“Try not to be political.”

That’s what I tell myself every time I sit down to write a blog post like this, but how can I not?

Politics can divide people and that’s never my intent here on Toronto Realty Blog. But I can’t stand the way this country is being run from a financial standpoint, so I can’t help myself.

I don’t understand.

It’s like “The Emporer’s New Clothes.” It’s like I’m watching this con job in 4K HD, right in front of me, and I’m the only one questioning it.

Except, I’m not the only one. In fact, criticism is increasing every day.

But it’s the people that have blinders on, or choose to remain willfully ignorant, that I don’t understand.

I mean, the ideas and the actions are just insane.

The government is going to “make groceries more affordable” by giving out cheques. That’s it. They’ll solve inflation and high prices by giving out $234 cheques to single people, $467 cheques to families, and this will only cost $2.5 Billion.

It seems like we need to spend our way out of declining economic prosperity?

This government doesn’t seem to understand supply-and-demand, and/or market forces, otherwise, they wouldn’t be providing subsidies that simply contribute to inflation.

But does any of this matter?

Who cares about economics when there are cheques to sign?

Sidebar, here’s a great article on that front:

“The Liberal Fixation On Addressing Complex Problems With $500 Cheques”

The National Post

March 29th, 2023

In any event, when looking over the federal budget, or the federal government’s planned expenditures, or while just simply laying back and thinking about how this government operates, it always gets me thinking:

How is this government going to pay for all of this?

No matter. That’s what deficits are for.

More importantly, that’s what new taxes are for!

But at some point, when this government realizes that their efforts to “increase affordability” are having the opposite effect, and when they realize that they can’t really invent any new taxes, they’re going to start to get very creative.

Especially when it comes to “affordable housing.”

Now, the government is unlikely to actually build affordable housing. I think we all know this. The public sector can’t and simply will not handle this.

But what if they could somehow magically make housing more affordable in the private sector?

Hmm. That’s a thinker!

After all, the private sector is, theoretically, private. Rents should be set as the participants of that market see fit, save for some regulations such as rent control of properties built before 2018.

But a friend of mine had an idea!

It’s an idea that, as you can assume from the title of today’s blog, I have always thought was an inevitability in our province and an idea that I might be introducing to you for the first time.

My friend, believe it or not, is on the other side of the political, economic, and socio-economic spectrum than I am.

So it should come as no surprise that, a few weeks ago, he sent me an article about a novel way in which rent increases are being determined in some areas of The Netherlands.

After explaining the idea to me, he signed off his email by saying:

“In a society with a capitalist economy that is designed to benefit the wealthy and is inherently winner-take-all…it kind of makes sense. Homes are for living, not for making money!”

I mean, the winner doesn’t take “all,” since we have tax brackets as high as 54%, but I understand what he’s saying.

Who says I can’t be friends with people whose opinions I don’t share, right?

All this is to say that, for years, I have mused that we are one small step away from the government tying allowable rents or rent increases to incomes, and when that happens, the entire system is going to collapse.

Remember: there’s a difference between public and private sectors, markets, entities, corporations, responsibilities, et al.

There are folks out there who spraypaint “build affordable housing” on Development Application signs, for properties being built by the private sector, as though it’s the job of the private sector to build affordable housing instead.

So is it the job of the government to regulate what the private sector, whether it’s a REIT or a single man named John J. Canadian, may charge in market rent?

Here’s a news release from a law firm in the Netherlands:

New legislation on housing in the Netherlands

In 2022 the Dutch government introduced several new regulations intended to stimulate the availability of affordable housing and to limit increases in rent levels in the residential market. This alert contains a summary of the most important regulations.

BUY-TO-LET RESTRICTIONS

In an attempt to discourage investors from buying up owner-occupied homes in areas with a scarcity of affordable housing, the Dutch government on 1 January 2022 effected legislation allowing municipalities to ban the letting out of formerly owner-occupied homes.[1]

Several municipalities have done so. The city of Amsterdam introduced a ban on the letting out of formerly owner-occupied homes with a listed value of up to EUR 512,000, representing approximately 60% of owner-occupied homes in Amsterdam. Buyers of owner-occupied homes in The Hague and certain areas of Rotterdam with a listed value of less than EUR 355,000 are also banned from letting out their properties. The same is true for homes in Utrecht, with a listed value of less than EUR 487,000.

