The multifamily market today is the strangest in my relatively short career (12 years). The range of potential economic outcomes is wide, and I certainly lack the experience to assess the impact inflation, rates, and a recession may have on the multifamily market over the near-term.

What’s great about having this outlet is that I get to write things down and think out loud, documenting my thoughts and doing my best to make sense of the market.

While admittedly I’m not sure what’s going to happen, the over-used adage rings true – while history may not repeat itself, it does rhyme.

Let’s break things down into a couple different segments; inflation/rates, single-family housing, supply/demand fundamentals, and questions/things to watch.

Inflation / Rates

Real estate, and multifamily in particular, is a good inflation hedge. Rents reset daily, and leases typically roll every 12 months. Rent growth at our existing properties have far outpaced inflation.

Although inflation fears are high today, the consensus is that it will be tamed, but at what cost?

Given inflation is a relatively short-term issue, the market is reacting more acutely to the rise in interest rates. The surge in borrowing costs have driven up cap rates and brought the capital markets to a momentary freeze. This has been most notable on value-add deals where buyer’s typically put on high leverage.

I expect rates to remain high, but normalize and come back down as recession fears set in. Spreads should also stabilize as we get more clarity on the market direction.

Single-Family Housing

The single-family housing market is terribly unhealthy today. Logan Mohtashami from HousingWire has the some of the clearest housing analysis which goes like this (based largely on this article):

- The run up in housing prices over the past 2 years has been driven primarily by inventory being at all-times lows at a time when housing demographics were incredibly strong.

- Inventory has been steadily falling since 2014 and is in an unhealthy position today. Traditionally inventory levels are between 2 million and 2.5 million. We started 2022 at just 870,000 homes for sale.

- A job-loss recession would be needed to create any sort of distress. However, the consumer is in a strong financial position today.

- Higher rates will slow housing demand and we’re already seeing purchase applications slowing, but it’s going to take a while for inventory levels to increase significantly.

Unaffordable housing is a boon for multifamily demand in the short-term, but over the long-term higher rates will slow housing demand and moderate pricing, thus making single-family housing more affordable.

The Renter

American consumers reman in good financial health due to the combination of a strong labor market, wage growth, low leverage, and run up in housing prices and the stock market.

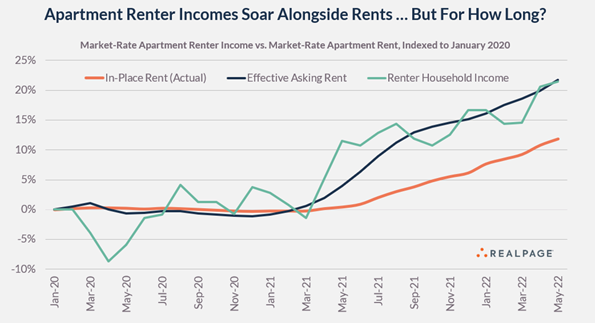

One of the biggest drivers and one of the biggest question marks today is what happens to renter household incomes goin forward. When I wrote about the SE multifamily market back in January, I asked ‘are rents outpacing wages in these markets to such an extend that there are not enough high-paying jobs to support them?’

That remains the biggest question about the multifamily market today. Incomes and rents are closely corelated. As expenses continue to surge, most notably payroll, insurance, utilities, R&M, and taxes, there remains pressure to push rents.

If wage growth stagnates, we’ll see more doubling up, lower retention, and a reduction in new lease demand. See the chart below from Jay Parsons of RealPage showing the tight correlation between incomes and rents.

Multifamily Supply/Demand

Demand

The multifamily fundamentals remain strong. Job growth and wage growth are both expected to remain healthy. Additionally, the uncoupling of young adults from parents and roommates will continue to benefit near term demand. However, the demographics soften as the 25–34-year-old cohort grows at <0.5% per year over the next 3 years, then declines starting in 2025 (Green Street).

Additionally, the recent rise in rates and the likely impending recession may lead to hiring freezes and layoffs in certain sectors, resulting in slower than expected job growth.

Revenue growth will continue to be strong due to mark-to-market of the rent roll (especially in the Sunbelt) but will likely slow due to deteriorating macroeconomic conditions.

Supply

On the supply side, development delays have helped insulate apartment fundamentals. However, supply will grow over the coming years as the units under construction eventually deliver and the starts/permits continue to accelerate.

Tightening credit markets and rising construction costs may restrain supply in the short-term, but rising rents (and attractive profit margins) will keep a floor under starts.

Supply will vary by market with the Sunbelt markets seeing accelerating supply growth over the next 2-3 years. There are no absorption issues today, and broad-based excesses in supply are unlikely in the near-term given the strong demand, but select markets are heading for over-supply.

Questions/Things to Watch

- Are we heading for a recession and if so, how severe will it be?

- Will the labor market remain tight and will wage growth continue?

- Will supply catch up to demand and are select markets over-supplied?

- Are rents outpacing wage growth, leading to expanding rent-to-income ratios?

- Will rates normalize then begin to decline as recession fears set it?

- When will supply-chain issues taper and will construction costs come back down any time soon?

While this is my attempt of making sense of today’s market, I remain focused on buying and building multifamily assets to hold long-term in markets with strong fundamentals.