“Hello, my name is David, and I have an addition to Microsoft Excel.”

(Hi, David).

It’s partially that.

It’s partially finding something to do when I need to occupy my mind.

I sprained my ankle, again, and this time it was really, really unfair.

I’m working toward a half-marathon and while I know some of our regular readers are also regular marathoners, like, “R” who has completed many, I’ve had a rash of injuries to deal with since I started running in 2020.

I pulled my right groin in December of 2021 when I was, for some reason, sprinting to try to beat my 5K time. Dummy.

I sprained my right ankle in April of 2022 when I was working on my lawn. That’ll teach me to call Jiffy next time…

I hurt my right patellar tendon in January of 2023 when I was, of course, running.

Then I sprained my ankle on my family trip to the Dominican Republic in February; the same ankle that I busted in April of 2022.

That hurt. Physically and mentally.

But I was doing great up until last weekend. I was up to 12 KM runs, ready to move to 14KM, 16KM, and onward, and I was flying high with a run in the sun on Father’s Day.

I stopped for a red light at Merton & Mount Pleasant and lightly jogged on the spot as I always do. Then a lady pushing a stroller walked up and I moved one step to my right to allow her to pass, but I stepped off the sidewalk and onto the grass, which was about 4-6 inches lower.

My right ankle just buckled.

I fell over immediately, not in physical pain, but just with that realization that “it happened again.” I limped over to a bench on Merton Street and sat there for a while. I crossed the street to the Esso and asked, “Can I use your phone?” like it was 1988. I had to call my wife and get her to come pick me up.

Absolutely demoralizing.

Happy Father’s Day!

I sulked a lot. I tried to get some perspective and think about people with far, far worse ailments than a damn ankle, but sometimes you just can’t convince yourself to listen to your own common sense. Even if you try really, really hard!

Eventually, I went to my computer and opened an Excel document.

Blank.

Just cells.

And yet with so much potential.

I put on some music and just said, “FUCK IT,” and started to enter data into the cells.

I was still sulking. To be honest, I sulked for days.

To be more honest, I’m still sulking.

(It’s just your goddam ankle, dude)

But when I need to take my mind off something, I find it therapeutic to work. Maybe that’s sad or maybe that’s a blessing, but whether it’s playing around in Excel or writing something in Word or on TRB, it gives me a place to escape to.

I had this idea on the weekend that I wanted to look at the seasonal variation in the Toronto real estate market, specifically how things change as we leave the late spring and enter the summer.

There’s so much talk in offices about this “summer slowdown” that it seems we almost will it to happen.

“Do you think the market is gonna be slow?”

“You workin’ this summer?”

“Got anything coming onto the market next month?”

“Your team takin’ time off?”

It’s a bit of a chicken-and-egg phenomenon if you will. I think many buyers won’t be active because they think sellers won’t be either, but vice versa too. Why would a seller list in the summer if the buyers aren’t active? In the same way, the agents often tell themselves that it’s going to be slow, so they can slack off and/or “enjoy life,” as I’m told people do, but that just results in less activity among market participants.

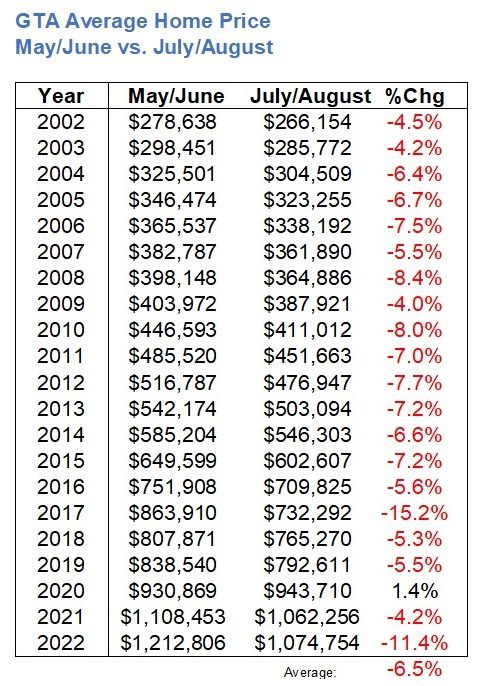

On Tuesday, we looked at how average home price retreats from May/June into July/August, as well as what happens in the same period with active listings and total sales in the GTA.