LIMITATIONS ON RENTAL INCREASES

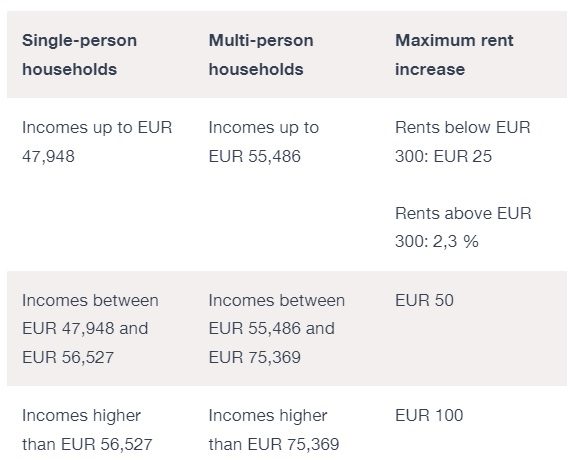

In the regulated housing sector, with initial rents of up to EUR 763, a Covid-era freeze on rent levels was replaced with a system of income-dependent rental increases:[2]

Other newly introduced legislation limits the role of the listed value of homes in the regulated sector, in the calculation of the permitted initial rent. The points awarded to the listed value are now maximized at 33% of the total.[3]

As a first, new legislation also introduces temporary rent-hike restrictions in the previously unregulated housing market of leases with an initial rent of more than EUR 763. From 1 January 2022 until May 2024 annual rent increases in this sector are limited to inflation plus 1%-point.[4] An evaluation and decision on a possible extension of this restriction is expected before the end of 2024.

This government is banning the leasing of formerly owner-occupied homes.

What effect does that have on the market?

How does this play out?

For one thing, it crushes the rental market. If you’re not allowed to rent out a house that was formerly owner-occupied, then if you move out, you either keep it empty, or you sell it. Neither option helps the rental market.

Is there a “vacant home tax” here? If not, then this ban will encourage people to keep properties empty, in an appreciating market, rather than sell them.

And if somebody does move out of an owner-occupied house and does decide to sell, then again, that’s not creating a unit of rental housing.

Was the goal here to add to the rental housing stock or to the resale housing stock?

The next section is the meat-and-potatoes, however. This is where we see the tying of rent to income.

Whether it’s the rent or the rent increases need not matter. The point is that we have finally made a distinction between one tenant and another tenant based on how much money they make.

This is a slippery slope. This could be a point-of-no-return.

How do you undo this legislation down the line? How do you stop the momentum created here? How does this not escalate as more and more people seek to benefit from the idea?

And while I know I’ll have my dissenters here, I have to ask: how does this motivate a person to increase their income?

I know a lot of people disagree with my thinking here, but I’ve long maintained that if you paid somebody $30,000 per year in guaranteed income, they would be extremely unlikely to seek a job that pays $35,000 per year. What would be the point?

And if people don’t work, then they don’t create. They don’t contribute. They don’t add to the economic output of society and the collective prosperity declines on the whole.

If we start tying rents to income, then it disincentivizes people from doing better.

I told a friend of mine that I had planned this blog post for today and he said, “It’s a bit of a strawman argument,” which is to suggest I’m arguing against a point that nobody made, ie. that we should tie rents to income here in Toronto.

But this point will be made eventually. It’s only a matter of time.

Something must give in our real estate market. We can’t continue at this pace.

The population of the country is expanding at record levels and there’s nowhere to house these people.

And as expensive as Toronto is, people aren’t leaving! It’s become a right to live here, not a privilege. And when people can’t afford to live where they want, they look to the government for solutions.

The government, no matter which party is in charge, is never going to stand up and say, “Maybe some of you folks just have to accept that you can’t afford what you want.”

Meanwhile, more people demand to live in the city, and the ratio of participants in the rental market to the number of available units continues to spiral out of control.

This was a problem five years ago. It was a problem two years ago. It’s a problem now.

And a year, two years, or five years down the line, it’s going to be catastrophic.

So, short of traveling back in time and doing things differently, what could the decision-makers do?

Get creative, as they always do. And perhaps look elsewhere for an original idea.

That is why I think there’s a non-zero chance that we could see rents tied to income at some point in the near future, as is the case in the Netherlands per the article you just read above.

