Let’s pick up right where we left off, shall we?

–

4) What is going to happen in the downtown condo market?

I was on CTV Your Morning last Thursday to discuss the 2021 real estate market, and it’s never easy to get meaningful points across, over five or six questions, in a mere four minutes.

But after a decade of being on these shows, I know how to take a ten-minute answer and compress it into a 20-second response that’s easy to digest, no matter the viewership.

So, what is going to happen in the downtown condo market – explaining in two words?

“Rough ride.”

That’s my prediction. A rough ride.

Not a depression, not a crash, not a surge in prices, or anything hyperbolic, but I do think, generally-speaking, it will be a rough ride.

Last month, in my “Top Ten: Real Estate Stories of 2020,” I reckoned that the #2 story of the entire year was the condo market.

And the story within the story was simply that, post-pandemic, freehold prices rose, and condo prices declined.

When all was said and done in 2020, the average 416-condo price was down 11.4% from February to November, despite the average TRREB sale price being up 5.0% in the same time period.

To be fair, we saw a massive increase in condo prices in January and February of 2020!

So what if we simply looked at the increase from November of last year to November of this year?

416 Condos:

November, 2019: $659,855

November, 2020: $640,208 -3.0%

TRREB:

November, 2019: $843,637

November, 2020: $955,615 +13.3%

Well, the story really doesn’t change all that much, does it?

Instead of a 5% decline in value being compared to an 11.4% increase in value, we see a smaller 3.0% decline being compared to a larger 13.3% increase. It’s pretty much a wash, isn’t it?

Despite seeing condo prices massively appreciate to start 2020, once we take into consideration the dramatic rise in price of the other market segments, there’s no making excuses for the condo market, specifically in the 416.

The freehold market, and within that segment – the entry-level home market, may have not only withstood the pandemic but increased in spite of it. However, the condo market got hit. It really, really did.

Now, why did it get hit?

Quick, call Kevin Spacey! Because it’s our usual suspects:

1) Increase in supply

2) Decrease in demand

There’s more for sale and fewer people are buying it, so prices, as a result, have to drop.

And what’s going to happen in 2021?

Well, I think it’s going to be more of the same.

As I wrote in Burning Question #2 on Monday, I think January is going to be a very slow month, not only due to the provincial shutdown but also due to the lack of interest among many would-be buyers to get out there.

As of December 31st, 2020, there are currently 1,607 active condominium listings in C01 & C08, aka “downtown.”

More concerning, however, are the 5,608 active condominium listings in the same are for lease.

That’s not a typo, by the way. It’s 5,608. I would spell this phonetically if I had to, just to drive home the point.

By comparison, there are currently 500 active condominium listings in all of Mississauga, and only 787 for lease.

I’ll save you the obvious math here; the ratio of leases-to-sales in downtown Toronto is 3.49 compared to 1.57 in Mississauga.

This is not a phenomenon, but rather this explains why prices dropped in downtown Toronto last year, and in my opinion, it gives you an idea of what to expect moving forward.

We would be irresponsible to dismiss the relationship between the rental market and the resale housing market, and I think there’s a bit of a “chicken and egg” phenomenon here, since we could blame the surge in rental listings on the cool resale condo market, but we could also argue that the resale condo market has been hurt by the decline in rental prices.

Either way, if we’re going to monitor and try desperately to forecast a 2021 condominium resale market in the downtown core, we have to continuously check up on the rental market. With prices dropping, some owners will elect to sell, and other investors will hold off on buying until rents rise again. Personally, I think the smart long-term investors will choose now as the time to buy, seeing as they can get a 10-12% discount from February prices in certain buildings, and that depressed rents for 6-12 months don’t matter. But my personal opinion aside, I see a lot of would-be buyers on the sidelines due to the cold rental market.

I don’t have statistics for “active rental listings” as of December 31st for previous years, but I know it’s nowhere near 5,608! Let’s be sure to check back at the end of January and see how that figure has changed. I think that will tell us a lot about the health of the downtown condo market to start 2021, and we can probably draw an inference from there as how the year will continue…

–

5) Will “entry-level” homes continue to rise in value?

Well, define “entry-level homes,” first and foremost.

