I had a wonderful Mother’s Day, thanks for asking!

But it’s not about me, of course. It’s about my lovely wife, Jenna, and my mother, Carole, aka “Moonbeam” or “Earth Mother” here on TRB. I’m not sure what moniker she uses these days, but I believe when I started the blog back in 2007, she was posting under “Bikermom.”

Bless my mother’s heart, when I told her that we could do anything she wanted on Mother’s Day in terms of a dinner or evening activity, her dream was simply to have us all over to her house – the same place that we go every Sunday, and order Thai food.

Nothing special.

Just simplicity. I admire that.

But sometimes, the most simple things are made complicated, and it’s often when you least expect it.

Yesterday, I used Uber Eats to order the Thai food, and knowing that when the app says “40-50 minutes” for delivery, it actually means 60-70 minutes, I decided to order the food at 4:30pm.

Raise your hand if you know what it’s like staring at the “TRACK ORDER” screen on the Uber Eats app. Tell me you know what it’s like to see the status of the order just stall.

The 5:20pm “estimated arrival time” increased to 5:25pm, then 5:30pm, then 5:35pm, then 5:40pm, then 5:45pm, and on, and on, until some time after 6pm, I finally called the restaurant directly.

But they told me the order had been ready for quite some time!

So I sent a message to the driver who was waiting out front and told him, “The order is ready inside, I spoke to the restaurant.”

But he said, “I can’t go inside until the app tells me to.”

Geez.

Remember when people did things of their own volition?

That driver canceled the pickup, and then another driver accepted the delivery.

But he sat outside and waited too.

At 6:30pm, I got a notification saying that the order was canceled.

I just about lost my mind.

I called the restaurant and the guy said, “The food is ready, it’s here, waiting to be picked up. But unfortunately, the order was canceled.”

I said, “Okay, so now what?”

He said, “Now nothing. The order is canceled.”

At this point, I was picturing a box, and somebody attempting to think outside of it, but that’s simply not what happened.

I asked, “So, my only option is to drive down there myself and pick it up?”

He said, “No, sir, I couldn’t do that anyway. The order is canceled.”

I said, “But the food is done, right? Like, you have food sitting there. I could, theoretically, give you money and you could give me food. That’s a generally accepted principle of commerce, right?”

To my dismay, he explained, “No, sir, because the order was canceled, there’s no way to revive this order. This food will unfortunately just be disposed of. You would have to order again.”

Again?

Really?

“Yes, you’d have to re-order. You’d have to start all over,” he told me.

Not a chance.

I hate doing things twice…

We’re heading into mid-May in the Toronto real estate market and that means we’re also heading into peak listing season.

Of course, with peak listing season comes peak re-listing season, and while I clearly demonstrated in the story above that I don’t like doing this twice and refused to re-order Thai food on Mother’s Day, that doesn’t mean I’m necessarily averse to re-listing a property after a failed offer date.

But is “failed” the right word?

How about, unsuccessful?

Call it semantics if you want to, but in a market like this, it’s almost a planned obsolescence.

Once upon a time, a failed offer night causing a seller and listing agent to re-list was referred to as “The real estate kiss of death.”

In a red-hot market, there was nothing worse than a property that failed to sell on the scheduled offer night and was re-listed at a higher price.

But just take a step back for a moment.

Think about how spoiled we are.

Imagine a market where people expect to sell their home in seven days?

Imagine a market where people expect to know the EXACT date on which they’ll sell their home?

Imagine a market where anything short of four, six, eight, or ten offers is considered a failure?

But we’ve seen markets like this over the years, many times! And when we get used these market conditions, the idea of failing to sell on the scheduled “offer night” is so foreign that we may as well be selling houses in Iceland. Hmmm. I wonder what their market is like right now…

So let’s go back to the idea of “failed” versus “unsuccessful.” How does that play out in today’s market?

Let’s say that your home is worth around $1,300,000 based on comparable sales. Now, let’s say that you list this property for sale for $999,900 and set an “offer date.”

Further, let’s say that on the scheduled offer date, three offers are submitted for $1,000,000, $1,070,000, and $1,090,000.