A “progressive” idea is all that we need.

But trust me, please, when I suggest that “fixing” a problem in this method will simply create a much larger one, which is something we’ve grown so accustomed to over the last decade when new policies are rushed out.

Just look at the problems in the Netherlands’ example above. Look at the unintended consequences resulting from banning the leasing of formerly owner-occupied homes.

Tying rent increases to incomes here in Toronto would force landlords to exit the market in droves and that would simply shrink the rental pool. What good does that do?

With all due respect to my friend who emailed me that article from the Netherlands, and others like him who feel that this is a step toward prosperity for all, I think your good intentions are getting in the way of your critical thinking.

April 28th, 2023.

If you’re Googling this topic years from now when it actually becomes a thing, remember that it was written here first…

Marina

at 7:09 am

Hi David. I’m in the same boat as you, in that my best friend is so far left she’s practically hanging off the side. I’m left too, but some far left ideas leave me a little queasy. Especially since I grew up under communism and trust me, it would not go well. You think a government is corrupt and inept? Wait til it owns everything.

The one part I do have to challenge you on is Universal Basic Income. UBI is universal, meaning everyone gets a check. So in your example, plenty of people will take the $35K job because it would not take away from the 30K basic income. I.e, they would get $75K total.

That said, it still doesn’t solve the issue of inflation. But as more jobs get automated, we’ll have to come to some kind of reckoning.

Libertarian

at 9:36 am

I’ve started to come around on UBI as well. I agree with you about everyone gets $30K and then gets a job. But the only way I would accept it is to shut down all the government programs that we currently have to combat poverty. Nobody can ask the gov’t for more. There can’t be any programs/benefits/tax credits, etc. I realize this would eliminate a lot of gov’t jobs, but that would be offset by lower gov’t spending. Heck, it would even simplify CRA and doing tax returns. (That reminds me, I have to do my taxes this weekend, even though they’re on strike! It bothers me to no end when government employees complain that they are hard done by.)

Island Home Owner

at 10:31 am

Have you had a single raise in the last 25 months? If so, you’re doing better than those government workers on strike!

And the idea that having Canadas biggest employer pay their employees raises less than inflation is good for the economy … I thought strong middle-class consumer demand was the key to a strong economy? Don’t know how you can have that if rank and file of Canada’s largest employer are seeing their real wages cut every month they don’t get a fair raise.

cyber

at 11:39 am

Government of Canada is trying to compat inflation, and as biggest employer it’s actually their responsibility to limit wage growth and not directly contribute to “wage price spiral” (look it up!).

I’d also ask government employees who “haven’t gotten a raise in the last 25 months”:

(1) When’s the last time you were worried about your job because employer was cutting 20% of staff to save costs? And if you were not cut, had to absorb the extra work and work longer hours?

(2) How does the combination of your current salary and benefits, including pension, compare to a similarly-qualified private sector employee (who is actually paying for this)? If you lost your cushy government job, how much are your skills worth on the market – or alternatively, how much harded would you have to work to get the same comp in the private sector?

It used to be that private sector jobs paid less, but were more secure with better benefits and lifestyle. We’ve been past the point of public sector having HIGHER cash compensation AND better benefits, job security and lifestyle for some time now…

RPG

at 8:14 am

This is never going to happen.

If it did, the government would find a way to screw it up anyhoo.

Paul

at 8:30 am

I think it’s worth noting that a move to tie rents to income would be more about furthering political aspirations through virtue signalling and optics than about improving the rental market for those who actually require assistance. Our current political landscape knows no bounds when it comes to furthering their aspirations.

Kyle

at 9:15 am

Landlords will either stop renting and the remaining ones will only select tenants with the highest incomes and highest potential to grow their incomes. How does this make things more affordable?

cyber

at 11:43 am

Landlords choose to sell properties because the business is not as good. With more homes on the market and only prospective owners competing for them, price is more affordable and more renters turn into owner-occupiers.

Yes, it would be harder to be a renter. But also fewer people would need to be renters – or there goes the theory of supply and demand, as landlords are no longer competing as much with owners in the resale home market.