The conclusion we drew was that the average home price drops 6.5% from May/June to July/August, based on data from the past twenty-one years, and that new listings drops 34.4% on average, but has dropped about 43% in the past two years.

We talked about whether a buyer would rather purchase a house or condo in the spring market but pay slightly more money and have more to choose from, or, whether a buyer would rather have limited options in the summer but pay a slightly lower price.

I think the buyer pool will be split on this, but one thing is for certain: if you think you’re absolutely sure which way you’d lean, in this hypothetical situation, you have no idea how the process of home-buying in Toronto and the emotions involved can change all that.

I’ve had buyers on both sides of this.

A few of my buyers became very diligent once we passed the Victoria Day long weekend, realizing they have maybe 4-6 weeks left of the pre-summer market in order to find what they want.

On the flip side, I have two sets of buyers that have specifically targeted the summer. One couple were in the market in early-spring, didn’t have any luck, and have now decided to switch gears and wait for a “slower summer,” and the other buyer reached out about two weeks ago and said he always planned to buy in the summer “when things slow down.”

Things?

Do you mean prices?

Do you mean listings?

Or do you mean market activity and everything in between?

On Tuesday, I showed you how home prices have declined, on average, by 6.5% from May/June to July/August.

But that was the GTA overall.

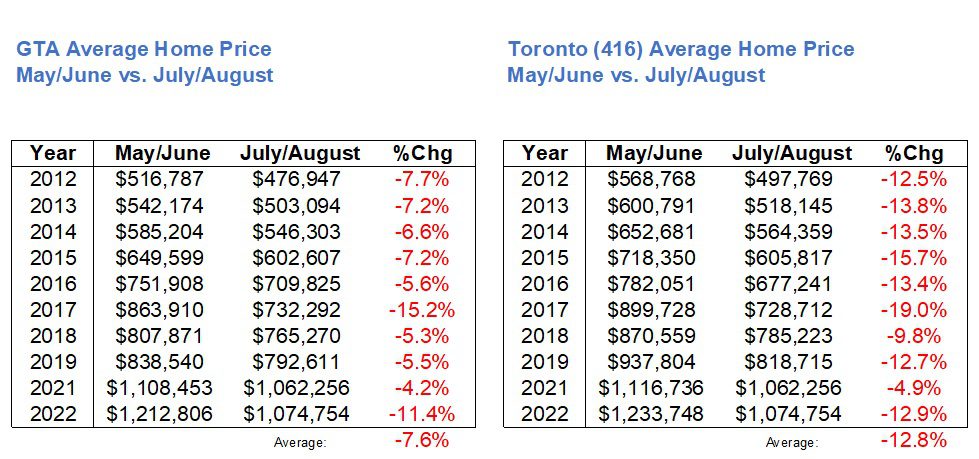

When I was inputting all this data over the weekend, I started to wonder: would the City of Toronto decline MORE or decline LESS than the overall GTA?

Now first, here was our chart for the GTA:

Unfortunately, the “district” data, specifically the breakdown between Toronto, York, Peel, Halton, and Durham, only started midway through 2011.

But let’s see what the City of Toronto data looks like in that timeframe:

Wow.

From a 6.5% average decline in the overall GTA to a whopping 10.7% average decline in the City of Toronto.

Now, to be fair, we’re comparing 2002 through 2022 for the GTA and 2012 through 2022 for the City of Toronto.

So let me re-run this data, and, I’ll remove the pandemic-affected year of 2020, which really makes no sense (especially considering the 416 apparently increased by 10.8%…) and we’ll compare:

Interesting!

Now the gap is even wider.

And, consider that the GTA average includes the 416, so if we only looked at the 905, perhaps that 7.6% decline would be more like 4%. Sorry folks, but TRREB divides the prices into districts (Toronto, Peel, York, etc), so I can’t show you 905 versus 416.

I mentioned at the onset that I want to look at the data by property type as well because I have a hypothesis:

I believe that a higher percentage of condos are sold in the summer, versus that of freehold.

Why is this important?

Because condos, on the whole, are cheaper!

So if you’re seeing fewer freehold sales and more condo sales, then the decline in “average home price” is based not entirely in prices and value, but rather the type of property selling.