You’re not accepting those offers, right?

So you say, “Thank you so much” to the three buyer agents who submitted those offers, and you move on with your night.

The next day, you re-list the property for $1,299,900.

What word would you use to describe this?

“Failure” or “unsuccessful?”

I suppose it depends on what comes next.

If you sell the property for $1,299,900 four days later, then I would say that your offer date was “unsuccessful” but hardly a “kiss of death” because you sold the property shortly thereafter.

But if the property sits on the market for 60 days, then is reduced to $1,249,000, then sits for another 40 days, then is listed for $899,900 with an offer date, then is terminated and re-listed for $1,234,900, and on, and on, then I suppose I would call that very first offer date a “failure.”

Last month, we saw only 7,114 sales in the TRREB region. That was the lowest number of sales in any month of April this millennium, save for 2020 during the pandemic.

With sales down and listings up, I do believe we’re going to see a lot of “re-listing” behaviour in May and June.

I started in this business in 2004 and I made it all the way to 2016 before I ever had a property fail to sell on offer night, with that property subsequently being re-listed higher two days later.

Since then, I’ve probably done this a dozen times. Maybe more.

But it’s an outlier.

It’s not a business practice.

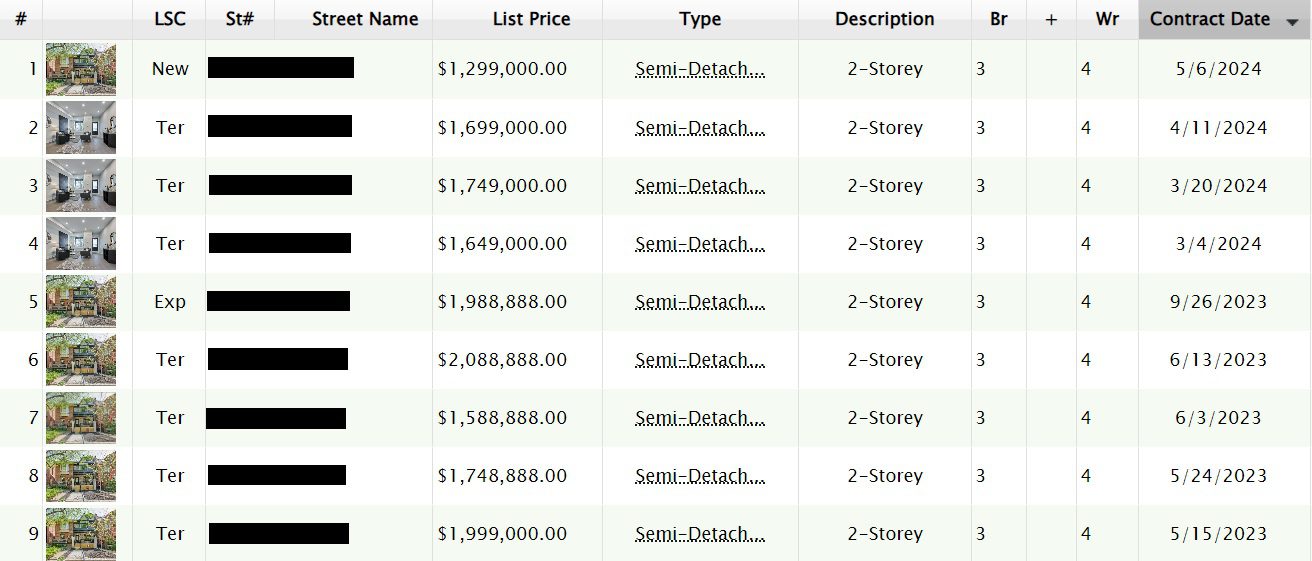

Listings like this, for example, aren’t what we’re talking about:

This is ridiculous.

And I’ve dedicated entire blog posts to properties like this which are listed over and over, with multiple “offer nights,” even though I maintain that you only get one chance to hide your motivations and target price, and that using the “list low, hold back offer” listing strategy is ridiculous when you’ve already shown the market your hand.

But as we move into mid-May, we’re starting to see properties fail to sell on their scheduled offer nights and be re-listed days later.

