Tell me that you hate the title of today’s blog and I won’t fault you for that.

You have your viewpoint and I have mine.

For what it’s worth, and in the spirit of brutal honesty, the original title was, “February TRREB Stats: Swallowing My Pride.”

I wrote a large portion of today’s blog with that title adorning the top of my page, but about two-thirds of the way through, I thought to myself: “I’m not wrong here.”

You like that?

Some of the TRB readers have been waiting for today’s post to see how I would react.

React, or maybe “spin.”

And yet some of the TRB readers have absolutely, positively, no idea what I’m talking about here.

In short, the January TRREB stats were released on Tuesday morning and they were not pretty.

They were actually quite poor.

Some were monumentally awful, and others were in the “all-time” category.

I was surprised to only see Derek’s comment on the previous blog, from Monday, poking the bear in this regard. But I think that many of the TRB readers who did see the TRREB stats also figured that they would just wait and see how I would react.

Of course, then there’s also the matter of a certain blog post from March of 2023 that needs to be discussed today, not only so a couple of people can take their victory laps, but also so others can take shots at me.

Tired of the euphemisms?

Alright, let’s get started here.

As I explained in my Instagram/YouTube video, my eNewsletter, and virtually every other forum this week:

I have been in real estate for twenty years. I have been writing blogs about the TRREB market stats since 2007 and I have been exploring and analyzing these stats for about a dozen years via my eNewsletter. Never before this month have I seen such a large disconnect between what we’re seeing and experiencing in the market and what the TRREB stats show.

Fair enough?

Smile if you want. Watch me squirm. Watch me try to “explain away” a new market bottom and an average home price that just dropped five percent.

But I’m anything if not honest, and I also believe that February and March will prove my thesis. Hence, my smoke and mirrors title today.

About twenty-or-so days into January, we started to see a massive shift in the market.

Properties were not just receiving multiple offers, but we were seeing 10, 15, or 20 offers on houses and condos alike.

Not only that, we were seeing huge “over-asking” numbers, and while it’s true that the lower you price a home, the higher it could sell for over list, we weren’t seeing $200,000 over list in the fall, let alone the $300,000 over list we saw in January.

At the end of the month, I wrote:

January 29th, 2024: “Just Like That, It’s A Seller’s Market Again!”

I took some heat for this from a few readers who felt I had cherry-picked a bunch of hot sales, but the hot market continued from there, and remains today.

My teammate Tara sold a condo townhouse last night amid 12 offers.

We brought out a listing in Mississauga yesterday that had twenty-five showings booked through ten hours on the market.

The market isn’t slow, folks. And the buyer’s market from the fall is long, long gone.

However, the January TRREB stats don’t show that.

So if you’re tired of me attempting to convince you, then let’s just get to the numbers…

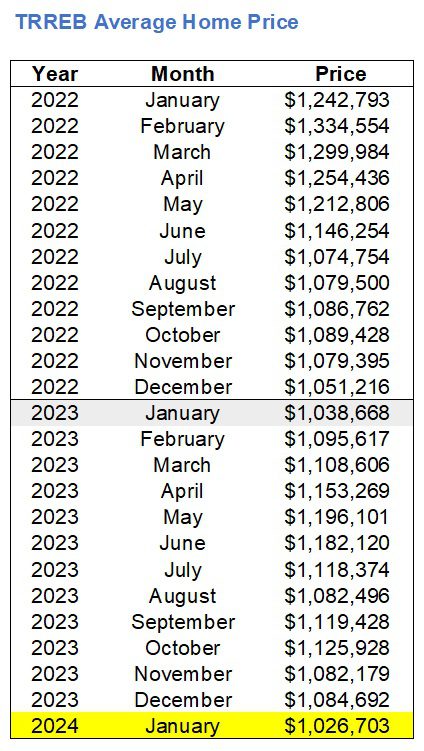

That’s an up-to-date look at the TRREB average home price.

Apparently, despite the red-hot market over the last few weeks, the average home price is down 5.3% from December.

For the record – and not trying to brag about how wrong I was, I had started building these charts last weekend and I had used $1,118,540 as a place-holder for January.

