VA unveils new program to buy defaulted mortgages

Housing Wire

APRIL 10, 2024

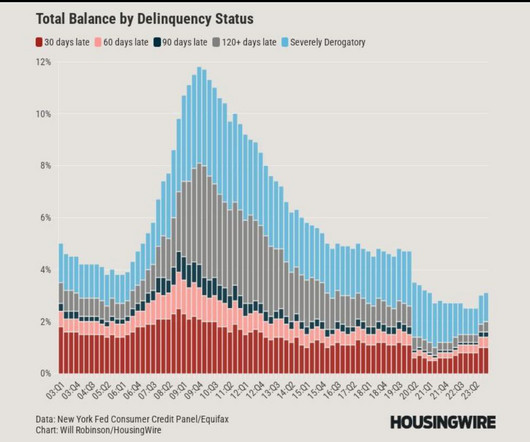

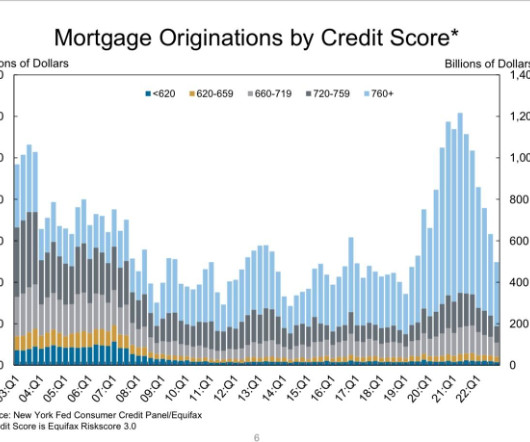

loans from mortgage services and place them in its portfolio at a fixed 2.5% The Veteran Affairs Servicing Purchase (VASP) program attempts to prevent foreclosure actions against military members still experiencing financial hardship due to the consequences of the COVID-19 pandemic. Department of Veteran Affairs (V.A.)

Let's personalize your content