Looking back on it, I suppose I didn’t “need” to write a thousand words or more about my holiday break in Thursday’s blog post, thereby extending the length of the blog and only allowing us to examine two of the ten discussion points for 2023.

But then again, I don’t really “need” my morning coffee.

It’s just that in both cases, it’s impossible not to act accordingly…

On Thursday, we looked at two huge topics of discussion for the 2023 real estate market: average home prices and a cornucopia of mortgage issues, specifically mortgage renewals, trigger rates, and interest rates.

Today, we’ll go through a few more of the “Top Ten” as I see them in my crystal ball, starting with something that relates back to Thursday’s conversation…

3) Mortage Delinquencies

Ah, yes! I told you in the previous section that we would return to this topic!

I’m not including this as a topic because I expect mortgage defaults to actually be a “thing” in 2023, but rather because I expect there will be more talk about mortgage defaults than in the previous decade.

Why?

Because negativity sells!

But just how common are defaults in Canada?

Exceptionally uncommon, it seems.

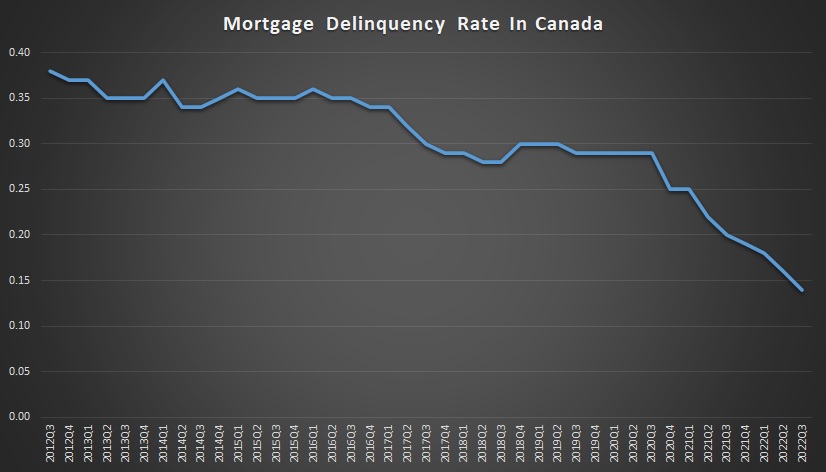

Here is every province and major metropolitan area’s Mortgage Delinquincy Rate in Canada from 2012 through 2022.

Canada-wide mortgage delinquencies rates were at 0.14% in Q3 of 2022.

Is that a lot?

Is that rhetorical?

Do I know what rhetorical means?

Let’s put that 0.14% from Q3 into context by looking at the Q3 of the previous five years:

Q3 of 2021: 0.20%

Q3 of 2020: 0.29%

Q3 of 2019: 0.29%

Q3 of 2018: 0.28%

Q3 of 2017: 0.30%

Alright, so you don’t have to be Albert Einstien to see that a delinquency rate of 0.14% is not only low, but historically and comparatively very low.

So if mortgage delinquency rates were to double this year, we’d still be below the average of delinquency rate in 2017 through 2020?

My holiday reading saw the words “default” and “delinquency” pass by my rods and cones many times, and I knew that in a week or more, I’d be sitting here in front of the computer, writing this section.

I know we talked above about how I’m going to try to be less cynical and pessimistic in 2023, but come on! You know we’re going to hear about this all year. It’s such a sexy topic!

Yet all the while, this should be the story:

It’s not the prettiest graph, but what more do you need to see?

Mortgage delinquency in Canada has done nothing but decline over the past decade, and we’re currently sitting at an all-time low.

Critics will suggest, “David, we also saw mortgage rates at an all-time low as well,” but even when rates were much higher, pre-pandemic, we still saw delinquency rates at less than a quarter of a percent!

There’s just no way to spin this, folks.

The market bears and the journalists that thrive on negativity can’t use this data. They just can’t.

What’s more, is that if they wanted to cherry-pick individual data points to make some areas look worse than others, they would be unsuccessful there as well.

Case in point: let’s look at mortgage delinquency rates by province:

Arguably the two “most important” provinces from a real estate perspective would be those with the largest populations and the largest two cities, notably Ontario and B.C..

Here we can see that while the prevailing Canada-wide mortgage delinquency rate over the past decade (by averaging each quarter) checks in at 0.30%, and the current mortgage delinquency rate checks in at 0.14%, the province of Ontario is merely half of that at 0.7%. Oh, and B.C. is only 0.10%.

So that’s that.

What about cities, you ask?

Let’s plot Toronto and Vancouver against the overall rate in Canada:

Uh-huh.

