Are there different levels of “wrong?”

Like, if somebody said to you, “Oh, wow, that’s really wrong,” does it make sense?

If you thought that the Seattle Seahawks were going to beat the Baltimore Ravens on Sunday, and instead of winning, the Seahawks not only lost the game, but lost by a score of 37-3, does it make you “more” wrong?

Or is wrong simply wrong?

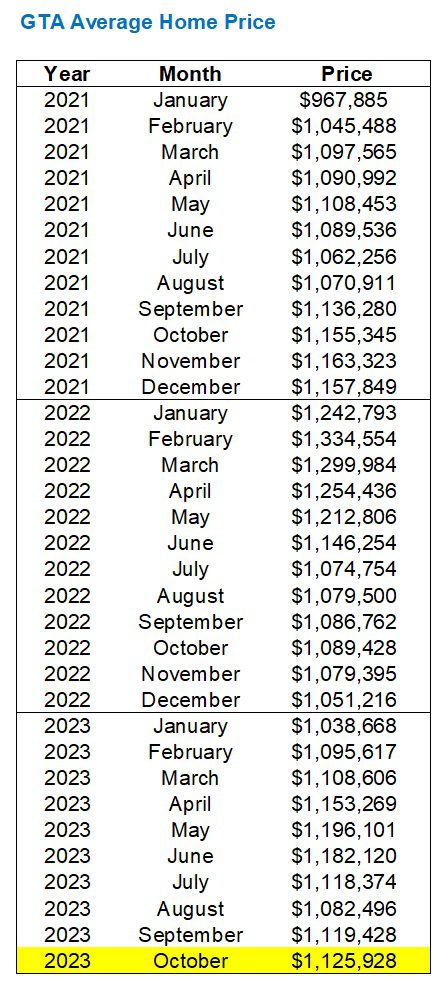

In this space last month, I mentioned that was 110% certain that the GTA average home price would show a decline in September, over August. And while it doesn’t take Carl Friedrich Gauss to tell you that you can’t be more than 100% certain of anything, I was, in the end, wrong.

So does it make me more wrong when I was certain that we would see a decline in GTA average home price from September to October, only to find out last week that prices actually increased?

Gamblers would call that a “parlay.”

A “double down,” if you will.

But based on my feeling in the market, both in September and October, I remain completely and utterly confused as to how the GTA average home price hasn’t declined – on paper.

Because I’ll tell you this, with absolute certainty: there isn’t a single property in the city that was “worth” more in October than September.

Ask any seller out there on the market right now, or who ended up selling last month, and they’ll tell you that the market conditions have tightened since September.

Having said that, the stats say what they say.

The average home price in the GTA went from $1,119,428 in September to $1,125,928 in October.

That’s an increase of 0.6%.

Now, you might be thinking, “Come on, David, that’s a rounding error! Who cares about 0.6%! What’s all the fuss about?”

But had the TRREB average home price come in at $1,085,000, which is good for a 3.1% decline from September, I wouldn’t have batted an eye.

In fact, if the TRREB average home price came in lower than the August price, I wouldn’t have been surprised.

The stats don’t lie. They aren’t wrong.

And many Realtors are happy that the media headlines are talking about “prices increasing.”

But in my opinion, the headlines and the stats aren’t showing the true market conditions out there, which I feel right now are poor.

Here’s an update on the GTA average home price, which we have going back to 2021 so I think we’ll have to pare this down next month…

Here’s the problem with the data above: nobody’s house is worth more today than it was in March, but the stats aren’t backing it up! It clearly shows a March price of $1,108,606 compared to an October price of $1,125,928, and you don’t have to be Pythagoras to note which price is higher.

But if a would-be home or condo seller saw this, they would not accept the market conditions out there today.

Give me ten minutes and I’ll pull a condominium unit that sold for 5-10% less in October than the identical unit sold for in March.

Give me twenty minutes and I’ll find a whole bunch of them.

I have a very, very good feel for the market, and what these stats are showing does not work out in practice.