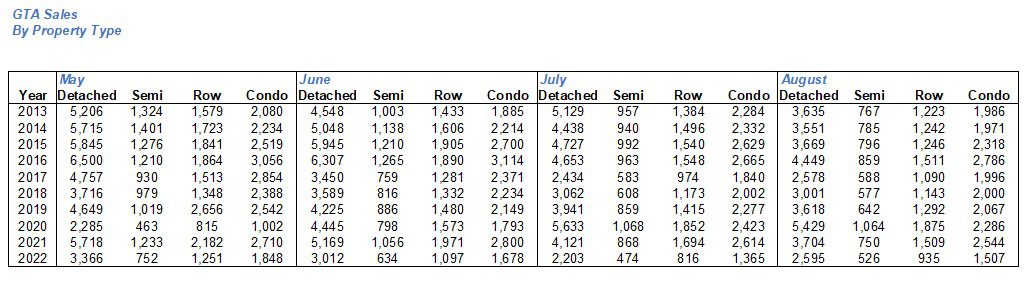

Fair warning: this is a lot of data!

And I don’t know that you’ll be able to read this on your iPhone versus desktop, but here goes:

Those are the sales in each segment (detached, semi-detached, rowhouse, condo) for the last ten years.

This data isn’t helpful on its own, and thus we need to convert this to percentages.

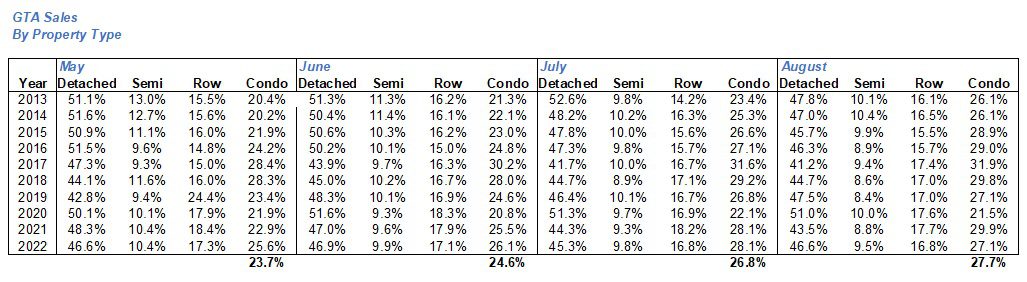

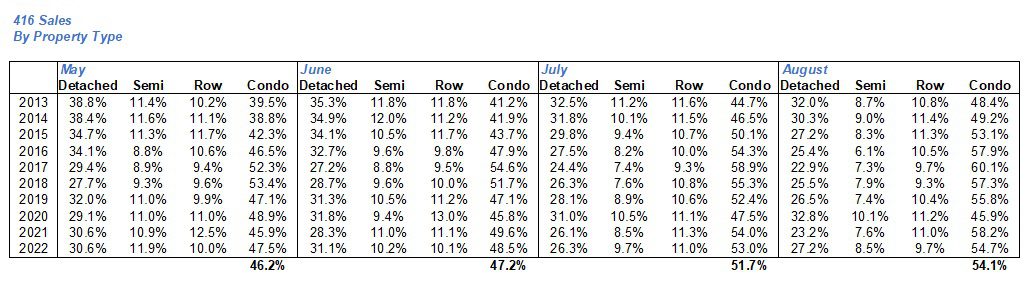

Doing so shows us a better picture of how the property types change by month:

This is exactly what I suspected!

In May, we see that an average of 23.7% of all sales are for condominiums.

That figure increases each month through the summer, up to 24.6% in June, then 26.8% in July, and finally 27.7% in August.

These might not seem like big jumps, ie. a 4.0% difference from May to August, but on a relative basis, among 5,000 – 10,000 sales, this can make a huge difference in where the average price lands!

4% more condos means 4% fewer freehold.

And when we look specifically at the 416, the data is even more telling:

I’ll skip the sales data chart and go right to the percentages here.

In the 416, the change is even larger!

Almost an 8% change in the percentage of condos being sold versus that of freehold.

Not only that, you can see that TRREB-wide, the number of condos as a percentage of freehold is about half that of the 416. So consider that when we see the 416 average home price decline, spring versus summer, at a higher rate than in the GTA, it’s in part because of just how many condos are being sold!