Kyle

at 9:37 am

I guess if their definition of affordability only looks at ownership affordability as oppose to overall housing affordability. On a net it doesn’t help, it just advantages one segment (prospective buyers) at the expense of another segment (renters). I’d also argue that any benefit to prospective owners will be fleeting in nature, once all the ex-rentals are bought up and they reach a new equilibrium, then they’re back to where they were. I’d also argue that many rentals are going to be expensive or impractical to convert to owned housing, which further negates the intended benefit.

JL

at 10:07 am

“Something must give in our real estate market”

I made this point a few times here too; at this pace something will break, its just a case of knowing what will crack first (depending on how the economy is steered by BoC and Gov), and at what point.

When I saw the title, I thought the tilt would be towards the growing divergence between rent and income. I’m not a fan of tying rent to income literally through directive as proposed here, but in a functioning market it really ‘should’ already be tied organically. People come here to live and work. If they get paid the same, but continue to pay more for rent, they’re worse off and liable to move. This all takes time to play out and will never be absolute, but how high can it really go before it breaks the local economy? imagine an absurd case in which rent at some point reaches 100% of average income – who would choose to live and work here and why?

TLTR; rent is, or should already be, tied to income naturally. Even in a broken distorted market, at some point that factor will come into play to balance the market, but given where we are today, likely by breaking it rather than smoothly balancing supply/demand as intended.

Erin

at 10:11 pm

I mean average income in Toronto is $39,000 before tax, (31495.39 after taxes). Average rent for a 1 bedroom is $2513(x12=$30,156.00) leaving a average single person with $111.62/MTH for all other necessities eg. Food, transportation etc. We are almost to the point where rent does cost 100% of income.

Bryan

at 1:54 pm

This brings up a very interesting distinction. The average income you cite is not the average income of Torontonians, rather the average pay for a job in Toronto. The average household income for Toronto is about $90k before tax (average # of people working in a household is something like 1.4). All that to say that the average person working in Toronto is significantly poorer than the average person living in Toronto…. which is why the suburbs are growing so fast.

lr

at 10:42 am

Rather than creating creative ways to give people more why cant people just learn to live with less or within their means? I feel the government is creating a society of spoiled kids and disfunction. How will our society look like in 20 years full of spoiled, entitled adults? Maybe I should start investing in psychopharmacology psychology stocks

Ace Goodheart

at 2:24 pm

Any socialist housing system is very difficult to get into. This is the norm for socialism. If you get a house, somehow, some way, in a socialist country, you stay put and never move again (because you can’t, really).

Canada seems to be headed more and more in that direction. Look at, for example, the situation of a person who has never owned real estate, trying to get into the market.

You have the stress test. Have to get past that one. Then you have the real political favoritism given to people who already own houses. You can extend your amortization period to 95 years and beyond, but ONLY if you already have a mortgage. Qualifying for the first time? It’s 25 years max and you better be able to make that stress test, or no money for you!

Socialism tends to build a wall around the existing status quo. You see this with unions and their insistence on promotion based on seniority rather than merit.

Socialist countries usually have large, angry groups of disenfranchised young people who cannot, no matter what they do, break into the existing system. Canada is quickly cultivating a group like this, young folks who will never own real estate.

I guess at the point that we put up a wall for people in terms of rental housing, that is the point we start to shift to full socialism and when our young people become fully disenchanted with the socialist system. Want an apartment? You have to already have one (and your rent is geared to your income). Anyone who wants a fresh lease has to pay an astronomical sum for an apartment, probably in a bidding war, and then pay more per month than the existing tenants in the building, by exponential amounts .

I guess the only thing we don’t have yet (but we will) is long wait lists for vehicles. You can still purchase a car off the lot (but only a gasoline engine car, and they are banning them completely in 2030). Want an electric one? The wait list is more than a year long, and you have to have a lot of cash (try to get financing for an electric car and see what happens).

Canada no longer has a “middle ground” when it comes to politics. On one side, we have the Trudeau socialists (not really Liberals anymore, so I don’t call them that). They want a planned economy, a social credit system as opposed to capitalism, a public private partnership with large, multinational corporations owning everything, and people “owning nothing and being happy” as per the WEF slogan (“by 2030, you will own nothing and be happy”). Corporate socialism with a heavy focus on green energy multinationals, pharmaceutical companies and WEF related companies. Social credit is the thing. You will need your “carbon offset card” to “purchase” things with your monthly allotment of credits.