In Q3, 2022, Toronto saw a mere 0.06% mortgage delinquency rate, and Vancouver wasn’t far behind at 0.08%.

This compares to the 0.14% Canada-wide.

And for those wondering how this compares to the United States, the rate was 1.86% in Q3, 2022.

So if I see the word “default” or “delinquent” in another article about interest rates, mortgage rates, trigger raters, or personal finance, I’m going to know it’s merely for shock value and will represent the best in inventive news this year.

And now, thanks to our #3 discussion point, you’ll know too…

4) Inflation…..and Conversations Around It!

Can we simply end it here? Haven’t we talked about this enough?

I’ll be brief. Er, I mean, as brief as I have ever been…

When we discussed inflation in our year-end posts, we noted that the November data hadn’t yet been released.

Well, now we have it!

6.8%

And boy, isn’t that anti-climactic!

With October inflation checking in at 6.9%, on the heels of 6.9% in September, we now bear witness to a “decline” in Canadian inflation, all the way down to 6.8%.

(womp womp)

The glass-half-full viewpoint would be to look at the month of June, where inflation was 8.1%, and suggest that we’re in a good spot.

But we could also look at our glass as half-empty, noting that inflation only 12 months prior was a mere 4.7%.

With a “final” interest rate hike expected in January, the expectation is that inflation will ease over the course of 2023.

But it’s not so much the actual rate of inflation that I wanted to discuss in this point, but rather the conversations around it.

For example, if I search “Canada inflation” in Google, this is what pops up:

We have a CBC news article about politicking, whereby Pierre Poilievre discusses his plans to replace Tiff Macklem as the governor of the Bank of Canada.

We have a rudimentary article from CTV News about how inflation leads to higher prices for gas and food, but likely not real estate in 2023.

Then we have an article about the pay of CEO’s, which seems to shame individuals for working hard, climbing the company ladder, achieving positions of influence and stature and then (gulp!) making lots of money.

Lastly, we have an article about immigration.

You heard it here first, folks: 2023 will be the year of misinformation about inflation, and everybody in the country is struggling to control the narrative.

I continue to read about the price of groceries and how it’s the fault of “greedy” grocery stories.

This is nonsense.

And yet, it’s pervasive across the media.

“Supermarkets Continue To Increase Profits On Back Of Inflation”

Toronto Star

December 23rd, 2022

I recognize, as with the article above about CEO compensation, that the definition of success is changing rapidly.

But I’m so tired of reading these articles about grocery prices.

Inflation is real, and it’s causing grocery prices to increase.

But what about the increased price of fertilizer, not to mention the Liberal government’s forced reduction of overall fertilizer use? What about climate change initiatives that have made farming more expensive?

What about the cost of labour for farmers – or the complete inability to find people who want to work, possibly because of the pervasiveness of financial assistance from the goverment?

What about the cost of gas for farmers, the interest rates on leased farm equipment, and the transportation of goods?

Here’s an article I read with glee over the holidays:

“Jagmeet Singh, Don’t Blame Capitalism For The Price Of Lettuce”

National Post

December 17th, 2022

Mr. Singh seems to believe that all businesses and individuals should operate as non-profits, or at the very least, an entity with a pre-approved and pre-determined levels of profit.

Then again, much of society has this view.

Somewhat related:

No, you’re not being gouged.

Banks are in business, ya know, to make money.

They don’t take in money at 2% and then loan it at 2%.

And they have billions of dollars in expenses, including but not limited to their hundreds of thousands of employees, physical branches, marketing, operations, etc.

Geez.

When did society get this stupid?

This was a painful read, but I’m sure 90% of the people who saw the headline didn’t read the article. More importantly, this headline caused a large chunk of society to say, “He’s right, what the hell is going on here?”

Give a forum to people with this level of ignorance, naivety, and lack basic understanding of economics and commerce, and you’re going to fill the minds of readers with utter nonsense.

So in 2023, watch as society turns its angry gaze toward Loblaws, Sobeys, and Metro, blaming grocery stores for the price of good, which seems to blame them for inflation.

Who should be blamed for inflation, you ask?

Us.

All of us.

A basic understanding of inflation tells us that the two major causes are a demand-pull and a cost-push.

We might not be able to directly control increasing costs, but we sure as hell can control increasing demand!

Low interest rates were a direct cause of our increase in demand, so blame the Bank of Canada too.

But what would we have them do in the face of a worldwide pandemic in 2020, the likes of which the world has never seen?

Maybe we don’t give the Bank of Canada a pass here, since they could have started quantitative tightening in the fall of 2021, or even the summer. But even if inflation peaked at 6% rather than 8.1%, we’d still have seen rates increase.