That is how sure I was that the average home price would increase from December.

I felt that a 3-5% increase would result, so again, ask me how shocked I was to find a 5.3% decrease in the TRREB stats on Tuesday morning.

But more importantly, this sets a new “market bottom.”

That $1,026,703 figure is now lower than the $1,038,668 figure from January of 2023.

Uh-oh.

Now we have to revisit this blog post:

March 15th, 2023: “TRB Reader’s Write: When Will We Peak Again?”

Recall that eleven months ago, I asked the readers when we would “peak” in the market again. More specifically, when would the TRREB average home price top the $1,334,554 set in February of 2022.

Although it seemed like a foregone conclusion, I first asked, “Have we hit bottom yet?”

Here’s how the readers responded:

Derek, Bankersorta, JL, and Sigruper were the only ones to say “no.”

Derek and JL both predicted we would hit bottom in December of 2023, which wasn’t a bad guess. We were $50,000 higher in December, but that was only one month from the new trough.

Bankersorta said November of 2024, so there’s still time.

Sigruper said February of 2027, so there’s all kinds of time!

And I’m still sitting here having revise all of my charts! Like this one here:

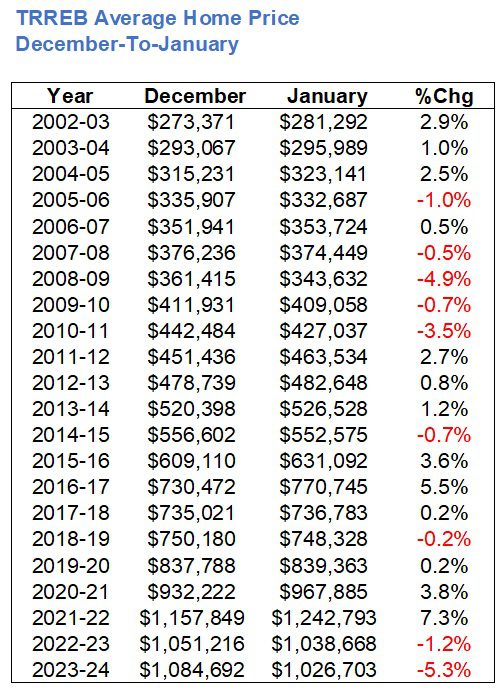

I wanted to know how the market typically starts each year in comparison to the tail-end of the year before it.

December is not a busy month in the real estate market. It’s hard to use the stats for much, but if we wanted to see how some years “start hot,” we can compare December to January.

Here we can see that the 5.3% decline from December of 2023 to January of 2024 is the worst decline this millennium!

Right.

May I please continue to “explain away” these really, really poor stats?

I just don’t see it.

The above chart says, “This is the worst start on record” but that’s not at all what we felt last month.

Not only that, if you take a look at the sales data, it further confounds the perspective on price.

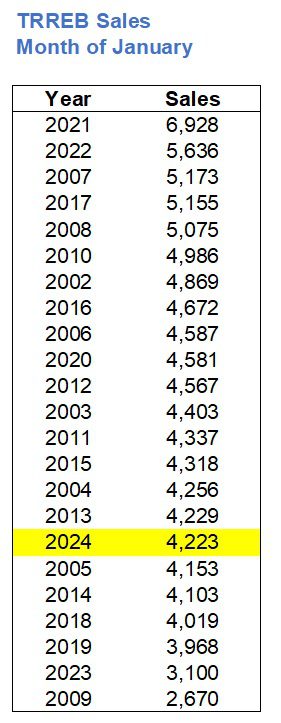

We saw 4,223 sales in the month of January which is actually quite a lot when you consider how the month started. I wrote in blog posts both to end 2023 and to start 2024 that there’s a chance we see the fewest sales in January on record. Given the 2,670 recorded in January of 2009, maybe that was a poor bet. But I expected little-to-no inventory, and once the year started, we learned that all of the “new listings” were actually re-lists from the fall of 2023.

So the market did pick up in the second half of the month, and statistically, this was not a poor January:

Anything in the 4,000 – 5,000 range is what I would consider “the mean.”

But it’s also important to note that sales were up 37.0% year-over-year.