And if you don’t want that…..

Then we have the ultra rights. The conspiracy theorists. The convoy folks. Led by Pierre, the master of complaining about everything, while having no plan other than “tear it all down”. US style, Trump-esque politics, ultra far right. Plug your nose and just keep telling yourself “I hate him, but he’s not Trudeau, so this is all we can do…..”

Trudeau is a far left socialist. Pierre is a conspiracy theorist nut job. And in the middle, the party of everyone, the center-ists, the folks who can bring Canada back to a functioning, middle of the road political environment we have….

No one.

Toad

at 12:05 am

It’s maddening when people get stuck in their own line of thinking and therefore never see any other possibilities. David is no exception. Even though you’re supposed to rail against any suggestion of rent control and government interference because you’re a free market guy, you can stop and think about the alternatives to your narrative and not have to toe the line with comments like:

If you’re not allowed to rent out a house that was formerly owner-occupied, then if you move out, you either keep it empty, or you sell it. Neither option helps the rental market.

Not that I agree with the legislation, but the whole point is to stop mom and pops (and bigger companies too) from buying houses to rent them out. Stopping that would help the rental market. Hogwash, you say because there’s less rentals available. But if that mom and pop or company doesn’t buy that house, someone looking for a home to live in does. Which takes them out of the rental pool which, as supply and demand dictates, lowers rent prices. So then the debate becomes, which process wins out? Sure, let’s debate that but to not even acknowledge that possibility while stating the free market position like it’s fact is disingenuous.

Also, I would like folks to drill into their head commentor Marinas first post about UBI. David saying that it wouldn’t work because it disincentivizes people from working is just false. Just misinformation (probably not on purpose) that again is driven by the right leaning political line of thinking. Towing that line. But sadly, even though Marina is correct, it won’t dissuade David from posting something a few months from now saying the exact same thing.

For the point of tying rent to income and being a slippery slope and how does it motivate someone to make more money. As you mentioned, your marginal tax rate goes up the more you make, so we already have that. Did David sell one or two less houses last year because he’s probably in the 53% tax bracket? Probably not. You can think it sucks to hand that much of an extra dollar earned over to anyone, but to argue that people won’t work to make more money due to an associated rise in cost (taxes or increased rent) doesn’t prove out. If I call David in December to get him to sell my house for me, I can guarantee he’s not saying no because his taxes are too high (yes, I know he can probably defer taxes in the corporation, but my point remains).

Anyhow, I’m not far left or far right but people just get stuck in their thinking and no matter what is said or proved out, their beliefs remain the same. So why am I even posting all this? Good question. I’m just shouting into the ether knowing that it won’t do a damn. Such is life.

JL

at 9:32 am

If it makes you feel better, I appreciate knowing that there are other people out there that think logically and take a reasoned and rational approach to these issues.

It’s just too bad, as Ace points out above you, how no one on the political spectrum seems to want to take that center lane.

Derek

at 4:18 pm

Good post

Vancouver Keith

at 1:21 am

I hate to break it to all the free market people, but UBI originally came from right wing politicians, the most notable advocate in Canada was Hugh Segal, long time federal Conservative mover and shaker going back fifty years or more.

UBI is based on the idea that you get rid of as many forms of welfare as possible, which amount to a patchwork quilt of half baked ideas and public funded assistance which are small scale, inadequate and inefficient. No more EI (a huge amount of payroll tax), no more welfare, no more subsidized job creation schemes. Replace them all with a simple monthly payment which is then spent by the recipient in the manner they choose. Eliminate the bureaucracy and put the savings into cash for people.

For the recipients of UBI, they have complete freedom of choice what to do with the money they receive. No food stamps, no lining up for coupon for a pair of shoes, no report cards of jobs applied for. They get the benefit, and spend it as they see fit. No government telling them what to do.

As for housing affordability, it began to die thirty years ago when the government stopped building over 20,000 units of non market housing per year back in the nineties. Coupled with literally dozens of programs that increased liquidity in the property market, a massive secular decline in interest rates, and a vast and unmeasurable increase in aggregate investor demand for Canadian real estate, we now have land prices in our major cities that completely preclude the private sector building affordable rental housing for people with a five figure income. That ship has sailed.

