A transparent foreclosure marketplace reveals hidden equity

Housing Wire

APRIL 8, 2021

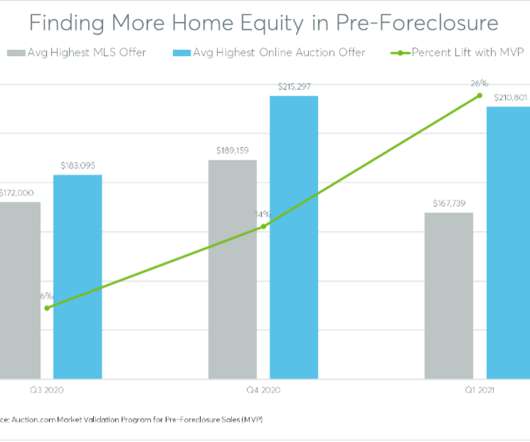

“A foreclosure sale usually represents the last chance for a distressed homeowner to benefit from any equity in a property being foreclosed,” said Ali Haralson , Auction.com president. “If Those winning MVP offers have averaged 19% higher — or more than $33,000 higher — than the highest offer received on the MLS.

Let's personalize your content