Yes, the January, 2023 sales figure is the second-lowest on the chart above, but I don’t think that a 37% increase gives any bearish vibes, whatsoever.

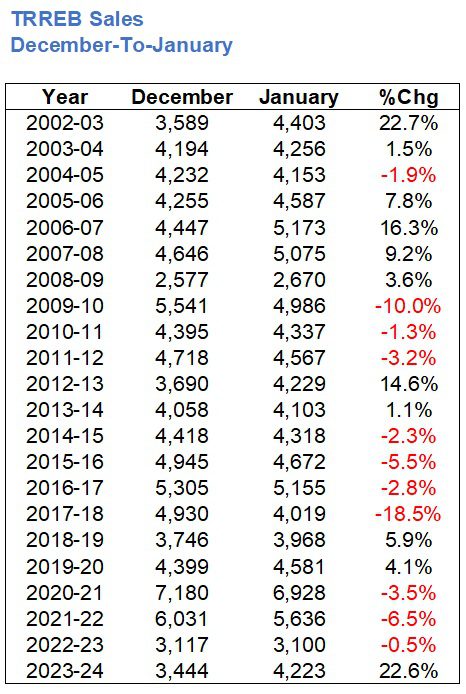

As for the month-over-month sales data, we saw 3,444 December sales against 4,223 January sales.

This is an increase of 22.6%.

You might think that this is lower than it should be, given that December is slow and January is supposed to be the start of a new real estate cycle, but the following chart shows otherwise:

That December-to-January increase of 22.6% is the largest since 2002-2003.

Not only that, in 11 of the previous 21 years, we actually saw a decline.

So again, I have to ask:

With a year-over-year increase in sales of 37.0% and a month-over-month increase of 22.6%, how could we see the year-over-year price decline by 1.0% and the month-over-month price decline by 5.3?

I suppose if inventory skyrocketed, then it would become a buyer’s market and prices would plummet.

Right?

But that didn’t happen.

In fact, after seeing a sales to new listings ratio (SNLR) of 40.3% in January of 2023, we saw that rise to 51.0% in January of 2024.

So the market this January was tighter.

And yet prices declined.

Now, let me try to make sense of this:

Ignore December. Just do it.

The SNLR peaks every December and it makes sense when you consider that nobody lists “new” and a lot of buyers seek deals, but regardless, I left that figure in the chart so people wouldn’t accuse me of manipulating the data.

But look at the SNLR from last fall.

Prices held!

The SNLR was the lowest I had ever seen.

28.6%, 32.3%, and 40.2%, but prices held.

Then in January, with an SNLR of 51.0%, which is higher than the previous January’s 40.3%, for some reason, prices drop.

Prices didn’t drop in September with an SNLR of 28.6%.

But they did last month in January.

What other reasons could there be to explain the decline?

Perhaps we have to look at property type?

A couple folks read my eNewsletter on Wednesday and emailed me with their sentiments, specifically as to how different proportions of property types could have sold in December versus January.

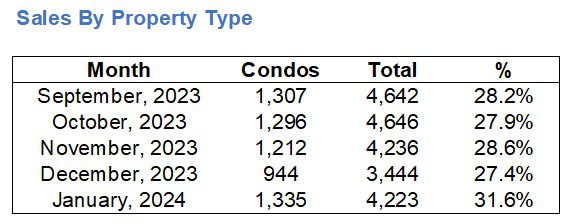

For example, what if we looked at the proportion of condo sales?

With the average condo costing far less than the average freehold, that could have an effect…

Very, very interesting!

We don’t know how much the higher proportion of condo sales in January, relative to the previous four months could “move the needle,” but it’s fair to say that there is going to be an effect.

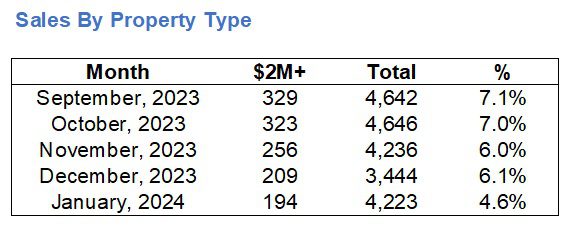

As for low-end versus high-end, which another reader suggested, the stats would look something like this:

Same pattern.