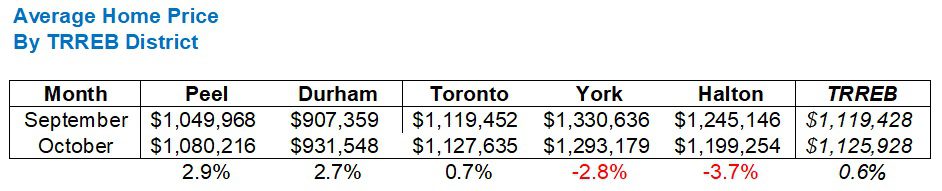

As far as the individual TRREB districts, we saw positive movement in three of the “Big Five” and negative movement in two:

Every average is made up of other averages, right?

So while the TRREB average increased by 0.6%, we saw York and Halton decline, while Peel, Durham, and the 416-Toronto all increased.

We’ve seen a lot of ebbs and flows through these five major TRREB districts this year, but overall, all five remain in the black on a year-to-date basis.

While January is a very slow and often seasonally depressed month, it’s worth looking at the year-to-date data for each area:

As I said, January is typically a seasonally depressed month, but these appreciation rates would meet my “sniff test” or “gut check” for how the market has moved this year. Perhaps I would suggest that Durham’s rate of appreciation is higher than expected, but overall, this feels about right.

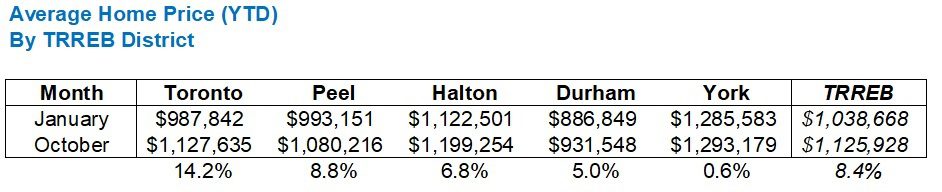

In any event, while prices have slightly improved, we’re still seeing all-time-low sales.

Remember that in this space last month, we saw only 4,642 sales in September, which was the fewest sales in any month of September since this data began 2002.

Now, what of October?

Essentially the same theme.

4,646 total sales, which is four more than September, but also the fewest all time in this month…

Interesting that the second-lowest in any month of October happened to be 2022. So it’s not like this fall’s slowdown should be unexpected, and yet here we are, collectively looking skyward for answers.

We say that the “fall market” starts after Labour Day and begins to fade once we turn the page to December, so we’re essentially looking at three months, often less.

So what relationship should we expect between September sales and October sales?

While September is historically a “big month” as we see a pop from a solemn summer, history shows that we should expect to see October sales come in higher than September.

In fact, from 2002 through 2022, we saw sales increase 15 times, compared to only 6 years of decreases:

From 2002 through 2022, the average movement from September to October was +4.9%.

And yet this year, we saw an increase of 0.1%, or those measly four sales that I noted above.

I shudder to think what November will show.

Last month, I also showed you a statistic that I simply couldn’t comprehend:

September’s sales-to-new-listings ratio was 28.6%.

Anything under 50%, in theory, points to a buyer’s market, and anything over 50% points to a seller’s market.

I couldn’t remember the last time I saw something under 40%, let alone 28.6%!

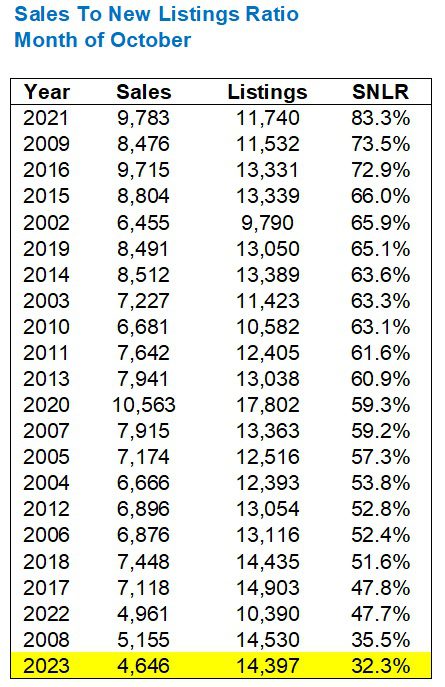

In October, this ratio ticked up – barely!