This isn’t anything new, of course, and this happens year-round.

But May and June are when listings typically peak, and if the number of buyers doesn’t increase at the same rate, then the number of bidders on offer nights decline.

Fewer bidders means less leverage for sellers.

Less leverage for sellers means that the sellers won’t always get their price, and since there’s no rule saying that “a seller must accept the highest offer on offer night” (although this could change if our federal leaders keep acting crazy…) then the seller simply takes the property off the market and re-lists at a higher pice.

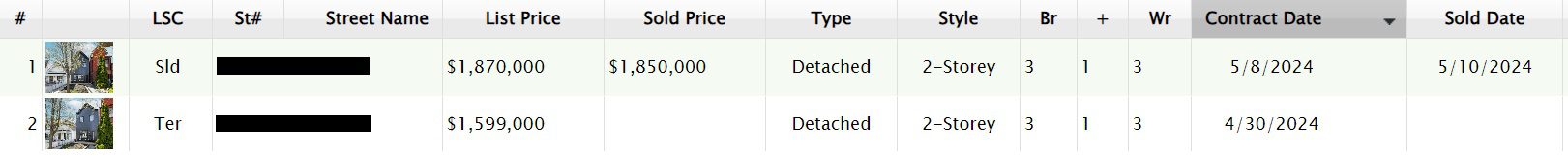

Here’s a recent example:

No harm, right?

They didn’t have success on offer night so they re-listed and sold in only two days.

Bravo!

But not every property sale works like this.

We’re in the time of year when listing agents really show how uninformed they are.

The market moves quickly and if you’re not working in this market 24/7, you get left behind.

Every year at this time, we see listing agents acting like we’re in a different market. A very simple, standard, somewhat boring 1-bed-plus-den, 1-bath condominium in King West hits the market for $499,900 with an offer date when it’s worth $625-$640K. That property is not going to sell on offer night, but the listing agent doesn’t know that because he or she hasn’t really been paying attention, and the last time he or she came up for air was in March.

That property is going to come back onto the market, guaranteed.

And it’ll be part of the “re-list” statistics.

Wait….what?

There’s statistics for re-lists?

You betcha!

It took the figureheads at TRREB years to finally come around on this, but in May of 2022, they did.

Here’s their press release explaining why they decided to track this data and why it’s important:

June 3, 2022

Market Uncertainty as Measured by the Share of Re-Listed Properties

As the housing market evolves over time, uncertainty in the market ebbs and flows. One measure of uncertainty is the share of re-listed properties each month. In other words, the share of properties listed more than once by the same combination of owner and brokerage during the original contract period.

A property owner, in conjunction with their brokerage and salesperson, may choose to terminate their original listing and relist their property under a new agreement if they feel that their property was not properly positioned in the marketplace. This type of activity is more common during periods of rapidly changing market conditions. In recent years, market conditions have changed markedly and uncertainty has increased due to changes in government and monetary policy. Examples include:

• The onset of the Non-Resident Speculation Tax included in the 2017 Fair Housing Plan;

• The application of the OSFI two percentage point stress test in 2018; and

• The recent rapid increase in borrowing costs over the past three months.

