The 2021 Toronto real estate market has been like few others. Pre-pandemic 2020 comes to mind, as does 2017. We’ve seen the market slow down over the past three weeks as the red-hot first five months of the year closed out, and we now find ourselves in that transition period after May-24 weekend and July, where the spring market is just concluding before the summer market begins.

From January 1st onward, my team and I have worked tirelessly with our buyer-clients on both house and condo purchases, anything from a $490,000 condo to a $3,000,000 house. We’ve worked with end-users and investors. Individuals and families. First-time buyers and downsizers. You name it, we’ve worked on it.

I always wondered how my insights into the buyer mindset would line up with what other agents experience, let alone what buyers themselves are thinking. I’ve said this before: many of my buyer-clients are repeat and have worked with me before, but most of my new buyer-clients come to me from Toronto Realty Blog, usually after reading for quite some time. So suffice it to say, I feel as though my buyers have a much better understanding of the real estate market than most.

The stories I tell on TRB involving buyer interaction in the marketplace will always seem a little easier and calmer than what others will experience out there. So this OREA survey on buyer insights is an excellent look at the buyer pool as a whole.

If you’re wondering what buyers are thinking out there in 2021, you can’t simply read my blog, or ask your friend from work who’s in the condo market; you need a much larger sample size!

So let’s look at a few statistics from the recent OREA Buyer Survey 2021.

First and foremost, who’s buying?

Only 6% of respondents are “very likely” to buy in the next twelve months:

The OREA blurb that accompanies this chart speaks to “resiliency” in the market, but again, it’s all in how you spin this data.

My two interesting takeaways:

-17% of the buyers who are likely to purchase in the next twelve months live with extended family

-29% of the buyers who are likely to purchase in the next twelve months immigrated to Canada from another country

The latter stat is fascinating, considering my take in Monday’s blog about people coming from other countries to be far less likely buyers than those already living here.