There is, however, one more culprit for the cause of inflation, and this one won’t be liked by many of the readers.

It’s the government.

Specifically, the free-wheeling, high-spending, good-times-riding federal party at the controls.

Another article I enjoyed last month:

“Do-Nothing Liberals Hide Behind Tiff Macklem On Inflation”

National Post

December 12th, 2022

I love the entire article, so choosing an excerpt is like choosing a favourite child.

But here’s the point I want to make:

The current inflation situation is exacerbated by their poor energy policy, ineffective –– if not counterproductive –– housing policy, inability to boost Canada’s innovation and productivity, and acceptance of oligopolies and anti-competitive behaviour. It’s also made worse by continued high government spending and preference for sending out cheques rather than doing the hard policy work.

Unfortunately, from the Liberals’ perspective, to effectively act on many of these issues would require having tough conversations with, if not upsetting, key voter and donor groups. So rather than lead, they hide behind the BoC. This, much like how too-loose monetary policy grew systemic risk, increases the chances the bank will error and over-tighten into a large recession.

Over-relying on interest rate increases to fight inflation also ensures average workers and savers will pay the highest price for returning to two per cent inflation. Some pain is inevitable at this point, but to burden the working class with so much of it is a choice.

This is what I’ve been saying all along.

I know that we had a federal election last year and no party and no politician would have been elected on a platform of, “Cut government spending, cut public sector jobs, encourage individuals to manage their finances better, spend within or below their means, and forego luxuries they can’t afford,” but a guy can dream, right?

It felt as though every week in 2022, we were hearing one body of government talk about increasing interest rates to combat inflation while another body was talking about another forty billion dollars of new public spending.

You can’t have it both ways.

Inflation is where it is in our country because consumers can’t control their spending and because the government can’t either.

Grocery stores??? Are you kidding me?

Is now a good time to talk about windfall taxes, or should we save that for another day?

A reader emailed me over the holidays and said, “David, a word of advice: stick to writing about real estate. Leave politics out of your blog.”

But I can’t. It’s impossible.

The price of real estate is related to interest rates, which is related to inflation, which is related to public policy, which is related to politics.

If you want simplistic and inane real estate information, there are all kinds of well-known Toronto websites and blogs that show pretty pictures of houses and condos, complete with snide comments from “writers,” and even more snide comments from readers who feel that all Toronto real estate is over-priced by 80%.

On this blog, we’re better than that.

And we sure as hell don’t shy away from tough discussions, even if they can be divisive, as my comments above could be.

I don’t know that a different political party would have done anything differently. Politics is all about staying in power, and elections are primarily purchased through promises and spending. So this isn’t just a Liberal problem; it’s a political problem.

But if the government keeps spending in 2023 and injects more and more money into the economy, inflation won’t decrease. And this isn’t something you’re going to see in a headline this fall.

Ugh, grocery stores. I still can’t believe it.

If you see the word “inflation” in a headline in 2023, get ready for a load of bullshit…

5) Building On The Greenbelt

How can something so specific be so high on our list of real estate topics for the year ahead?

Well, for starters, because it’s going to be talked about a lot!

But secondly, because there are so many implications here.

Building on the Greenbelt affects our conversations about development, home prices, politics, urban sprawl, net migration, immigration, and more.

But there are also going to be two very different conversations about building on the Greenbelt:

1) Building on the Greenbelt.

2) Whether or not developers, speculators, and so-called “buddies of Doug Ford” were tipped off about the plans.

Geez, where to start?

How about back in 2018.

How about when Doug Ford suggested that developing the Greenbelt would help with our housing crisis in the GTA, only to backtrack on that one day later?

Look at the titles and dates of these two articles:

“Doug Ford Promises ‘Big Chunk’ Of Ontario’s Greenbelt To Developers”

The Globe & Mail

April 30th, 2018

“Doug Ford Recants Vow To Allow Greenbelt Development”

The Globe & Mail

May 1st, 2018

Okay.

So when we heard in 2022 that now, we’re going to see building on the Greenbelt, who’s to blame:

a) People for thinking this was never going to happen

b) Doug Ford for “lying”

He said this in 2018. Does that make him a liar? Or did he change his mind after another four years of increasing real estate prices, demand-pull, and a massive increase in immigration planned for the country?

For those not familiar with the Greenbelt, or who have heard the word a thousand times, but don’t know what we’re talking about, here’s a map of the Greenbelt as established in 2005:

As you can see, it’s a lot of space!