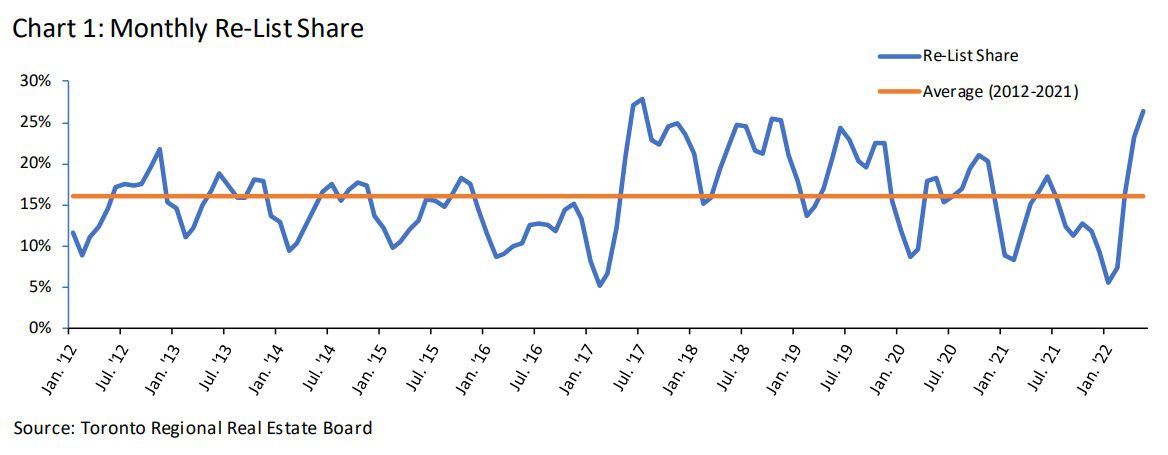

Chart 1 below shows the share of monthly new listings accounted for by re-lists since 2012. For the 10- year period ending December 2021, the average monthly re-list share was approximately 16 per cent. In 2016 (the year immediately before the announcement of the Fair Housing Plan and OSFI stress test) and most of 2021, the share of re-lists was below average – market conditions were very tight and homes took very little time to sell, so it makes sense re-list activity was low. In contrast, the re-list share was above-average in 2017 (Fair Housing Plan), 2018 (OSFI stress test) and most recently in 2022 (Bank of Canada interest rate hikes). As government and monetary policy impacted the market, more home owners and their brokerages/salespersons felt the need to reposition their listings in the market, perhaps by changing the asking price or other aspects of the offering.

As you can see, re-listing has been around forever.

But there are periods when re-listing is extremely higher than average.

Sometimes, this is based on the cyclical nature of the market.

Then other times, this is based on the type of market that we’re in.

