, for $610,100.

If we assumed that the market was the same today as it was then, perhaps listing at $614,900 wouldn’t be out of whack.

But the market isn’t the same today as it was then.

Condo prices have dropped.

So why in the world is this condo listed for $40,000 more?

I have no idea.

This could literally be a $550,000 condo, and somebody listed for $650,000.

You can’t blame a guy for trying, right?

Except that I just don’t understand the point. That’s all.

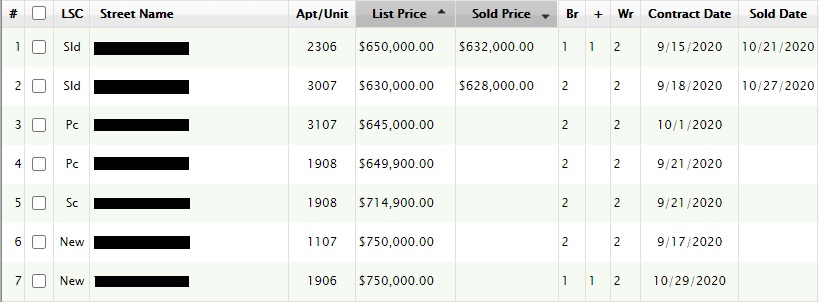

Here’s another example:

Those models – the ’02, ’07, and ’20, are all the same. They may have different exposures, but no exposure in this building is worth writing home about, trust me.

The most recent sale for this model was for $660,000, and it was an odd one, since they actually sold for more than list in a strategy that really isn’t working out there, but low and behold, they listed for $620,000 and sold for $660,000.

But look at the other four units.

Only one is below $700,000, and three are above $700,000, all the way up to $749,900.

Can you blame a guy for trying?

In this case, yes, I think you can.

To have a listing on the market for $749,900 when the same model just sold for $660,000 is pointless, and this goes for any market, hot or cold. I don’t care if this is March of 2017, or even February of 2020 in the condo market, but there’s just no way this listing is going to succeed.

Perhaps one more example, just to drive the point home?

Two of these units are listed as a “1-bed-plus-den,” but they are the same units. I suppose two agents had a crisis of consience and couldn’t believe what’s being called a “second bedroom” these days, but it seems that five agents didn’t have the same issue…

Two recent sales show this unit is “worth” somewhere around $630,000.

And yet after those two units sold, somebody came along and listed for $750,000.

It makes absolutely no sense.

And I can blame this guy or gal for trying.

Some of you may not find fault with this.

Some of you may ask, “Who are you to tell a person what he or she should their condo for?”

I suppose that’s fair. It’s a free market and a free country. I’m not the authority figure here, because there isn’t any authority. A seller can ask ten million dollars for a 1-bedroom condo, if that seller so chooses.

But I go back to that first example, with the King West condo owner who threw his arms out to his sides, smiled, and said, “You can’t blame a guy for trying!” I think his exclamation was more suited to a guy asking or trying something that was much simpler and commonplace, like making an unreasonable trade offer in a fantasy football pool, or asking for feigning a score of 17-10 in a ping-pong match when he knows he’s only up 16-10.

In the Toronto real estate market, I just don’t know if we can say, “You can’t blame a guy for trying” when a seller lists his or her condo for a price that’s not even remotely in the same universe as what buyers are looking to pay. It doesn’t bother me because I have a horse in this race but rather because I fashion myself a logical, rational person, and I get confused when I see people acting in a matter that is totally out of touch with reality.

As a seller, you can use this to help you. Price reasonably, and even a little more than current fair market value if you so choose. The sellers that are out of their mind on price will make you look like a bargain.

As a buyer, I can see how the confusion sets in. You almost wonder if the well-priced unit has a “holdback” on offers, or if the unit has a ghost or something. But as a buyer, in this condo market, you have to be more diligent than ever before.

So call me puzzled, if anything else.

I’m not saying that I’ve never tried anything for which I had a low-percentage chance of success, but I certainly wouldn’t set out on a path that led absolutely nowhere, while expending time, effort, and energy in the process.

Speaking of which, should I sit down and watch CNN before bed, or is this going to be like 2016 all over again?

I shudder to think…

Sirgruper

at 9:08 am

You can’t win if your not in the game. Would that be more acceptable? If the seller doesn’t care if it doesn’t sell and another agent wants the listing (maybe to pick up new buyers) can you blame a guy for trying? If to them there is no downside why not? Would you pick up a lotto max ticket if it was free despite infinitesimal odds. Why not?

Ps I’ve seen this work in commercial real estate often where product is harder to value and it’s not a cookie cutter commodity.

All that said it’s perfectly understandable why you wouldn’t take the listing as your time have value. Others have lots of time and few opportunities. Consider yourself lucky and therefore more easily frustrated ????

J G

at 10:45 am

416 Condo continue to slump – medium price $645k down from $727k in Feb (-11%)

YoY down 4%. Condo investors are definitely suffering.

https://housesigma.com/web/en/market?municipality=10343&community=all&house_type=C.&ign=

Caprice

at 11:59 am

Do we need to do this every month?

– 1 Year Value Change -4.1%

– 5 Year Value Change +65%

– 10 Year Value Change +97%

Most condo investors have substantial equity and will weather this out. I haven’t seen fire sales.

Professional Shanker

at 12:31 pm

You believe condo speculators are rationale individuals. Condo investors will ride it out but those same people would not have been the driving force behind recent price increases.

If Covid is still around in 2021 & 2022 fire sales will transpire, for everyone’s sake I hope we do not see this.

J G

at 1:06 pm

Sure ride it out. Take your time, make sure to pay condo fees and property tax on time.

Mean while AMZN and GOOGL popped 6% today, FB up 8%. Have a good day 🙂

Bal

at 1:23 pm

October is a very strong month with very high house sales…..i think I just did Appraiser’ job…he is bit late today ????

Bal

at 1:33 pm

and yes condo are going south…maybe i should buy condo…lollol…

Caprice

at 2:18 pm

Couldn’t care less about AMZN GOOGL FB. My condos are occupied, bottom line is better than ever thanks to variable rates.

Appraiser

at 12:05 pm

@ Caprice: Currently also enjoying the drop in prime. I also have some properties with hybrid mortgages (part fixed / part variable); currently early renewing the fixed loans where possible. Just renewed a 2-year fixed at 1.13% lower than previous contract.

The loans in my portfolio have dropped 33% in overall interest costs in the past 6 months. I also keep the payments constant. Most investors are laughing.

Pragma

at 1:12 pm

The amazing (to some people) thing about how percentages work: you can be up 60%, and then be down 30% and now only up 12%! Is a 30% correction impossible? if we dropped 30% tomorrow that would only put us back on the long term inflation adjusted price trend. The question everyone should be asking is how much do condos need to drop in price so that it makes sense as an “investment”. You probably need a yield of 5%? That calculation gets even muddier considering how fast rent is dropping. Lets do some quick math. Assuming $1800 rent for a 500sqft unit, 60c/sqft maintenance, $2500 property tax:

5% yield –> $310k

4% yield –> $388k

3% yield –> $517k

And what if rent drops to $1700?

5% yield –> $286k

4% yield –> $358k

3% yield –> $477k

this should give you a good idea of how stretched the Toronto condo market was even before covid. I think a 30% drop would be quite reasonable.

Fearless Freep

at 3:05 pm

When I began reading your comment, I thought you were talking about JG’s beloved FAANG stocks. Silly me. Everyone here loves him (well, except Appraiser).

Bal

at 12:45 pm

If rent also dropped on the rental property…even with lower interest rates….you are not saving anything no?