–

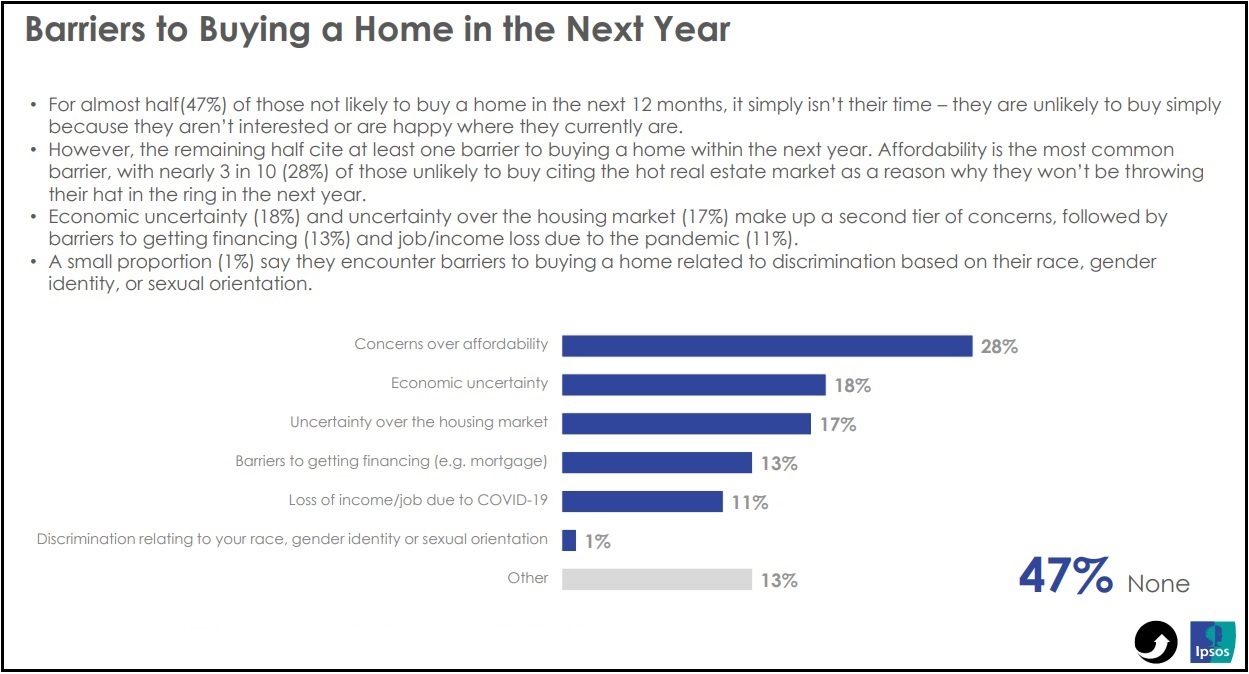

In terms of “barriers” to buying a new home, 47% said they’re just not in the market.

But the most common “barrier” for those who do want to buy?

This should come as no surprise…

I would argue that “economic uncertainty” and “uncertainty over the housing market” are essentially the same thing. Yes, you can argue that some whiz-kids out there have confidence in the housing market but might have questions about Nominal GDP Per Capita, but that’s not going to be common.

So 35% of respondents essentially cite “the market” as a concern, whether it’s the Canadian economy, Toronto housing, their stock portfolio, or some combination therein.

–

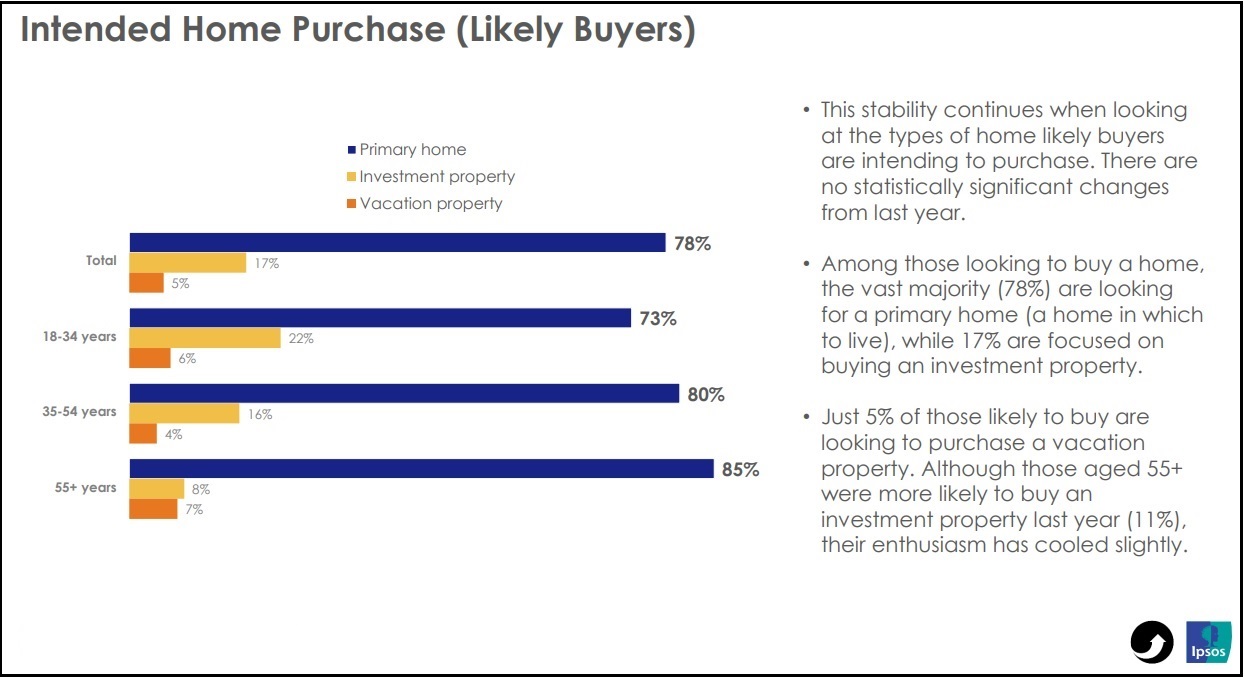

What type of buyers are out there?