Last, but not least, I want to look at the “luxury” market.

Now, we won’t debate “luxury” today, but TRREB’s highest category is sales of $2,000,000 and higher, even though I don’t think $2,000,000 is “luxury” in Toronto.

Nevertheless, I have yet another hypothesis:

I believe that a lower percentage of luxury properties are sold in the summer, versus the late spring.

So, let’s look at the percentage of sales at $2,000,000 or more in May, June, July, and August over the last few years (I’m only going back eight years because before that, there were so few sales) and see if there’s a correlation:

Once again, the theory holds.

This isn’t a huge difference: 1% from May to August, but enough that, along with the higher percentage of condo sales in the summer, the average home price is going to be adversely affected.

What’s the take-away here?

There are a few.

Prices do decline in the summer, however, not nearly as much as the data shows. With a higher proportion of condo sales to freehold sales, and a lower proportion of luxury sales, the data is skewed.

We also learned that there’s far less available in the summer. Buyers will not have nearly as much choice as they would in the late spring and should expect at least 40% less inventory.

Lastly, we saw how prices in the 416 are more volatile in the summer months than the 905. Who knew there was more cyclicality in Toronto versus Durham, York, Halton, and Peel?

In the end, I don’t know that the last two days’ worth of stats and analysis is really going to sway buyers out there. If you’re the proverbial pregnant-couple, renting a one-bedroom condo, who needs a house by the Fall, you’re going to buy when you find the right property. But if you’re a condo investor, or a casual buyer who’s been looking off-and-on for some time, you might decide to target the summer months.

Here’s hoping for some sunshine this weekend!

Nobody

at 8:42 am

Why would the mix change? Think of who the buyers are.

Houses are primarily occupied by families and they care a great deal about school schedules and, especially, registration dates. So many buyers will have a need to be settled by the first day of school and/or be able to demonstrate their address before a certain date. With a common 90 day close, and allowing 2-4 weeks to execute minor repairs and a move, You’re looking at June 1 to May 1 as a key deadline. Then allow for some slip as people accept less buffer to move and for a shorter close process and you get closer to mid/late June as the hard deadline.

Then there’s summer vacations or even wholesale moves to cottages for the summer- highspeed internet and good cell coverage enables an incredible amount of work to be done from a dock in Muskoka/Georgian Bay/Kawarthas…

It LOOKS like small, single digit percentage changes in the market – but it’s a 25% drop in demand for “luxury” (ie. 3 vs 4) and a 17% increase for the share of condos (i.e. 54 vs 46). That’s a HUGE move in markets and explains both the fell of the market and the price changes.

Marina

at 2:03 pm

This is very true, especially the part about families with school-age children. Nobody in their right mind wants to move little Johnny a month into the school year.

Oddly, it can present a great seller opportunity. In my parents’ neighborhood (VERY family-centered), there are always a few houses that sell over summer for mad money (like 1-200K over normal) because most people have sold in the spring so no inventory, and there is always some poor schmuck who got a job move over summer and is scrambling.

Ace Goodheart

at 1:11 pm

I still say this whole situation is going to blow up if/when the Liberals lose the next Federal election.

Due to changes in regulations, mortgage amortizations can now be extended up to I believe 100 years, so that people’s monthly payments don’t increase.

However, these mortgages still have to be renewed at some point. When they are, the amortizations will renew at 25 year periods, with an interest rate of over 6%.

When you borrow money, you get an interest rate based on your credit worthiness (which is kind of counter productive – people like me can get a very low rate, because there is virtually no chance that we won’t pay the loan back – but we can afford a high rate. People with bad credit or less credit worthiness cannot get a low rate and must pay a very high interest rate, but they cannot afford a high rate).

If the Libs win, then they will figure out a way to help all of these underwater mortgage holders, and things will just carry on as they are with no one having to lose their house and everyone being fine, no matter whether they actually can afford the house or no.

But would a majority Conservative government do this? My thinking is, probably not. PP has made it clear he understands why houses cost so much, he blames it squarely on Federal policy decisions and he indicates he will not follow such decisions. I think he wants a price crash, even if it means a lot of road kill and over indebted mortgage holders get run over in the process.