In fact, it’s 2,000,000 acres of land, including 721,000 acres of protected wetlands, grasslands, and forests.

The amazing part about the Greenbelt, in my opinion, is that it was established in a bipartisan way of sorts.

The Mike Harris government (Conservatives) established the Oak Ridges Moraine Conservation Plan in 2001, which paved the way for Dalton McGuinty’s government (Liberals) to establish the world’s largest greenbelt in 2005.

It took only thirteen short years for a government to suggest we allow the Greenbelt to be developed, as Doug Ford did in 2018, and only seventeen years before a government (again, Doug Ford) actually did go ahead and allow it to be developed.

And despite massive opposition, it looks like at least some of the Greenbelt will, in fact, be developed.

So what’s the story here, folks?

Do we all get a vote? In theory, maybe. But do we all have an opinion? And for the “average” person out there, what is his or her opinion based on?

Any guesses on where I stand here?

To nobody’s surprise, I’m open to the idea of building on the Greenbelt. But every single one of us will have his or her perspective shaped by age, occupation, lifestyle, political views, and where we all live.

I happen to be a real estate broker who sees a housing crisis up close, but I’m also a realist who sees a plan to bring 500,000 people to Canada every year with no plan on how and where to house them.

I’m not saying that we need to build on all of the Greenbelt, but I think the idea that this land would be protected for thousands of years became impossible when the government decided to promise “housing affordability” to the masses and increase immigration targets to never-before-seen heights.

I’m not the only one with this view…

“Like It Or Not, Building Houses On The Greenbelt Is Necessary”

National Post

November 21st, 2022

From the article:

Unless someone is going to invent a time machine and make different housing choices, we’re going to have to take an all-of-the-above approach to housing development. All Ontario political parties agree that we need to roughly double housing starts over the next 10 years to tackle this crisis. So we’re going to have to make hard choices, both in existing neighbourhoods and on the urban fringe.

The crazy thing is: the government proposed to remove 7,400 acres from the edge of the Greenbelt.

Out of 2,000,000 acres.

And, they’re going to further protect an additional 9,400 acres! So “building on the Greenbelt” in this case nets out at 50,000 new homes plus another 2,000 acres of protected lands.

Again, I point to the people in society that are against the idea of building on the Greenbelt, but won’t look past the headlines. We’re talking about 7,400 acres out of 2 Million.

But the larger story in 2023 could be the idea that Doug Ford “tipped off” developers.

There’s no shortage of coverage on this.

“Ford Denies Claims That His Government Tipped Off Developers On Greenbelt Changes”

The Globe & Mail

December 1st, 2022

I’m telling you, this is going to be a huge theme in 2023, whether it’s true or not, doesn’t matter.

People want to believe that it’s true!

“Doug Ford is in bed with developers,” we’ll see and here. And worse, I’m sure.

It already started last year:

“Prominent Developer Family Linked To More Greenbelt Properties Slated For Housing”

CBC News

November 22nd, 2022

This article is about the De Gasperis family, who are one of the largest land-owners in the Province. When I first read the article, I laughed. Imagine the people who own the most land in the Province being taken to task…………..for owning land?

The article notes that much of the land was purchased before the Greenbelt was created.

But does that matter?

Probably not to many headline-readers and those who have their minds made up already.

Tell me you won’t read this article because it’s in the Toronto Sun, but you just have to:

“Ford’s Opponents Call For OPP Probe Over Greenbelt Changes Based On Lies”

Toronto Sun

December 15th, 2022

From the article:

Have you heard the story about the wealthy developer family that took out a $100-million loan at 21% interest to buy a property just before the Ford government announced they would allow some 7,400 acres of Greenbelt land to be developed for housing?

That would be a juicy story if true and might hint at someone getting the inside scoop in time to snap up some soon-to-be-valuable land. It’s even been cited as people call for the Ontario Provincial Police to launch an investigation into possible wrongdoing.It’s not true though.In May 2021, TACC Developments, controlled by the DeGasperis family, purchased a 107-acre parcel of land off Pine Valley Drive north of Teston Road in Vaughan. They bought the land because there were 27 acres of development land included in the parcel and most of the land actually remains in the Greenbelt even after changes by the Ford government.The land is also next to another 200-acre parcel TACC owns that has long been zoned for housing development.Also, the 107-acre parcel wasn’t purchased for $100 million but for $50 million. TACC took out a $30-million loan to finance the purchase with an option to increase the loan to $100 million if needed to finance development costs. As for the interest rate, it wasn’t 21% but was set at prime plus 75 basis points.

The original story, published in November by the Globe and Mail, didn’t confirm the facts before putting the story out in the world.