In Vancouver, we are facing the prospect of affordable fifty year old low rise apartment buildings being torn down, with one bedrooms renting for as little as $1200 per month to be replaced with new much higher density, and much smaller apartments. The government demanded that displaced tenants be guaranteed their existing rents in the new buildings. The landlord’s association said you’re dreaming in technicolour. The new units will rent for 20 percent below the average market rate, so another group of working people will be displaced from the city. A big win for YIMBY’s, but a big loss for real people.

There are a few jurisdictions that have created affordable housing primarily using the private sector. They don’t have the land prices of major Canadian cities. Dozens of cities in the world have 30 – 60 percent of the housing stock in public hands, and have affordable rent based on income. I note with amusement the dividing line in the example cited of rents below or above 300 euros, which is about $470 Canadian at the current exchange rate. You can’t get a room with a shared bathroom in a shared property for $500 in Toronto or Vancouver.

This is how out of whack the income of Canadian is with the real cost of living. Before the pandemic, a local architect and developer pointed out that with free land, a one bedroom apartment at current building costs would rent in the private market for $1500 in Vancouver. You cannot zone enough density, to get the land cost low enough to build affordable rental housing in the private sector for over half the population. Incomes aren’t high enough.

As for it being a privilege to live in Toronto, it used to be a reality for real working people to afford a house in major Canadian cities on a single working income. The reason we can’t afford any property at all is that working incomes got stiffed for decades so that a few people could become superwealthy instead of ordinarily rich. Not a great deal for building community and society.

As for dealing with the current reality, the failed policy direction seems to be entrenched. Immigration, in the face of failing infrastructure and lack of housing is being increased. The overpriced housing market, due to a tidal wave of liquidity for decades, has just been handed yet another first time home buyers savings plan, which will largely be funded by wealthy parents for the few children who might hope to buy real estate. Adding even more liquidity to the market will make it less, rather than more affordable. There is no real political will, for real solutions to affordability.

JL

at 9:28 am

“You cannot zone enough density, to get the land cost low enough to build affordable rental housing in the private sector for over half the population. Incomes aren’t high enough. ”

This. The consequence of the ongoing divergence between income and housing pricing.

Appraiser

at 4:57 am

“Ottawa posts $3.1 billion surplus for first 11 months of 2022-23 fiscal year”

https://financialpost.com/news/economy/ottawa-billion-surplus-2022-23-fiscal-year

Appraiser

at 10:19 am

Yeah, but giving lower income workers a few bucks for groceries is going to bankrupt the nation don’t you know.

Oh, and your children & grandchildren will be paying the price for generations to come for such unseemly government largesse.

Or something like that.

Dan

at 1:47 pm

the point here seems to be hey Ive managed to afford a one bedroom in Toronto but the rest of you stop coming over here cause you are driving the prices up. sure tell a teacher in Toronto if he cannot afford a place to rent he has to accept it and leave the city. Great point. Your next rant will be about how pissed you are about the lack of teachers in the city and there is noone left to teach your kids. What an effing joke. Especially the piece about not having room to house more people. Look around how much undeveloped land is out there. Jc

Toad

at 2:43 pm

This.

David wants his morning double double, but for the minimum wage Tim Horton’s workers, it’s a privelege to live here and not a right? Tell that to them next time you pay for your coffee. Sure, no one is entitled to live in Rosedale, but you need folks from all walks of life to live in Toronto. It’s a requirement if we want to keep capitalism humming along. How else can we exploit if they don’t live close?

It’s not an individual right to live here, but it’s a societal requirement.

Ace Goodheart

at 4:13 pm

So Toronto has…..wait for it…exactly 2100 vacant homes.

Most of which are apparently builder – owned new cons not yet sold but on the market.

That 2100 figure will of course drop when the builders get their extensions, which they are all applying for.

Maybe a couple hundred homes that are actually vacant?

We are told we need about 200,000 new residences per year to meet current demand.

So someone has to say it:

What a crock of s$it. Total hooey. Baloney.

More political game playing and grand standing.

There are basically no vacant homes in Toronto.

Epic fail. Will probably cost them (ie, us) more to administer this tax, than we will ever collect in revenue.

JL

at 8:11 pm

What did Vancouver do differently to kind of make this work?

Ace Goodheart

at 10:46 pm

They actually had vacant houses.

Toronto doesn’t.