VA extends deadline for COVID-19 home retention options

Housing Wire

MARCH 3, 2022

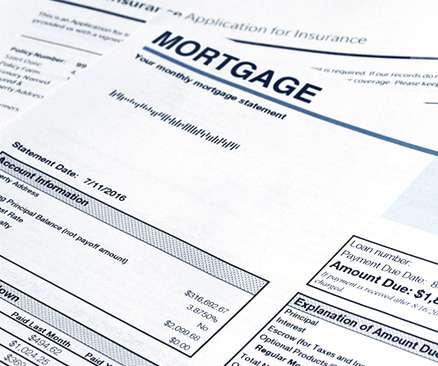

The modification must be made no later than 18 months after the date in which the COVID-19 national emergency ends, without VA pre-approval. The option allows the VA to purchase a borrower’s forbearance indebtedness amount, up to 30% of the unpaid principal balance of the VA-guaranteed loan.

Let's personalize your content