Since then, there has been no end to the politicians and activists willing to comment on this wildly fake claim. The online insinuation from critics of the Ford government is that this is obvious corruption by the premier, while the DeGasperis family have been subject to racist slurs as a result.

I can’t wait for somebody to disregard this because it’s from the Sun, or it’s too convenient, or “just because.”

Those who have their minds made up about Doug Ford, the Greenbelt, developers, or all of the above don’t want to hear any of this.

But the reality is: we’re talking about building on 0.37% of the Greenbelt while adding more protected lands than that which we’re we’re taking out.

This story might be the one that bothers me the most in 2023 since it shouldn’t be a story at all…

Phew!

Five down, five to go!

The next five will be served in more digestible quantities, I promise!

Until then, have your say below!

cyber

at 7:32 am

I will have to disagree or add additional color to pretty much all of the above:

– Google historical graph of mortgage arrears, and go back to few actually comparable historical period relative to where we are in the economic cycle (going only as far back as 2013 is not enough): mortgage arrears are pretty much directly correlated with unemployment rates, with a bit of a time “lag”… During both the financial crisis of 2008-2009 and twice during the 90s, default rates spiked as unemployment did. We are not there yet, but will be – there’s pretty much a consensus on an unavoidable recession in 2023, the question is really only on how bad and long it will be. And real estate prices are set on the margin, just like small % of foreign buyers willing to pay more sets a high water mark, so will the (still relatively few additional) distressed sellers. Maybe not a massive crash that BlogTO readers/writers are hoping/waiting for…but enough to drag price down a bit further even after interest rates increases have stabilized, and keep the conversation going as certainly the current generation of first time actual or aspiring home owners has only ever seen massive, well above inflation annual home price increases their entire adult lives.

– Loblaw alone controls over 40% of supermarkets in Canada, and Weston family also controls additional chains (including, ironically, Your Independent Grocer). What business is not going to take advantage of such a monopolistic position in the market? Their prime objective is to maximize shareholder value, right? And if with Rogers and Bell, who control similar market shares in Telco, Canadians are paying the highest broadband prices in the developed world, it’s not really an “out to lunch” conclusion that there’s at least some opportunistic price gouging going on beyond the mere passing on of higher costs. Both can be true, government over spending and supermarket price gouging… Especially as effectively one man controls near majority of supermarkets in the country, AND has already been found guilty of price fixing.

– Previous provincial election was in June 2018. Doug Ford did not just “lie”, he very specifically and conveniently lied on what would have been a major election issue at the time, DURING the campaign. Many people in the GTA feel strongly about the Greenbelt from not just environmental but also food security perspective – GTA borderline lands are prime farmland that, once removed, cannot be brought back. And one acre of prime farmland is NOT equivalent to another acre elsewhere (not just from food security but also biodiversity perspective)… Otherwise you’d be OK with government expropriating your home in Leaside in exchange for a 50% bigger house/property in Sudbury? Didn’t think so! Not to mention that adding homes here, in exurbs that will likely serve as bedroom communities commuting to GTA (as opposed to adding density to massive swaths of already developed areas that have tons of infill capacity for literally generations), will be imposing extra costs specifically on Toronto – think worse traffic for everyone, plus extra infrastructure wear and tear on DVP and Gardiner, without ability to actually recoup these extra costs via tolls and passing them on to Toronto property owners via extra property taxes. Heck, enough of that non-Toronto GTA, SUV-driving crowd that got Ford originally elected would have switched their votes just to prevent higher traffic on their daily commute to at least prevent a majority government… So yeah, plenty of diverse “people are upset” and with good reason.

Mike

at 8:48 am

Fair point re: Loblaws. But then why is the federal government so focused on grocery prices and they have done nothing to address the highest broadband prices in the world? Rogers and Shaw are allowed to merge. Nothing to worry about here, people! It’s just easier to go after Loblaw’s than it is Rogers and Bell. Path of least resistance I guess?

David Fleming

at 11:14 am

@ Cyber

I appreciate the lengthy and detailed response!

Based on your background and eduction, you obviously know a lot more about urban planning and responsible development than I do.

I would be very interested to hear your insights on how to answer the same questions we keep asking every year: “How do we build? What do we build? Where do we build? Who builds it? how do the public and private sector roles look? How do we address this ‘housing crisis’ and how do we plan ahead for massive immigration?”

Your thoughts would be very valued. Thx!

Jimbo

at 5:12 pm

The cost associated with building, maintaining, and employing maintenance pers is fairly steep. Perhaps it would be more cost effective if the gov bought units in upcoming developments and paid for the maintenance fee associated with each unit.