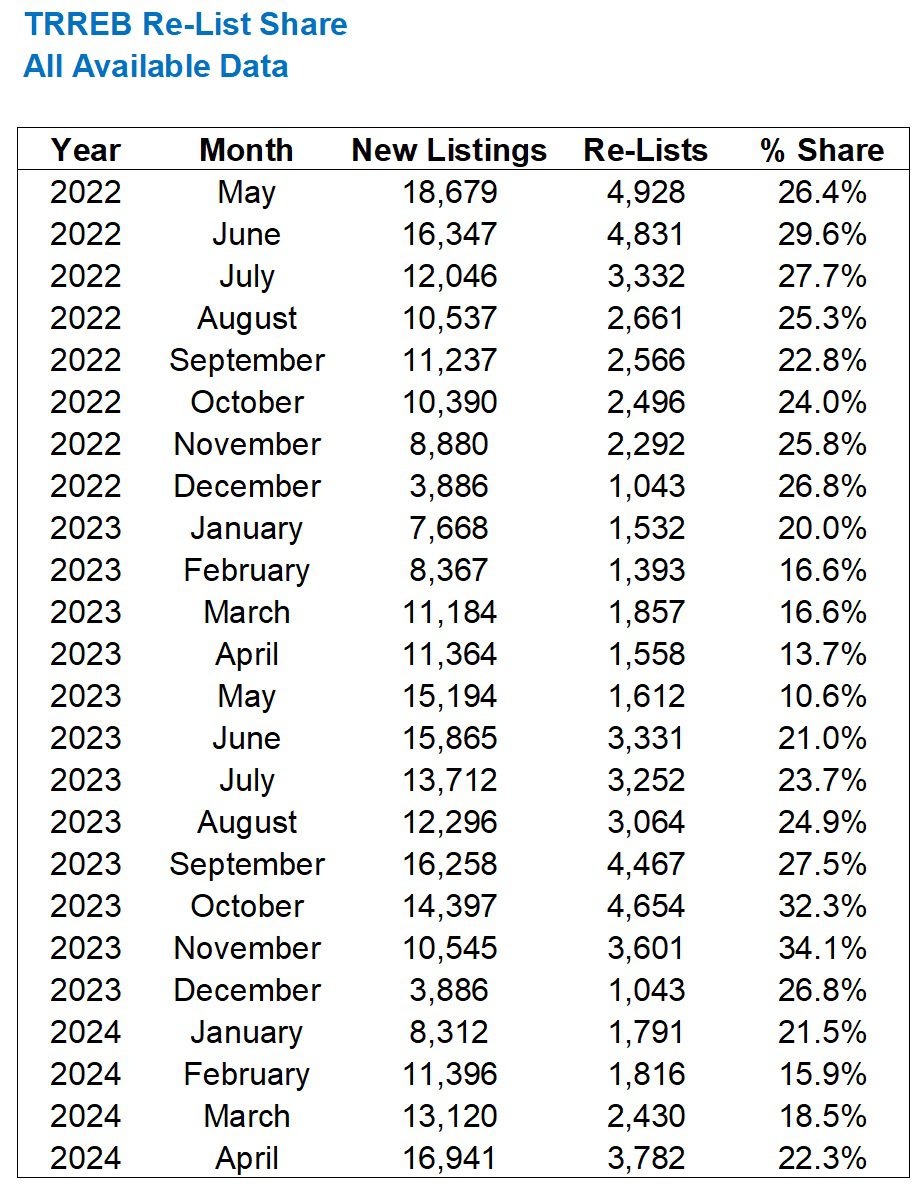

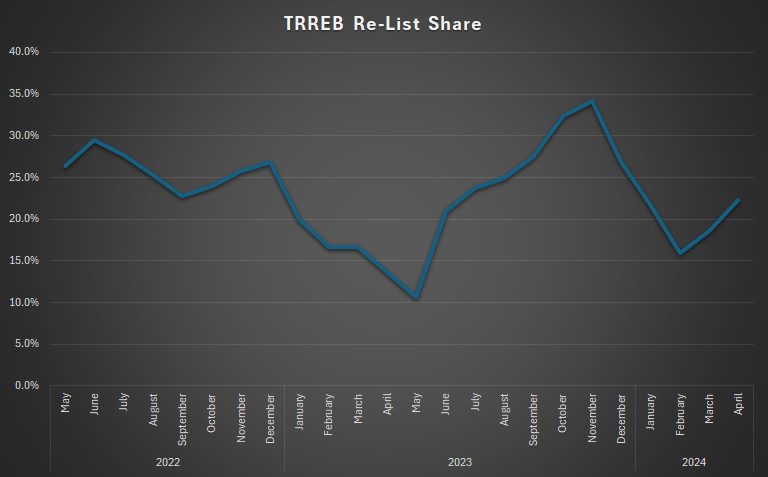

As mentioned, TRREB started tracking this data in May of 2022, so here’s all the available data:

For those of you who always wondered, “What percentage of listings are actually re-listings,” now you know!

The highest percentage of re-listings since this data began was 34.1% and that occurred in November of 2023.

But that makes sense, right?

2023 saw the fewest sales in over two decades and the fall was the slowest point of the year! When properties aren’t selling, and sellers and listing agents get impatient, they start to play pricing games and list, re-list, and then re-list all over again.

But note the trend – it’s increasing.

In April, we saw a re-list percentage of 22.3%.

This is up from the 13.7% we saw in April of 2024.

Also note that from February’s 15.9%, we increased to 18.5% in March, then up to 22.3% in April.

Here’s how the data looks graphically, and see if you notice the same thing that I do:

In 2023, the re-list percentage started to increase in May.

In 2024, the re-list percentage started to increase in February.

It seems to me like we’re about to head into prime “re-listing season,” and that’s already been felt through the first two weeks of May.

As I showed you above with the property that sold for $1,850,000, it’s not a bad thing, necessarily, if sellers are still getting their price.

But that was a great listing agent.

What about all the poor ones out there?

This time of year, it’s essential to monitor the market before and during your listing. Let me give you an example.

We listed five properties last week and two were in the same geographic area.

The first one was around $1.4 Million and we had 26 showings booked through the first two days (essentially 30 hours).

The second one was around $900K and we had only 4 showings booked in the same time period.

What does that tell you?

Many listing agents would simply sit back and wait for the market to come to them, and that’s a recipe for disaster.