I have a habit of using this term in the way that I view “entry-level homes,” but many others out there have different definitions. A “home” in my mind is often used as a synonym for a “house.” So while a young man or woman moving out of Mom & Dad’s house might think of a 1-bed, 1-bath condo as their “entry-level home,” I consider that more of a “first,” or rather a starter-condo.

In my mind, “entry-level home” means entry-level house, and from there, we often draw that inference that every entry-level house is also an entry-level family house, whether it is in practice, or not.

But then just to take this one step further, how large must a family be in order to be considered a family?

I have clients who are a couple, with a dog, and no plans to extend beyond that. Are they a family?

So for the purpose of this question, let’s assume that “families” who are looking for entry-level homes, are simply looking for the cheapest freehold properties out there, cool?

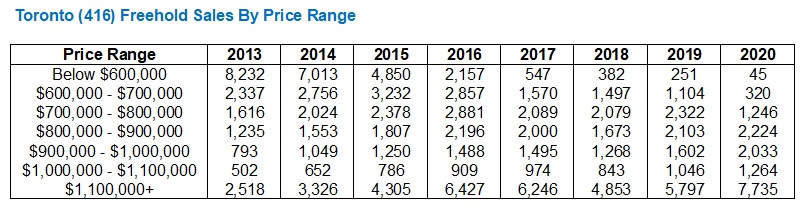

I have an idea here, and while incredibly time-consuming, I’m writing this on New Year’s Day and the kids are both asleep, so let me have at it! I want to break down all the 416 freehold sales by price range. Let’s look sub-$600,000, which isn’t a category today, but was seven or eight years ago, and we’ll go by $100,000 increments up over $1,100,000. Cool?

This took longer than I thought it would, but it’s awesome:

Yes, I realize how sad and frustrating this is for those of you who don’t own homes.

But hindsight is a you-know-what, and if you’re a would-be, 27-year-old home-buyer today, consider that you weren’t ready to buy a house at 19-years-old, so you can’t quite lament what prices were like back then.

Take the frustration and jealousy out of the equation (both very fair emotions, by the way), and you might find this, as I do – fascinating!

I started with the 2020 stats, and worked my way backward. So when I saw a mere 45 sales under $600,000 in 2020, and finished with a whopping 8,232 in 2013, my head just about exploded.

If you care to look at this on the flip-side, how about a mere 2,518 sales over $1,100,000 in 2013, compared to 7,735 in 2020?

I’m looking at my freehold sales under $1,000,000 from back in 2013:

$515,000 for a 3-bedroom semi at Dufferin & Davenport

$582,500 for a 3-bedroom semi at Bloor & Jane

$750,000 for a 2-bedroom Victorian at Yonge & Summerhill

$951,029 for a 4-bedroom semi in Playter Estates

$575,088 for a 2-bedroom semi in Leslieville

$640,000 for a 3-bedroom semi in Danforth Village

$466,000 for a detached bungalow at Coxwell & Danforth

I think you get the picture?

Again, I know this is painful for those who wish they had bought, or could have bought, but you’re essentially wishing you were older. Every time I watch an 80’s movie, I think I would have loved to have been a 20-something and experience that decade, but I am where I am today, and that’s that. So for young buyers, well, at least you have your youth! One day, you’ll be forty, like me, and you’ll be sitting on an ergonomic chair with an electric blanket to soothe your aching lower-back, but I digress…

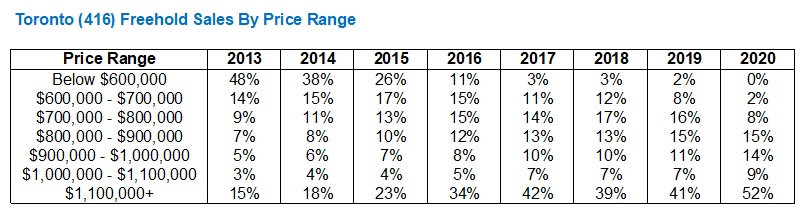

Another way of looking at the above information, and perhaps a better way, which I realized after my eyes began to tire, is to look at each of the figures above as a percentage of the market:

This reads much cleaner, doesn’t it?

Once again, the eyes sort of drift toward the start/finish or the lower/higher figures.