They could then charge subsidized rates and get mixed income developments. They could also increase the supply of 2-3 bedroom layouts.

Ace Goodheart

at 9:50 pm

Where I live in Toronto there is a No Frills, a Nations and a Walmart all within walking distance of each other.

They are all controlled by different corporate masters. They are all grocery stores.

They all compete with each other. You can actually go into the No Frills with a flyer from Walmart, and they will match the prices.

They all advertise heavily and are constantly in competition with each other.

If any one of the three was engaged in price gouging, people would just stop shopping there. The store would get the reputation of being expensive, and would lose all its customers.

There is just no merit to an argument that the Weston Family is price gouging in their grocery stores. To do so, would be economic suicide for them. People could just shop elsewhere (and we would).

Crofty

at 9:52 am

“Where I live.” Anecdotal, aka meaningless.

Bryan

at 10:49 am

In Toronto (and this is a Toronto “Realty Blog”), I have a very hard time believing that there are many (or really any) neighborhoods where a person can’t conveniently get to at least 3 different grocery stores (owned by different corporate overlords).

The comment above may be anecdotal, but it is also likely exemplary of the economic setting in which this conversation is taking place. That is certainly not meaningless.

Crofty

at 11:10 am

“I have a very hard time believing…”

“…it is also likely exemplary…”

“I.” “likely.” Like I said, meaningless. I’m not saying you’re wrong, or an idiot, or whatever. Only that you’re putting out your opinion(s) based on your experience, an experience not shared by everyone in society.

Bryan

at 12:58 pm

This is a blog, not an academic journal. It’s not even a blog actually, it is the comment section under a blog…. where people have a place to share their opinions in an effort to reach a broader and fuller understanding of the topic at hand. Doing so requires sharing and listening to other people’s perspectives, even if they are not accompanied by statistics or peer reviewed studies.

Question for you: Are your two comments here about what others say being “meaningless” not just YOUR opinion… and does that not, by your own admission, make them anecdotal and meaningless as well? At least Ace’s anecdote had an underlying point meant to further the discussion….

Cam

at 10:52 am

I honestly don’t care if they build on the Greenbelt. Too much talk about this. So many other priorities. So many other problems. Too many to count.

Ace Goodheart

at 1:10 pm

I would agree with you and David on this point.

The Feds are all about the “housing crisis” which crisis they want to solve by adding new taxes.

Ford actually opens up land for development and the socialists are suddenly upset.

What do they expect? Developers build houses, not governments. They need land to build them on.

Nick

at 12:05 pm

Sorry but as long as there are huge chunks of brownfield sites in Toronto itself that can be redeveloped I won’t be supporting opening up the Greenbelt. Not to mention all of the non-Greenbelt currently serviced land in the GTA that we can build houses on first.

Additionally looking at that map it tells a story to me. Its time that Toronto is not the only major city in this province. I don’t know how to change that but if we don’t start now, when do we?

By this I don’t mean sending people to Alberta or Manitoba, but certainly Barrie? Sudbury? Sault Ste Marie? Grow Ontario but spread it around the province.

Bryan

at 11:24 am

I came down here to comment something similar to that last sentence of yours. Environmental concerns aside, at some point urban sprawl gets too far from the centre to be serviced by the same infrastructure. Newmarket/Aurora has like 150,000 people now and the vast majority of them have work/leisure lives centered around Toronto in spite of it being over an hour drive away (and forget about transit). Making those communities bigger at all seems silly to me, but doing it by increasing sprawl rather than density, and at at the expense of the greenbelt? I don’t understand it at all. I can’t imagine how many lanes the DVP would need to be, or how many cars the GO Trains would need to have with another 400,000 people living in that greenbelt space straight north of Toronto….

If Toronto is like LA (and I think this is a better comparison than NYC with all the suburban satellite cities. Brampton/Sauga = San Bernidino/Anaheim?), Ontario is missing a San Diego. While we should be looking to add enormous amounts of density (rather than sprawl) to Toronto, Peel, and York regions, at some point there needs to be another hub to handle some of southern Ontario’s population growth if we have any hope of actually servicing that new population with roads/transit/places to do things.

I always thought Kitchener would be a good candidate for this…. especially now. It’s geographically close enough to Toronto and Hamilton (which I don’t think could ever become the missing metropolis until the waterfront is cleaned up enough for people to want to spend time there) that it couldn’t ever be considered isolated, it isn’t a million miles from the border the way that Barrie or Sudbary are, the weather is OK compared to the Sault etc, there is a fair sized tech industry that has emerged, there has always been a strong immigrant population, and in spite of the monumental amount of empty space in and around it, people actually live there! Make it a million person city with a nice downtown and suburbs and this entire conversation becomes a lot different.