We had serious interest in that second property, even though the showings were slow-going. An agent asked about a bully offer, and I played coy, then finally dragged it out of her.

We were able to sell that property for $1,120,000, which was well above my target price, and that’s despite only having four showings.

That offer night would have been problematic and we might have been a re-list statistic thereafter. But when the interest was shown, I jumped on it. When the overture was made, I grabbed hold of it. And when the offer was finally submitted, I explained to my clients why this was such an incredible situation to be in, and they made the right decision.

As for the $1.4 Million listing, who knows why this one is so popular. But we just passed fifty showings which is exceptional in this market, and I expect to be busy on our Monday “offer night.”

This house will most certainly not be part of the re-list statistic, but so many others will.

And just to show you that I’m not above all that, I’ll disclose that we did re-list a property this month.

We listed a property for $899,900 and it failed to sell on the offer night, so it was re-listed for $1,149,000.

But here’s the crazy part: we had 20 showings when the property was listed for one week at $899,900, and in a mere four days since we re-listed at $1,149,000, we’ve had 16 showings.

Is it possible that buyers are fed up with the “under listing?” Is it possible that buyers saw our listing at $899,900 with the “offer date” and decided not to view the property?

Perhaps that’s the next piece of consumer behaviour to monitor.

In the meantime, Pad Thai for lunch, anyone?

JF007

at 9:09 am

On the love of Thai food…i was in Kansas for couple of years late 2000’s and used to love this small quaint Thai place called Tup Tim Thai..i swear every Friday, except when away, I would go for lunch at this joint and order the same dish medium hot- Basil Fried Rice with chicken….best thing I ever ate..still try to hunt down same taste whenever I am in mood for Thai but alas the same remains elusive till date.

Marina

at 9:38 am

My tale of woe with a Thai restaurant goes back to 2012. I ordered takeout that my husband would pick up. Gave them his name, and spelled it out. Apparently the place was loud, and they misheard, and so began the most frustrating 20 minutes of my husband’s restaurant life.

The typo was something like Bavid instead of David. They refused to hear that Bavid is not a name. They called me back to complain about the crazy man who was trying to steal my order, and asked when Bavid would be there. They refused to believe that they in fact wrote it down wrong. “But the receipt says ‘Bavid'” must have been said a hundred times.

After 20 minutes they did finally release the order, but I think to this day they believe we somehow pulled one over on them.

I have no thoughts on relisting, but I’m off to drink coffee and recall all my misadventures in food ordering 🙂

Ace Goodheart

at 12:43 pm

The trick with this market will be what ends up happening with inflation stats in the USA.

The BoC has an unenviable job to do. If inflation keeps running hot in the USA (which it is) then the BoC can either cut rates here, and cause our currency to devalue against the greenback (the world’s reserve currency) or leave rates as they are, and crash our real estate markets and economy in a more fullsome manner.

But really, is it a choice at all?

If you devalue the CDN dollar, you cause inflation. Anything we import will become more expensive. That would be a lot of stuff.

If you leave rates as they are and follow the Fed on cuts, then you crash housing. But didn’t everyone want housing to crash anyway? Wasn’t that the purpose behind us all having to declare to the government that we live in our homes (and perhaps, soon, that we occupy each and every bedroom and there is no room for an unhoused person in our basement or third floor loft)?

Wasn’t that the whole thing that everyone wanted? Cheaper houses?

So why drop rates when the BoC knows doing so will cause our currency to devalue (which will lead to inflation) and our house prices to resume their inflated bubble journey up?

What would Pierre do?

What to do about all that Federal debt that has to find a buyer each year on our bond markets, before anyone even thinks about purchasing a mortgage bond?

I am continuing to be a total housing bear at this point. I see that my predictions keep coming true.

Different David

at 9:49 am

Thank you Ace, I always appreciate your point of view.

I think (hope) that they will keep the value of the dollar, because a drop in housing prices is just a paper loss for most people. Going to the grocery store and seeing the cost of citrus fruit, packaged goods, imported specialty products double or triple could cause a revolt.