As with every predictable event in finance, the above information is a major money maker if you know how to use it. In the weeks after a Conservative win, there will be incredible investment opportunities, for someone who understands what is about to happen.

Same goes for a Liberal majority win. You can actually predict six months’ of movement data on a range of investments, based on which Federal party wins an election (this is a gift, don’t underestimate how few times in your life this will actually happen).

The last major event like this was the 2008 US credit crisis, which provided over a year of predictable investment opportunities in Canada (I still have those RBC shares I bought for $24.00 per share, and I also have the Muskoka cottage that I got for $189,000.00).

Different David

at 1:59 pm

I agree Ace, a PP win in the next federal election will have huge opportunities for those people with liquid assets who are willing to take advantage of an opportunity, although I don’t see a Liberal win being a big change in the status quo. With JT winning, it will condemn Canada to be in a perpetual deficit position (like the USA) – are they ever going to pay off their trillions of dollars of debt?

In terms of the housing market, PP will want to be forever known as “the correctionist” who righted the real estate Titanic. His voter base, the rural non elitists, will lap that up as the Liberal/NDP elites with their millions of assets tied up in urban real estate take one on the chin.

Bank stocks will nosedive, and those with money to buy them on the cheap will see nice returns. Look out for deals on value stocks like railways, utilities, insurance companies who will be unfairly dragged down in the ensuing recession.

Ace Goodheart

at 8:50 pm

The thing that bugs me about what the Libs did with extending amortization periods up to 100 years, is they created a situation where our big 5 banks have a lot of “off the books” defaulted mortgages.

Normally, a bank would have to disclose to the regulator all mortgages in a state of active default (ie not being paid).

That reduces the value of the bank’s loan book and, with that, it’s cash reserves and share price.

But if the bank is directed to push out the amortization period, they end up with “off the books” defaulted mortgages.

When these mortgages come up for renewal, the borrower can’t pay on a 25 year term, so they all go into default at that point.

What this does is artificially increase the bank’s share price.

All five big banks in Canada are currently in this position.

It’s almost dishonest to do this.

These loans are in default. The govt just gave them impossible amortization periods to make bad debt look like good debt.

LaraK

at 1:59 pm

So what’s your recommendation for Libs winning, and what is it for Cons winning?

Seems you’ve done well – it would be cool to get your prediction now, and see how accurate you are this time around.

Ace Goodheart

at 3:43 pm

Well there will be buying opportunities in chartered Bank stock if the cons win.

You can expect the big 5 to take a significant hit in the 6 mth to a year period following a majority conservative govt being elected. The hit will be temporary. Buy the dip. They are going back up again.

Joel

at 3:50 pm

It is not going to depend on who is in power. With interest rates as high as they are the prices are going to come down. A large amount of people have more debt than they can manage and we are going to see more inventory or arrears.

Car arrears are already up and homes will follow. The drastic change in interest rates is going to slow down the market and reduce prices.

Ace Goodheart

at 4:34 pm

Very true.

However, what has recently happened is the Feds, championed by Minister of Finance (and former journalist, with no financial training) Freeland, has directed the banks to push out people’s amortization periods, rather than putting them into default, when they cannot make their monthly payments.

So for someone with a 25 year mortgage, with a variable rate, instead of pushing that borrower into default, the bank just pushes out the amortization period, as far as necessary, so that the person’s monthly payments do not change.

This will work until the mortgage comes up for renewal, and then the fireworks start.

Firstly, less was paid off than anticipated, because the amortization period was lengthened. So they have a bigger debt on renewal than they expected to have.

Secondly, renewal must be at a 25 year term. And the interest rate at renewal will be close to 7%, for a person who used to have an interest rate that often was less than 2% (they were giving out variables at 1.7% at the height of the housing frenzy back in 2021).

These renewals will all happen in late 2025, early 2026. Which is the exact same time that Trudeau will either be coasting to a majority government, or coasting to the airport to go golfing on one of his billionaire friends’ islands, having lost the election.

If Trudeau wins, he is going to figure out a way to keep these people in their houses.

If he loses, there is no way, on this earth, that PP is going to do the same. Those people are going to lose their homes, go bankrupt, face foreclosure and power of sale. It is over for them.

I guess they better get out and vote!