How’s 32.3% sound?

Better than 28.6%, but still not anywhere near anything resembling “normal.”

In fact, just last October, sitting at an SNLR of 47.7%, we were talking about how shocked we were to see the figure under 50%.

So how’s 32.3% sound?

Like September, the October SNLR is the lowest in any October, ever:

That’s bleak, man. Better than September, but still from the world of “Oh my god, I cannot believe this.”

An uptick in SNLR, it seems, is expected from September to October. It’s happened in the last two years, which I’ll show on a chart in a moment.

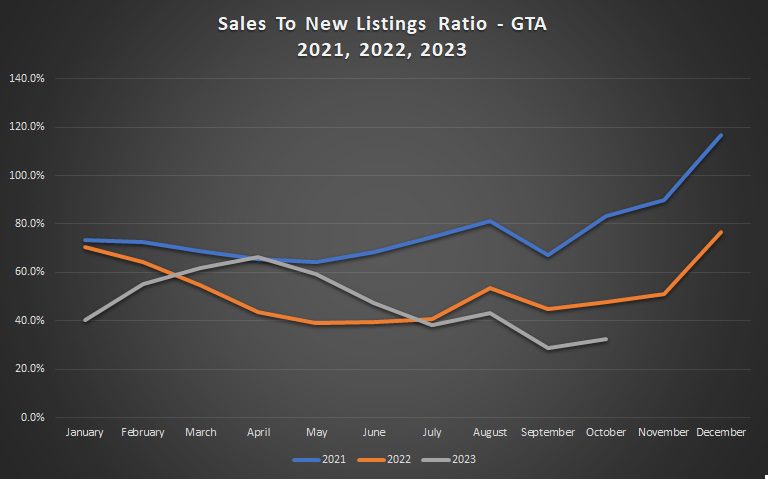

SNLR typically declines in “peak” spring season like April, May, and June, then spikes in the summer when listings are down, declines again in the fall, and spikes in December when absolutely nobody lists.

This year, the SNLR tells a very interesting story.

It shot up in the first couple of months and has steadily declined every since. Despite a small uptick from July to August and September to October, it’s part of a downtrend that began in April, and which forms an opposite shape to that of 2021 and 2022:

Are we guaranteed to see that same spike in December?

It’s been automatic in previous years, but this fall seems like no other.

As for this month, I think listings will be down substantially and there will be sales, so the SNLR will increase. What sales? Which sales? Think of all those properties sitting on the market, for which buyers are biding their time, waiting to make an offer. I think this is the month when existing inventory clears, and with new listings down, we’re going to see SNLR back around 45% for November. Remind me to bookmark that prediction.

Lastly, I want to look at SNLR in the five major TRREB districts:

First, I find it interesting that the 416-Toronto segment saw the lowest SNLR from January through May, and yet the appreciation through 2023 is the highest of the five, by far.

The other eye-catcher here is that Durham Region is the only district of the five that did not see SNLR increase from September to October, but that seemingly had no effect, since the average price increased by 2.7%, month-over-month. Durham’s SNLR has been highest for three months running.

Overall, the five districts seem to be moving in tandem, but there’s more differentiation this fall than there was in the spring.

–

There’s been a lot of talk in the comments section lately about houses that aren’t selling, or houses that are being listed over and over with different “strategies.”

On Wednesday, I want to look at some of these strategies, with or without quotations.

We’ll decide which are actual, bona-fide strategies, and which are absolute shots in the dark.

Nobody

at 7:59 am

This weekend I saw something I haven’t seen in at least a decade.

Saturday afternoon in Rosedale/Summerhill there were more than 5 open houses with sandwich boards on the sidewalk. One street had 2 open houses across the street from each other. They didn’t have 24 year olds sitting these open houses either – named persons from the realty groups were running the show.

Good houses in superb neighbourhoods are plentiful. Things are on the market for more than a month.

Feels like the minivan scene from Big Short: “oh it’s just the gully”

Sunday – tons of sandwich boards for condo open houses in King West. Good condos have been on the market for more than a month.