Just consider the sales below $600,000 again. We saw 48% of all freehold sales in the 416 fall below $600,000 in 2013, and that number has declined every year, down to 38% in 2014, 26% in 2015, a mere 11% in 2016, and after that, the sub-$600,000 freehold purchase became a unicorn! FYI – the 0% figure in 2020 is actually 0.3%, but we’re rounding down.

On the other end of the spectrum, we saw only 15% of all freehold sales in 2013 top $1,100,000, and that figure has risen to a whopping 52% as of 2020.

So if you’re an “entry-level freehold buyer” in 2021, what can you expect?

If the trend continues, perhaps we’ll see 60% of all sales in 2021 top $1,100,000, which means it will be that much more difficult for entry-level buyers.

Only 10% of all freehold sales in the 416 were available below $800,000 last year, so if you’re looking in that price point, you would be wise to consider other options. Perhaps you can live outside the core and commute if need be? Don’t shoot the messenger, I’m just saying…

–

6) Can interest rates really stay this low, for this long?

Absolutely, and what’s more, is that some people think they can go lower.

Just look at where we came from!

A short while ago, say, September for example, we were reading headlines like this:

“Canadian Mortgage Rates Are The Lowest In History; Can They Go Any Lower?”

That’s from the Financial Post on September 28th of last year, and indeed, we did see mortgage rates decline in the fall.

One thing I learned through my experiences last year is that a lot of people out there don’t understand the different types of rates that we throw around. The overnight lending rate, prime, posted mortgage rates, and actual mortgage rates are all very different numbers, and while I don’t’ want to turn this into a tutorial, I do want to briefly discuss.

For example, we saw the bank of Canada leave the overnight lending rate at 0.25% from March through the end of 2020, however, actual mortgage rates came down. Why? How is that possible? Well, mortgage rates are impacted by the bond market, not the BOC lending rate.

This is important to remember because a question like, “Can interest rates really stay this low, for this long?” will translate differently for different readers.

Some think, “interest rate,” and think Bank of Canada overnight lending rate.

Others think, “interest rate,” and think fixed-rate mortgage.

Then, of course, we throw the prime rate into the equation, just to confuse those readers who aren’t experts in this field.

Since the prime lending rate is based on the BOC’s overnight lending rate, many sources of information online use prime.

