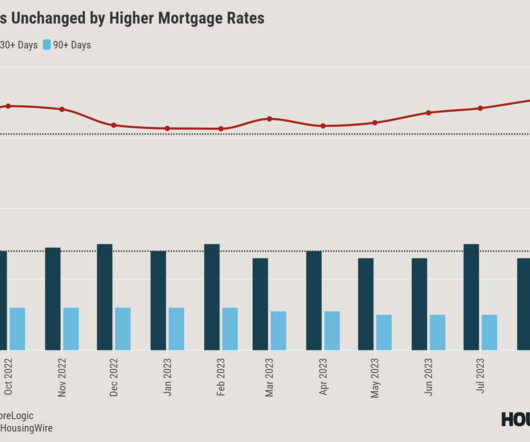

U.S. mortgage delinquency rates remain near historic lows: CoreLogic

Housing Wire

MAY 30, 2024

In March 2024, the national delinquency rate for residential mortgages stood at 2.8% for the third month in a row, up slightly from March 2023, according to the latest CoreLogic Loan Performance Insights report. Early-stage delinquencies (mortgages 30 to 59 days past due) accounted for 1.5% in March 2023. in March 2023.

Let's personalize your content