This is very, very interesting!

For those who question what percentage of purchases are for “investment,” this answers that query:

22% of all buyers aged 18-34 are buying investment properties.

8% of all buyers aged 55-and-up are buying investment properties.

According to this chart, the older you are, the less likely you are to buy an investment property. However, this doesn’t take into account those aged 55+ who are helping their children buy their first home, which is, in a sense, investing.

–

How many are first-time home-buyers?

This is about the most easy-to-predict statistic in the whole presentation:

Not judging here at all, but how many folks aged 55+ are buying their first property? HUGE congrats to them!

But the rest of this seems to flow naturally, as we’d expect.

Only 1% of buyers aged 18-34 are on their fifth property? Well, no kidding.

It’s the first-time buyer stats that are what interest me.

26% of would-be buyers are not yet owners.

37% of those aged 18-34 are first-time buyers, and amazingly another 24% of those aged 35-54 are first-time buyers. I would expect that if we further divided this into those 35-40, most would fall into that category.

–

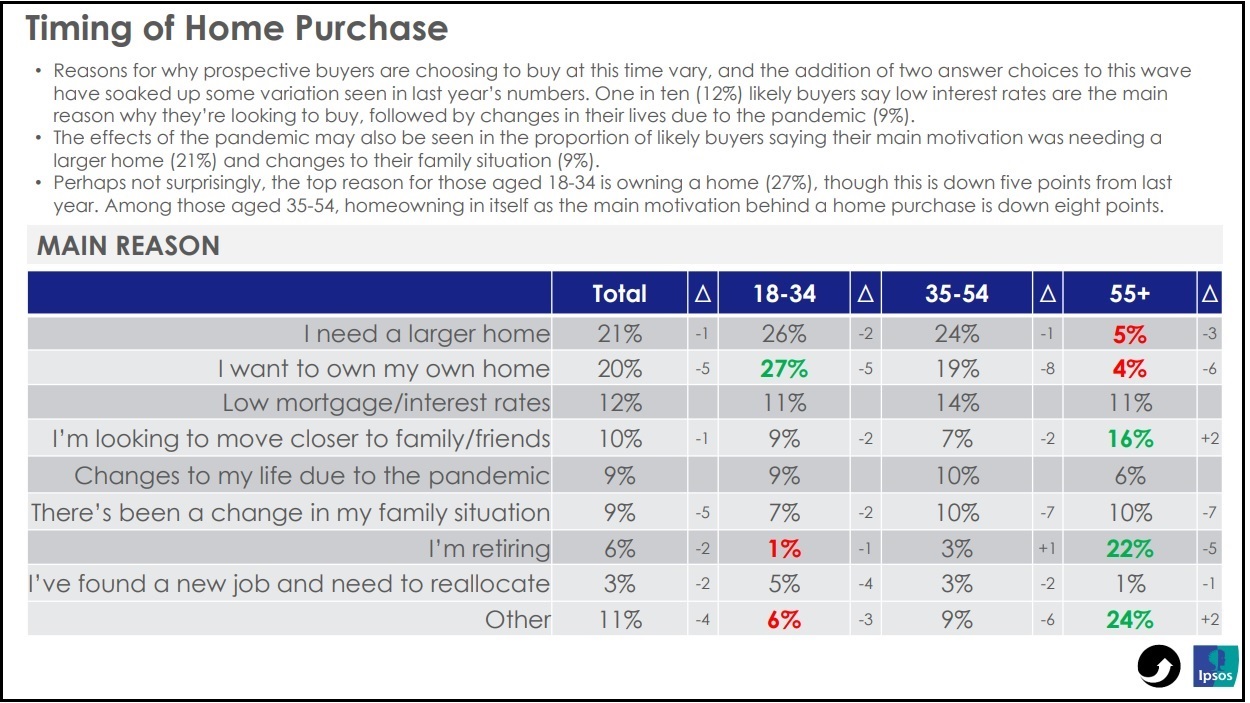

This next slide didn’t really teach me all that much:

Reasons for moving?