Checked out listings website – there’s a house in Rosedale for sale in the middle of a gut reno. It has 20+ photos showing exactly how much of a bare shell it is, not your usual 1 outdoor picture. And again this is an abandoned project on one of the best streets in Rosedale. Tons of product available on great streets. Some obviously need work as they haven’t been traded for 40 years but all of these people are sitting on 20x appreciation – they don’t need the cash immediately (ok except for the abandoned spec project) even if it’s something close to an estate sale.

Next few quarters are going to be WILD

Different David

at 6:23 pm

Lots of motivated sellers…

Appraiser

at 8:11 am

The two most recent interest rate shocks tasered the market. Sales volumes are super low and at today’s prices are being conducted primarily by super qualified individuals with high incomes, lots of equity or both.

Interest rates appear to have topped out both here and in the US. With the threat of ever higher mortgage rates seemingly off the table, it will interesting to watch the next few months to see if buyers and sellers have the confidence to re-enter the market with gusto, or not.

Andrew

at 9:06 am

David did you just turn into a bear?

David Fleming

at 10:58 am

@ Andrew

No, of course not!

I’m just trying to point out that the market isn’t as “good” as the TRREB stats show.

My example – the average TRREB sale price was higher in October than in March. Not a single property in the GTA right now could get even close to March’s price. So how does that make sense?

Ace Goodheart

at 9:08 pm

Only really good houses are selling?

Would explain the price difference. You can’t move garbage anymore. If something actually sells, it was a special kind of awesome.

Sirgruper

at 9:15 am

Yes, I think you can be more or less wrong. You can feel Seattle will win and bet 5 bucks or your net worth.

As for the increase, possibly with low sales and the new Toronto land transfer tax set for January , you have more very expensive houses (Russel Hill $11M) that are transacting to beat the tax.

Derek

at 9:21 am

Yes, I took the most cursory of glances at the September and October TRREB Market Watch expanded breakdown, imagining much higher >$2M numbers for October, but it’s not the case. Must be an outlier month for the mega $Millions houses then???

Rick Michalski P.App ACCI

at 9:31 am

It’s just a bit slow on sales but price is up and will keep going UP UP UP now that bank of Canada has said rates are going to be cut back to 0% by end of the year!!

QuietBard

at 11:14 am

“But in my opinion, the headlines and the stats aren’t showing the true market conditions out there, which I feel right now are poor.”

I wonder if the underlying mix of properties selling has significantly changed and could be causing these discrepancies. For example (intentionally exaggerated to show effect) lets say a small town had 20 sales, 10 @ 1Mil & 10 @ 4 mil -> Avg = 2.5Mil. The following month 10 units sell (so sales crash by 50%) but here is the mix of sales: 2 @ 0.6Mil & 8 @ 3.2Mil -> Avg = 2.72 Mil. So even though sales have crashed by 50% AND home sales have dropped by 20%, the average actually went up by 8.8%! (2.72/2.5-1). Which would also explain why the numbers aren’t coherent with the “gut check”

Or another scenario. 10 units sell but the mix is as follows: 3@0.8Mil & 7@3.2Mil -> Avg = 2.48Mil. Everything is the same as before but because the mix is slightly different the Avg actually fell by -0.8%.

And finally something that I didnt expect but after thinking about it makes sense. First another scenario: 10 sales but 5@0.8Mil and 5@3.2Mil -> Avg = 2Mil. Now we see that Avg declined by 20%, which is same as the home prices! I think that means to get an apples to apples comparison (or I guess a Red Delicious to Red Delicious comparison) we need the underlying mix to be the same across months. (good luck with that I suppose)

Disclaimer: I only spent 10 minutes on my this and it may not work outside of my silly example. Dont obliterate this post like its a doctorate defense or something

Gauss, Pythagorus? David did you by chance watch the latest Veritasium video?

QuietBard

at 11:22 am

*For some reason my comment didnt show up the first time.*

“But in my opinion, the headlines and the stats aren’t showing the true market conditions out there, which I feel right now are poor.”