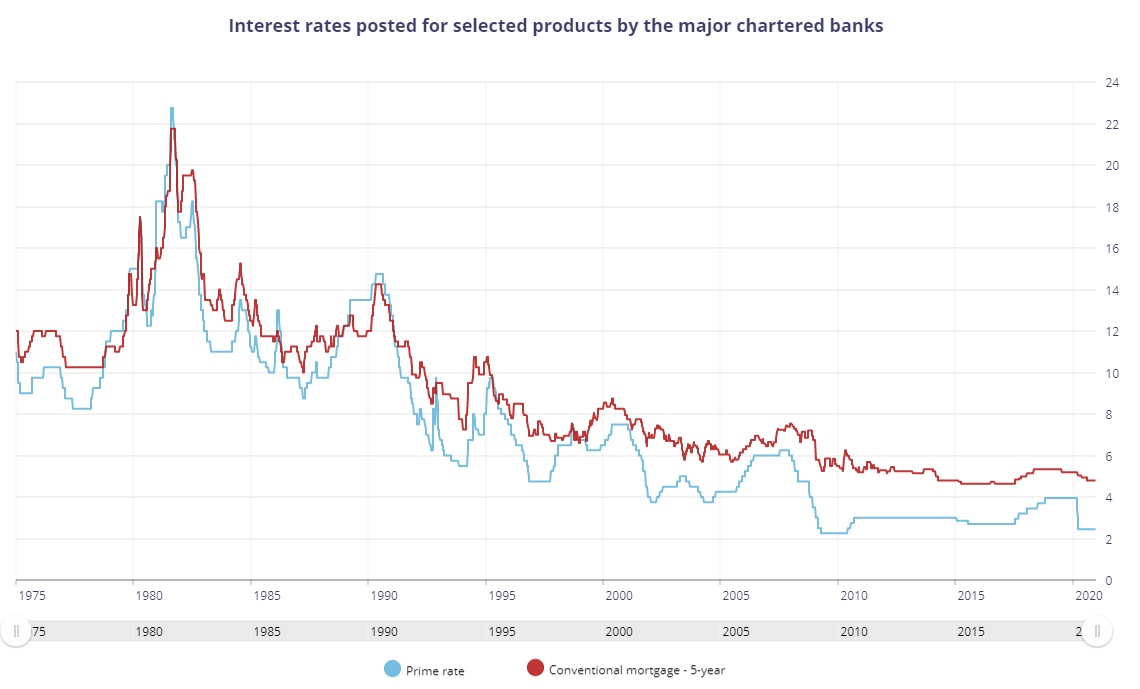

For example, if you want to gain some historical context and use the BOC’s online tool they chart prime rather than the overnight lending rate. So if we want to look at prime and conventional mortgage rates on a chart dating back to the 1970’s, we’ll see something like this:

I think no matter what type of rate you’re looking at, you’re likely to see a similar trend.

This is incredibly important for new(er) buyers in the market, since many are taking low interest rates for granted. Then again, the argument could be made that not enough people are taking advantage of these rates! Not to sound like a market cheerleader, but when you look at this chart and you see where rates were, and where they are now, shouldn’t you be buying anything and everything in sight?

To normalize or somehow standardize rates for this discussion, let’s assume that we’re always talking about the 5-year, fixed-rate mortgate, which is the most common rate that borrowers will take. Out there today, I would assume that 80% or more of borrowers are taking the fixed rate compared to the variable, and for borrowers that do take the fixed-rate, I would estimate that 90% or more are taking the 5-year rate.

Most of the banks are providing “posted rates” around 2% for their 5-year fixed rate terms:

BMO: 1.93%

TD: 1.94%

Scotia: 1.99%

CIBC: 2.10%

Royal: 2.17%

But their actual rates are likely to be closer to 1.69% for insured, and 1.79% for uninsured.

Again, the conversations around rates can be frustrating without knowing how the rates work and how banks advertise their rates. But the actual rates are always far lower than what’s posted.

Consider that the “Big Five” banks aren’t the only lenders out there, and you’ll come to realize just why rates are declining. After all, there are a lot of lenders out there, and only a finite number of borrowers. Some borrowers will never leave their “home bank,” and that’s a mistake. I firmly believe that the worst rate offered to you will be through your existing bank, since they already have your business, and don’t need to earn it. Other borrowers will only consider a rate from the “Big Five,” for example, they bank with BMO but they would consider a mortgage offered by TD Bank or Royal Bank if it were more competitive.

Others will consider a lower-tier bank, such as National Bank, Laurentian Bank, Equitable Bank, or HSBC.

But what about other lenders:

Have you heard of First National? They’re Canada’s largest non-bank lender of single-family residential mortgages, commercial mortgages and multi-family mortgages.

What about an independently owned mortgage services company like CMLS Financial, Canwise Financial, or MCAP?

What about the credit unions: Duca and Meridian, for example?

There’s no shortage of lenders out there, and many of them are offering rock-bottom rates.

I’ve heard through the grapevine, and I may have mentioned this late last year, that HSBC is trying to regain a foothold in the lending sphere, so they’re offering rates that are almost like loss-leaders. If they can get mortgage business, they can sell other products, or so the thinking goes. I heard about a 1.39%, 5-year, fixed-rate mortgage that sounded too good to be true, and while it was only offered for a short period of time last year, and was a stripped-down mortgage with no features (think: pre-payment, portability, etc), the rate was just obscene.

Imagine that? A rate of 1.39%?

Do you need to look at that chart again, or do you grasp the implications of 1.39%?

Never in the history of mankind have we seen rates this low, and that’s something I’ve said before many times, but the rates keep dropping.

Remember the first time you heard about a 2.99%, 5-year, fixed-rate mortgage?

I do.

It was March of 2014, and I wrote: “Ready, Set, Rate War!”

The banks were giving out 2.99% rates, albeit on stripped-down mortgages, for a short period of time. It was absolutely insane. It would be the equivalent of somebody offering a 0.79% rate today – that’s just how mind-boggling it was.

And today? Well, 2.99% is almost DOUBLE what most people expect to pay to the lenders.

So how in the world can we ask questions like, “Will rates go lower?”

Because for every time I’ve said, “I’ve never seen this before,” there was almost certainly a time shortly thereafter when I saw something even crazier…

–

That’s all for today, folks!