I suppose if I thought of reasons, before reading this slide, I’d assume the #1 reason would be first-time home-ownership, the second would be buying a larger house, the third would be moving to a different area either for a job transfer or a lifestyle change.

“Change in my family situation” is one that didn’t come to mind, but people do get divorced! It’s very common, and while I’m sad when past clients call me with this news, I realize that it’s going to continue to happen.

The idea that somebody is buying only because of “low interest rates” sounds like a planted answer, or at least an answer from somebody that doesn’t realize this is actually the second reason they’re in the market. A first-time buyer’s primary reason is to own their own home, first and foremost, and then they could add, “the low interest rates help.”

–

This one is really a continuation of the last slide:

–

This next one is fascinating, if for no other reason than the fact that I was completely caught off-guard by the demand for real estate in June 2020 and beyond. We all figured that the pandemic would slow the market, almost to the point of a full stop. In reality, it gave people reason after reason to move…

“I have saved more money throughout the year so I can afford to buy.”

I just read this in a Toronto Life article today:

“We Weren’t Ready To Move To The Suburbs Just Yet”

It’s one of those real estate porn articles that Toronto Life and other magazines, online and in print, just love to feature – especially when the people profiled in the article will pose for a photo!

Here’s the quote I want to draw your attention to:

During the pandemic, we became mindful of our spending by cutting down on things like clothes, haircare, tech and gadgets. And we were saving a ton by not going out at night and cancelling vacations—we’d originally planned to travel to Portugal, Vietnam, Bali and Chicago. By September, we’d probably saved more than $35,000 and our condo was starting to feel really small. We decided it would be a good time to buy a place. We realized we could afford a place and spend about the same as we paid in rent month to month.

They saved $35,000 in the pandemic and it enabled them to buy a home.

That’s what 25% of people aged 18-34 answered above.

It’s always nice when the stats line up with what you’re seeing in practice, right?