Different David

at 6:04 pm

Don’t forget that during 2021 and 2022, people were HELOC’ing their way to oblivion. Boats, trips, cars, renovations, investment properties…it was a free-for-all, guaranteed by the all-mighty 20% YoY growth in property values coupled with miniscule interest rates. I actually remember fixed rates in the 1.49% range (from non big 5 banks trying to break in), and variable sub 1%.

I can’t imagine my mortgage coming up for renewal and owing more than I did 5 years ago. But this will be the sad reality for some.

Derek

at 2:41 pm

More condos and less $2M++ properties sell (relatively) in the summer compared to the spring, skewing the Avg price lower. So, if the conclusion is that the remaining detached and semi-detached (under $2M) home prices aren’t dropping “nearly as much as the data shows”, then what does the data show for the price change in such detached and semi-detached homes from spring to summer?

QuietBard

at 8:12 pm

I think to cement your hypothesis it might have been fun to find the average selling price per property type and see how those numbers changed throughout the summer. Other than that great read with the stats.

Also, not to sound patronizing, but have you considered strengthening the muscles in and around your ankle? Strength has been correlated to reduce the risk of injury by various studies. While I don’t have experience with ankle injuries (lower back and shoulder for me) I have found the above to be true. There are tons of great resources on youtube that explain the science of injury and what exercises you can to do help. Just some food for thought.

David Fleming

at 10:35 am

@ QuietBard

I’ve been doing physio and exercises since April of 2022 after the first of three sprains.

I know this is going to sound cliche, but these accidents are always freak things.

April of 2022: I’m gardening and I hop over my hedge, my ankle lands in an indentation in the lawn, and it shifts. But the “hop” means my entire body weight is on the right ankle and it’s game over.

February of 2023: I’m playing golf in Punta Cana and after I hit my tee shot, I step towards the golf cart and I step into a hidden sprinklerhead hole. Game over.

June of 2023: I’m running in the beautiful sunshine on Father’s Day. I move out of the way for a woman pushing a stroller and I step off the pavement and onto the grass. Wasn’t as bad as the first two, but enough to knock me out for two weeks.

All three were flukes. Could I have been more careful? I mean, wrap me in bubble-wrap and maybe…

QuietBard

at 11:42 am

Hmmm I guess you don’t have a bad ankle. You just have bad luck…

While I don’t have a first hand experience with physio therapists I have family and friends who have used them and their experiences leave me underwhelmed with PTs. Not saying they are bad or that yours is incompetent. It just seems they dont have the resources to give their clients 100% attention (unless your a professional athlete). I think people fall into the trap of thinking they are “doing enough” when they are just following a set of, sometimes mindlessly, instructions. Can you tell me in all 3 instances what muscle was injured? (my ankle hurts doesnt count). Can you tell me if there was some kind of tear or were muscles just pulled? Can you tell me what muscles in your foot and up your leg into your hip help stabilize your body while walking, running and trying to recover from a trip up. Sometimes the problem may not even be in your foot but in other parts of your body. Could be muscle imbalances, lack of flexibility, postural issues etc. My point is that while I do agree sometimes its just a freak accident, are you at a level where you understand how your body is reacting to different situations so you can atleast try to avoid a potential injury. I’ve pulled my back constantly over lifting heavy (and not heavy) things 1) with poor form or 2) just being an idiot and not paying attention. Do i still hurt my back, yes. But is it way less often, also yes. Last point, learning all this stuff takes time. Took me years to get my lower back pain under control. I still havent figured out the shoulder stuff yet, but Im hopeful with time I will. Sometimes you just have to trust the process. Just make sure its the right process.

David Fleming

at 4:27 pm

I move too quickly, that’s for sure.

I’m impulsive. I can often be careless. I can be manic.

My occupation and the surrounding environment has shaped my lifestyle and the result is often doing things way too quickly or carelessly. Those “little things” matter. Like picking up your wallet at Tim Horton’s in a haphazard manner that throws out your back two weeks before Christmas…

I’m going to get religious about these ankle-strengthening exercises. I spent some time watching videos and reading up today.

Morning coffee + Globe & Mail + ankle exercises… 🙂

QuietBard

at 8:14 pm

Good luck and godspeed

Looking Up

at 10:47 am

Great article thanks!!

It’s nice to see actual data to confirm the seasonal summer slowdown belief.