Ace Goodheart

at 12:35 pm

Re: “I continue to read about the price of groceries and how it’s the fault of “greedy” grocery stories.

This is nonsense.”

Exactly.

There was actually an article in The Star regarding chicken being sold at No Frills for $27.00 per pound.

You have to look closely at the product label to see why. The chicken is, of course, certified organic, which means it is usually 3-4 times the price of regular chicken.

I actually walked over to that same No Frills, and was able to find chicken for a fraction of $27.00 per pound. But not certified organic.

You can very clearly see the label advertising the chicken as organic.

But it is click bait, right?

Grocery stores operate on razor thin profit margins. They sell in volume, which creates a price structure. If the idea is to break up the stores and distribution into smaller organizations, I can tell you that the result will be higher prices. Groceries are a volume business. The more you sell, the lower you can sell for. The more you buy, the better prices you can buy for.

If you want to watch a company that really knows how to sell groceries, watch Walmart. They buy in very large quantities, hammer their suppliers for low prices, and then roll out the volume sales. They do this across borders (Canada and USA) and they are very good at it. The result is very low grocery prices.

The trick with groceries is to always ensure you are not being undersold by anyone. You do this by buying in the largest quantities possible, keeping a firm grip on the prices you are paying your suppliers, and then selling in huge volume over a large geographical area.

For groceries you want volume, volume and more volume. The more you buy, the bigger your operation, the cheaper you get stuff for. Then you can undercut everyone else (Walmart is amazing at this).

Coming at the grocery inflation problem with the media’s message “break up the big corps, demonize the CEOs, and then have some sort of government control over the grocery business” will not result in lower prices. It will result in food shortages, long lines at the government food stores, and people having to line up all day to buy a loaf of bread.

Socialist countries already exist. You can just go and visit one, to see how the government runs the grocery business there.

Or you can look at Canada’s socialist, supply managed grocery supply chains and see for yourself.

Dairy in Canada is fully supply managed. You cannot sell into the system unless you have a quota from the Dairy Board. The result is Canadians pay dairy prices that are exponentially higher than Americans, who do not have a supply managed system.

Any government intervention into the grocery business will have two results:

1. Supply shortages

2. Higher prices.

Vancouver Keith

at 2:27 pm

I’ll take on three. First of all, people would whine a lot less about corporate profitability if they knew how much skin they had in the game. We all get CPP, and I guarantee you that the CPP holds investments in some of the major banks, the major telcos and in retailers like Loblaws and Canadian Tire. Regulated oligopolies are a license to print profits, but they offer tremendous stability and every major mutual fund in Canada and ETF owns a piece of the action, as well as pension funds. You’re free to buy as many shares as you like, and in the long term you will prosper in a tax advantaged way.

CEO pay is a joke. Just ask Warren Buffett about stock option based compensation. The reality is that major corporations have a compensation committee from the board of directors, most of whom went to business school with the CEO they are compensating, who is also on the board of directors of their company. CEO and director pays is a legal white collar scam, except for Berkshire Hathaway but it was ever thus. The worst part is that they can get an eight figure golden parachute negotiated long before they get fired for losing bilions in shareholder value. It’s funny how the merit principle works for the elite.

Inflation. Scotiabank has released its analysis of Canadian inflation, it says fifty percent is from energy price, thirty five percent is from supply chain issues and fifteen percent is from excess government spending. I’ve seen loads of people claim that government spending is the sole cause of the inflation, and I haven’t seen a single online commenter explain how they would have stopped CERB payments to people who didn’t need it while specifically helping only people who needed it and done so in a timely fashion. Don’t bother trying this argument on a Friedman monetarist, they won’t believe you.

Adrian

at 5:13 pm

If you were going to remove land from the greenbelt wouldn’t you choose the land that was closest to development and most likely to be developed in a timely manner? Why would you remove land that was owned by someone with no development experience and no interest in building houses? I do believe the government worked with developers behind the scenes to decide what would be removed but I’m not sure what the alternative would be. Perhaps that’s cynical but I think it’s how things get done.

I do understand the argument that it sets a bad precedent but the GTA is a very different place than it was in 2005. It needs to be on the table with all other solutions.