–

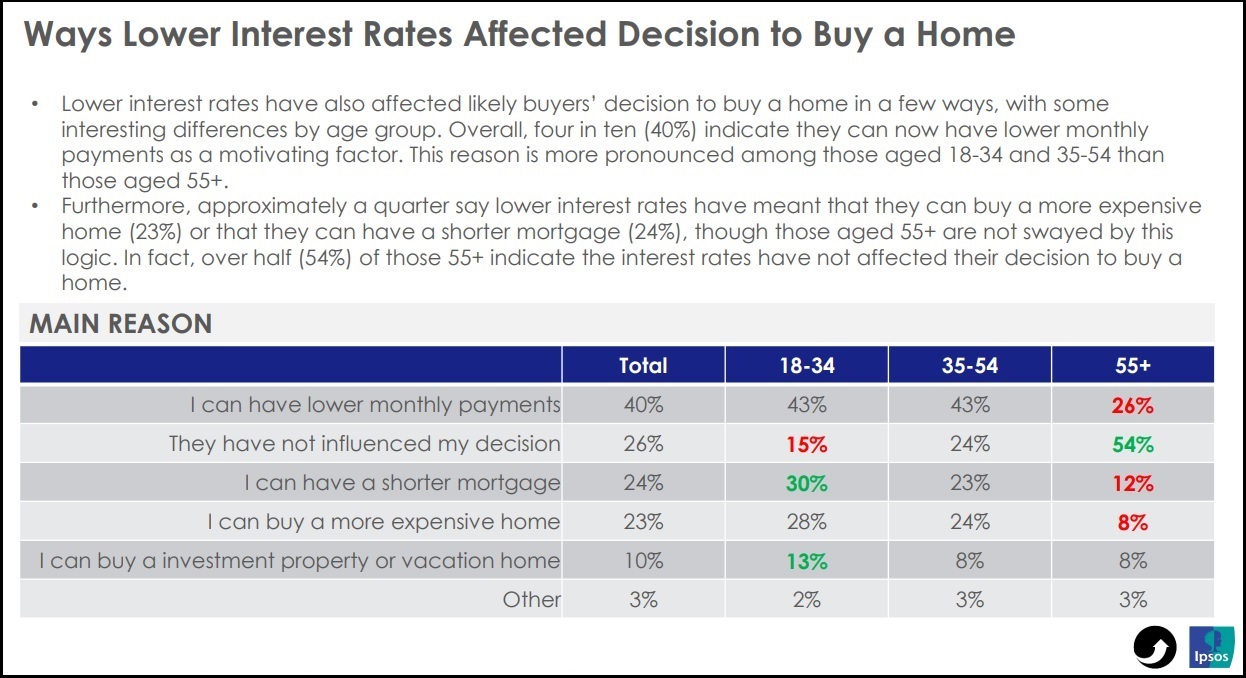

If interest rates dropped, and you could either: a) afford a larger home, b) reduce your payments, what would you do?

40% of respondents said they were going to lower their payments whereas only 23% said they wanted a larger house.

I don’t know who in the world is concerned with the length of the mortgage. On a 30-year amortization, you’re paying less each month. A higher proportion of interest, but your payment is lower. So dare I say, many people don’t quite understand the question and/or answer they’re providing.

How interesting that a whopping 54% of those aged 55+ said that lower interest rates do NOT affect their decision.

–

This is a fantastic question!

I just came from showings with a couple who are placing a massive premium on a main-floor home-office. It’s bordering on a “must-have,” and they would sacrifice backyard space and/or location to get this home office. This is 100% pandemic-induced.

