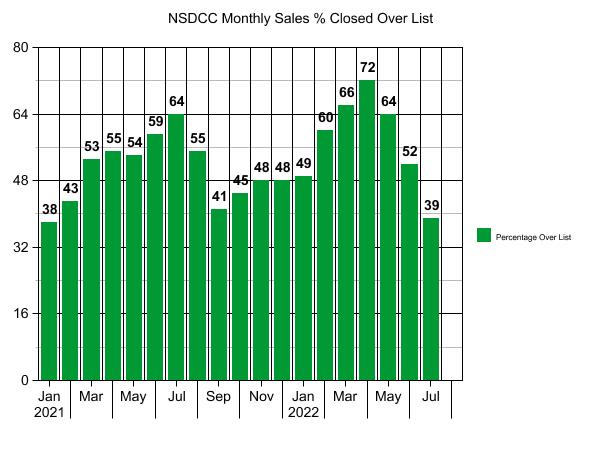

The graph above shows how the 2021 off-season wasn’t off by much, with nearly half of the Nov-Jan sales closing over their list price. We probably won’t see that happen this year!

On the street, it feels like the off-season is already here, which is fine. The seasonality has been topsy-turvy ever since the pandemic started, so we can handle a longer off-season this year. The outcome will be determined by what the listing agents are telling their sellers.

Are they saying that this is the start of a long downward slide, and sellers should hit the panic button and dump on price to get out while they can? If so, shame on them. If 39% of the buyers who closed in July were still paying over the list price, then it suggests that what we are experiencing is an inventory problem – there aren’t many superior houses for sale at decent prices, and the gap between them and inferior houses hasn’t adjusted enough yet.

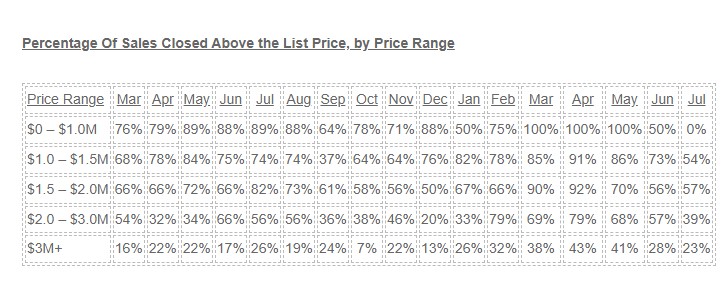

Here is the breakdown by price range:

There was only one sale under $1,000,000, and it was a mobile home. Most of the homes sold between $1,000,000 and $2,000,000 closed for more than their list prices, and the sales above $2 million were still competitive. The group of salable homes is smaller than before, but the great ones are still being bid up.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

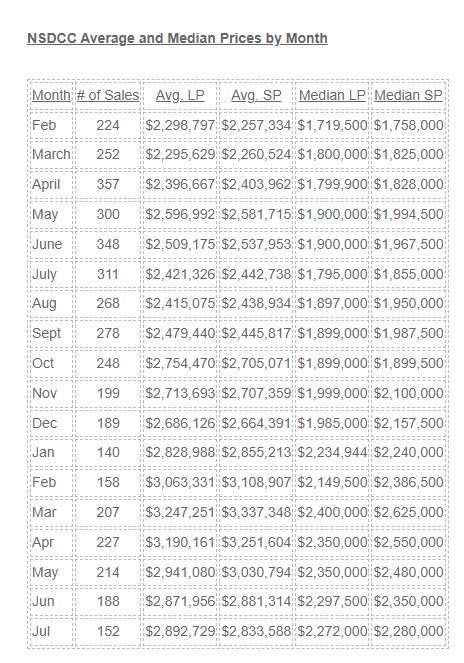

The average and median sales prices are closer to the list prices now, suggesting that those who do bid over the list price aren’t going over by much:

For an industry that has never figured out how to properly handle a bidding war, it is a miracle that this many homes are still selling over list. This was our big chance to incorporate a true auction format, but it will pass us by, unfortunately.

Unless there are substantial job losses, the real estate market appears on track for a soft landing, said economists for University of Southern California’s Lusk Center for Real Estate.

“We don’t believe the housing market is going to fall off a cliff. We don’t really subscribe to the hard-landing story,” said Stuart Gabriel, Lusk Center director, during a presentation Thursday at the annual PCBC event, a conference for home builders held at San Francisco’s Moscone Center.

This is, however, a time of “stagflation,” or economic stagnation coupled with inflation, Gabriel said, and the real estate market is losing steam — with a general slowing in price-appreciation and sales.

Higher interest rates and energy costs, and reduced refinancing activity are also taking a toll on consumer spending, which has sunk from about 3.9 percent in 2004 to a current level of about 3 percent.

Despite this, Gabriel said it’s unlikely that there will be a major shrinkage in house prices, given the strength of employment numbers. Interest rates, though marching up, are not high by historic standards, he said.

The situation was a lot different in the early 1990s, when job losses contributed to a major downturn in the real estate market. Gabriel said that the impact of job losses in the aerospace sector hit Southern California’s real estate market hard during that period.

“Barring that sort of event we don’t expect significant falloff in house prices,” he said.

Likewise, job losses in the construction and real estate-related industries during this slowing period should not cripple the housing industry, said Raphael Bostic, director of the Master of Real Estate Development program at USC and a Lusk Center expert.

Gabriel’s forecast calls for the economy to slow to a 3 percent to 3.5 rate of real gross domestic product growth for the remainder of the year after a rate of about 5 percent in the first quarter.

Delores Conway, director of USC’s Casden Real Estate Economics Forecast who also participated in the presentation, said that in California, rising home prices appear to be driving more housing activity to central areas.

“The population is shifting in California more toward the center of the state, where we tend to have more affordable housing,” she said.

Some major markets in the state, such as Los Angeles, are still seeing high levels of price appreciation, though sales activity is down from a peak. “The number of sales has declined very significantly in all the cities,” she said.

The apartment market, meanwhile, has rebounded in some areas as shrinking housing affordability has diminished the pool of potential home buyers.

“People are in some sense being priced out of the market,” she said, while there are year-to-year rental increases of 7 percent to 10 percent in some Southern California markets.

USC economists noted that condo markets — particularly in formerly frenzied areas such as San Diego and Las Vegas — might be the most vulnerable to changing market conditions.

Conway said that some proposed condo projects will actually be built out as apartments because unit sales fell short of expectations. “This is particularly true in San Diego, which has been a bit of a bellwether and a bit of a leading indicator for the rest of the cities,” she said.

There is no evidence of price declines in any California markets at this point, though, “If we do see price declines, where we would probably look for them first is in the condo markets,” Conway said.

Bostic said, “I’ve been concerned about downtown San Diego for a long time, particularly in the condo market.” He also said the luxury real estate market may feel the weight of the housing slowdown more than the general market.

But he said he is generally bullish on the housing sector, and he noted that the Lusk Center is not predicting a recession.

“I don’t think price declines are likely at all, absent significant job loss,” he said.

As available land dwindles and housing affordability worsens in California, Gabriel said he expects that buyers will increasingly gravitate toward multi-family dwellings.

Regulators have turned their attention to the popularity of unconventional home loan products and the risk that such products could pose, though the Lusk Center experts said they expect the use of such products will not have a substantial negative effect on the housing market.