Derek

at 10:22 pm

I remember finding it just plain weird that Lilley attributed his rebuttal of the numbers from the other story to absolutely nobody. Just weird journalism. According to absolutely nobody, this is the real story, per Lilley. Not sure his numbers made the context sound that much better. They bought 107 acres of which only 27 were developable, while having nearby, 200 undeveloped (but wholly developable) acres? Where the truth lies is anybody’s guess, but the land purchase and subsequent carve out are deserving of scrutiny whether it turns out to be corrupt, corrupt-lite, corruptish, or innocent, and regardless of whether it’s fine to open up the greenbelt because we’re running out of land or whatever reason one wants to pretend to use. I imagine the #1 reason the greenbelt needs to be developed is that it provides the big developers with the largest profit margin compared to every single other alternative that might be better for the people of this province.

PM

at 6:04 am

“Arguably the two “most important” provinces from a real estate perspective would be those with the largest populations and the largest two cities, notably Ontario and B.C..”

AHEM, us in Montreal (second largest city in second largest province) matter too, specifically when talking about defaults and bank lending

David Fleming

at 9:17 am

@ PM

I had a feeling somebody from another major city would take issue with this! 🙂

How else could I have worded this? Vancouver & Toronto are always grouped together. They’re the cities with the two highest home prices. Montreal has a larger population than Vancouver but it’s real estate market has never been as talked about – probably because it’s been less volatile, less affected by foreign buyers, etc.

“Most important” isn’t meant to speak to anything other than most influential from a real estate perspective.

Appraiser

at 9:03 am

@Vancouver Keith, thank-you for exposing the “government-caused” inflation myth.

As for emergency spending on income support, I hope they “overdo” it again next time. I’m old enough to remember the Great Financial Crisis of 2007, when banks and billionaires got bailed out, while the rest of the world learned the word “austerity.”

Sorry David, it’s just another recycled talking point:

130 years of ‘Nobody Wants to Work Anymore’ Meme Cites Real Newspaper Articles

Not to mention – Canada added 104, 000 jobs last month and that “Employment growth was led by an increase among youth aged 15 to 24” https://www150.statcan.gc.ca/n1/daily-quotidien/230106/dq230106a-eng.htm

Regarding the greenbelt land grab debacle: Not only is he a complete doofus, the Premier of Ontario is a corrupt fraud.

Appraiser

at 9:06 am

https://www.snopes.com/fact-check/nobody-wants-to-work-anymore/

David Fleming

at 9:23 am

@ Appraiser

They’re all crooks. I have never found a politician that I like.

Can anybody name one?

It typically comes down to either “vote the party, not the person,” or “the devil you know, versus the devil you don’t.”

I agree with your sentiments on the bailouts in 2008. Especially in the United States. Likewise, I agree with the point by another reader about CEO compensation, but the point I was making there was that a journalist trying to report on “inflation” found a way to turn it into a conversation about CEO compensation.

As for “people not wanting to work,” our outlooks are shaped by what we see, what we experience, the fields we’re in, and to some extent, discussions with colleagues in other industries. The latter is a bit of hearsay, but if a best friend who works for government says, “The entry-level 22-year-olds that I manage are always taking personal days, demanding to work from home, calling in sick, and the older folks never do,” I can’t discount that because I didn’t see it first hand.

Crofty

at 10:01 am

“They’re (politicians) all crooks.”

And you wonder why so many people hate “all” real estate agents (or CEOs)? These folks are simply painting an entire group with the same (negative) brush, exactly what you’re doing. They’re wrong to do so, and so are you.

Nick

at 12:04 pm

Yes our outlook is shaped by what we see, its also affected by what we are told.

Younger people are no more lazy today than millennials were twenty years ago at their age.

And the view of 20-30 somethings is no better today than it was in the 80’s. Seriously, look up articles about “yuppies” from the 80’s and their selfish ways.

Its just evolution of how the generations work and the older generations not seeing eye to eye with them.

Jimbo

at 6:35 am

What is the saying, careful what you say to the person you disagree with across the table, because the person in that chair will be you one day.

Kevin

at 9:58 am

https://www.theglobeandmail.com/opinion/article-its-not-racist-or-xenophobic-to-question-our-immigration-policy/

Is population growth a topic for the next blog?

Dan Tailor

at 7:52 am

Over the past half century, many have blamed the Green Belt for reducing the number of available building sites as well as increasing the cost of new development. However, many agree that development in the Green Belt should be carefully considered and planned.Although there are sites in the Green Belt that deserve care and protection, the number of permitted developments in the Green Belt is increasing. However, it is important to have a good understanding of Green Belt development rules to consider any development of property in one of these areas. Task management and field inspections for construction can help with this, here’s what I mean https://fluix.io/industry-construction

sprayfoam kings

at 5:51 am

Love your blog Very much needed this. I will be regular visitors

Wall Spray Foam Insulation