–

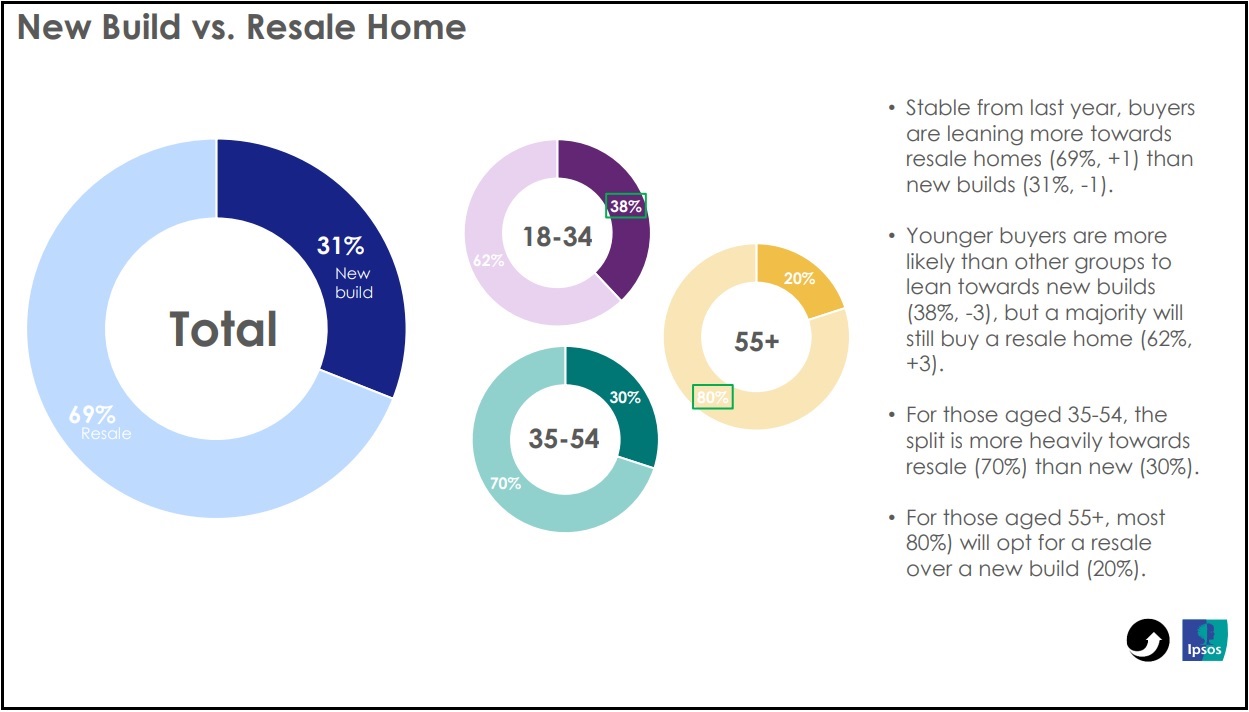

I cannot believe that 31% of buyers are targeting a new-build…

I just hope they aren’t thinking “pre-build.”

I suspect this question confused some respondents.

–

I’ve saved the best for last, folks.

These are the questions that many of the TRB readers will love to see answered.

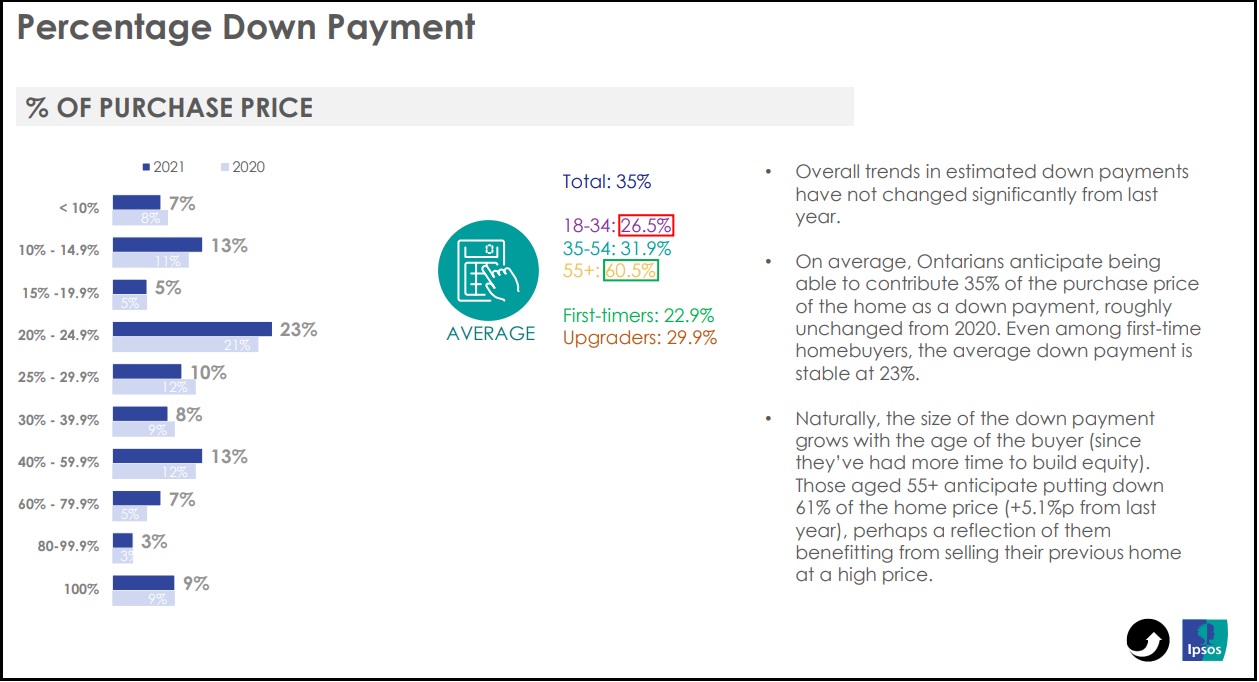

First, what are down payments looking like these days?

What’s more surprising: a) that 9% of buyers are buying in cash, or, b) that only 7% of buyers are making a down payment of less than 10%?

With interest rates where they are, I don’t understand putting down 50%, 60%, 70%, or 80%. You either have an investment vehicle for your money and make a 20-25% down payment because you see the value of a 2% mortgage rate, and want to invest your money elsewhere, or you buy in cash or close to it.