Unfortunately, we only know sales of $2,000,000 or more, whereas I wish TRREB would revise this to $3,000,000 or more, as the definition of “luxury” continues to change.

But with a higher proportion of condos selling in January and a lower proportion of $2M+ properties selling in January, I think this explains at least some of the confusion around average home price.

As for the rest of the reason? Maybe it was the tragically slow first half of the month.

But if you want to look forward and not back, I’ll leave you with one final chart:

On average, from 2002 through 2023, the TRREB home price has moved 6.0% from January to February.

In the past twenty-two years, we have never seen a decline.

This year will be no different.

In fact, I believe that because the January average home price was so unreasonably deflated, we could see a double-digit gain next month.

Appraiser

at 9:36 am

Statistically, it has long been recognized that average price has its limitations when examining real estate sales. Thus the invention of the HPI composite index many years ago.

The overall HPI benchmark price for TRREB was down a modest -0.44%. Only one category property was actually down – condo apartments by -0.67%. Single family detached homes, single-family attached properties and townhouses were actually slightly higher year over year. https://trreb.ca/files/market-stats/market-watch/mw2401.pdf

QuietBard

at 2:45 pm

Godsend Ace. Just reviewed the numbers and looks like our esteemed author isn’t cooking the books.

Censoring the data at $2Mil is pretty annoying. But I’m not sure how much of a change it would make.

The one thing that is still bothering me is the investor class, especially the condo guys. Apparently they have been bleeding for a while now and it’s unclear what they will end up doing. Also, now that the prime rate is so high borrowing against existing properties to finance new ones doesn’t really make sense. I wonder if the condo market will just freeze up. Guess we have to stay tuned.

Derek

at 9:51 am

Meh. It is what it is. Who’s printing the exclusive t-shirts, “I said there will be a new bottom and all I got was this lousy t-shirt”? Looking to the future, how about, will the 2024 “TRREB MLS System Sales and Average Price” be over or under the 2023 number of $1,126,591?

https://trreb.ca/files/market-stats/market-watch/historic.pdf

Sirgruper

at 11:55 pm

I still have a shot at that T-shirt. Large please.

Derek

at 9:22 am

FWIW, by my scoring/understanding of the questions, 4 people answered #1 correctly, everyone answered #2 incorrectly (and the question is now closed), and question 3 remains open. But yes you do get the tshirt!

Question Guy

at 11:03 pm

your “feeling” that January was “red hot” is just a feeling – likely because ANYTHING was better than December.. but, feelings lose to data every. single. time.

stop spinning. prices are NOT going to increase – MAYBE stay flat – but likely starting a slow decline

David Fleming

at 2:10 pm

@ Question Guy

I’ll wager, if you’re game.

I honestly feel like it’s an unfair wager. That’s how certain I am.

You feel that the average home price will “decline” from the $1,026,703?

I just showed you that February has been higher than January EVERY YEAR since 2002.

Do you want to be against that?

Derek

at 3:15 pm

Narrator:

“He did not want to bet against that.”

Daniel

at 9:39 am

Yes let’s get some skin in the game here. And I hope that David is logging all of these predictions. Not to say “I told you so” or anything but to evaluate the accuracy of public perception.

Kramer

at 1:42 pm

“Regardless of whether interest rates remain where they are, or come down a whole point or half a point or whatever may happen, the course of action remains the same because we know we need to build millions of homes” – Housing Minister

+

Interest rates have been at max restrictive for 6 months and will be dropping toward neutral rate very soon. (David, I like your 3.49% 5-year fixed in 12-24 month estimate – and I hope it comes true)

= housing prices are going UP.

Kramer

at 1:48 pm

I said it years ago on here, vehemently, that Canada had a SUPPLY PROBLEM… back when the word bubble was being used in EVERY article on Toronto real estate. Common knowledge now… even Chrystia Freeland has been forced to say it because her government’s policies so obviously work against housing affordability and her only out is to get on the rational side of it, sound positive and say build baby build. Too little too late Liberals. YOU’RE OUT.