I wonder if the underlying mix of properties selling has significantly changed and could be causing these discrepancies. For example (intentionally exaggerated to show effect) lets say a small town had 20 sales, 10 @ 1Mil & 10 @ 4 mil -> Avg = 2.5Mil. The following month 10 units sell (so sales crash by 50%) but here is the mix of sales: 2 @ 0.6Mil & 8 @ 3.2Mil -> Avg = 2.72 Mil. So even though sales have crashed by 50% AND home sales have dropped by 20%, the average actually went up by 8.8%! (2.72/2.5-1). Which would also explain why the numbers aren’t coherent with the “gut check”

Or another scenario. 10 units sell but the mix is as follows: 3 @ 0.8Mil & 7 @ 3.2Mil -> Avg = 2.48Mil. Everything is the same as before but because the mix is slightly different the Avg actually fell by -0.8%.

And finally something that I didnt expect but after thinking about it makes sense. First another scenario: 10 sales but 5 @ 0.8Mil and 5 @ 3.2Mil -> Avg = 2Mil. Now we see that Avg declined by 20%, which is same as the home prices! I think that means to get an apples to apples comparison (or I guess a Red Delicious to Red Delicious comparison) we need the underlying mix to be the same across months. (good luck with that I suppose)

Perhaps the reason for the change in mix might be that first time buyers have been pushed out of the market with the higher rates.

Disclaimer: I only spent 10 minutes on my this and it may not work outside of my silly example. Don’t obliterate this post like its a doctorate defence or something

Gauss, Pythagorus? David, did you by chance watch the latest Veritasium video?

Jordan

at 1:45 pm

I’m in outer suburbia and I think my neighbourhood is a good microcosm of what’s going on. Mature area with many original owners from the 1990s and early 2000s. Right now, we have 7 active listings with 3 sales and 1 full termination in the last 30 days.

– Sale #1: Fairly nice property listed originally at what I would say is Feb 2022 pricing (bigger lot – recent reno but very Ikea-looking). It sits for a month and they do a 10% price drop. It then sells in a day for 100% of its new list (call it late 2021 or average 2023 pricing)

Sale #2: Almost the same story as House #1 except better everything including reno quality. Sells for 101% of list after 3 weeks. I would definitely call it Feb 2022 pricing

– Sale #3: Nice enough house but on a terrible lot (small lot major street, just a few hundred metres from your now typical suburban condo construction zone). Sells for 5% more than its last sale in Summer 2019 (!) / early 2020 prices.

No wonder trying to make sense of the average numbers is a challenge.

Of the other 7, you have 3 with pricing histories that would inspire a TRB blog (1 of whom is also trying to stay whole on their Feb 2022 buy + flip cost and are delusional); 2 too new to judge just yet but seemingly priced reasonably; and the final 2 running with classic keep dropping your price by $50k.

Gallop

at 2:11 pm

Just a general comment:

We are sold w/cash and looking. The agents we are meeting at open houses (not jr’s) and site visits are biting our arms off, not to sell the house in front of us, but to rep us on any buy.

While that’s normal, earlier they wouldn’t be so bold, they’d at least give it the college try. Now they almost say, never mind this house, here’s the best deal I know of. The agent crisis vibe seems off the charts, maybe that’s a good market indicator too.

If this sustains won’t it clear out a ton of agents? Are there stats for that?

Nobody

at 3:32 pm

Yeah it wasn’t quite having David or Jimmy Molloy running the open houses but not that far off. And they were SCARED.

One realtor told me the sellers were motivated and I hadn’t been inside for 60 seconds. “This is a great market to buy in, can definitely negotiate…”

These aren’t houses with problems. Not an issue with a huge condo going in literally next door or obvious issues that require immediate attention.

This will definitely wash out a ton of agents. The ones who are in real danger were barely hanging on with a vibrant condo market. The big agents are going to take all the work they couldn’t bother with before…

David Fleming

at 5:32 pm

@ Nobody

Was I just mentioned in the same breath as Jimmy Molloy? 😍

Appraiser

at 7:00 pm

“A survey of influential economists and analysts shows many are expecting the Bank of Canada’s first rate cut by April 2024.”

https://www.canadianmortgagetrends.com/2023/11/market-participants-expect-first-rate-cut-as-early-as-april-2024/

Josh Hryniak

at 8:56 pm

And these guys all accurately predicted boc rate jumpin to 5 % back in 2021….. right????