–

Secondly, how clued-in are these would-be buyers?

They don’t, for example, all think they can afford a detached house, do they?

While I recognize that this is a survey of Ontario, and there are very affordable detached houses in many cities and towns in the province, I think the fact that 56% of those aged 18-34 are looking for a detached house tells me that the younger part of the buyer pool is in for a rude awakening when they learn what prices are like in the Golden Horseshoe, which is where an overwhelming majority of these buyers will be looking.

–

Lastly, and this is the best slide in my opinion, how long do buyers expect to be in their new house or condo?

This goes to show me how delusional these buyers are.

Who buys with a 40-year outlook? A 35-year-old buying his or her forever home?

I’ve been selling real estate for seventeen years and I’ve got clients on their fourth property. If there’s one thing I’ve learned over the years, it’s that buyers drastically overestimate how long they’ll be in their house or condo.

76% of buyers believe they’ll be in their house or condo for 10+ years? Not a chance.

People move far more frequently than they believe they will. They get married or move in with a partner, they break up, they need larger properties, they start families, they move for work, they lose jobs, and on, and on. If the pandemic taught us anything it’s that a slew of people moved out of their existing house or condo for reasons they didn’t know existed, pre-pandemic.

Everybody will have their own “favourite” slide, question, or data set, but for me, it was this one.

Verbal Kint

at 8:46 am

Local agent surveys a survey, says respondents don’t realize why they’re in the market, “don’t quite understand the question and/or answer they’re providing,” are “in for a rude awakening,” were “confused” by another question, aren’t “clued-in,” and says he can’t understand why anyone would express a desire to pay off their mortgage in under 30 years.

Should’ve just filled out the survey for them, David. You know best!

Jenn

at 10:53 am

*yawn*

Mike

at 11:37 am

Yah okay David may have pooh-pooh’d the survey but he’s on to something re: mortgage term. Borrowers aren’t or shouldn’t be looking at how long it takes to pay off the mortgage ie. 25 v 30 yrs but rather they should realize they’re simply buying a 5-year payment plan. That’s what a mortgage really is these days. To David’s other point about length of tenancy/ownership 30 year olds aren’t taking a 30 yr amortization because they’re looking to stay in that house and pay the mortgage off in thirty years. It’s just a payment plan.

ChT

at 9:19 am

Valuable opinion/contribution pal…

TLM

at 11:07 am

That Toronto Life article didn’t make sense to me – the numbers don’t add up. They say their rented condo cost $3000/month, okay. Then they note their pandemic savings amounted to $35k.

But then they bought a $1.06M property, and say that the mortgage is roughly the same as their rent. What?! That means that they already had something like $300,000 to use as a downpayment, even assuming a really nice mortgage rate (~1.7%) and a 25 year amortization.

It feels really dishonest to say that cutting back on vacations and haircare will make the difference for a first time buyer. Who cares that they saved $35k – they already had more than enough to buy. Am I missing / miscalculating something?!

Steve

at 1:14 pm

“29% of the buyers who are likely to purchase in the next twelve months immigrated to Canada from another country”

I think you will find that this is actually roughly in line with the percentage of people in Canada who weren’t born here. Keep in mind nothing in that phrasing restricts it to *recent* immigrants, it’s effectively just anyone who wasn’t born here period. Based on stats can I think that’s 20-25% of the population.

Appraiser

at 8:38 am

“Pursuing demand-side solutions — from taxing foreign buyers, to rent controls, to taxing speculation — is like applying a Band-Aid to a massive head wound. It barely stops the bleeding. Politicians owe it to the next generation of homebuyers to identify the problem for what it really is…There is one simple reason homes are getting so expensive. There are not enough of them…” https://nationalpost.com/opinion/ginny-roth-the-true-villains-of-canadas-housing-crisis-arent-investors-theyre-municipal-politicians?utm_term=Autofeed&utm_medium=Social&utm_source=Twitter#Echobox=1624529515