The real problem comes when the job losses start and people HAVE to sell their homes, so the paper loss becomes a realized loss. In Canada, you can’t just mail your keys to the bank – you need to declare bankruptcy if you become so far underwater.

To quote from the Big Short: “Lots of people seem very motivated…it’s just a gully”

As for PP, I wouldn’t be surprised if he pulls the rug out, has a quick, brutal period to correct prices, and then show how he recovered the economy. Blame it on Justin-flation and then be there for a recovery just in time for 2030.

Ace Goodheart

at 11:02 am

Ontario’s house markets look a lot like a “big short” sort of situation to me.

I keep thinking, how did house prices get so expensive? Was there a large economic rally, everyone was earning tons of money, we were all flush with cash and we bought expensive houses with money we actually earned by working or investing?

Or did house prices run up because cheap money was available and everyone borrowed as much as they could at sub 2% rates?

Now, the idea seems to be, house prices will keep rising, so long as more cheap money is made available. So we need ultra low interest rates again, so we can have even more expensive houses.

Frankly, that is nuts. It is bonkers. Completely mad. Any asset that has a run up due to cheap borrowing, is headed for a cliff sooner or later. If that (cheap money) was the only thing holding our real estate markets together, we are not going to see an increase in prices and we likely will see a significant decrease, similar to what happened in 1989 (the last time we had a major credit crisis in Ontario).

With Pierre likely winning the next election Federally that is just going to be icing on the cake. Does anyone think he is going to support over leveraged home owners or folks who got caught when the tide went out, with multiple properties they can’t close on or in the condo assignment market?

Rick Michalski P.App ACCI

at 12:16 pm

What inane gibberish. There will be no Big Short moment in Toronto so don’t hold your breath. The market is driven by fundamentals pure and simple but enjoy your movies.

And there is a snowballs chance in hell of PP winning. Mark my words it will be another liberal victory as they ride the wave of the growing and strengthening economy and Canadians realizing the cons are completely socially backwards and will ban abortion.

Addison

at 2:05 pm

As much as I shudder against the thought of another Liberal federal government, I suspect that the Liberals will be returned to power during the next federal election. The supposition that this is another “throw the bums out” election is incorrect. We are not dealing with a Martin situation like in 2006 or a Harper situation like in 2015. Heck, we’re not even dealing with a Campbell situation like in 1993. In all of those previous situations, opposition leaders were actually palatable and preferable to the current then PM. In this case, we are dealing with an overtly antagonistic and frankly odious alternative in PP. As much as Canadians may dislike the current PM and his incompetent administration, the alternative arrangement will prove unacceptable.

Gallop

at 9:24 am

We are buyers looking in rural Durham area. The number of pandemic bought houses on the market now is impressive. It feels like I am seeing those squeezed sellers who have some wiggle room, have been hanging on with the now high rates but see the writing on the wall. They’ve hoped the market would come back but see its still soft from last summer but they can afford a $50-100k loss to move on with life. Then there are the “real estate always goes up” folks who are listing at $200-300k higher than they bought 1-2-3 years ago. They are on the relisting path and who knows where they land…

Of the 3 properties I’ve like, when I look up the charge history in OnLand, all three appear underwater. So we want to bid fair market rate, and I appear to be the only potential offer but buyers can’t or won’t float the difference to the bank. So I can’t buy these houses because they have a pandemic financing floor .

Last summer I saw the mortgage free owners trying to get unrealistic holdover pandemic prices and they appear to still be doing so. So those are sticking $200-300-400k over market and not budging because they’re fishing…

This post and your comment have hit home that things really might get ugly with anything else that tips things downward at least in areas that don’t have robust buyers markets. Maybe a buying opportunity for me eventually, but I’m not inclined to cheer about it.

Gallop

at 9:27 am

“all three appear underwater…[at their FMV where you’d expect a bit of buyer action]”

Ed

at 1:19 pm

Ordering Uber-eats on Mothers Day. What could go wrong?

Was there a Pick 5 last week?

Also your website does not ‘ Save my name, email, and website in this browser for the next time I comment.’. I’m on a laptop if that makes a difference.