Check back on Friday for Burning Questions 6 through 10, as we take a further look at the mortgage market, then consider government policies and influence, and finally discuss the real estate industry and potential change afoot.

Appraiser

at 6:39 am

Official TRREB data is out for December:

Sales +64.5% – New All-Time Record of 7,180 transactions for December.

New Listings +66.1%

Average Price +11.2% – $932,222.

Annual data indicates that the average sale price for the full year of 2020 reached an all-time high of $929,699 (+13.5%), while total sales of 95,151, were ahead of last year by 8.4%.

J G

at 9:15 am

Toronto RE prices lagging – smaller cities like Windsor price is up 35%(!!) YoY for Dec 2020.

https://wecartech.com/wecfiles/stats_new/2020/dec/

Like I said before, if you don’t like stocks fine. But smaller markets like Ottawa and Windsor have clearly outperformed Toronto RE in the last 3 years %-wise.

Francesca

at 7:17 am

The desire to be older and have gotten into the real estate market sooner is an ongoing one I believe. I remember how my husband and I newly married in our early 30s wished we were a decade older at the time back in the mid 2000s to be able to buy a more expensive and larger first home. Now that we are in in our mid late 40s we look back and are grateful we could when we did seeing how expensive property is now. The only caveat is that interest rates were much higher then so on a smaller mortgage you might have been paying exactly monthly what you are paying now on a more expensive house. I think back then we had a 4.5 fixed five year rate and considered that good! I do believe the declining interest rates have definitely spurred the price increases we’ve witnessed in the last 15 years.

hoob

at 8:22 am

David needs to choose/learn to use Excel conditional formatting data bars in his percentage tables in order to add visual impact to his point!!

Karolina

at 2:59 pm

Hi David,

I also noticed a bit of an increased activity is sale of condos the past 1 week. Agreed this is too early to call but if anyone wants to get in to the condo market for investment purposes, NOW is a good time. You can do a long closing to get possession in the spring.

Spring is always a better time for finding a tenant. In general the nicer and summer weather puts humans in a better mood. Hopefully, by spring we will have relaxed the lockdown and this will give the investor a few good months before another lockdown will appear (not advocating for another lockdown but this gov’t seems to be eager to roll them out etc). During spring / summer will give you plenty of opportunity to get a tenant. If your building has many available leases and competition is fierce, you have to have the best price and a clean unit. No deficiencies or unpatched walls. It will lease. Reasonably price units in excellent conditions always do. I have been doing it for many years. Sure it may take longer but you are hopefully buying for many years so it will appreciate in value.

Pragma

at 3:02 pm

The BoC can peg the overnight rate but can’t control the rest of the curve, unless they resort to printing money and QE bond buying, which has lost a lot of credibility as a real stimulus tool. Every dynamic that has been pushing rates and inflation lower is now in full reverse. All that offshoring of production is in reverse. Cutting rates to allow society to re-leverage has hit a floor. The new tool for stimulus is fiscal policy as monetary policy has been quite a failure. Fiscal policy is inflationary. In this environment, the appetite to hold BoC bonds/treasuries, which yield nothing, which provide no risk free return, and which fail to act as a “buffer” for equity volatility, is and continues to fall. In 1 year, inflation will be higher and rates will be higher (maybe not the overnight rate). The rally across asset classes right now is a flight away from currency, which is a flight away from gov debt. The 60/40 portfolio makes no sense in this environment. So I will take your “over” on mortgage rates being lower in a year.

Thomas

at 5:37 pm

I took my original mortgage from a B lender. Spoke to TD and they are offering 1.35%. It is insured and variable. I will have to pay a penalty of about 3500 but the porting still works in my favor

Appraiser

at 1:56 pm

Interest rates are incredible, especially to this old soul after personally experiencing 18% six-month mortgages back in the day. Now you can get a ten-year for under 2%!

https://www.ratespy.com/compare-lowest-mortgage-rates

Money is as close to free as it gets, especially after accounting for inflation. Homeowners and investors that are renewing mortgages are just as happy as first-time buyers at present.

Jimbo

at 9:19 am

I wonder what a mortgage payment looks like when rates are 0%. Do the banks charge monthly service fees on the mortgage?