The balance of consumer credit outstanding grew 6.5% in the fourth quarter of 2022 (seasonal adjusted annual rate) after climbing 6.7% (SAAR) in the third quarter according to the Federal Reserve’s latest G.19 Consumer Credit report. Revolving debt—which consists primarily of credit card debt—increased at a 12.0% rate, as the level of nonrevolving debt (excluding real estate) grew 4.8% (SAAR).

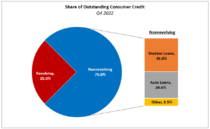

Total outstanding consumer credit currently stands at $4.78 trillion, an increase of $79 billion over the third quarter. Nonrevolving credit outstanding increased $191 billion, year-over-year, while the level of revolving debt rose $154 billion. Revolving debt accounted for 25.0% of total consumer debt outstanding, up from 23.5% in Q4 2021.

The average interest rate of a 60-month auto loan increased by more than a full percentage point over the quarter, from 5.50% to 6.55%. Over the past three quarters, the rate has climbed 2.03 ppts and is at its highest level since 2009.

With every quarterly G.19 report, the Federal Reserve releases a memo item covering student and motor vehicle loans’ outstanding levels on a non-seasonally adjusted (NSA) basis. The most recent release shows that the balance of student loans was $1.8 trillion at the end of the third quarter while the amount of auto loan debt outstanding stood at $1.4 trillion.

Together, these loans made up 88.6% of nonrevolving credit balances (NSA)—1.3 percentage points lower than the share in Q4 2021 and 4.4 ppts below the series high reached in 2010.

Discover more from Eye On Housing

Subscribe to get the latest posts to your email.